Oil dips amid broader market selloff strong dollar pressure – CNA

Published on: 2025-11-05

Intelligence Report: Oil dips amid broader market selloff strong dollar pressure – CNA

1. BLUF (Bottom Line Up Front)

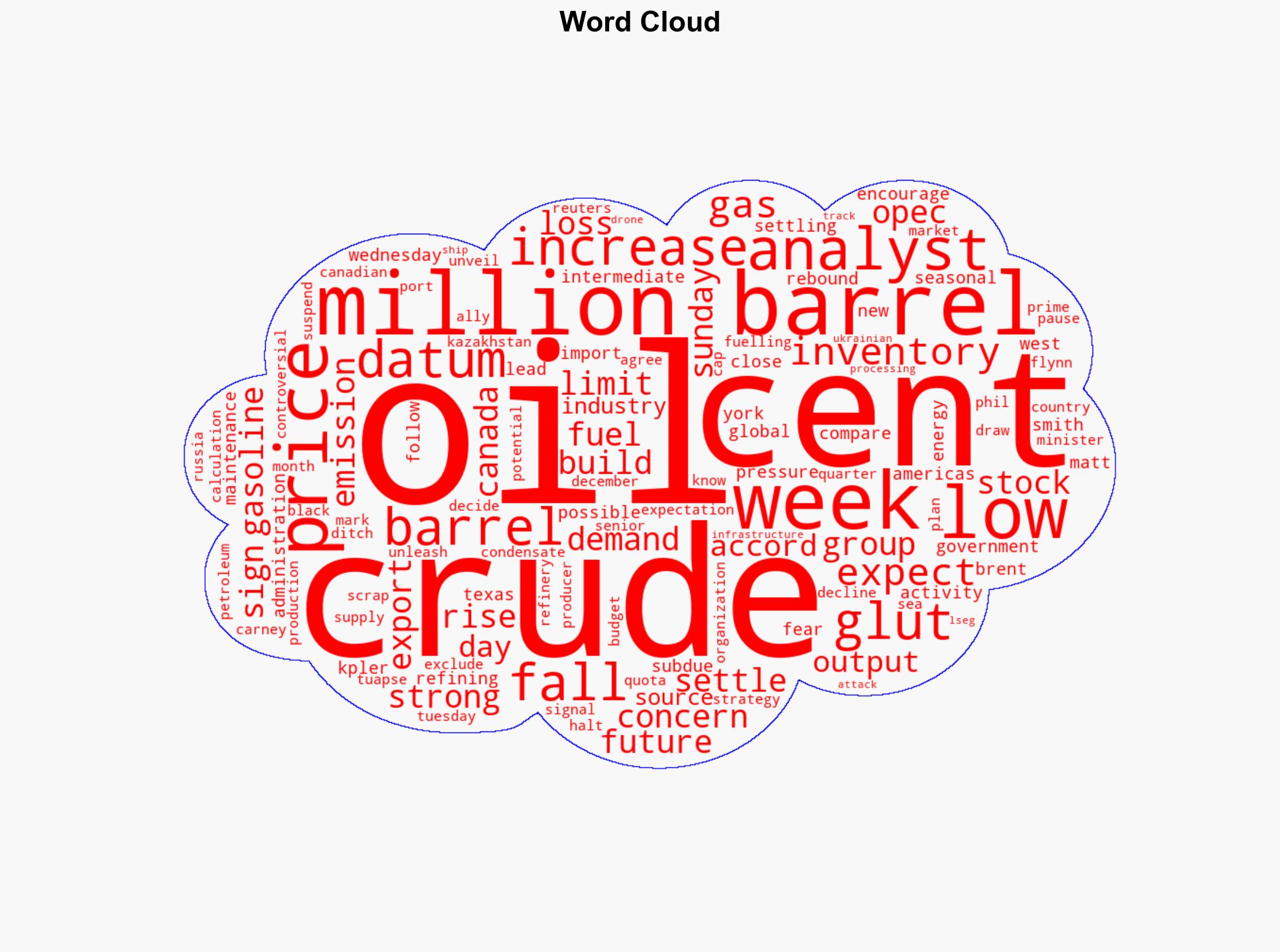

The most supported hypothesis is that the current dip in oil prices is primarily driven by a combination of increased crude inventories and a strong dollar, with a moderate confidence level. Strategic action should focus on monitoring inventory levels and currency fluctuations to anticipate further price movements.

2. Competing Hypotheses

Hypothesis 1: The decline in oil prices is primarily due to increased crude inventories and a strong dollar, which reduces the purchasing power of countries using other currencies, thus dampening demand.

Hypothesis 2: The oil price dip is mainly driven by geopolitical factors, such as Canada’s decision to scrap its oil and gas emission cap and the suspension of fuel exports from Russia’s Black Sea port due to infrastructure attacks.

Using ACH 2.0, Hypothesis 1 is better supported due to concrete data on inventory increases and the strong dollar’s impact on global purchasing power. Hypothesis 2, while plausible, lacks direct evidence linking these geopolitical events to the immediate price drop.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the continued strength of the dollar and stable refining activity post-maintenance. For Hypothesis 2, it assumes that geopolitical events have an immediate impact on market psychology and pricing. A red flag is the lack of direct causation between geopolitical events and immediate price changes, indicating potential cognitive bias in overemphasizing these factors.

4. Implications and Strategic Risks

The primary risk is a potential oversupply in the market if inventories continue to build, leading to sustained low prices. Geopolitical tensions could exacerbate market volatility, particularly if infrastructure attacks or policy changes disrupt supply chains. Economic implications include potential strain on oil-dependent economies and shifts in energy market dynamics.

5. Recommendations and Outlook

- Monitor crude inventory reports and currency exchange rates closely to anticipate further price movements.

- Engage in scenario planning for potential geopolitical disruptions, focusing on best (stable prices), worst (prolonged low prices), and most likely (moderate fluctuations) scenarios.

- Consider strategic reserves and alternative energy investments to mitigate risks associated with price volatility.

6. Key Individuals and Entities

Mark Carney, Phil Flynn, Matt Smith

7. Thematic Tags

national security threats, economic stability, geopolitical dynamics, energy market analysis