Libya NOC Announces New Oil Find – Rigzone

Published on: 2025-11-06

Intelligence Report: Libya NOC Announces New Oil Find – Rigzone

1. BLUF (Bottom Line Up Front)

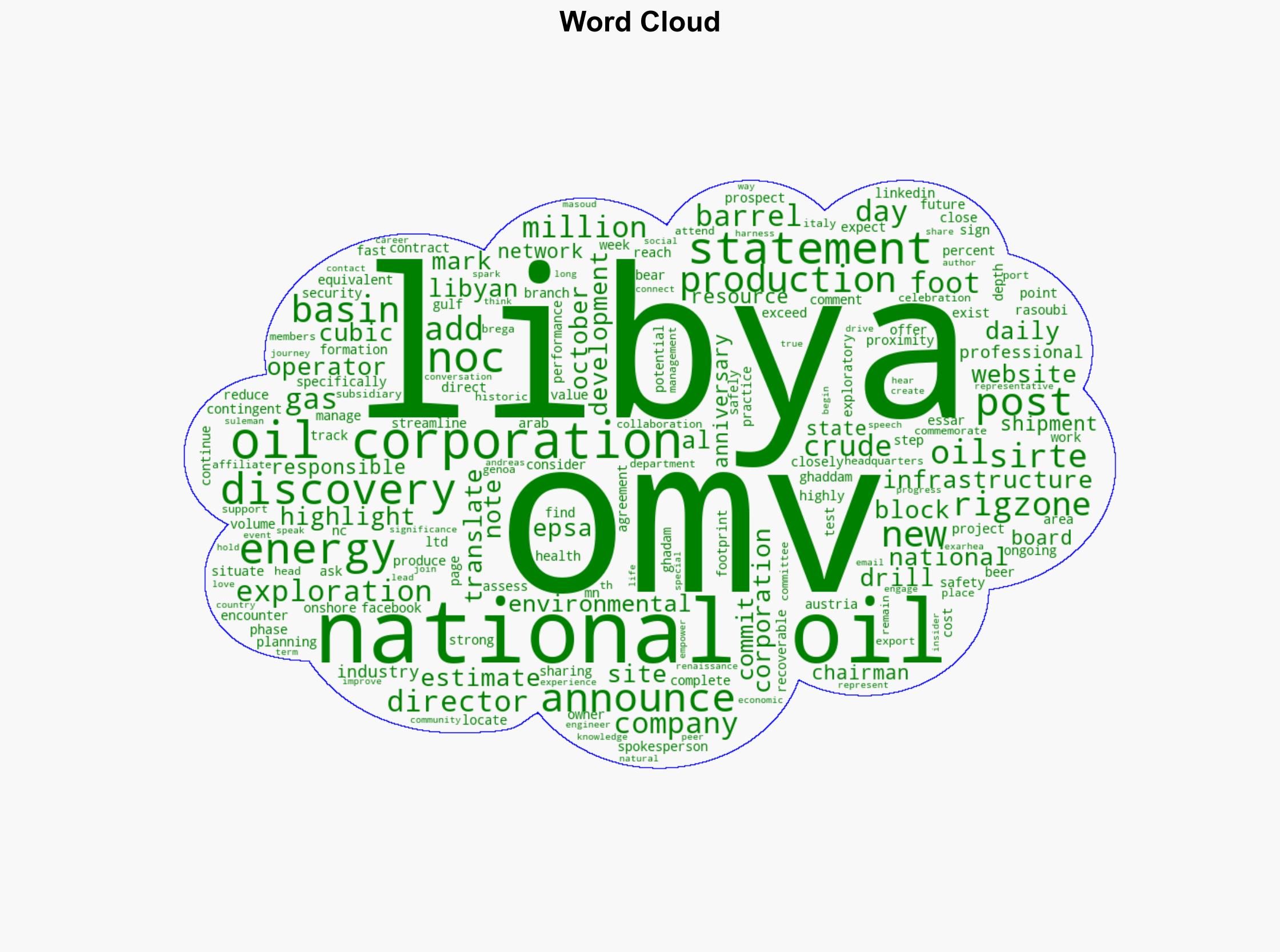

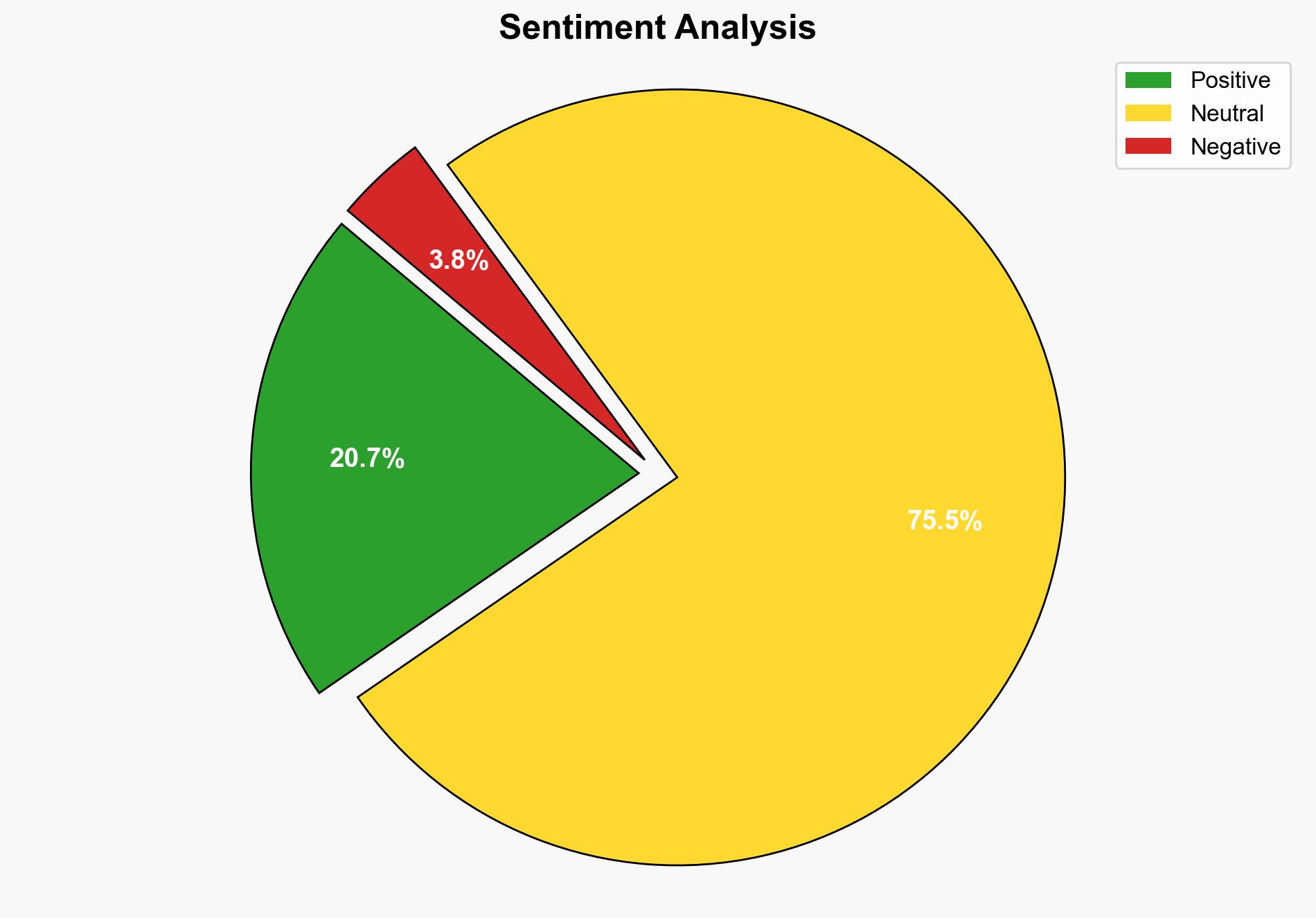

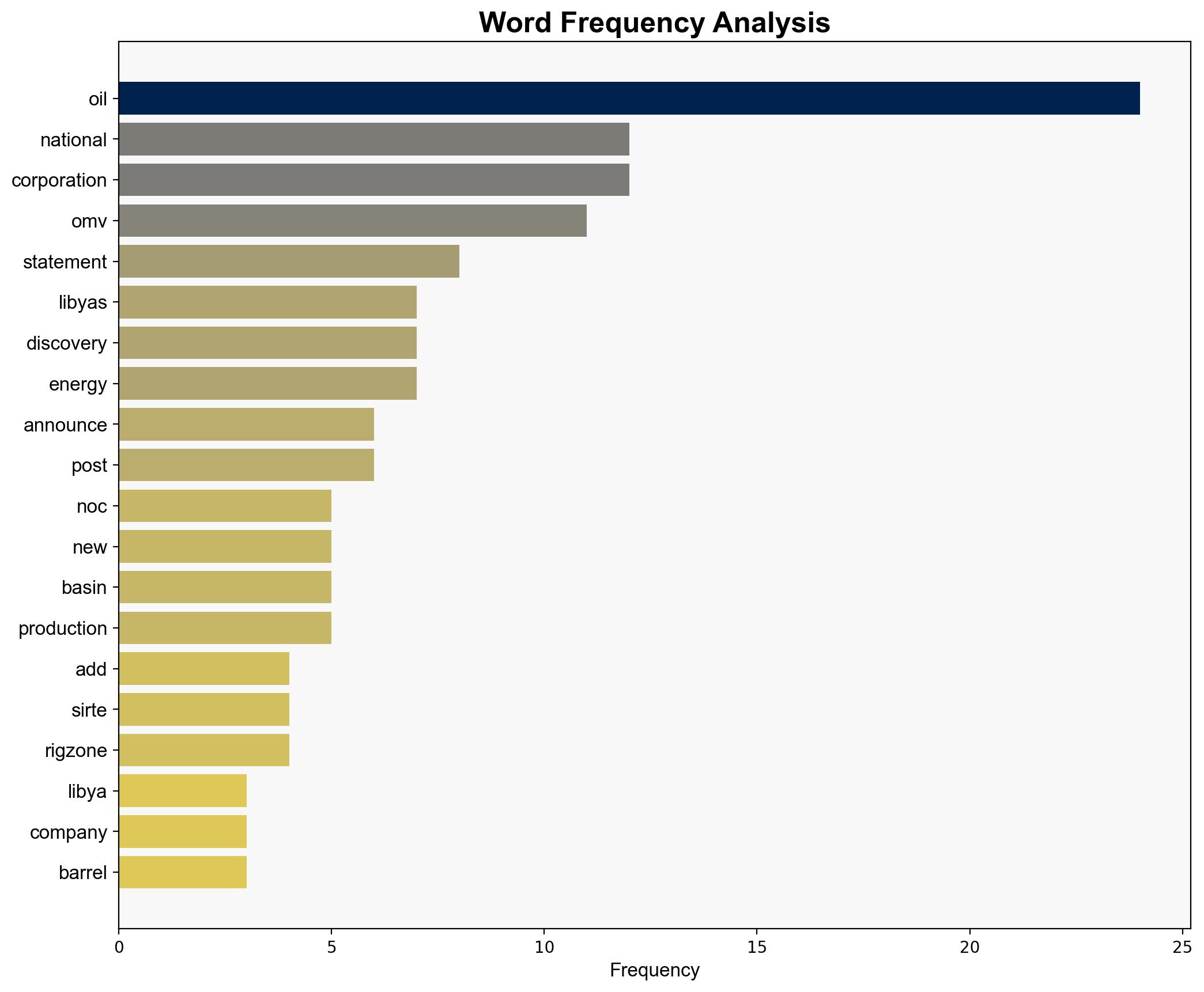

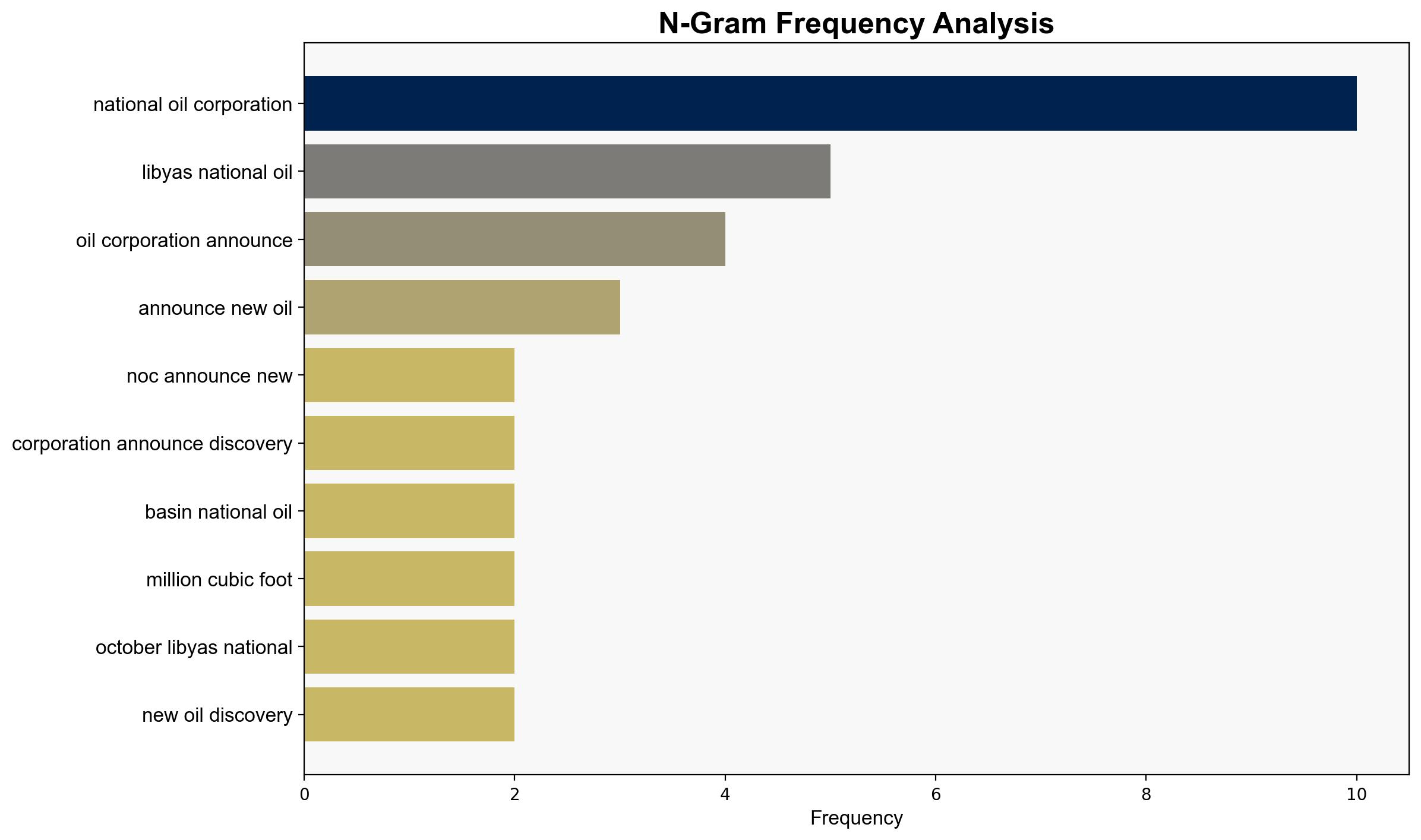

The discovery of new oil reserves by Libya’s National Oil Corporation (NOC) in collaboration with OMV in the Sirte Basin presents both opportunities and challenges. The most supported hypothesis is that this discovery will enhance Libya’s economic stability and energy sector, given the strategic collaboration with OMV and proximity to existing infrastructure. Confidence Level: Moderate. Recommended action includes monitoring geopolitical stability in Libya and assessing the potential for increased foreign investment in the region.

2. Competing Hypotheses

Hypothesis 1: The new oil discovery will significantly boost Libya’s economic stability and energy production capabilities. This hypothesis is supported by the strategic location of the discovery near existing infrastructure, facilitating rapid development and cost-effective production. The collaboration with OMV, a reputable international entity, further strengthens this hypothesis.

Hypothesis 2: The discovery may not lead to substantial economic benefits due to potential geopolitical instability and operational challenges in Libya. Although the infrastructure proximity is advantageous, political instability and security risks could hinder development and exploitation efforts.

3. Key Assumptions and Red Flags

Assumptions:

– The collaboration between NOC and OMV will remain stable and productive.

– Geopolitical conditions in Libya will not deteriorate significantly.

Red Flags:

– Potential for political unrest or conflict that could disrupt operations.

– Over-reliance on the assumption that existing infrastructure will suffice for rapid development without unforeseen technical challenges.

4. Implications and Strategic Risks

The discovery could enhance Libya’s position in the global energy market, attracting foreign investment and boosting economic growth. However, risks include geopolitical instability, potential sabotage or attacks on infrastructure, and fluctuating global oil prices. The development of these reserves must consider environmental impacts and community relations to avoid local opposition.

5. Recommendations and Outlook

- Monitor political developments in Libya to assess risks to oil production and infrastructure.

- Encourage NOC and OMV to implement robust security measures to protect assets.

- Scenario Projections:

- Best Case: Stable political environment leads to increased production and economic growth.

- Worst Case: Political instability disrupts operations, leading to financial losses and security threats.

- Most Likely: Moderate increase in production with some operational challenges due to regional instability.

6. Key Individuals and Entities

– Masoud Suleman, Chairman of the Board of Directors, NOC

– OMV Austria Ltd., Libya Branch

7. Thematic Tags

national security threats, geopolitical stability, energy sector development, regional focus