DNO Posts Solid Third Quarter Results Launches Fast-Track Kjttkake Tie-Back – GlobeNewswire

Published on: 2025-11-06

Intelligence Report: DNO Posts Solid Third Quarter Results Launches Fast-Track Kjttkake Tie-Back – GlobeNewswire

1. BLUF (Bottom Line Up Front)

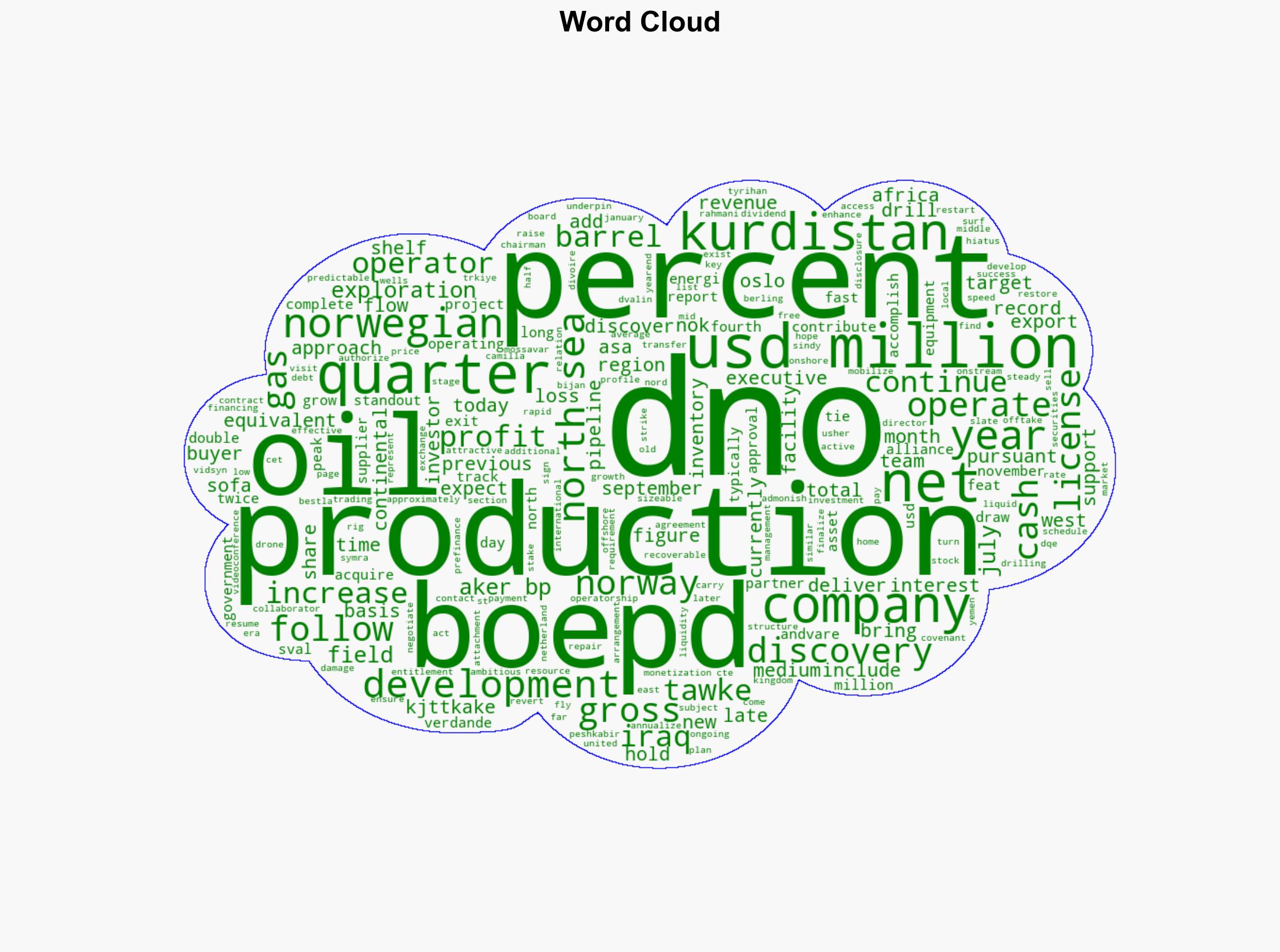

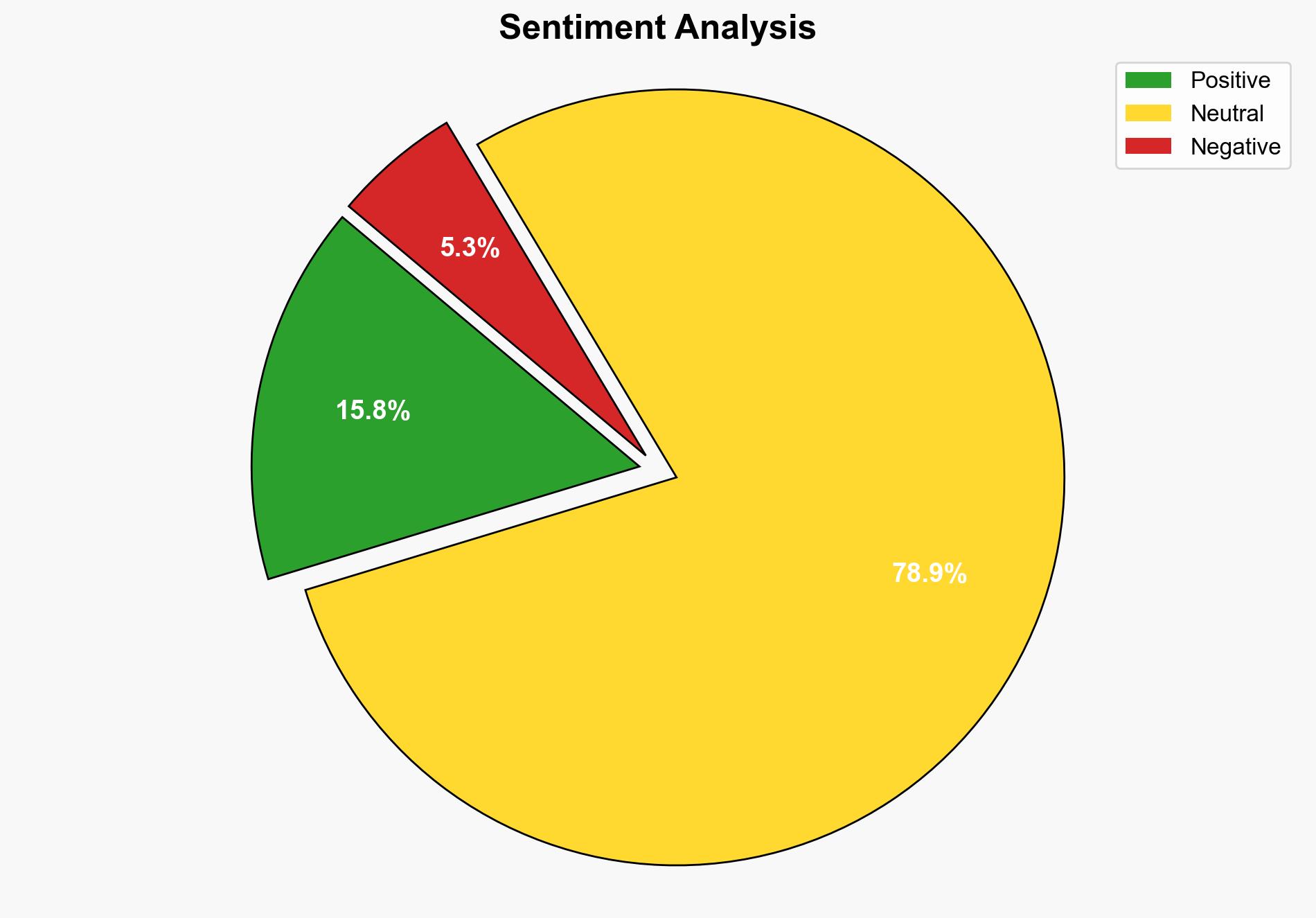

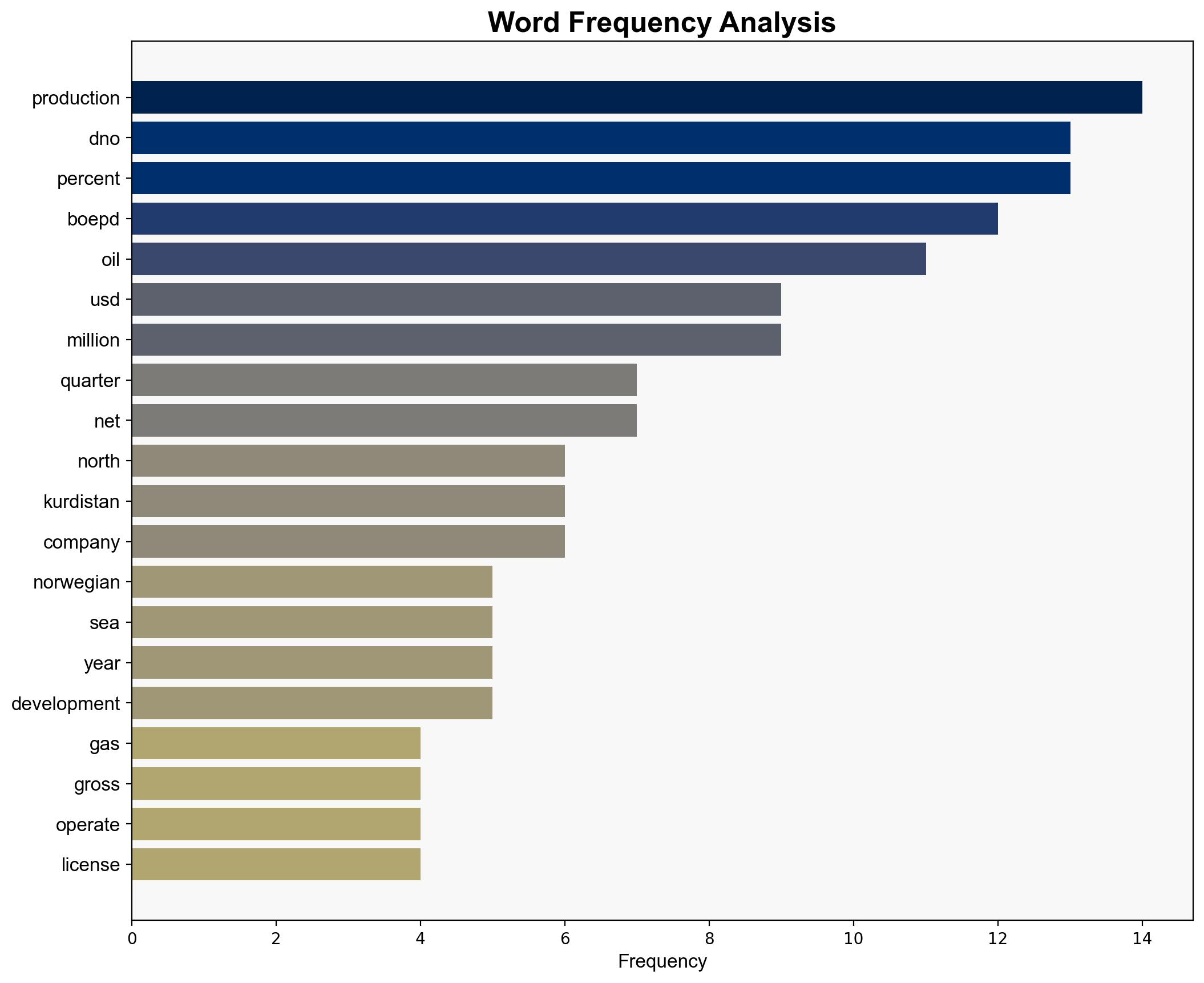

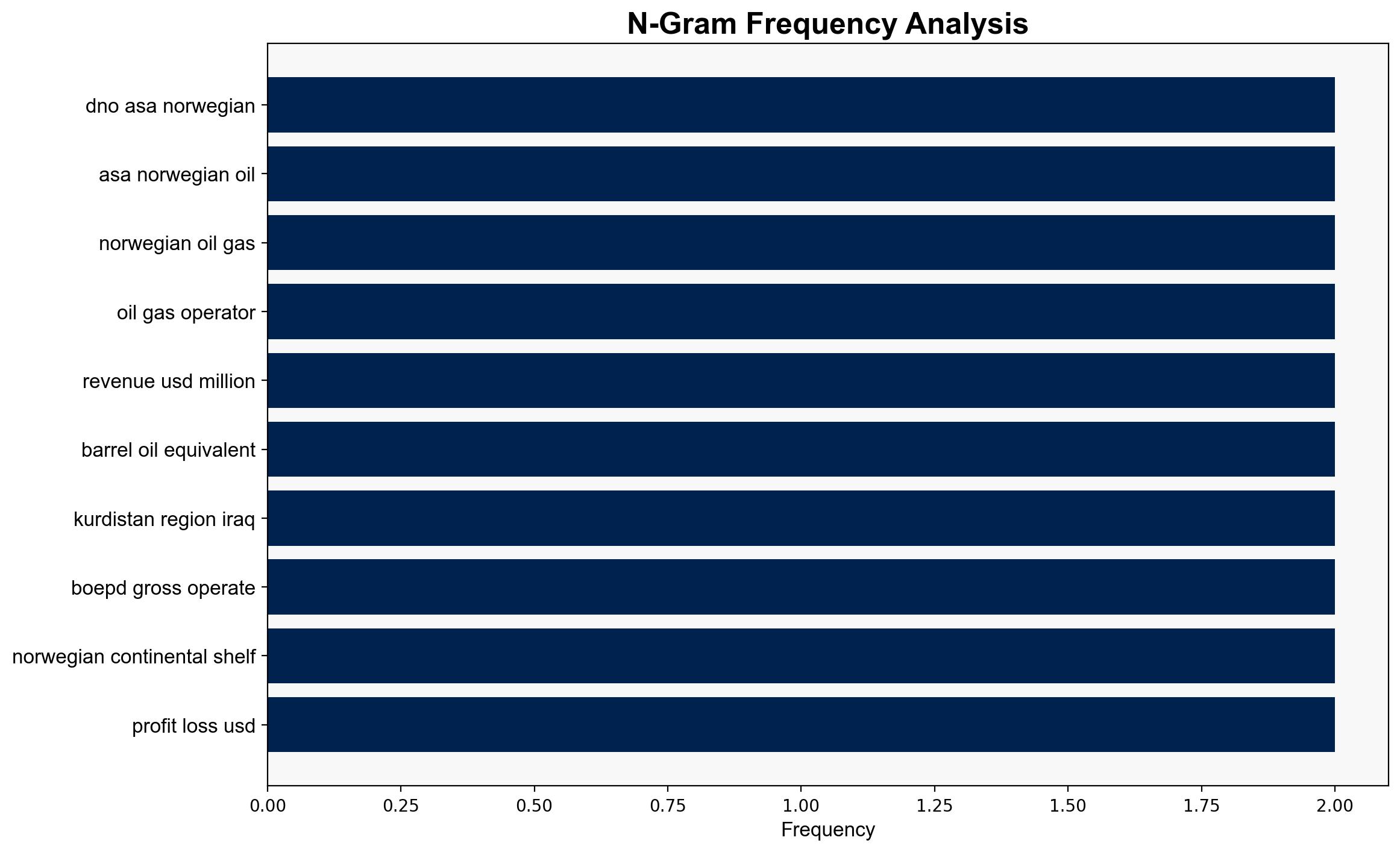

DNO ASA has reported strong financial performance and operational progress, notably with the fast-tracked Kjttkake tie-back project. The most supported hypothesis is that DNO’s strategic initiatives will enhance its market position and production capabilities, particularly in the North Sea. Confidence level: High. Recommended action: Monitor DNO’s operational developments and market responses, particularly in relation to geopolitical factors affecting the Kurdistan region.

2. Competing Hypotheses

1. **Hypothesis A**: DNO’s operational success and strategic initiatives, such as the Kjttkake tie-back, will significantly boost its production capacity and market competitiveness, leading to sustained growth.

2. **Hypothesis B**: Despite current successes, DNO’s growth may be hindered by geopolitical instability in the Kurdistan region and potential operational challenges in the North Sea.

Structured Analytic Technique: Cross-Impact Simulation was applied to assess the interaction of geopolitical risks and operational strategies. Hypothesis A is better supported due to DNO’s robust financial results and strategic partnerships, which mitigate some geopolitical risks.

3. Key Assumptions and Red Flags

– **Assumptions**: DNO’s partnerships and strategic initiatives will continue to yield positive results. Geopolitical tensions in Kurdistan will not escalate to disrupt operations significantly.

– **Red Flags**: Potential over-reliance on geopolitical stability in Kurdistan. The assumption that fast-tracking projects will consistently lead to successful outcomes without unforeseen delays or cost overruns.

4. Implications and Strategic Risks

– **Economic**: Increased production could lead to higher revenues, but market volatility and oil price fluctuations remain risks.

– **Geopolitical**: Escalation of tensions in Kurdistan could impact operations and revenue streams.

– **Operational**: Fast-tracking projects may lead to unforeseen technical challenges or safety issues.

5. Recommendations and Outlook

- Continue to diversify production sites to mitigate regional risks, particularly in Kurdistan.

- Enhance risk management strategies to address potential geopolitical disruptions.

- Scenario Projections:

- Best: Successful expansion and stable geopolitical climate lead to increased market share.

- Worst: Geopolitical instability disrupts operations, leading to financial losses.

- Most Likely: Continued growth with manageable geopolitical and operational challenges.

6. Key Individuals and Entities

– Bijan Mossavar-Rahmani

– Aker BP

– Sval Energi

7. Thematic Tags

economic stability, geopolitical risks, energy sector, strategic partnerships