Grant Thornton adds four partners in advisory and audit divisions – Internationalaccountingbulletin.com

Published on: 2025-11-10

Intelligence Report: Grant Thornton adds four partners in advisory and audit divisions – Internationalaccountingbulletin.com

1. BLUF (Bottom Line Up Front)

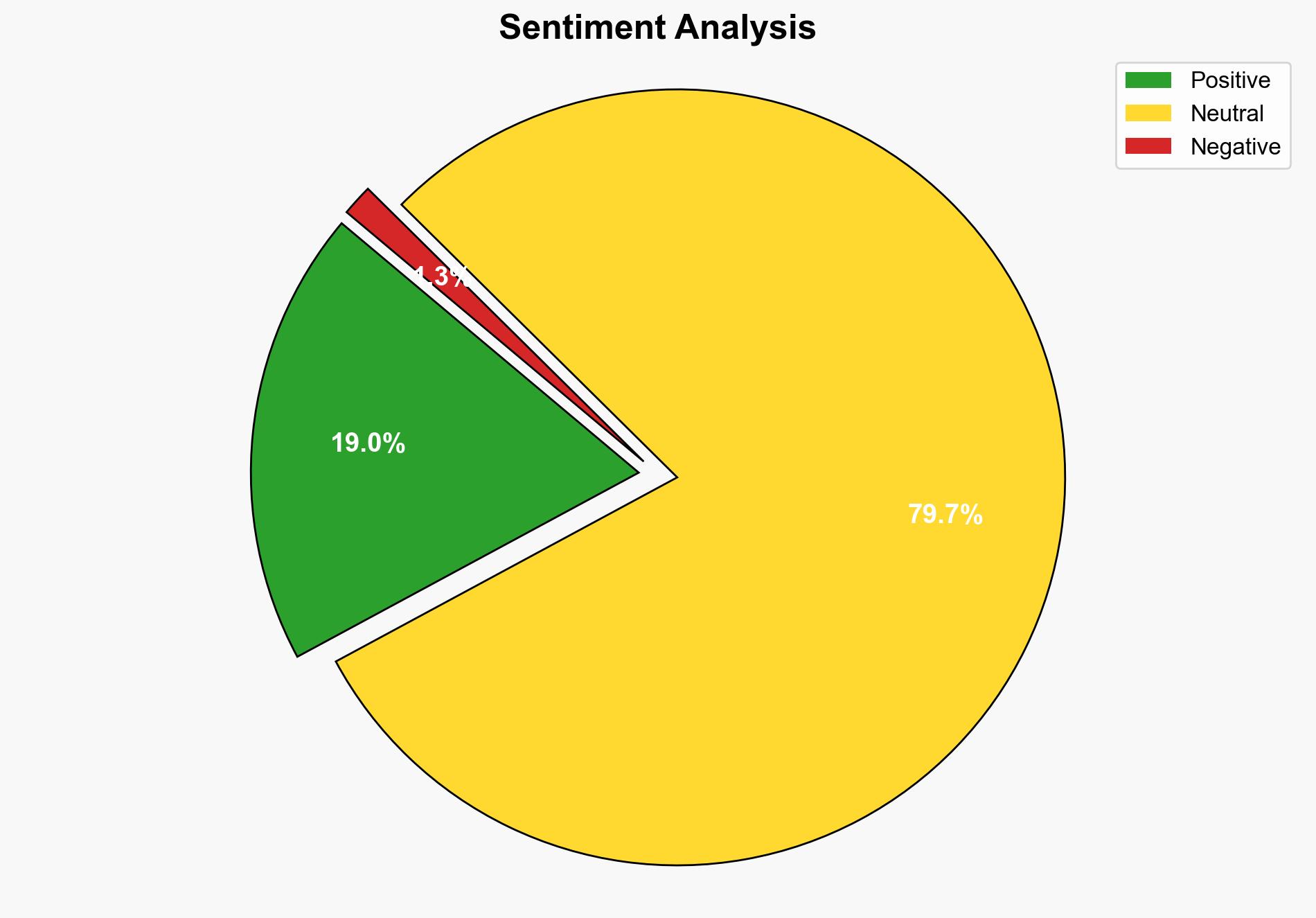

Grant Thornton’s strategic expansion by adding four partners aims to strengthen its advisory and audit capabilities, potentially enhancing its competitive position in the global market. The hypothesis that this move is primarily driven by a need to bolster expertise in response to evolving industry demands is better supported. Confidence level: Moderate. Recommended action: Monitor the impact of these appointments on Grant Thornton’s market performance and client acquisition.

2. Competing Hypotheses

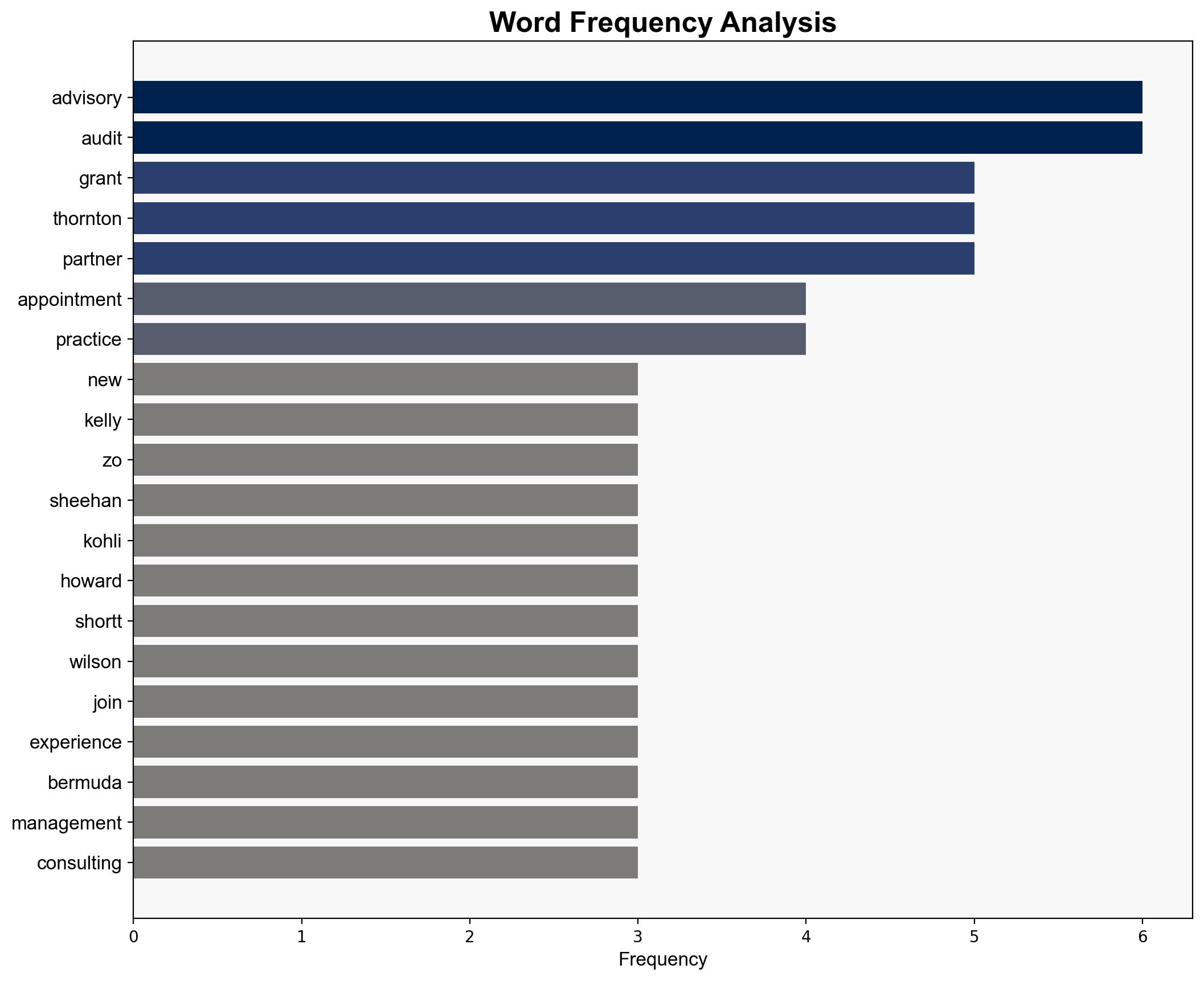

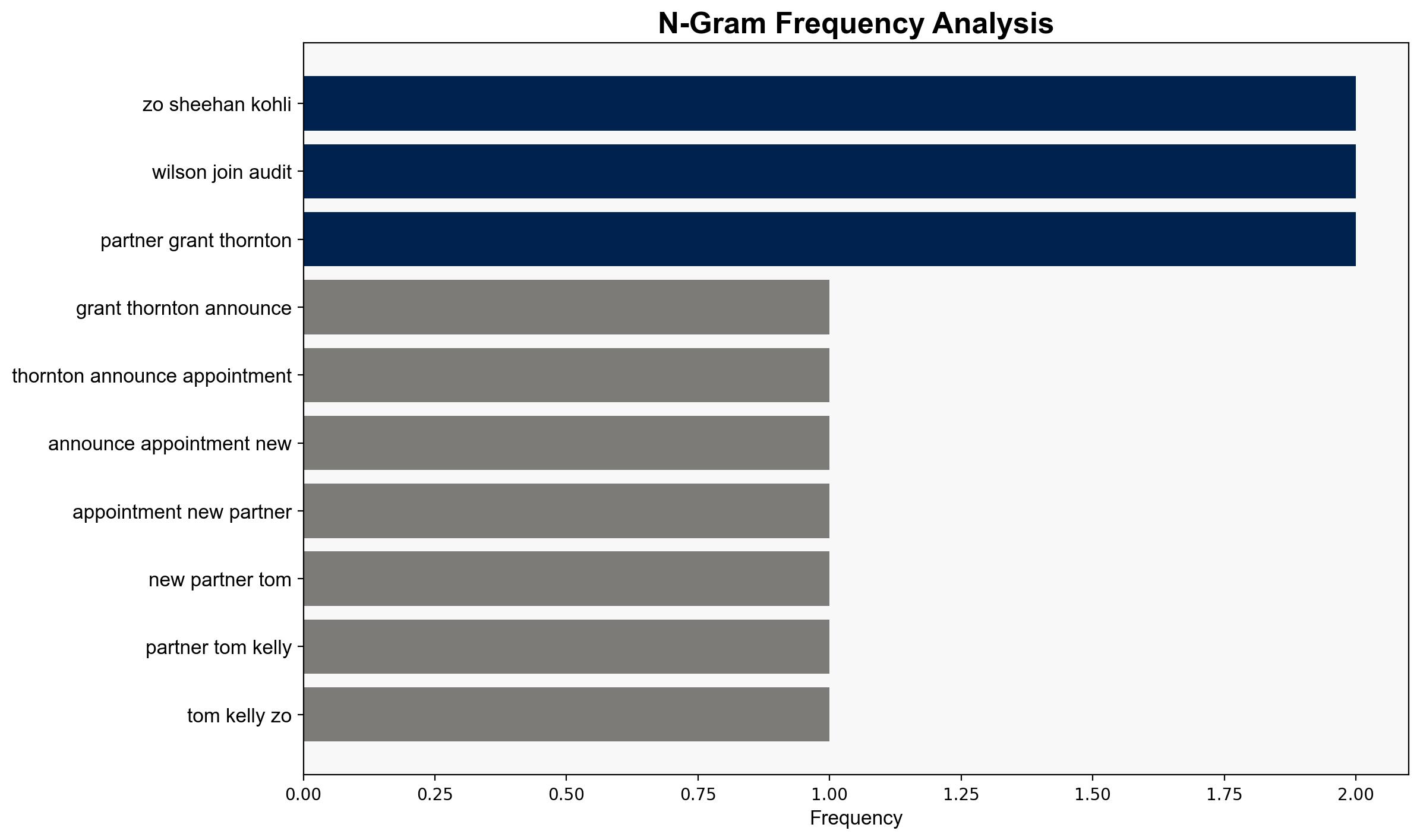

1. **Hypothesis A**: The appointments are a strategic move to enhance Grant Thornton’s capabilities in response to increasing demand for specialized advisory and audit services, particularly in cybersecurity and asset management.

2. **Hypothesis B**: The appointments are primarily a response to internal restructuring and leadership changes, aiming to stabilize and reinforce the firm’s regional and global operations.

Using ACH 2.0, Hypothesis A is better supported due to the alignment of the new partners’ expertise with current industry trends and client needs, as well as the firm’s recent international partnerships.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the new partners’ expertise will directly translate into enhanced service offerings and client satisfaction.

– **Red Flags**: Lack of specific details on how these appointments will address potential gaps in Grant Thornton’s current service offerings. The absence of information on how these changes align with the firm’s long-term strategic goals could indicate potential internal challenges.

4. Implications and Strategic Risks

The appointments could lead to increased competitiveness in the advisory and audit sectors, particularly in cybersecurity and asset management. However, there is a risk of over-reliance on new partners to drive growth, which could lead to challenges if integration is not seamless. Additionally, the firm’s ability to adapt to regulatory changes and market demands remains a critical factor.

5. Recommendations and Outlook

- Monitor the integration of new partners and their impact on service delivery and client satisfaction.

- Explore opportunities to leverage the new expertise in expanding service offerings, particularly in cybersecurity and asset management.

- Scenario-based projections:

- Best: Successful integration leads to increased market share and client acquisition.

- Worst: Integration challenges result in service disruptions and client dissatisfaction.

- Most Likely: Gradual improvement in service capabilities with moderate market impact.

6. Key Individuals and Entities

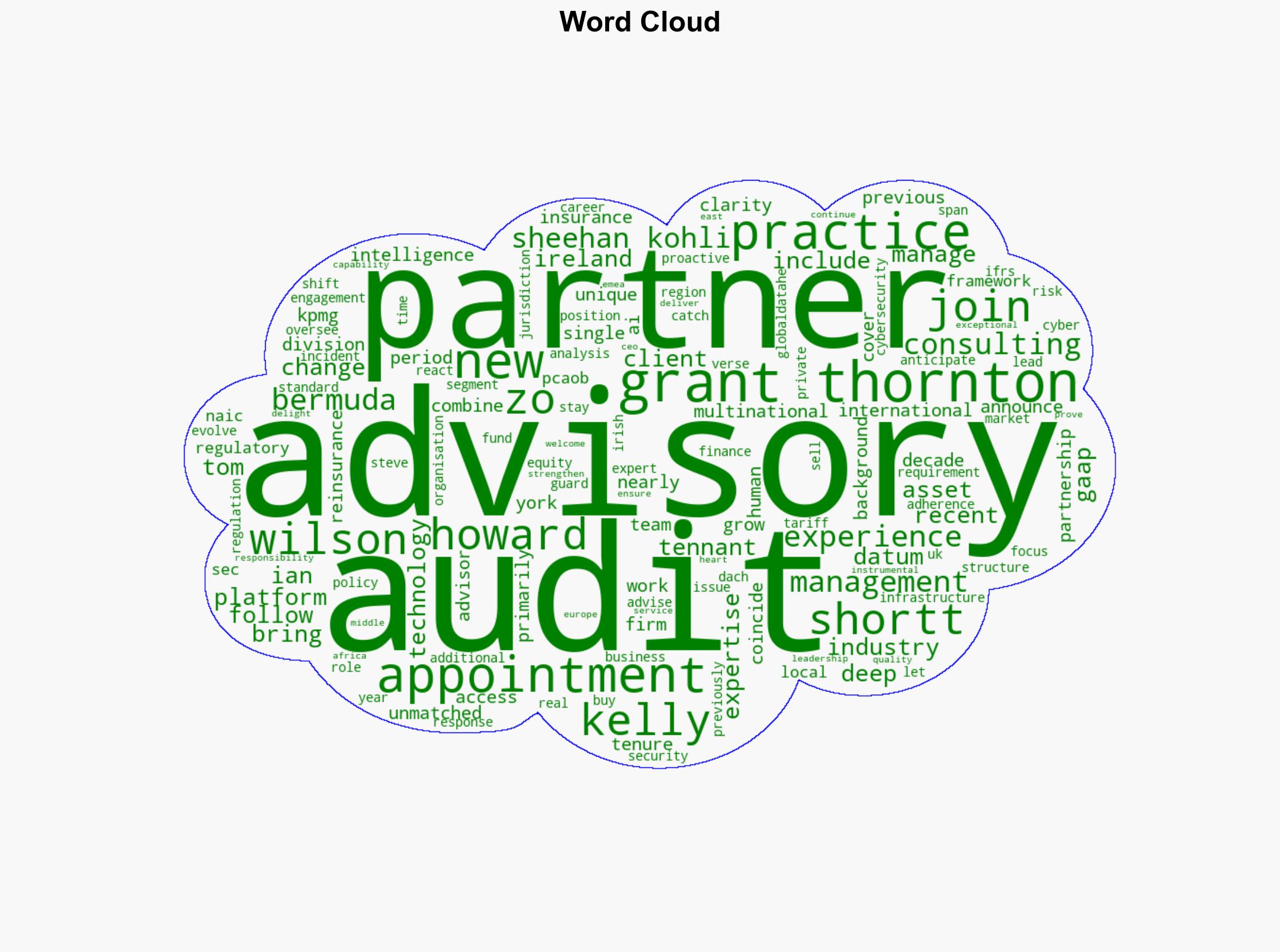

Tom Kelly, Zo Sheehan, Kohli Howard Shortt, Ian Wilson, Steve Tennant.

7. Thematic Tags

corporate strategy, professional services, cybersecurity, asset management, global expansion