Russians agree to quit Serbian oil company as US sanctions bite – Al Jazeera English

Published on: 2025-11-11

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

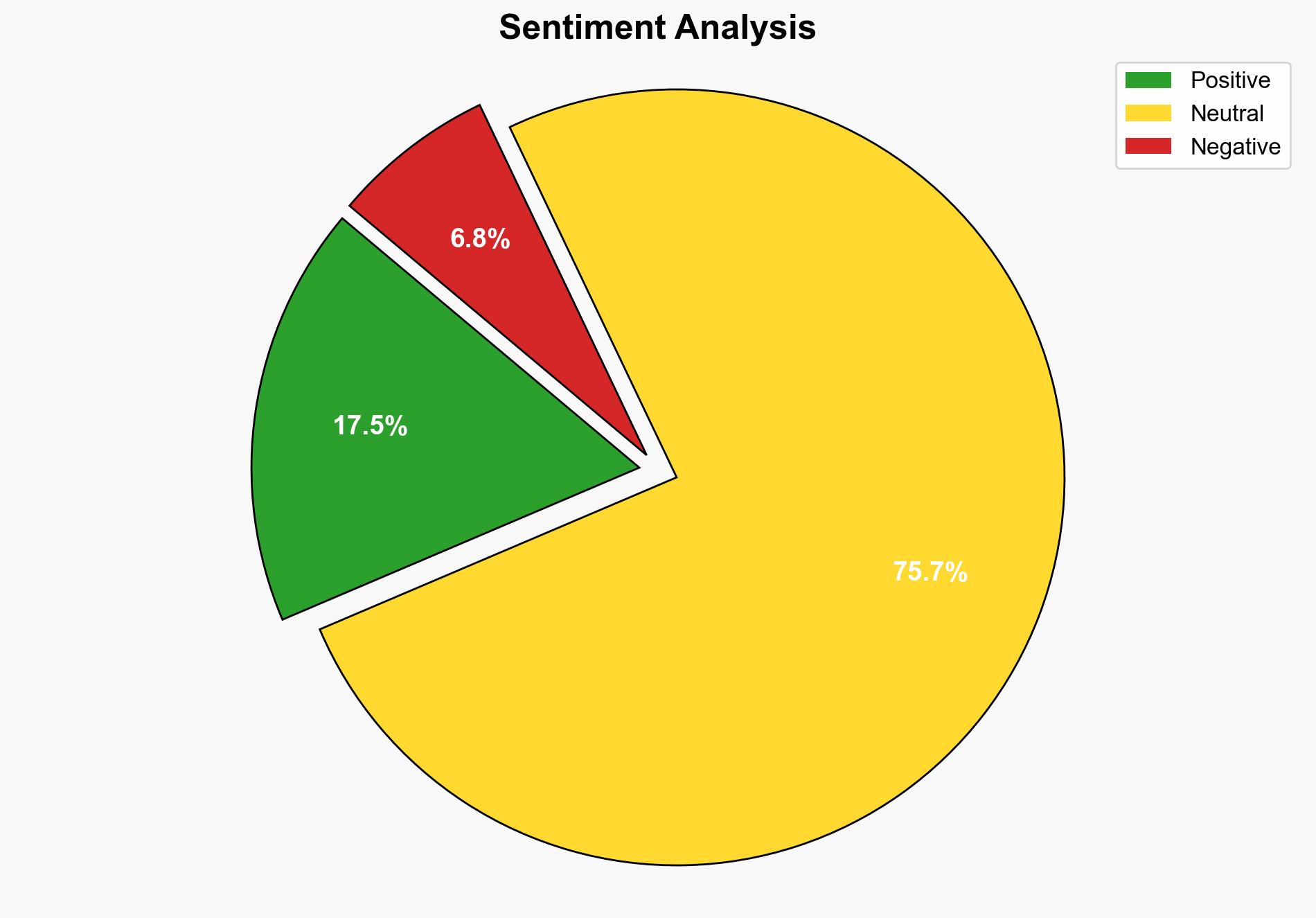

Intelligence Report: Russians agree to quit Serbian oil company as US sanctions bite – Al Jazeera English

1. BLUF (Bottom Line Up Front)

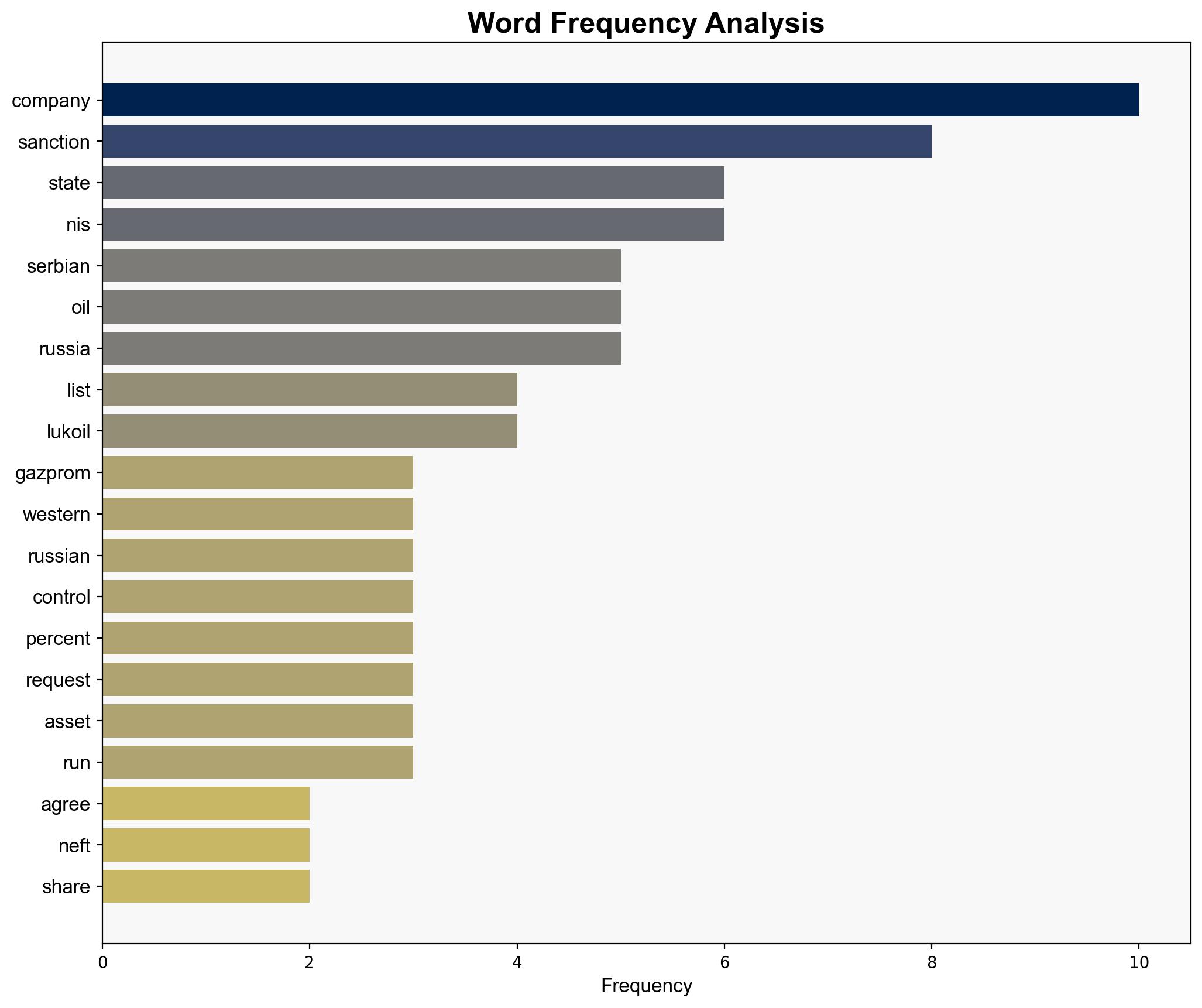

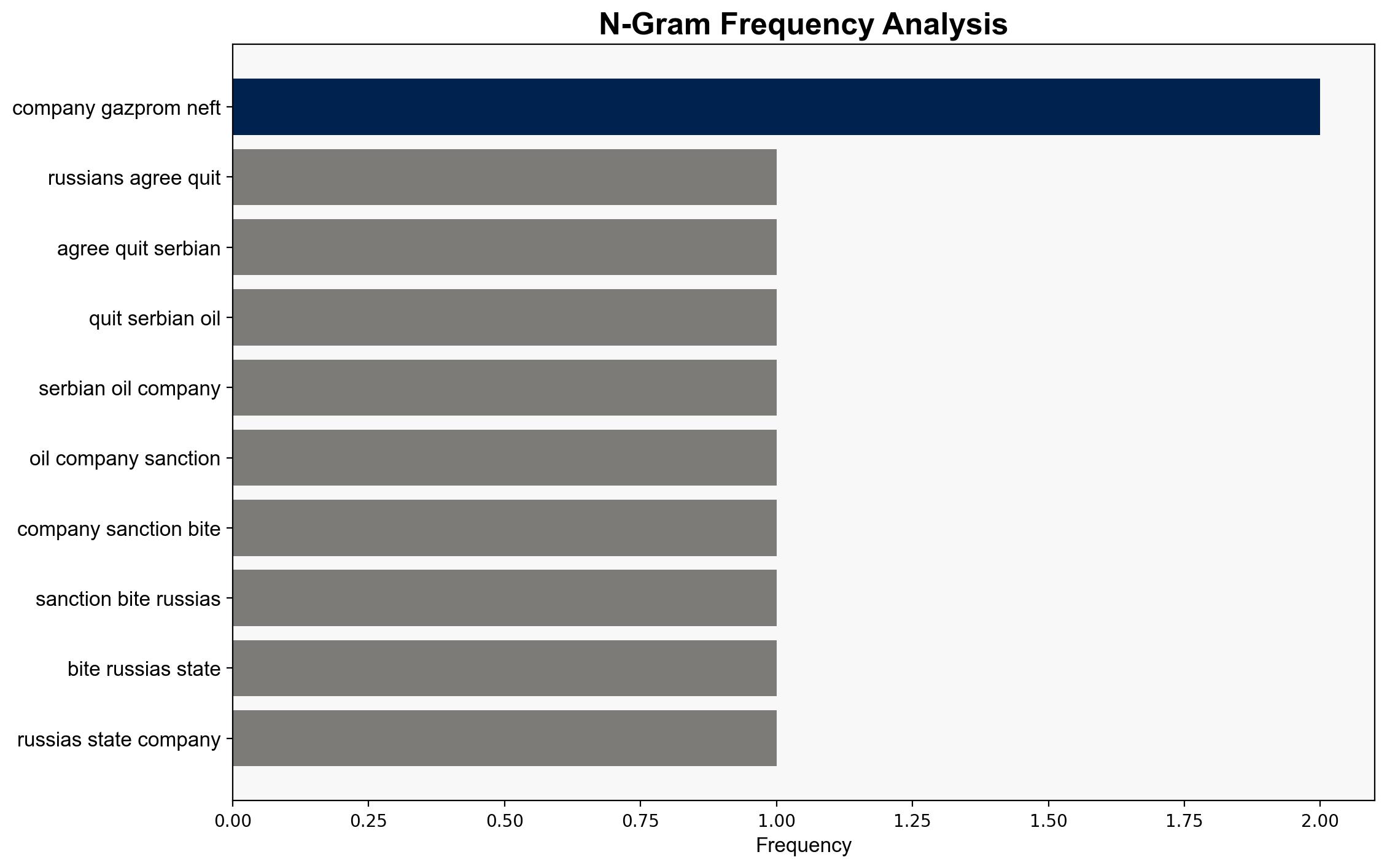

The most supported hypothesis is that the Russian decision to divest from the Serbian oil company NIS is primarily driven by the increasing pressure of Western sanctions, particularly from the US, which are severely impacting Russian economic interests abroad. Confidence Level: Moderate. Recommended action includes monitoring the situation for potential shifts in regional energy dynamics and preparing for possible Russian countermeasures.

2. Competing Hypotheses

Hypothesis 1: The divestment is a direct result of the effectiveness of Western sanctions, which are constraining Russian economic activities and forcing compliance to avoid further financial losses.

Hypothesis 2: The divestment is a strategic maneuver by Russia to reallocate resources and focus on more critical areas of interest, possibly in response to geopolitical shifts or internal economic strategies.

Hypothesis 1 is more likely due to the immediate and tangible impact of sanctions on Russian companies, as evidenced by the need for Gazprom Neft to request a sanctions waiver and the broader context of Western pressure on Russia.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the sanctions are the primary driver of the divestment decision, and that the Serbian government will continue to support Western sanctions.

Red Flags: Potential deception could involve Russia using the divestment as a cover for covert operations or influence in the region. The rapid compliance with sanctions might also indicate undisclosed strategic interests.

4. Implications and Strategic Risks

The divestment could lead to increased energy insecurity in Serbia and the Balkans, potentially destabilizing the region if alternative energy sources are not secured. There is also a risk of Russia retaliating through cyber or informational campaigns to undermine Western influence in the region. Economically, the shift could alter regional energy markets, affecting prices and supply chains.

5. Recommendations and Outlook

- Monitor Russian economic and geopolitical maneuvers in response to the sanctions and divestment.

- Encourage Serbia to diversify its energy sources to mitigate dependency risks.

- Best-case scenario: Serbia successfully transitions to alternative energy sources without significant disruption.

- Worst-case scenario: Energy shortages lead to political instability in Serbia and the Balkans.

- Most-likely scenario: Serbia manages a temporary transition with moderate economic impact, while Russia seeks alternative avenues to exert influence.

6. Key Individuals and Entities

Dubravka Djedovic Handanovic, Serbian Energy Minister; Gazprom Neft; Naftna Industrija Srbije (NIS); Office of Foreign Assets Control (OFAC), United States Treasury.

7. Thematic Tags

Regional Focus: Balkans, Russia, Serbia, Energy Security, Sanctions

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Cognitive Bias Stress Test: Structured challenge to expose and correct biases.

- Network Influence Mapping: Map influence relationships to assess actor impact.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology