BitMine Overhaul Signals Institutional Consolidation as ETH ETFs Record Outflows – Coinspeaker

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: BitMine Overhaul Signals Institutional Consolidation as ETH ETFs Record Outflows

1. BLUF (Bottom Line Up Front)

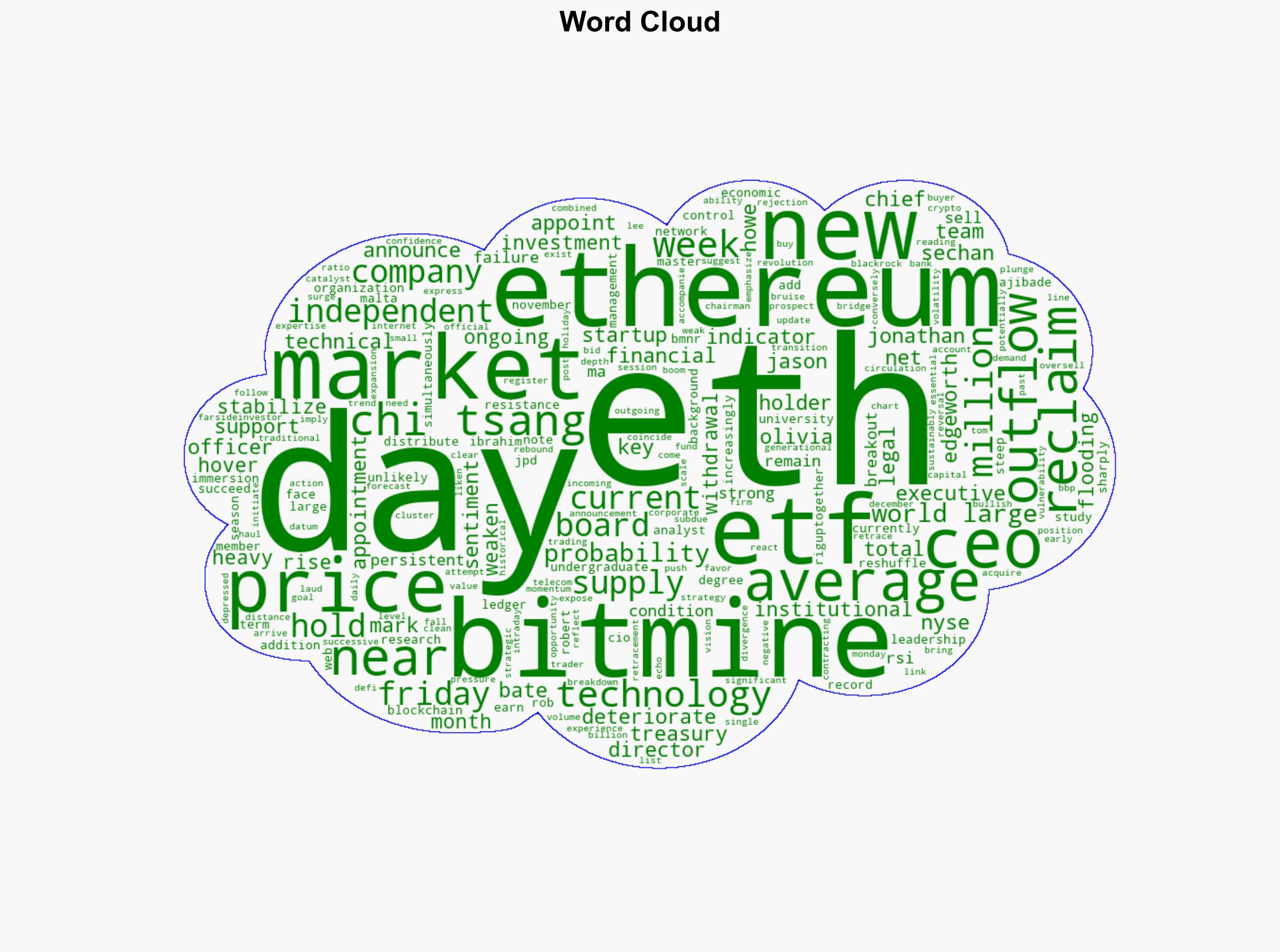

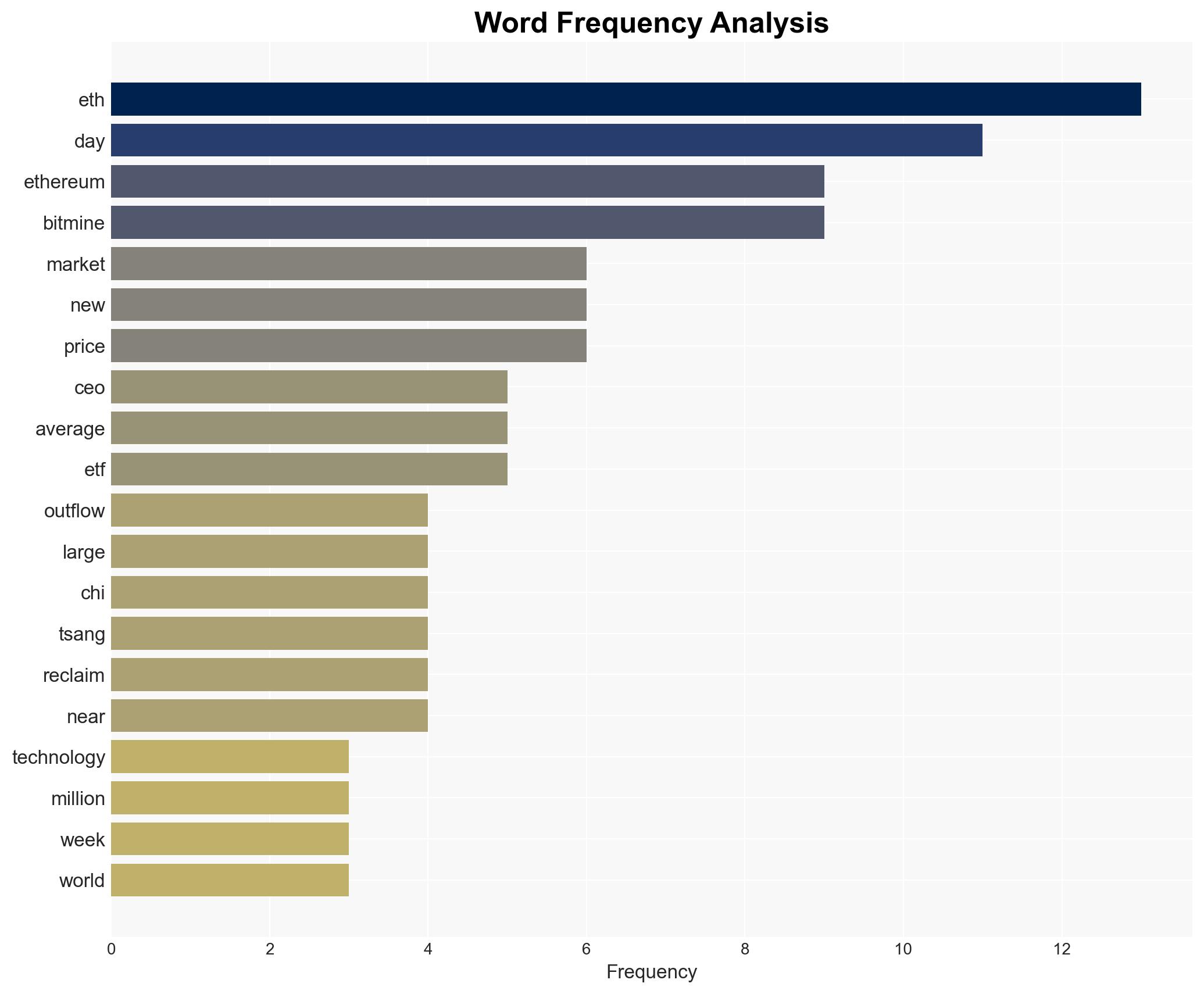

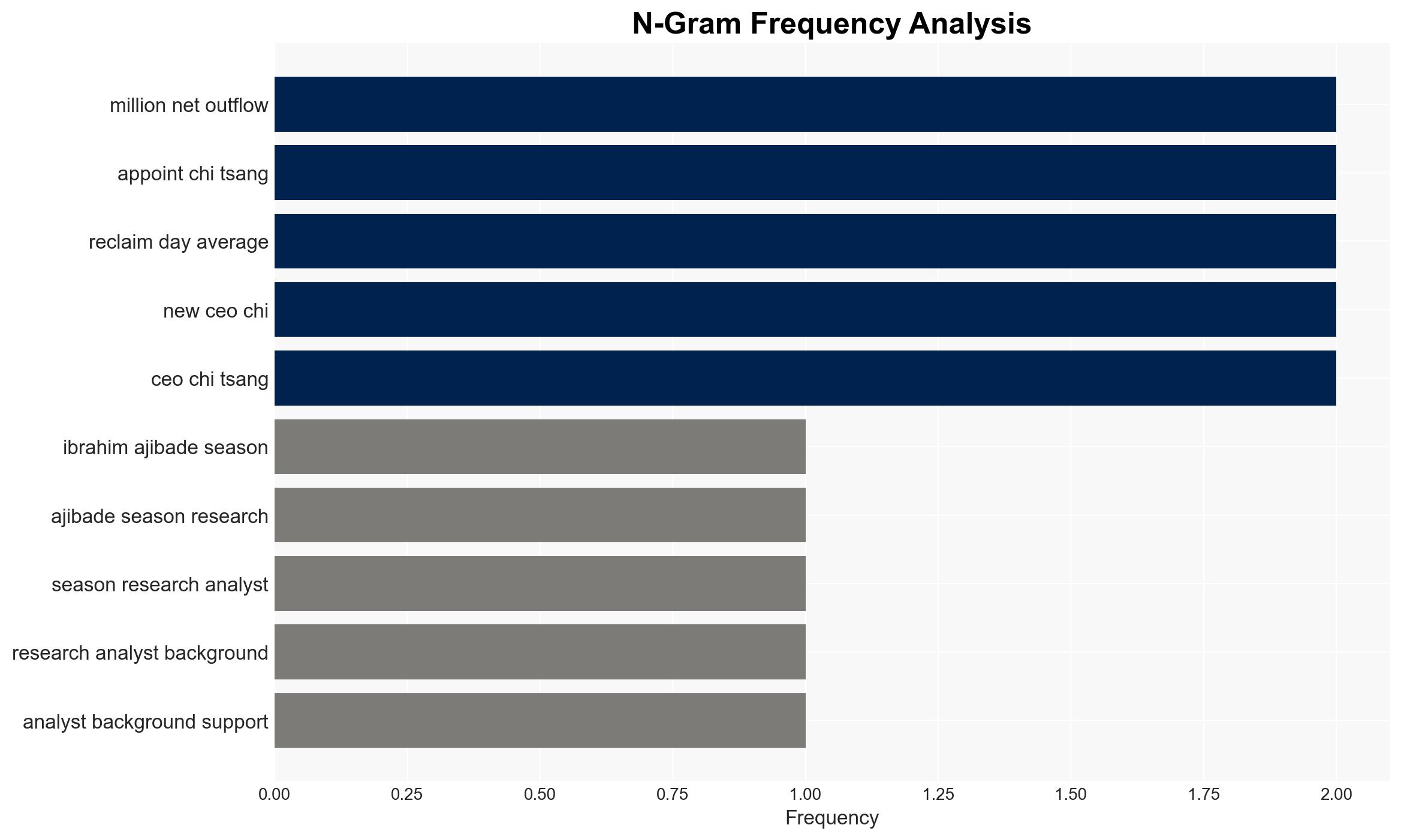

The strategic judgment is that BitMine’s leadership overhaul is a strategic move to consolidate its position in the Ethereum market amidst significant ETF outflows, with a moderate confidence level. The most supported hypothesis is that BitMine aims to leverage institutional expertise to stabilize and potentially increase its control over the Ethereum market. Recommended action includes monitoring BitMine’s strategic moves and market reactions while assessing potential impacts on Ethereum’s market stability.

2. Competing Hypotheses

Hypothesis 1: BitMine’s leadership change is a strategic maneuver to strengthen its position in the Ethereum market by leveraging institutional expertise and bridging the gap between traditional finance and cryptocurrency.

Hypothesis 2: The leadership overhaul is a reactionary measure to address internal challenges and external market pressures, including the recent significant outflows from Ethereum ETFs, aiming to stabilize the company’s market position.

Hypothesis 1 is more likely due to the strategic nature of the appointments, which align with BitMine’s stated goals of bridging Ethereum with traditional capital markets and leveraging the ongoing crypto boom.

3. Key Assumptions and Red Flags

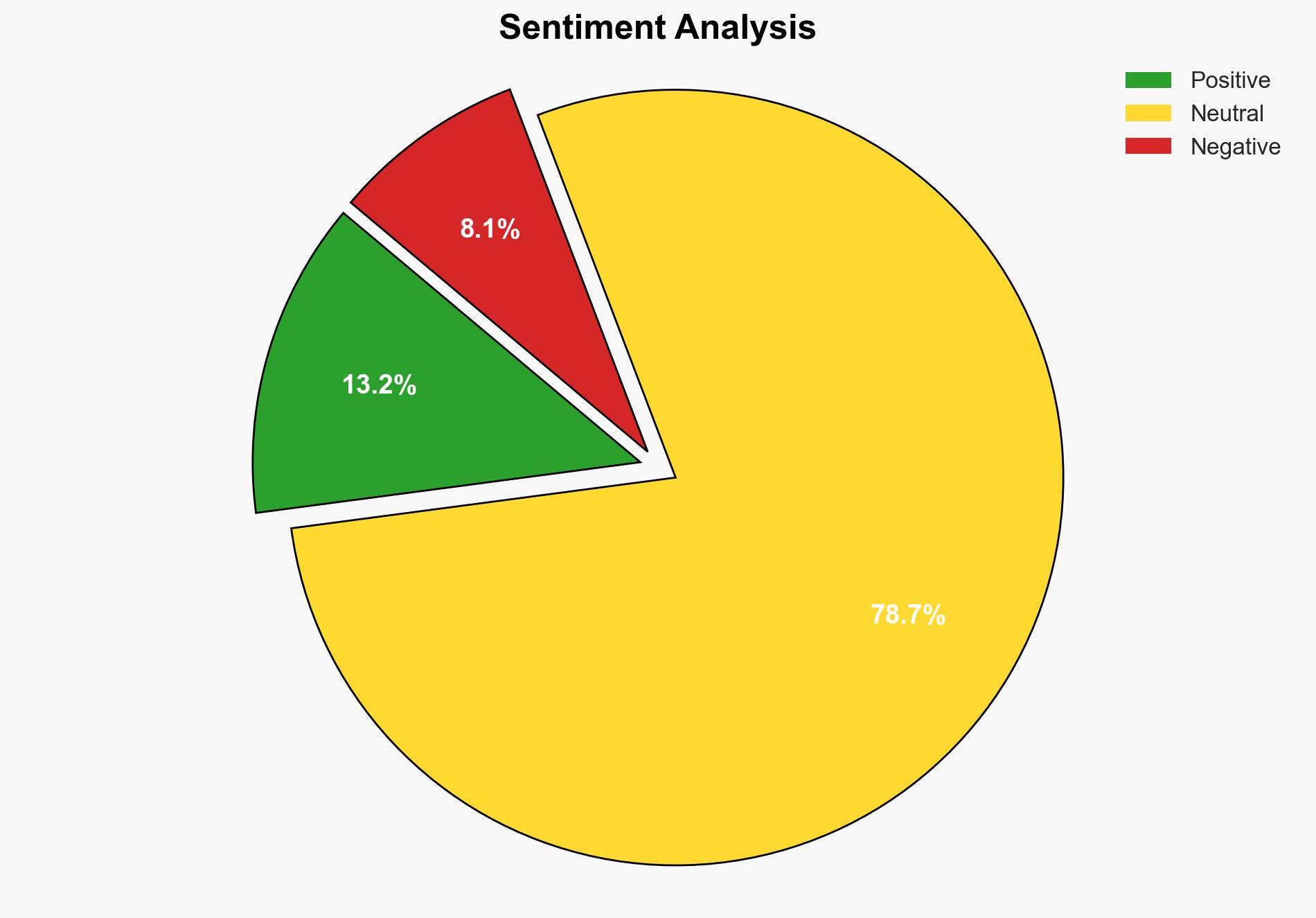

Assumptions: It is assumed that the new leadership team has the capability and intent to execute BitMine’s strategic goals effectively. It is also assumed that the current market conditions will persist, affecting Ethereum’s price and investor sentiment.

Red Flags: The significant outflows from Ethereum ETFs and the technical resistance faced by Ethereum’s price are red flags indicating potential market instability. Additionally, the rapid leadership change could suggest internal challenges or strategic pivots.

4. Implications and Strategic Risks

The leadership change at BitMine could lead to increased institutional interest in Ethereum, potentially stabilizing the market. However, if the new strategy fails to address the underlying market pressures, it could exacerbate volatility. The ongoing ETF outflows pose a risk of further price declines, which could trigger broader market instability and impact investor confidence.

5. Recommendations and Outlook

- Actionable Steps: Monitor BitMine’s strategic initiatives and market reactions closely. Engage with institutional investors to gauge sentiment and potential shifts in investment strategies.

- Best Scenario: BitMine successfully consolidates its market position, stabilizing Ethereum prices and attracting renewed institutional interest.

- Worst Scenario: Continued ETF outflows and leadership challenges lead to increased market volatility and a significant decline in Ethereum’s value.

- Most-likely Scenario: BitMine’s strategic moves result in moderate stabilization, with Ethereum prices experiencing fluctuations but avoiding severe downturns.

6. Key Individuals and Entities

Chi Tsang (CEO), Robert Sechan (Independent Director), Olivia Howe (Chief Legal Officer), Jason Edgeworth (CIO), Tom Lee (Chairman), Jonathan Bates (Outgoing CEO).

7. Thematic Tags

Cybersecurity, Cryptocurrency, Institutional Investment, Market Volatility

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Cognitive Bias Stress Test: Structured challenge to expose and correct biases.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·