Indian Economy’s 82% Growth in Q2: Can This Momentum Sustain Over the Coming Years?

Published on: 2025-12-01

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

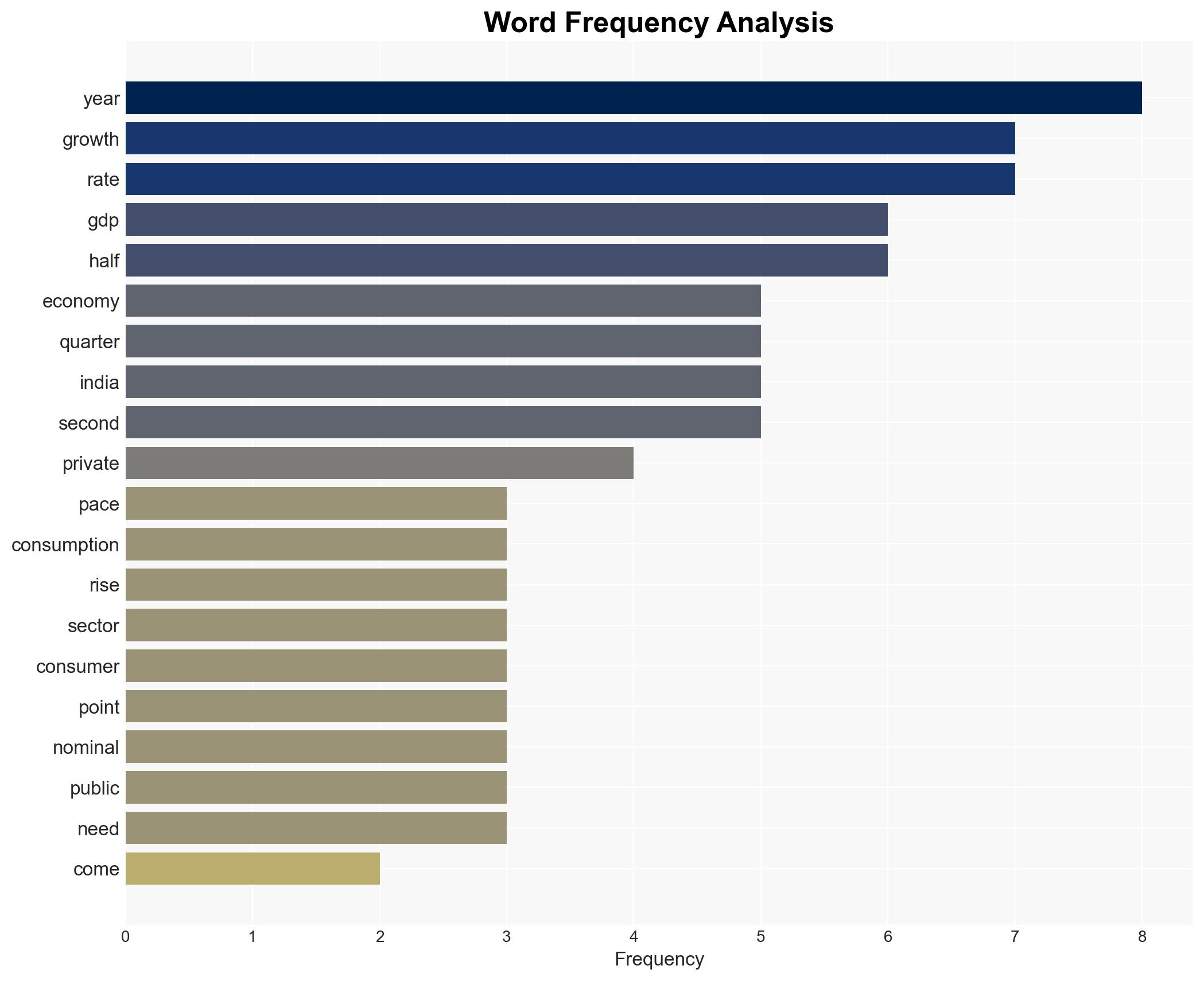

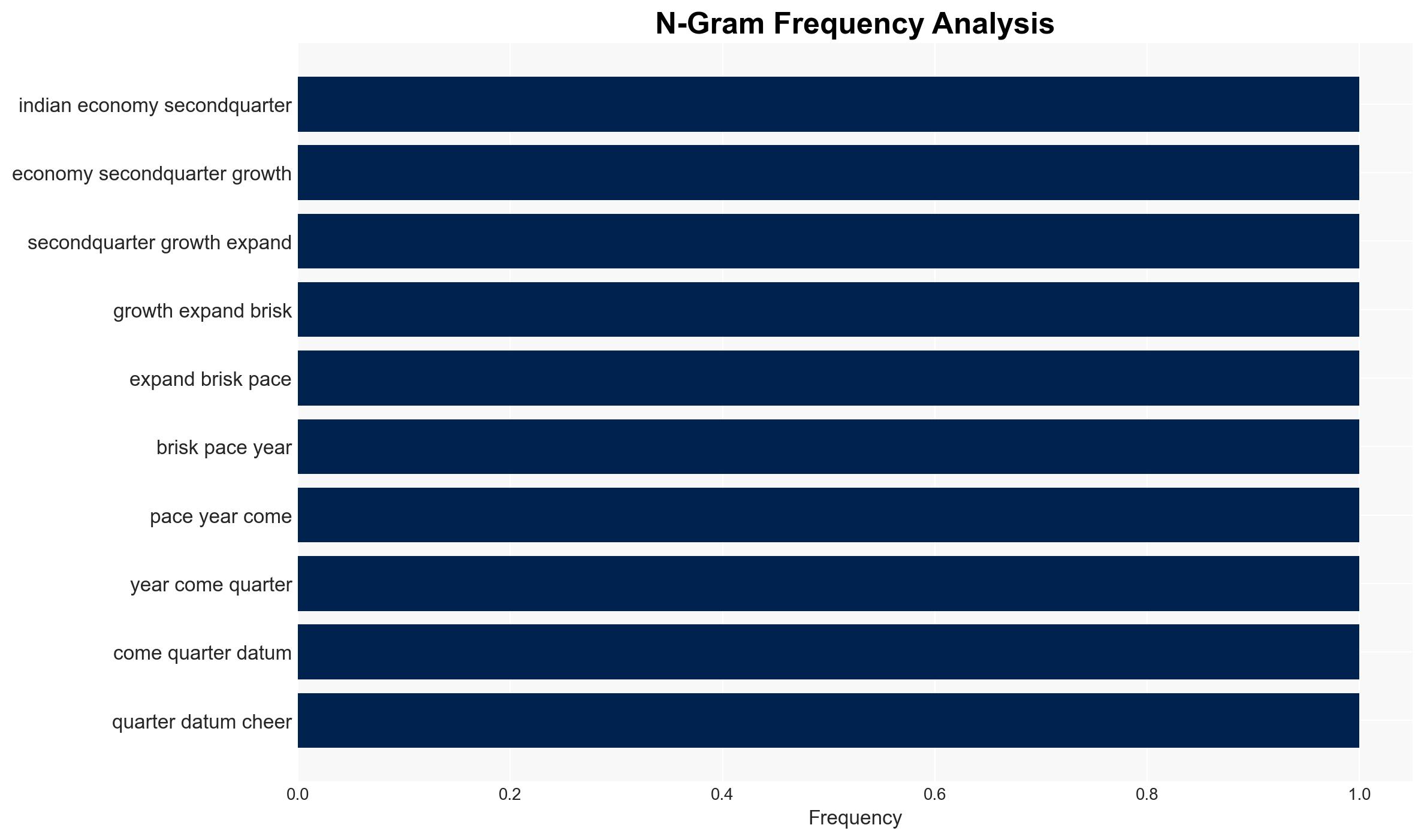

Intelligence Report: The Indian economy’s 82 second-quarter growth Can it expand at such a brisk pace for years to come

1. BLUF (Bottom Line Up Front)

The Indian economy’s unexpected 8.2% growth in the second quarter raises questions about its sustainability. While short-term indicators are positive, structural challenges and fiscal constraints pose risks to long-term expansion. Moderate confidence in the hypothesis that growth will decelerate without significant policy adjustments.

2. Competing Hypotheses

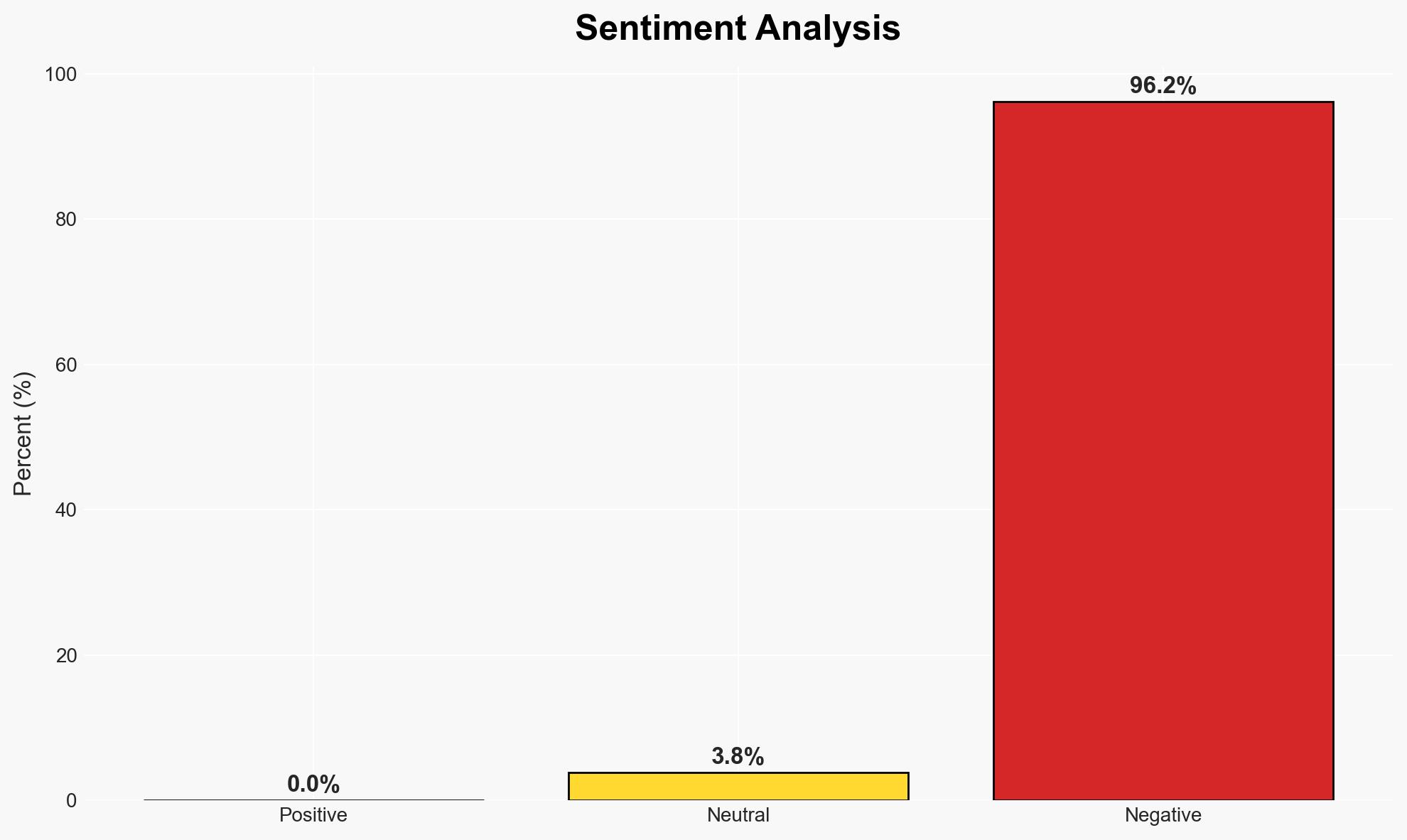

- Hypothesis A: The Indian economy can sustain its current growth rate due to strong manufacturing and infrastructure investments. Supporting evidence includes the uptick in manufacturing and public-private partnerships. However, uncertainties remain regarding private sector revival and fiscal space.

- Hypothesis B: The growth rate is unsustainable in the long term due to fiscal constraints and weak private consumption. Contradicting evidence includes the anaemic rise in consumer goods and potential fiscal deficits impacting public spending.

- Assessment: Hypothesis B is currently better supported due to the structural challenges and fiscal constraints highlighted. Key indicators that could shift this judgment include significant policy reforms or unexpected private sector investment surges.

3. Key Assumptions and Red Flags

- Assumptions: The current fiscal policies will remain unchanged; global economic conditions will not drastically deteriorate; public-private partnerships will continue to attract investment.

- Information Gaps: Detailed data on private sector investment intentions and government fiscal policy adjustments are lacking.

- Bias & Deception Risks: Potential bias in government-reported economic data; optimism bias in market reactions; possible underreporting of fiscal deficits.

4. Implications and Strategic Risks

The current growth trajectory, if unsustainable, could lead to economic instability and reduced investor confidence. This development could interact with broader economic and geopolitical dynamics, impacting regional stability.

- Political / Geopolitical: Economic instability could weaken India’s geopolitical influence and complicate regional relations.

- Security / Counter-Terrorism: Economic downturns may exacerbate internal security challenges, including social unrest.

- Cyber / Information Space: Increased digital infrastructure investments may attract cyber threats targeting economic data and infrastructure.

- Economic / Social: Potential economic slowdown could impact employment rates and social cohesion, particularly if fiscal austerity measures are implemented.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor fiscal policy announcements and private sector investment trends; engage with key economic stakeholders to assess sentiment.

- Medium-Term Posture (1–12 months): Develop resilience measures to mitigate potential economic shocks; strengthen public-private partnerships and transparency in fiscal reporting.

- Scenario Outlook:

- Best: Sustained growth with increased private investment and fiscal reforms.

- Worst: Economic slowdown leading to fiscal crises and social unrest.

- Most-Likely: Moderate growth with periodic fiscal adjustments and policy interventions.

6. Key Individuals and Entities

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

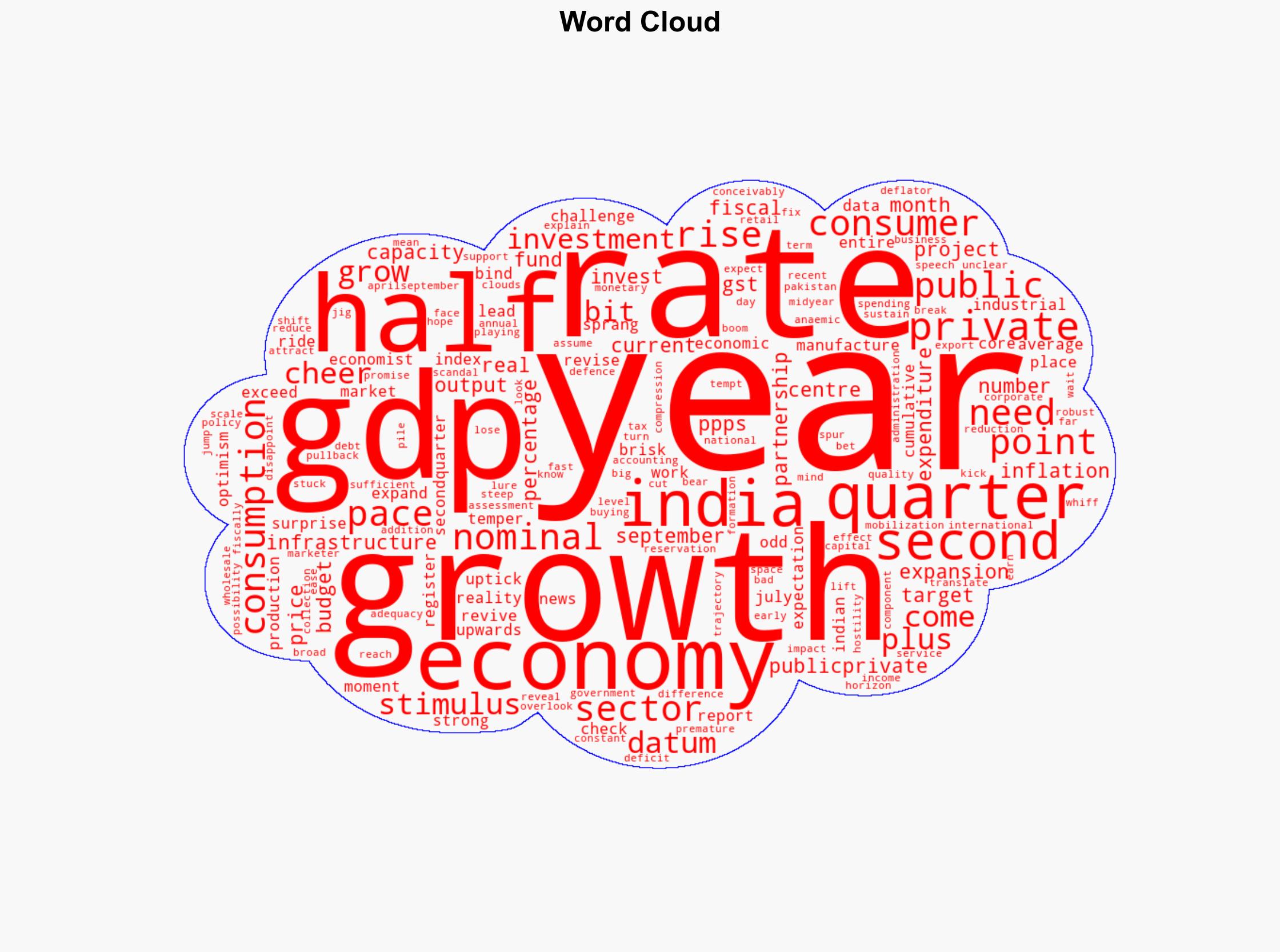

Regional Focus, economic growth, fiscal policy, public-private partnerships, manufacturing, private investment, consumer spending, infrastructure development

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us