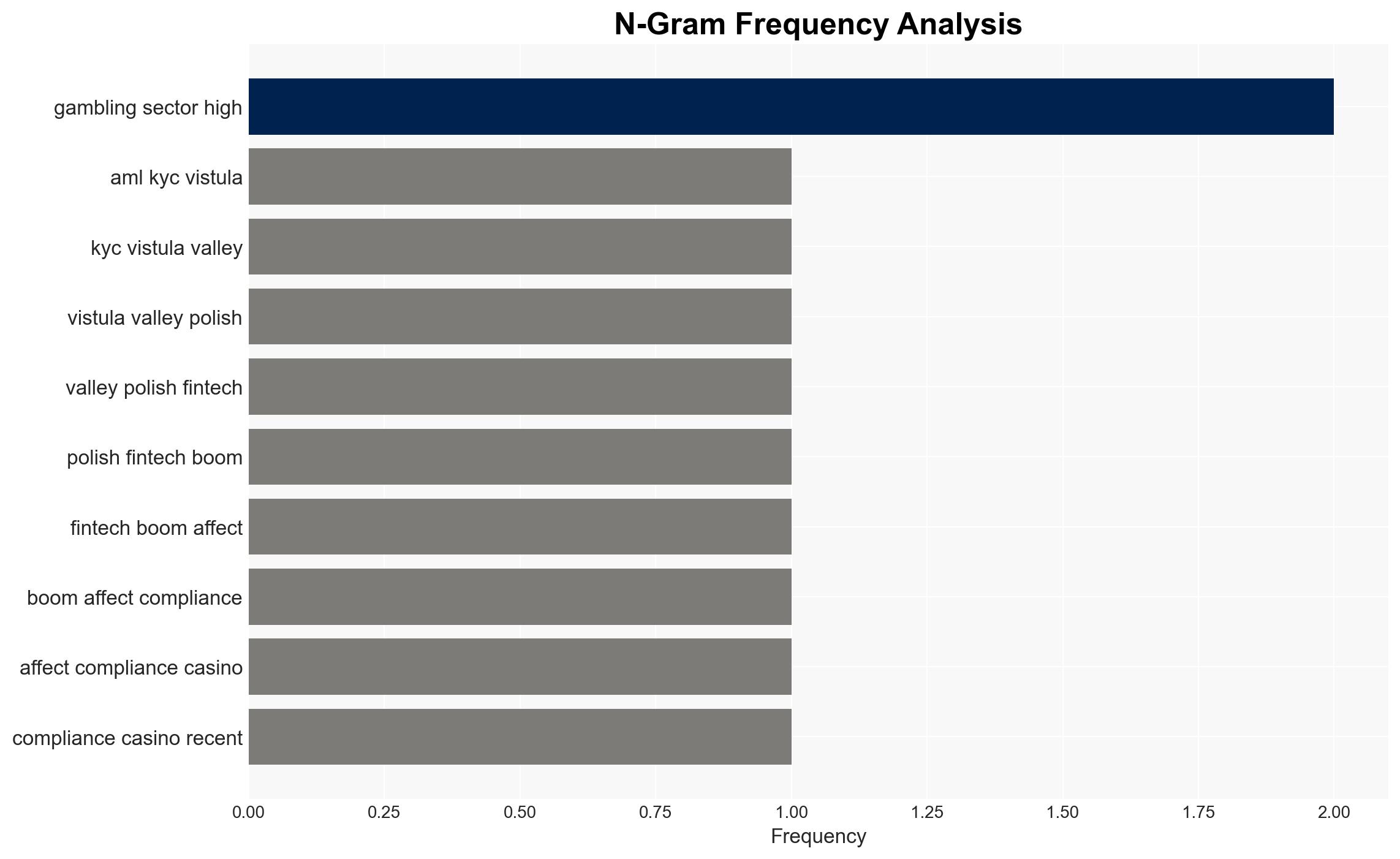

AML KYC in the Vistula Valley How is the Polish FinTech Boom Affecting Compliance in Casinos – Ahouseinthehills.com

Published on: 2025-11-13

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: AML KYC in the Vistula Valley How is the Polish FinTech Boom Affecting Compliance in Casinos – Ahouseinthehills.com

1. BLUF (Bottom Line Up Front)

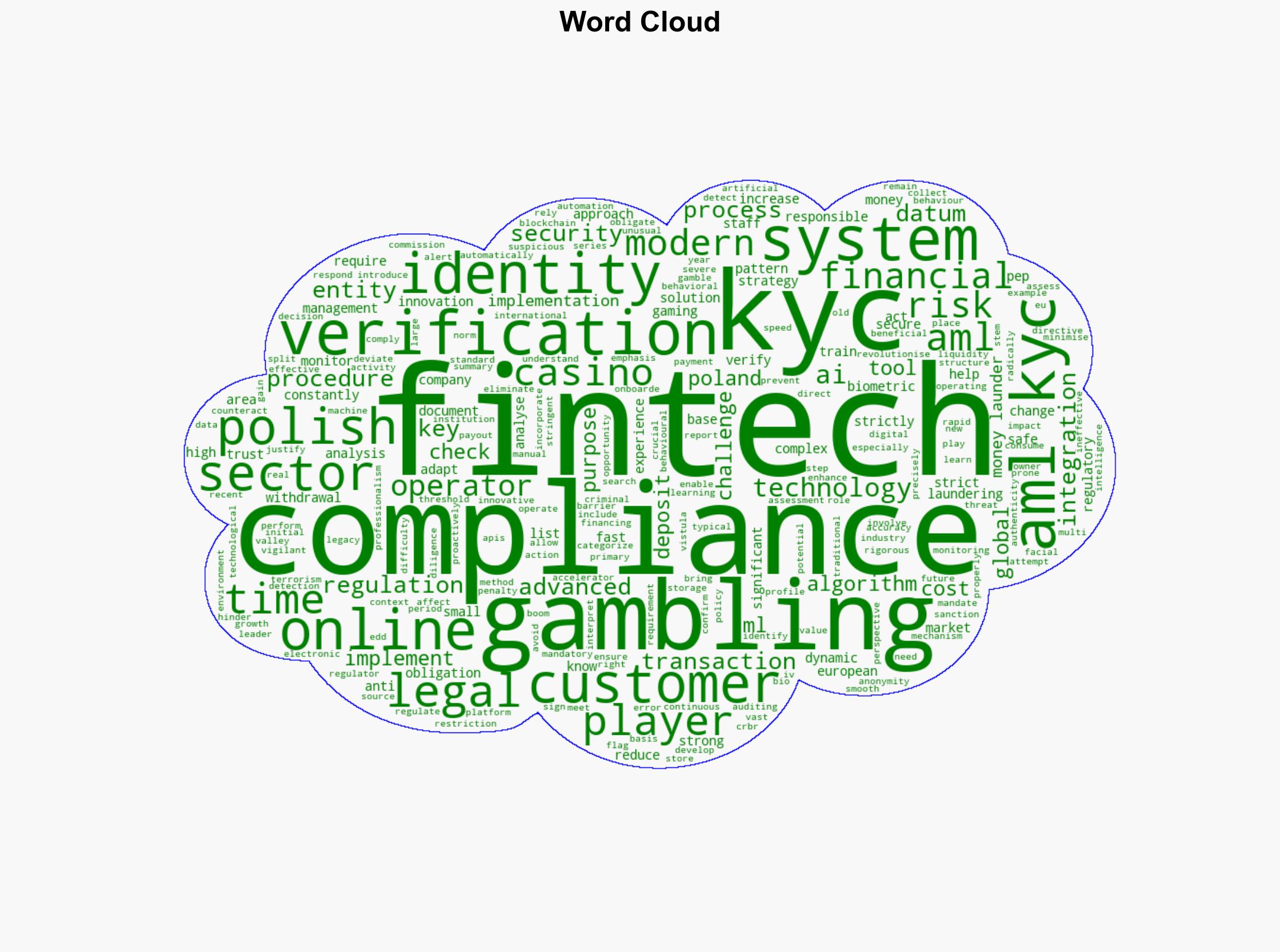

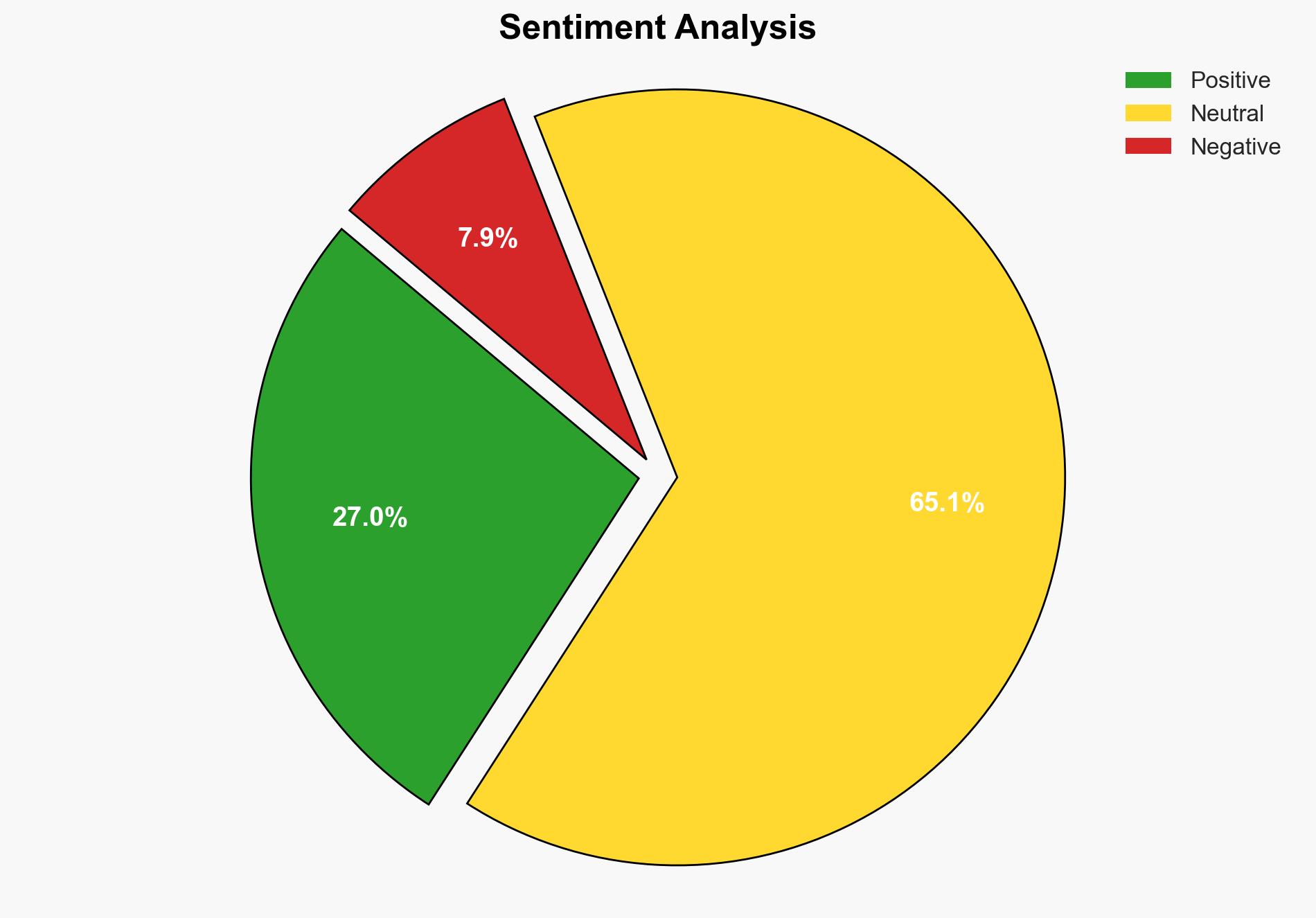

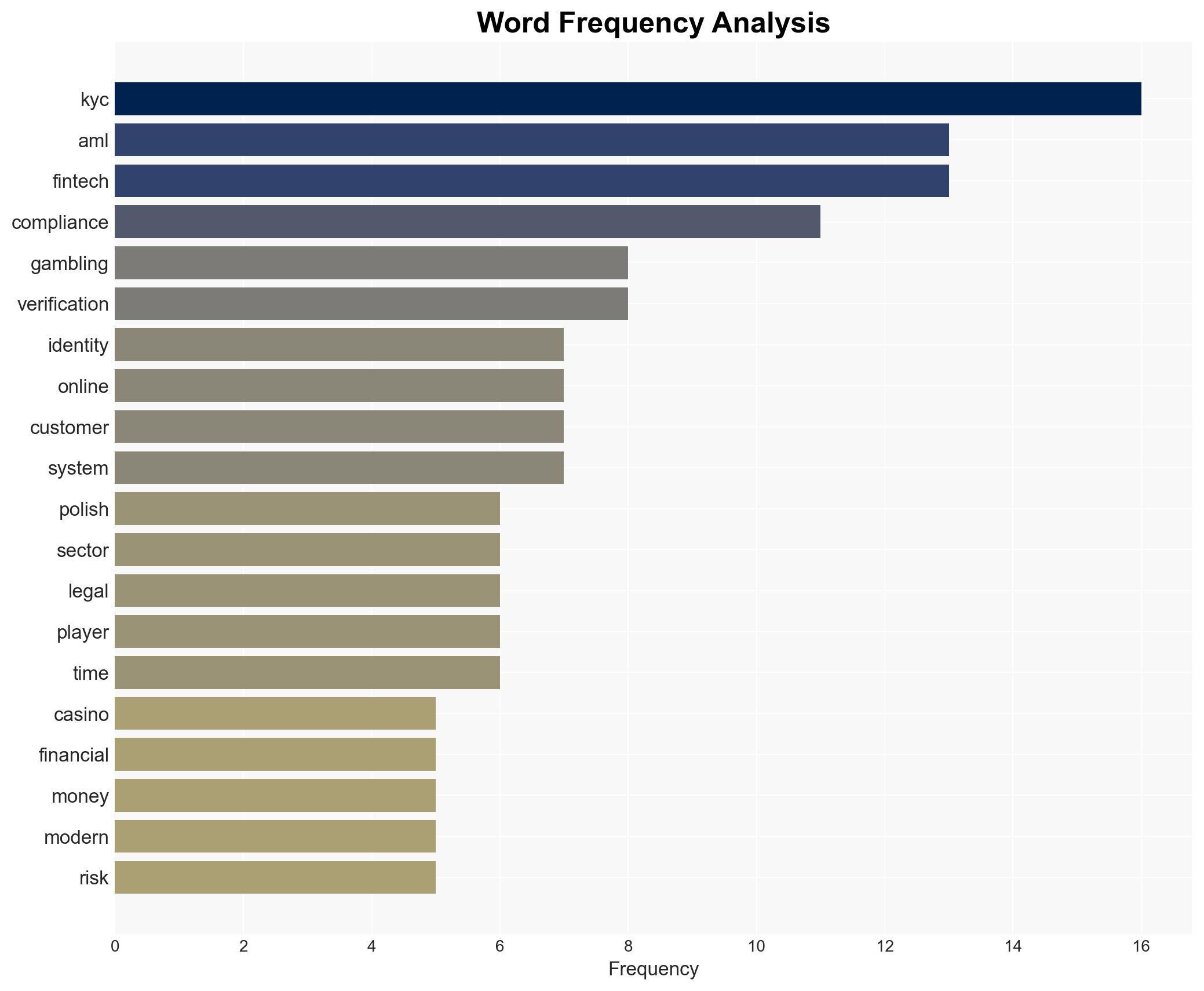

The Polish FinTech boom is significantly enhancing compliance capabilities in the casino sector, primarily through advanced AML and KYC technologies. The most supported hypothesis is that the integration of FinTech solutions is improving compliance efficiency and reducing operational costs, thus strengthening the regulatory framework against money laundering activities. Confidence Level: High. Recommended action includes fostering collaboration between FinTech companies and gambling operators to further enhance compliance mechanisms.

2. Competing Hypotheses

Hypothesis 1: The Polish FinTech boom is positively impacting compliance in the casino sector by providing advanced AML and KYC solutions that enhance efficiency and reduce costs.

Hypothesis 2: Despite the FinTech boom, compliance in the casino sector remains challenged by the rapid evolution of money laundering techniques, which outpace regulatory adaptations.

Hypothesis 1 is more likely due to the documented integration of AI, ML, and biometric technologies in compliance processes, which are known to improve accuracy and efficiency. Hypothesis 2 is less supported as there is no significant evidence suggesting that regulatory adaptations are failing to keep pace with evolving threats.

3. Key Assumptions and Red Flags

Assumptions: FinTech solutions are effectively integrated into existing compliance frameworks; Polish regulatory bodies are responsive to technological advancements.

Red Flags: Over-reliance on technology without adequate human oversight; potential for FinTech solutions to be circumvented by sophisticated money laundering schemes.

4. Implications and Strategic Risks

The integration of FinTech solutions in compliance processes could lead to a reduction in money laundering activities, enhancing the reputation of the Polish gambling sector. However, there is a risk of cyber threats targeting these technologies, potentially compromising sensitive customer data. Additionally, a failure to continuously update these systems could lead to regulatory non-compliance and associated penalties.

5. Recommendations and Outlook

- Encourage partnerships between FinTech firms and gambling operators to continuously innovate compliance solutions.

- Implement regular audits and updates of compliance technologies to mitigate cyber threats.

- Best Scenario: Enhanced compliance leads to a significant reduction in money laundering activities, bolstering the sector’s integrity.

- Worst Scenario: Cyber threats exploit vulnerabilities in compliance technologies, leading to data breaches and regulatory penalties.

- Most-likely Scenario: Continued improvement in compliance efficiency with periodic challenges from evolving money laundering techniques.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Key entities include Polish FinTech companies and online gambling operators.

7. Thematic Tags

National Security Threats

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Methodology