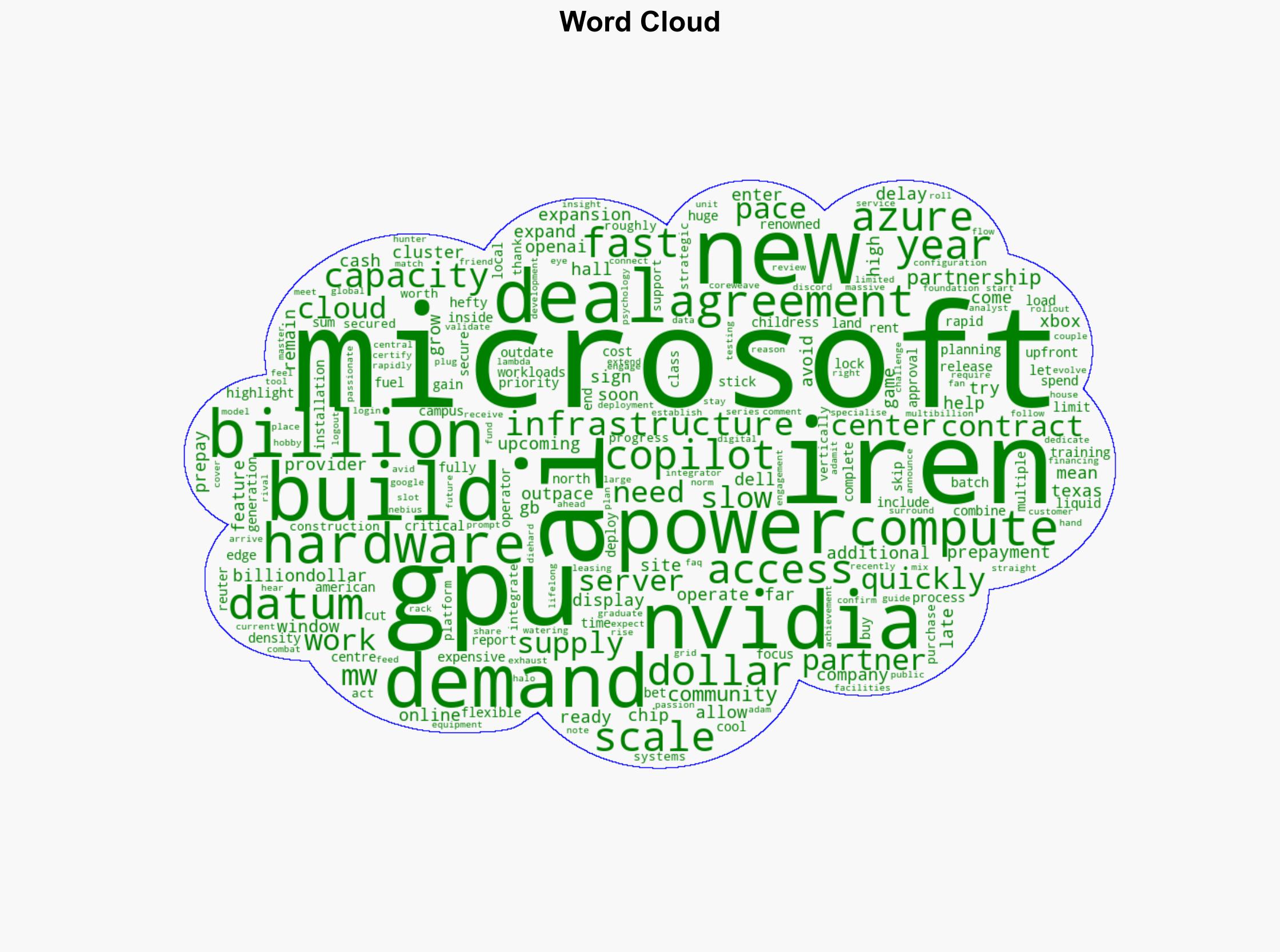

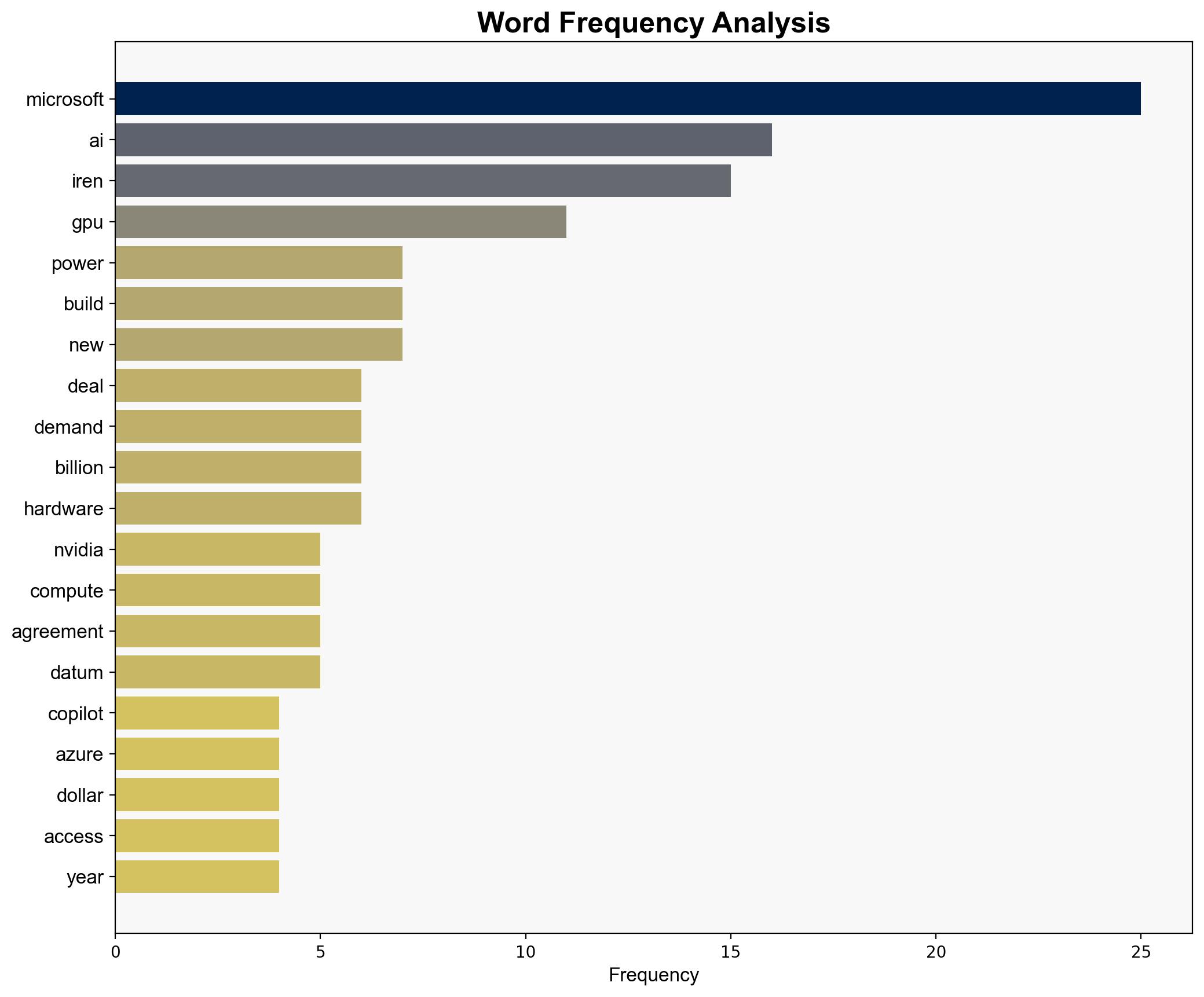

Another billiondollar bet Microsoft spends 97B on NVIDIA GPUs to fuel Copilot and Azure AI – Windows Central

Published on: 2025-11-11

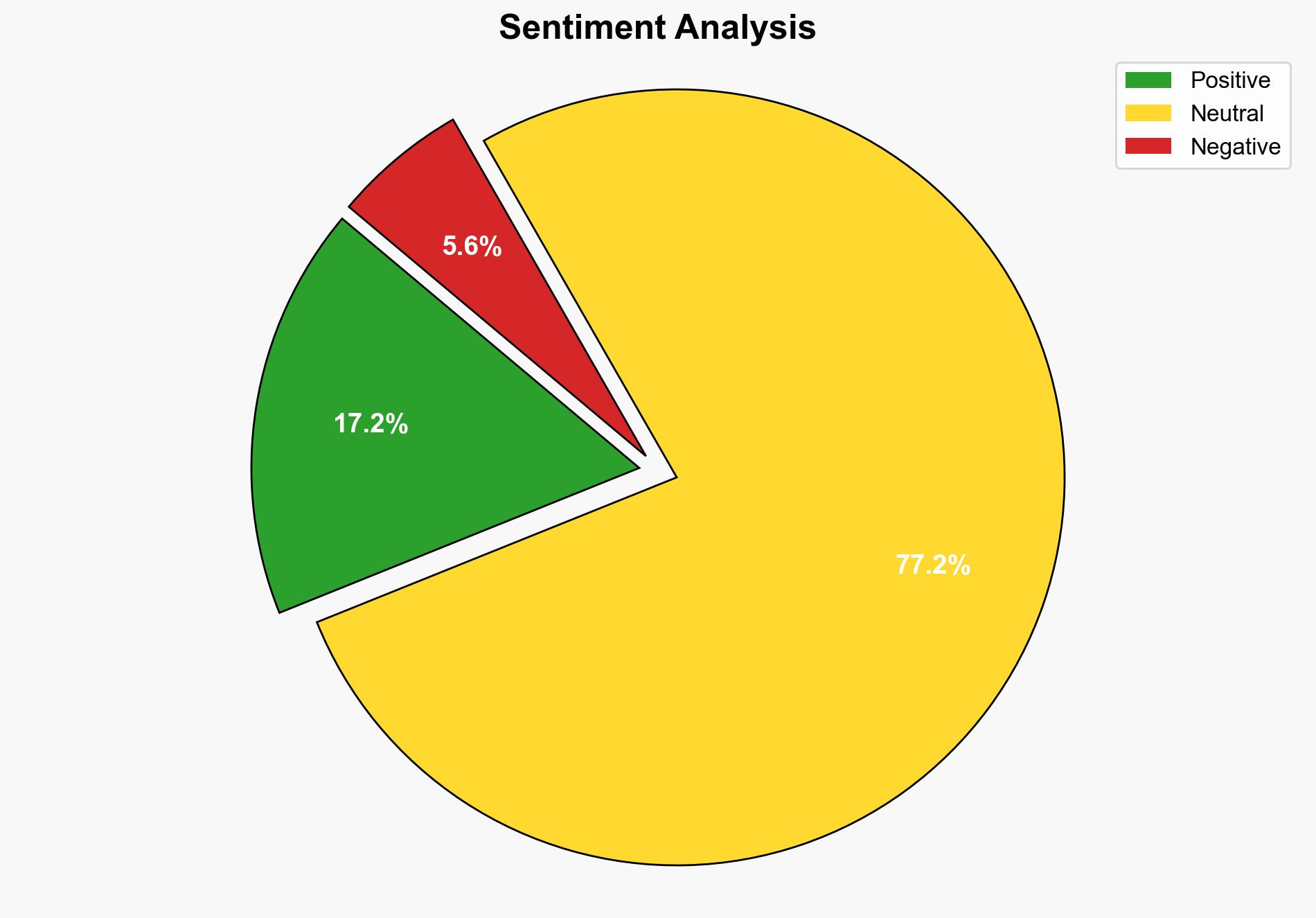

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Another billiondollar bet Microsoft spends 97B on NVIDIA GPUs to fuel Copilot and Azure AI – Windows Central

1. BLUF (Bottom Line Up Front)

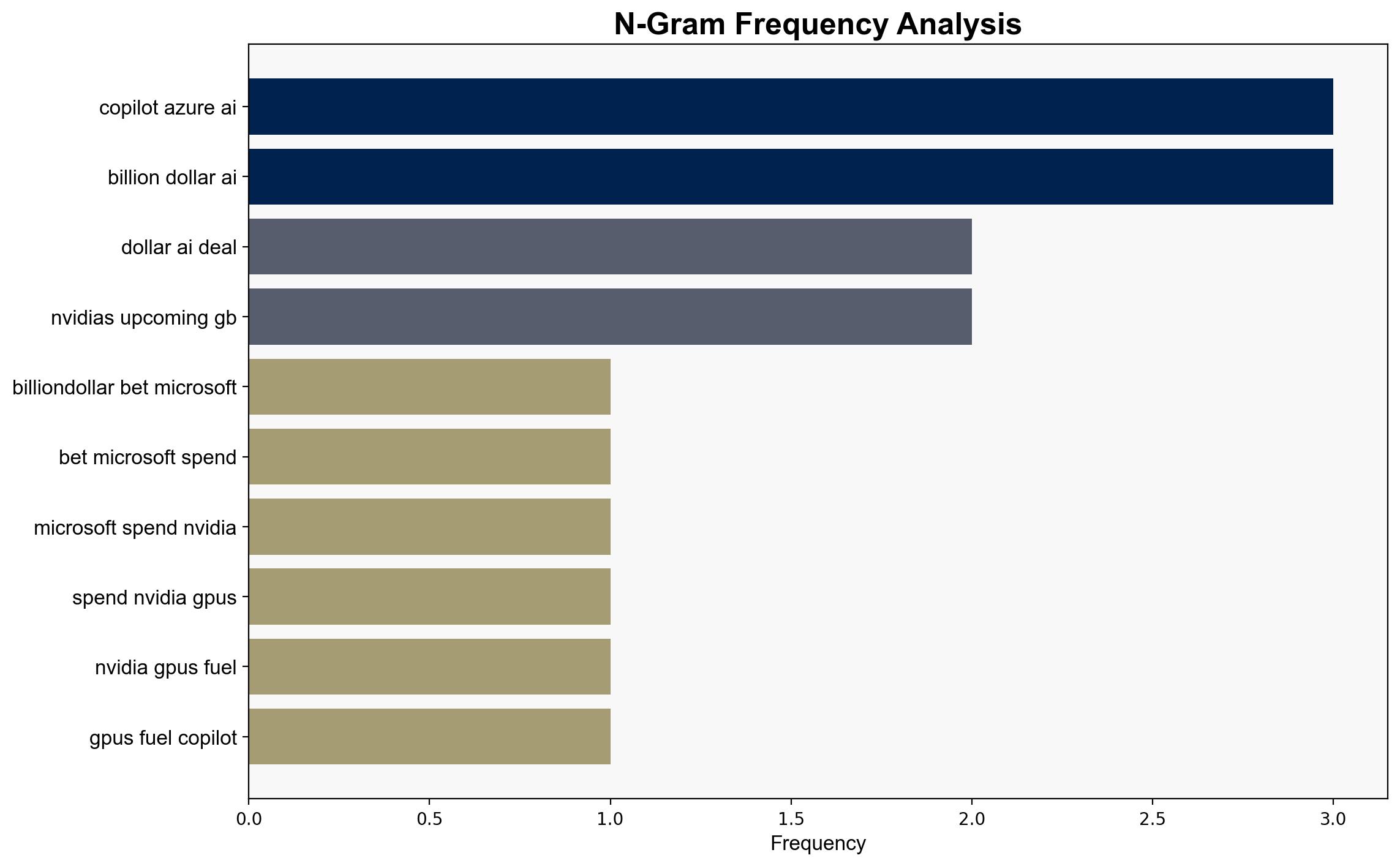

Microsoft’s $97 billion investment in NVIDIA GPUs through a partnership with Iren is a strategic move to meet the burgeoning demand for AI capabilities, particularly for Copilot and Azure AI services. The most supported hypothesis is that this investment is primarily driven by the need to secure cutting-edge computational resources to maintain competitive advantage in the AI and cloud services market. Confidence Level: High. Recommended action: Monitor developments in AI infrastructure and GPU supply chain dynamics to anticipate shifts in market leadership and potential supply constraints.

2. Competing Hypotheses

Hypothesis 1: Microsoft’s investment is a strategic response to the increasing demand for AI services, aiming to secure a competitive edge by ensuring access to advanced computational resources.

Hypothesis 2: The investment is primarily a defensive maneuver to preempt potential supply chain disruptions and mitigate risks associated with rapid technological obsolescence in the GPU market.

Hypothesis 1 is more likely given Microsoft’s history of strategic investments in AI and cloud computing to drive innovation and market leadership. The partnership with Iren and the focus on securing cutting-edge NVIDIA hardware align with this strategic objective.

3. Key Assumptions and Red Flags

Assumptions: The demand for AI services will continue to grow at a rapid pace. NVIDIA will maintain its position as a leader in GPU technology. Iren can deliver the promised infrastructure on schedule.

Red Flags: Potential over-reliance on a single supplier (NVIDIA) could expose Microsoft to supply chain vulnerabilities. Rapid technological advancements may render current investments obsolete sooner than anticipated.

Deception Indicators: None identified in the available data.

4. Implications and Strategic Risks

The investment positions Microsoft to capitalize on the growing AI market, but it also introduces risks related to supply chain dependencies and technological obsolescence. If NVIDIA faces production delays or technological setbacks, Microsoft’s AI capabilities could be compromised. Additionally, competitors may respond with similar investments, intensifying market competition and potentially leading to a GPU supply bottleneck.

5. Recommendations and Outlook

- Actionable steps: Diversify GPU suppliers to mitigate supply chain risks. Invest in R&D to develop proprietary AI hardware solutions.

- Best-case scenario: Microsoft solidifies its leadership in AI and cloud services, driving significant revenue growth.

- Worst-case scenario: Supply chain disruptions or technological obsolescence undermine the investment, leading to competitive disadvantage.

- Most-likely scenario: Microsoft successfully leverages the investment to meet AI demand, maintaining competitive parity with rivals.

6. Key Individuals and Entities

Microsoft, NVIDIA, Iren, Dell (as systems integrator).

7. Thematic Tags

Cybersecurity, AI, Cloud Computing, Supply Chain Management

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology