Godrej Consumer shares rally 6 as Goldman Sachs raises target after Q2 show Should you invest – The Times of India

Published on: 2025-11-03

Intelligence Report: Godrej Consumer shares rally 6% as Goldman Sachs raises target after Q2 show – Should you invest?

1. BLUF (Bottom Line Up Front)

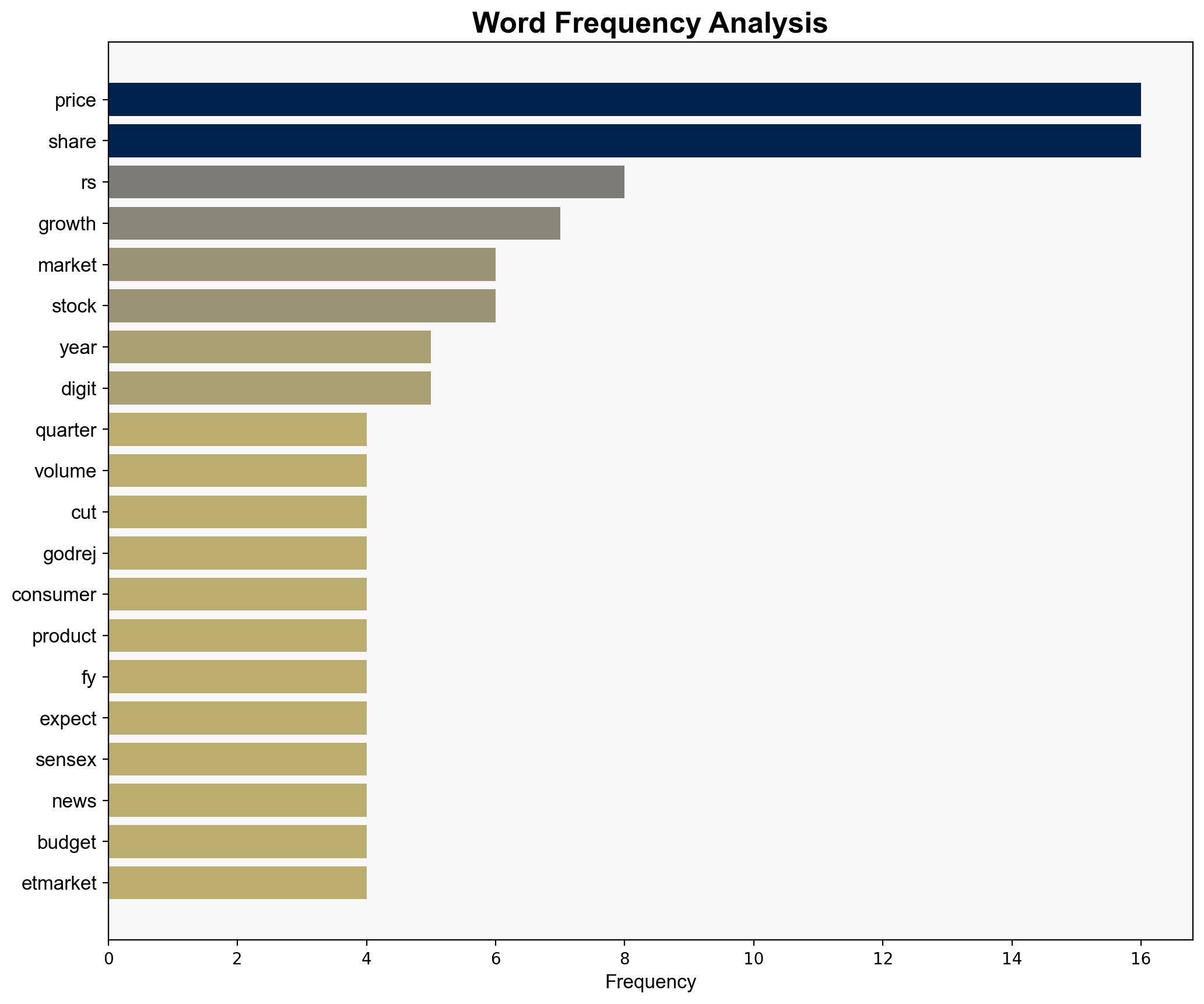

The most supported hypothesis is that Godrej Consumer Products Limited (GCPL) will experience moderate growth in the medium term, driven by strategic acquisitions and market expansion, despite current challenges such as GST transition issues and macroeconomic weaknesses in key markets. Confidence Level: Moderate. Recommended action: Consider a cautious investment strategy, monitoring key market developments and company performance.

2. Competing Hypotheses

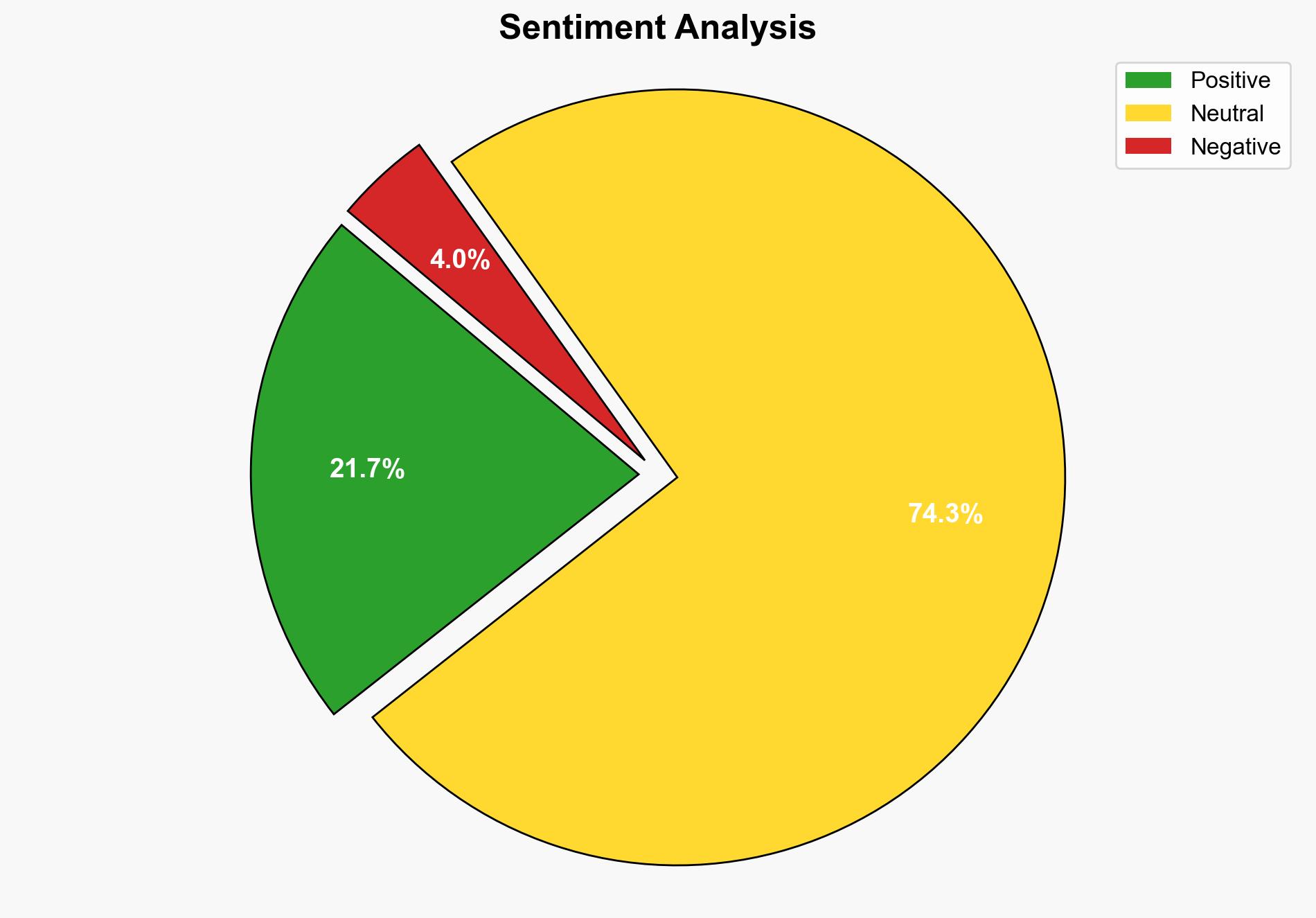

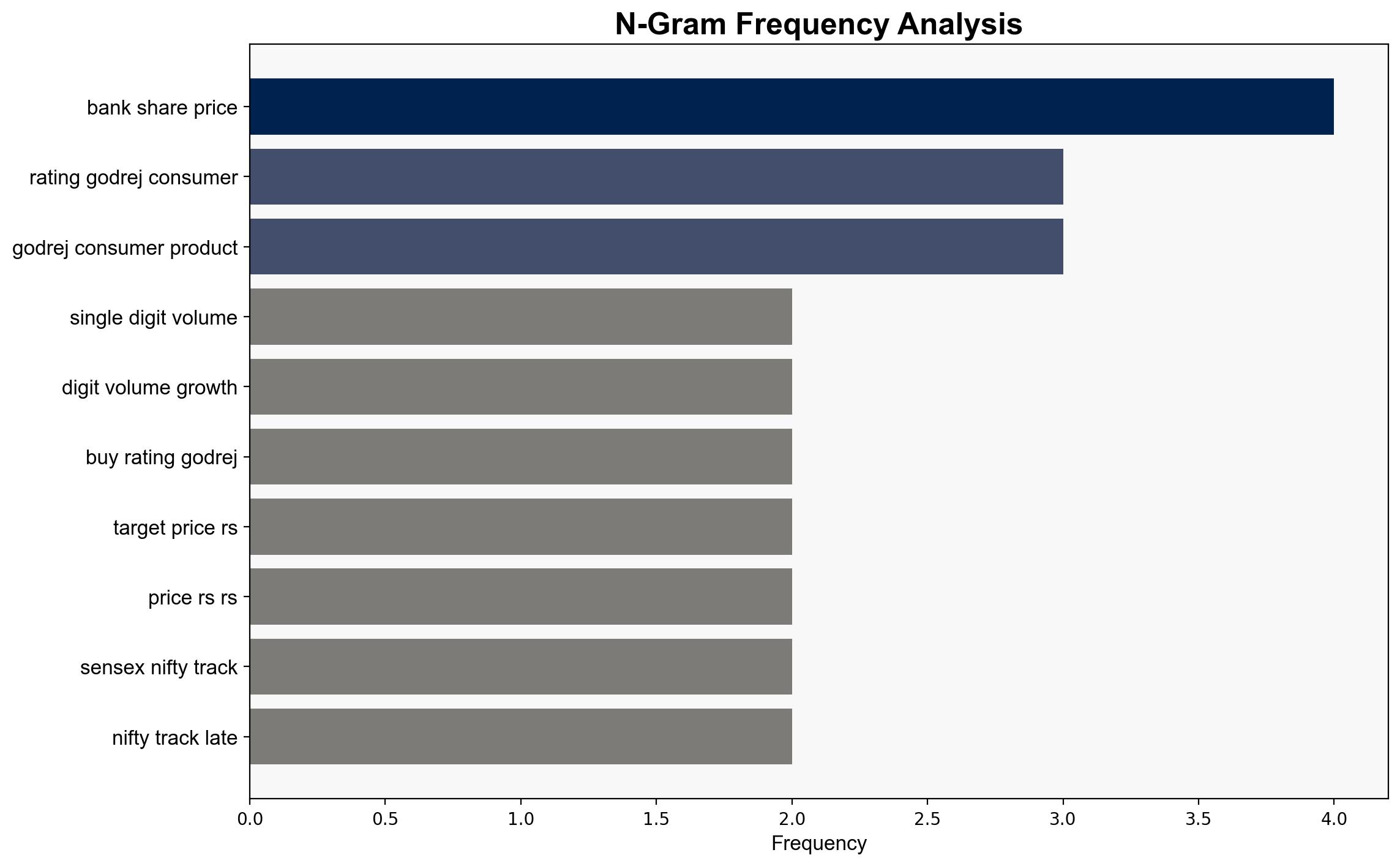

Hypothesis 1: GCPL will achieve significant growth in the medium term, fueled by strategic acquisitions, market expansion, and recovery from GST transition impacts. This is supported by Goldman Sachs’ positive outlook and target price increase, as well as anticipated benefits from recent acquisitions.

Hypothesis 2: GCPL will face continued challenges that will hinder significant growth, such as persistent macroeconomic weaknesses in India and uneven overseas performance. This is supported by Citi and Elara Capital’s cautious outlook and revised target prices, reflecting concerns over low margins and GST-related disruptions.

3. Key Assumptions and Red Flags

Assumptions include the expectation that GST transition issues will resolve and that acquisitions will be successfully integrated. A red flag is the uneven overseas performance, particularly in Indonesia and Latin America, which could signal deeper market challenges. There is also a potential cognitive bias in over-relying on optimistic projections without fully accounting for macroeconomic uncertainties.

4. Implications and Strategic Risks

The primary risk is that continued macroeconomic instability in India and key international markets could dampen growth prospects. Additionally, failure to effectively integrate acquisitions could lead to financial underperformance. A potential escalation scenario includes prolonged economic downturns in key markets, leading to reduced consumer spending and lower sales volumes.

5. Recommendations and Outlook

- Monitor GST transition developments and macroeconomic indicators in India and key international markets.

- Evaluate the integration and performance of recent acquisitions, particularly the Muuchstac brand.

- Scenario Projections:

- Best Case: Successful integration of acquisitions and recovery from GST impacts lead to strong growth.

- Worst Case: Continued macroeconomic challenges and poor acquisition integration result in stagnant growth.

- Most Likely: Moderate growth with fluctuations due to external economic factors and internal strategic adjustments.

6. Key Individuals and Entities

Sudhir Sitapati (CEO), Goldman Sachs, Citi, Elara Capital, Godrej Consumer Products Limited (GCPL)

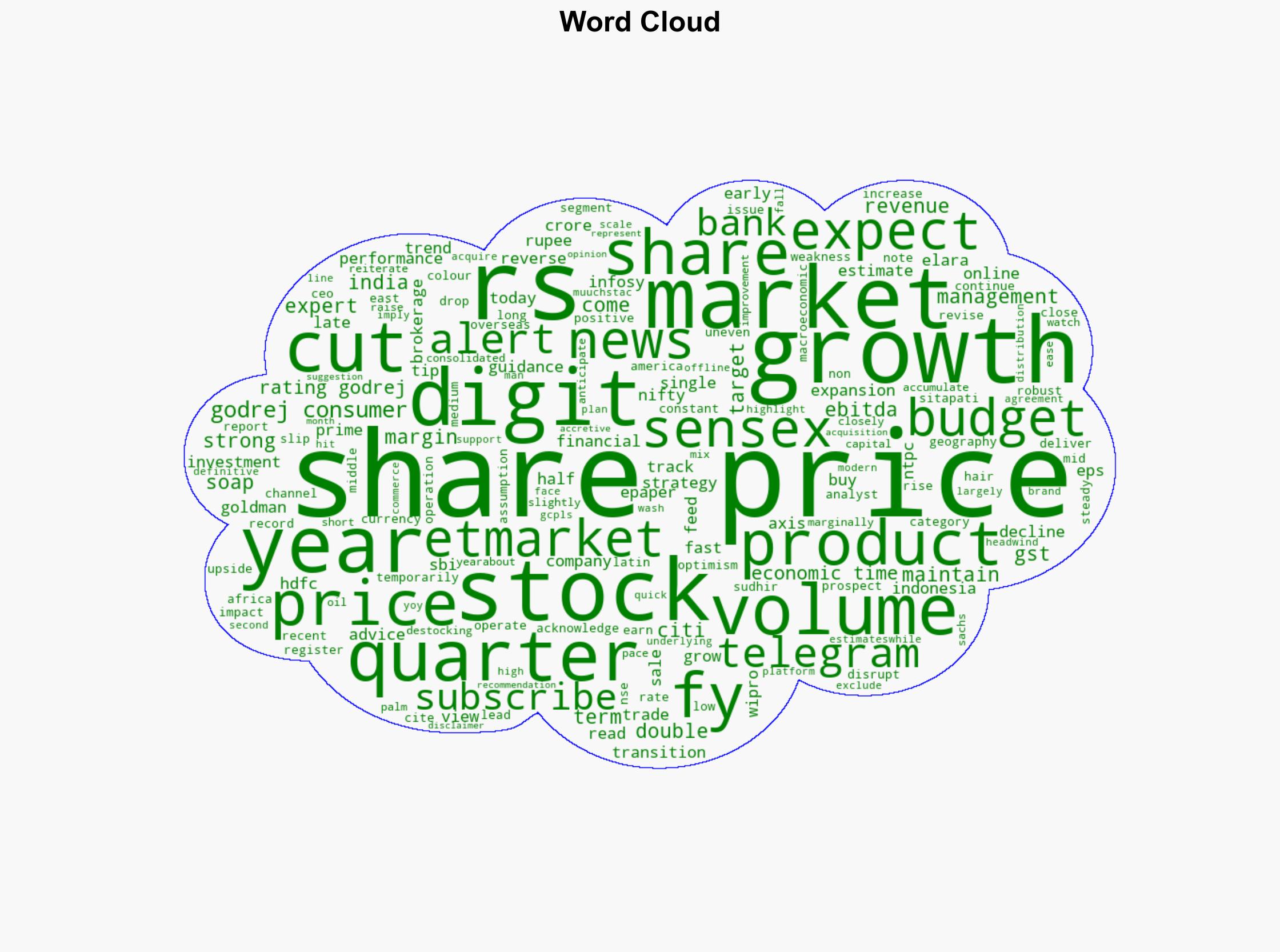

7. Thematic Tags

economic strategy, market analysis, investment risk, corporate growth, international markets