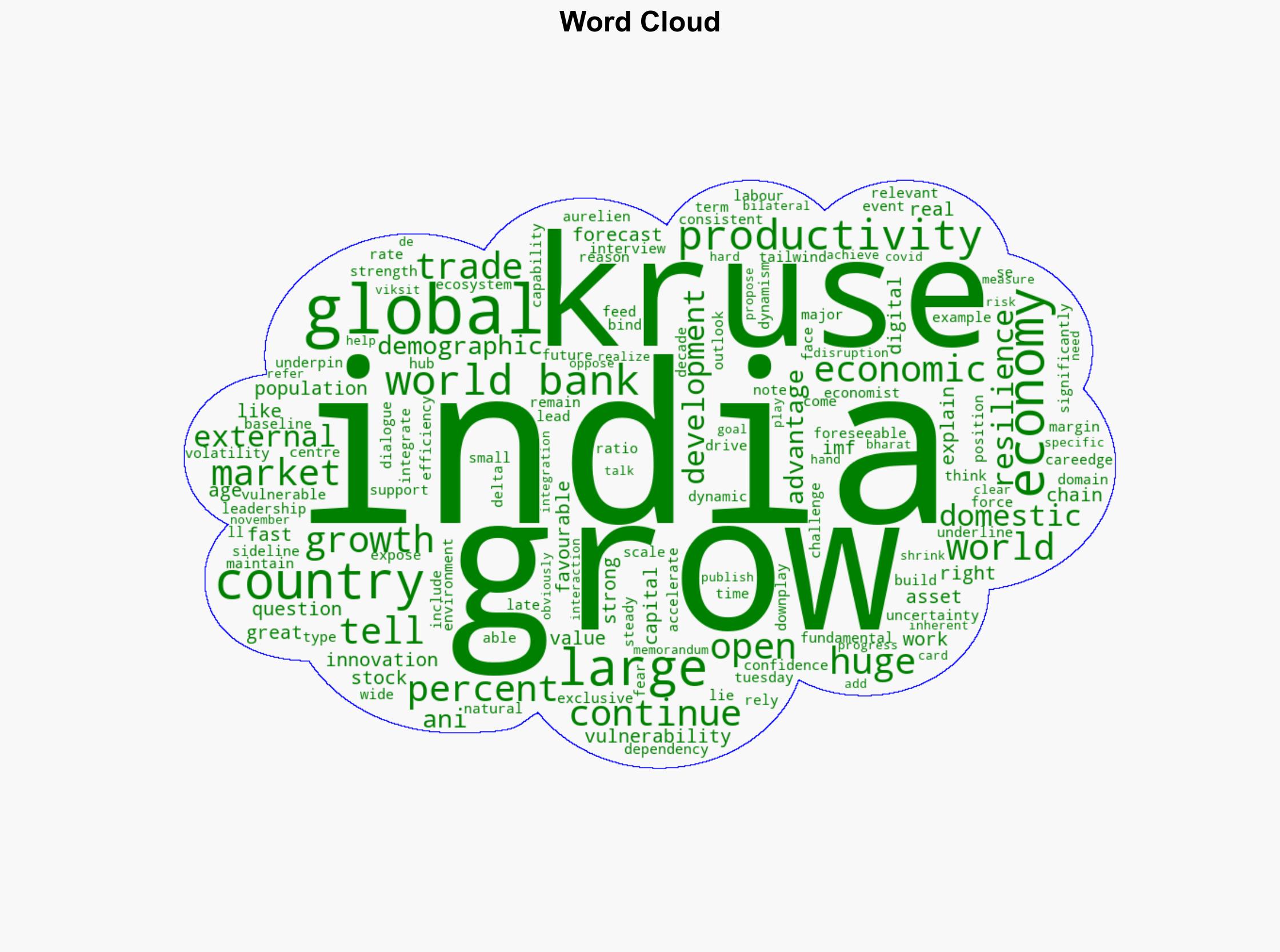

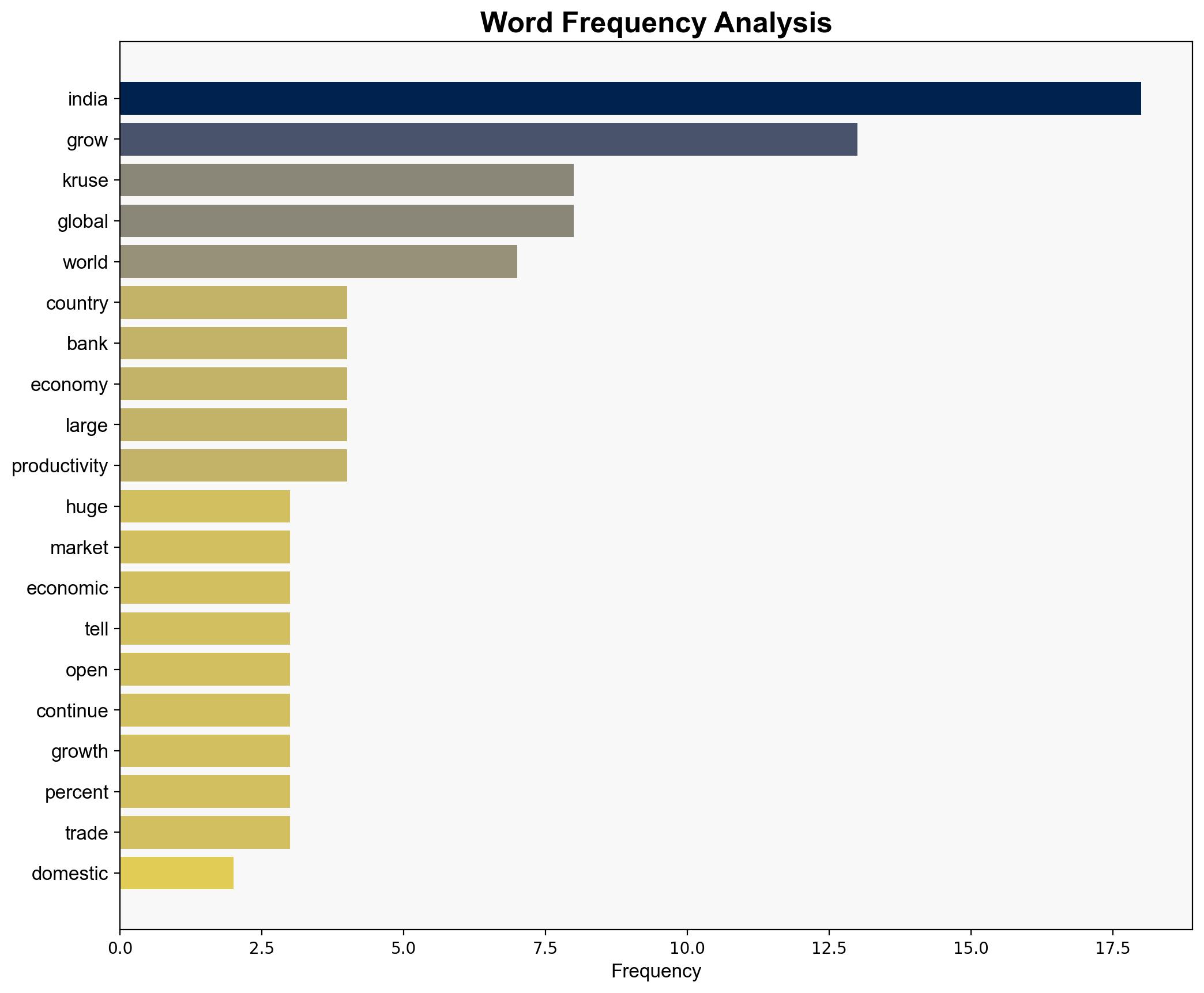

India’s huge domestic market makes it much less vulnerable to external developments World Bank’s Lead Economist – BusinessLine

Published on: 2025-11-12

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: India’s huge domestic market makes it much less vulnerable to external developments – World Bank’s Lead Economist – BusinessLine

1. BLUF (Bottom Line Up Front)

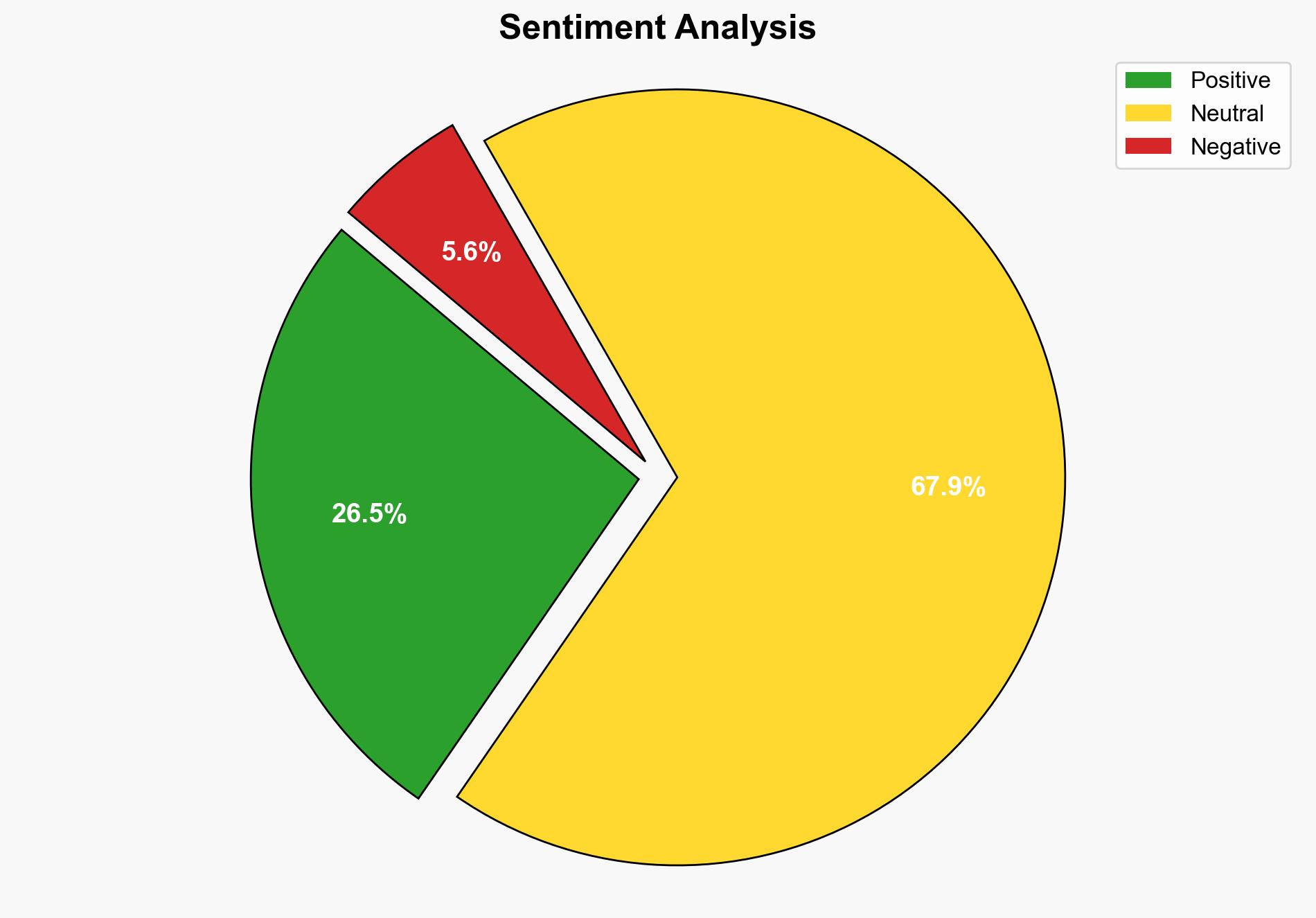

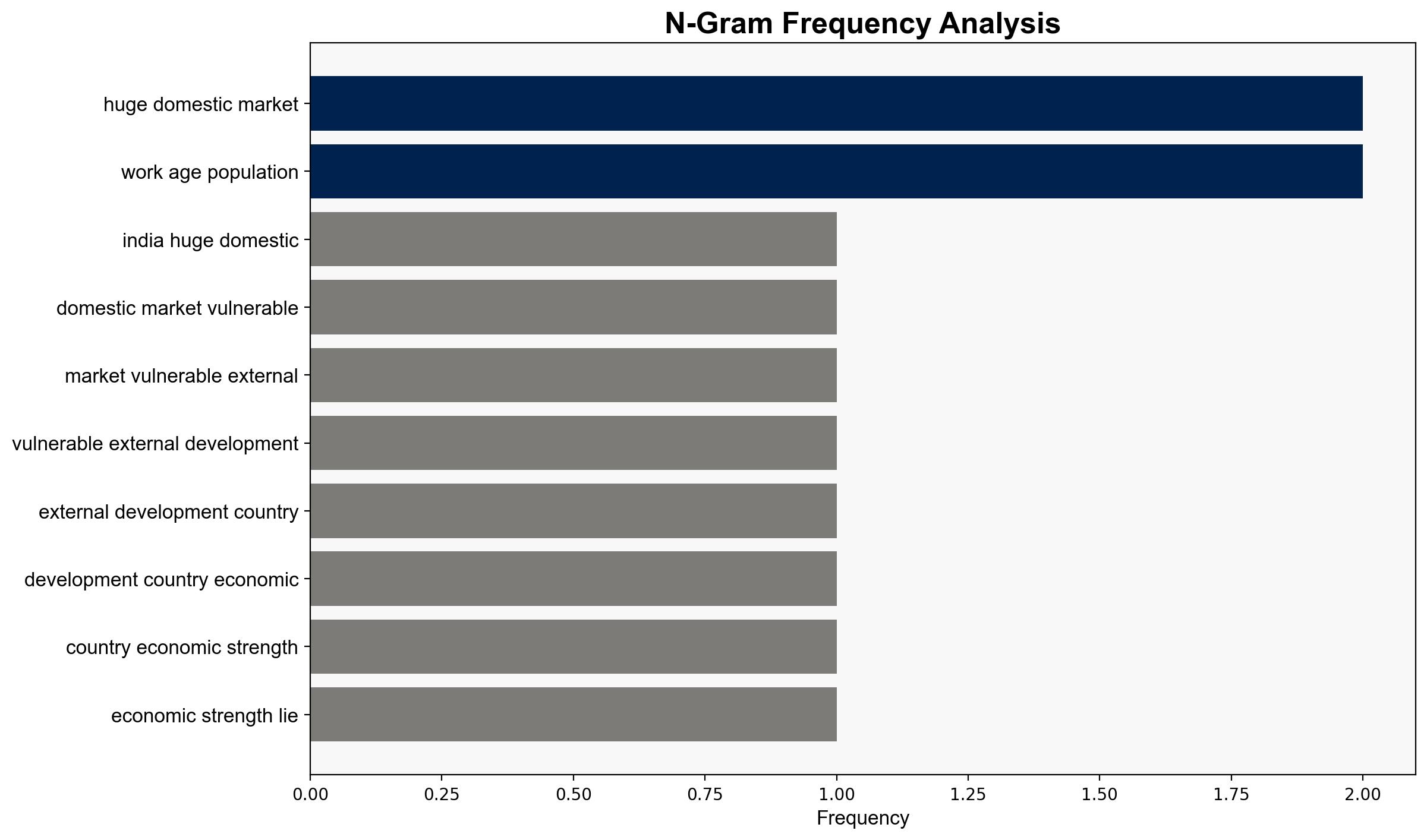

India’s large domestic market and favorable demographics provide a buffer against global economic volatility, making it less vulnerable to external shocks. The most supported hypothesis is that India’s economic resilience will continue to underpin its growth trajectory, albeit with strategic adjustments needed to mitigate potential risks. Confidence Level: Moderate.

2. Competing Hypotheses

Hypothesis 1: India’s large domestic market and demographic advantages will sustain its economic growth and shield it from global economic disruptions.

Hypothesis 2: Despite its large domestic market, India remains susceptible to global economic volatility due to its integration into global value chains and reliance on external trade.

The first hypothesis is more likely given India’s current economic fundamentals, including a growing labor force and capital stock. However, the second hypothesis cannot be dismissed due to the interconnected nature of global trade and potential geopolitical tensions.

3. Key Assumptions and Red Flags

Assumptions: India’s demographic trends will continue to be favorable, and its domestic market will remain robust. Global economic conditions will not deteriorate significantly.

Red Flags: Potential over-reliance on domestic consumption without sufficient diversification in export markets. Geopolitical tensions that could disrupt trade routes or supply chains.

Deception Indicators: Over-optimistic projections about India’s growth without accounting for global economic uncertainties.

4. Implications and Strategic Risks

Economic Risks: A downturn in global trade could impact India’s export sectors, affecting overall economic growth. Inflationary pressures from global supply chain disruptions could also pose risks.

Political Risks: Domestic economic challenges could lead to political instability, especially if growth does not translate into equitable development.

Cyber Risks: Increased reliance on digital innovation could expose India to cybersecurity threats, necessitating robust cyber defense mechanisms.

5. Recommendations and Outlook

- Enhance economic diversification by expanding into new export markets and reducing dependency on specific global value chains.

- Strengthen cybersecurity infrastructure to protect the growing digital economy.

- Invest in education and skill development to maximize the demographic dividend.

- Best Scenario: India leverages its domestic market and demographic advantages to achieve sustained economic growth, becoming a major global economic player.

- Worst Scenario: Global economic downturns and geopolitical tensions severely impact India’s growth, leading to economic and political instability.

- Most-likely Scenario: India experiences steady growth with occasional disruptions from external economic and geopolitical factors, requiring adaptive policy measures.

6. Key Individuals and Entities

Aurelien Kruse – Lead Economist, World Bank

7. Thematic Tags

Economic Resilience, Global Trade, Demographic Advantage, Cybersecurity

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology