Ledger Eyes New York IPO or Fund Raise Report – CoinDesk

Published on: 2025-11-10

Intelligence Report: Ledger Eyes New York IPO or Fund Raise Report – CoinDesk

1. BLUF (Bottom Line Up Front)

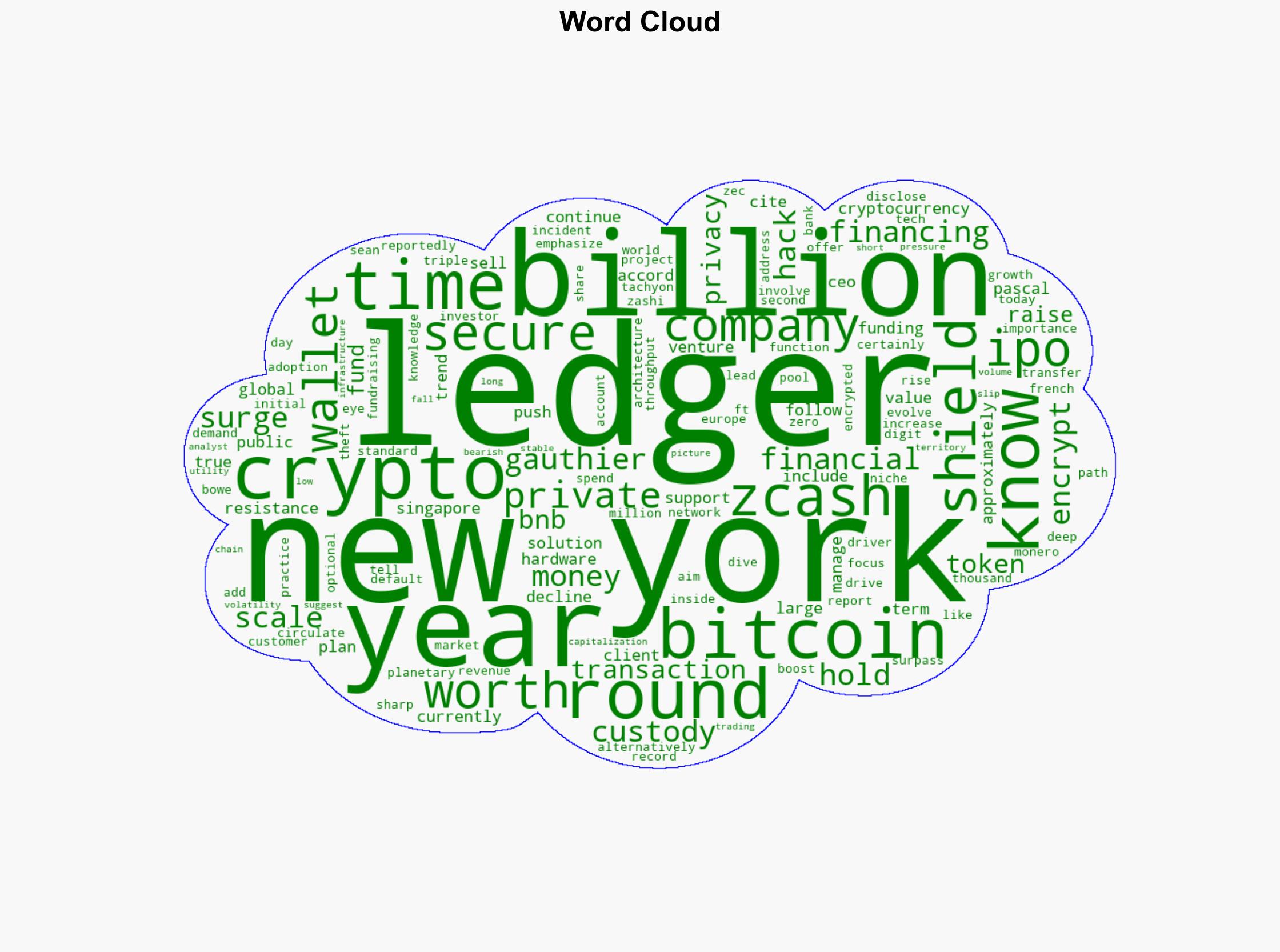

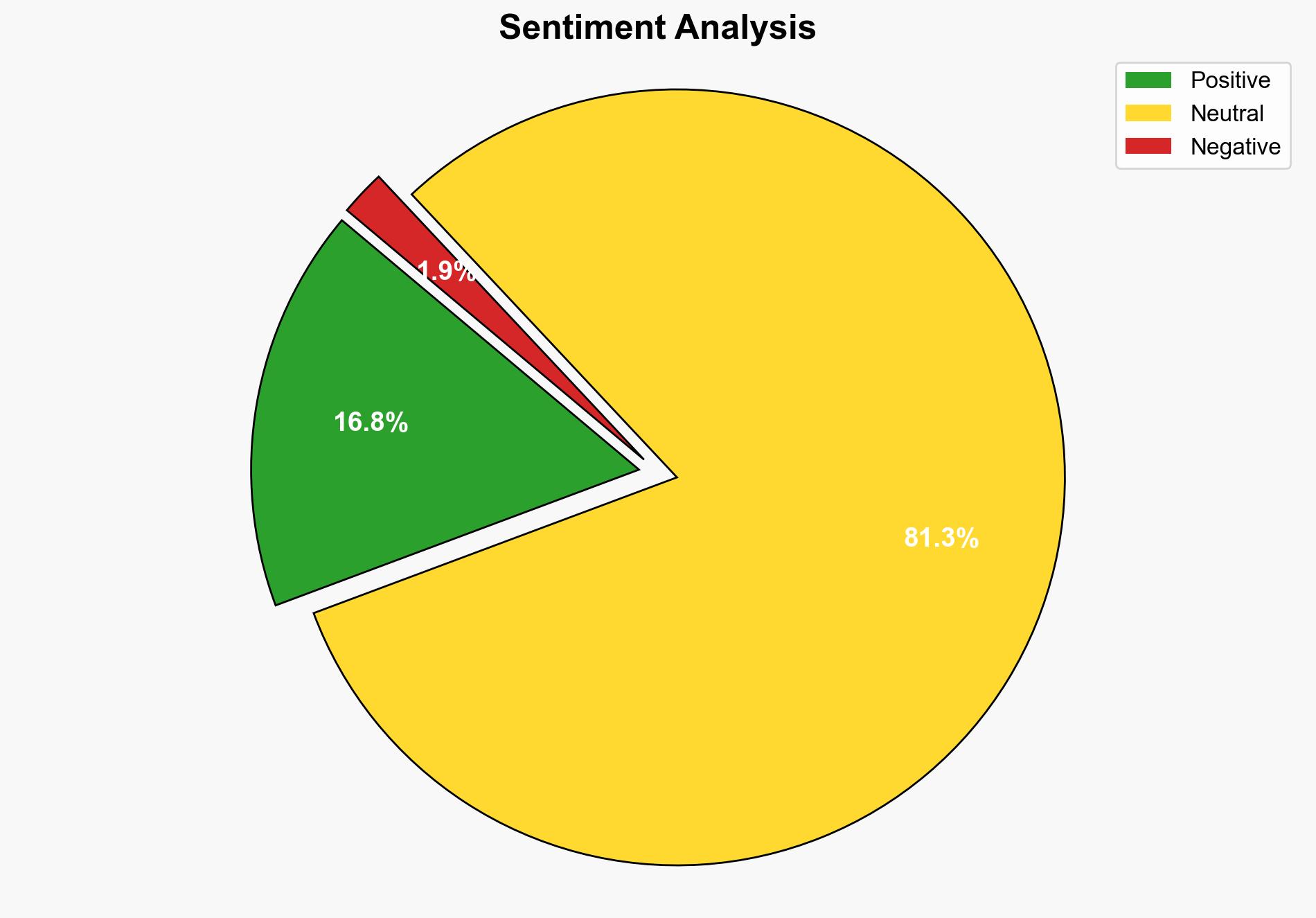

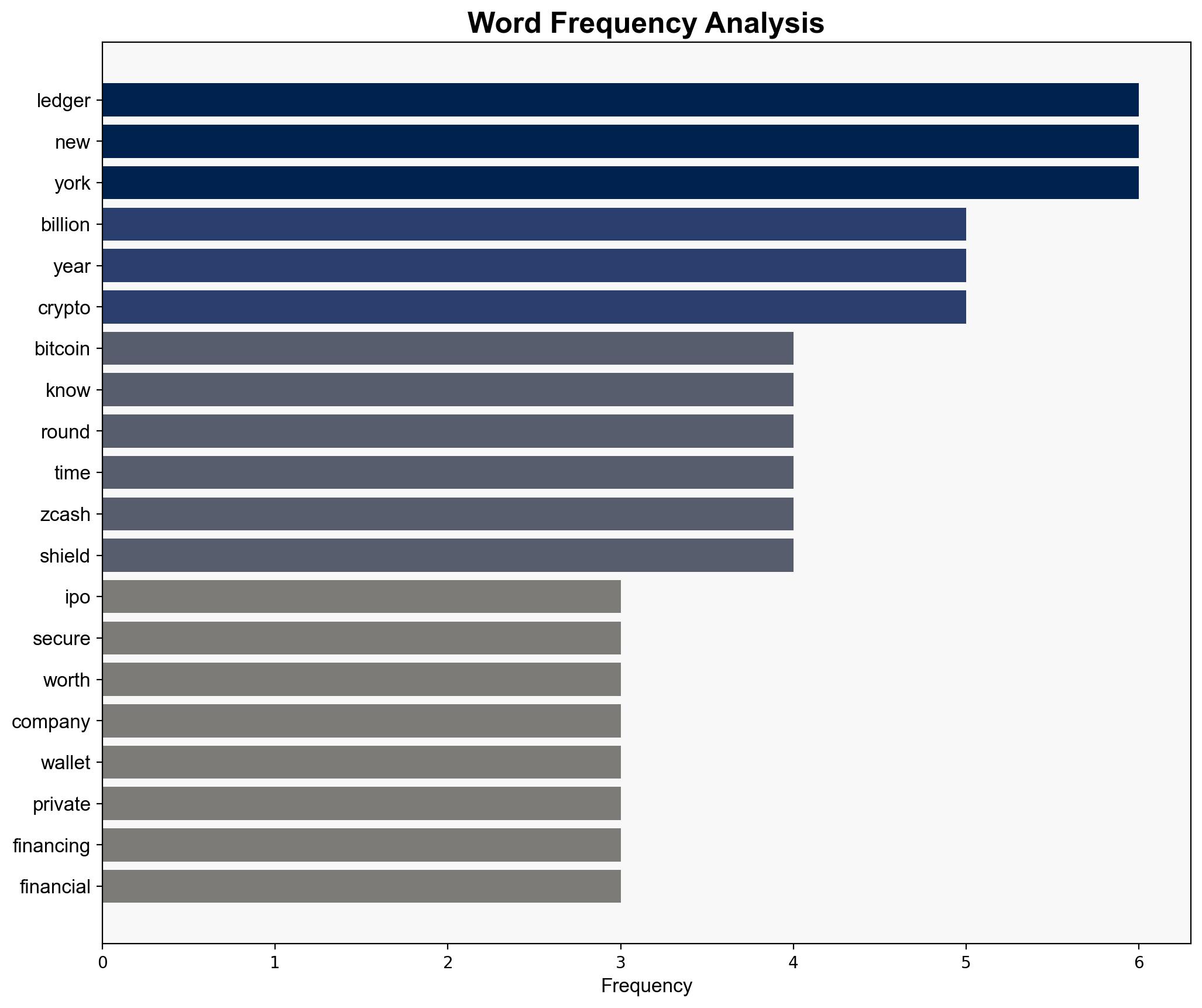

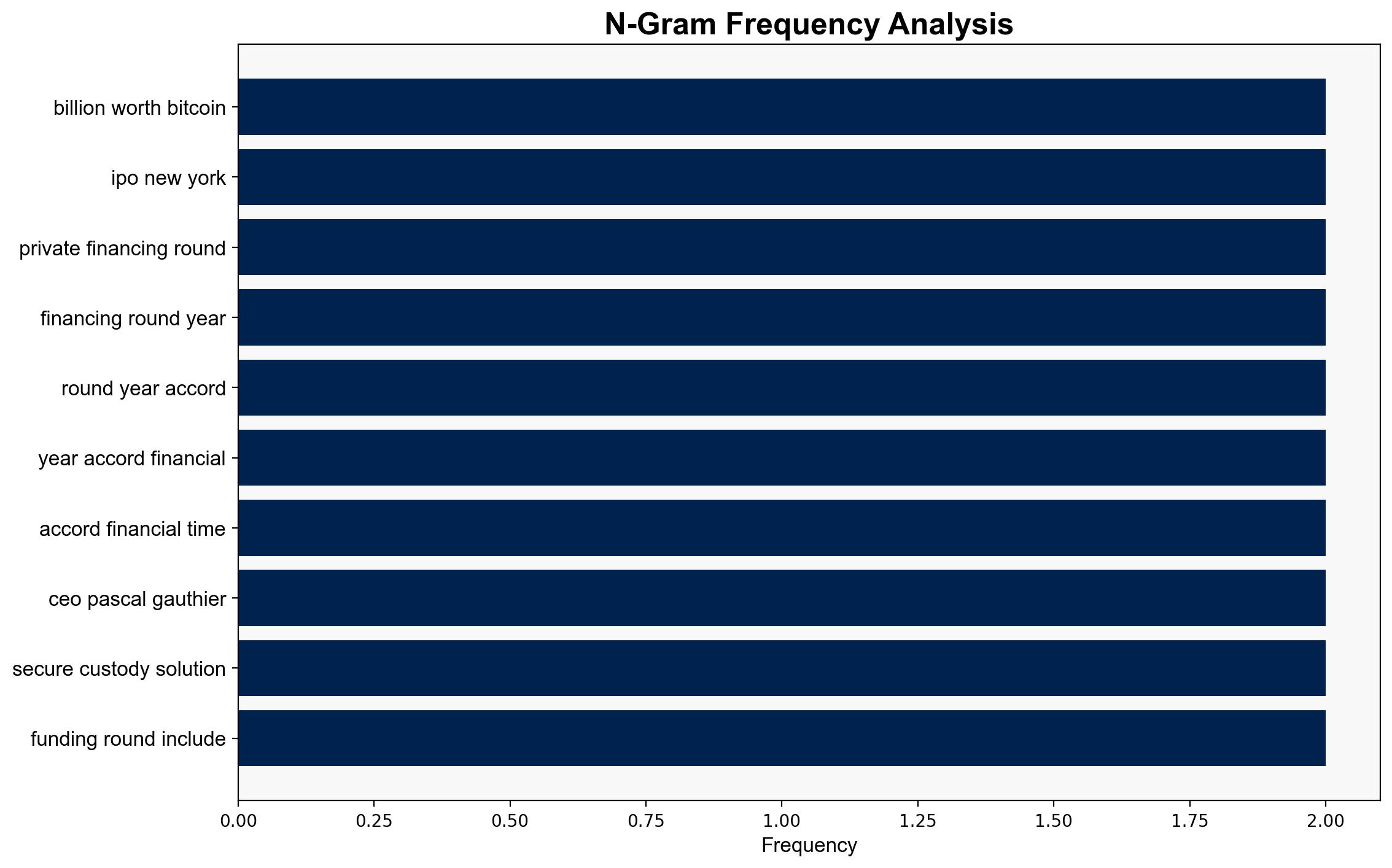

Ledger, a French cryptocurrency hardware wallet company, is considering either an Initial Public Offering (IPO) in New York or a private financing round to raise funds. The most supported hypothesis is that Ledger will pursue a private financing round due to the current market conditions and strategic priorities. Confidence level: Moderate. Recommended action: Monitor Ledger’s financial maneuvers and market conditions closely to anticipate shifts in the cryptocurrency security landscape.

2. Competing Hypotheses

Hypothesis 1: Ledger will pursue an IPO in New York. This is based on the company’s emphasis on New York’s importance in crypto financing and the strategic visibility an IPO could provide.

Hypothesis 2: Ledger will opt for a private financing round. This is supported by the current volatility in the cryptocurrency market, which may deter a public offering, and the company’s recent success in securing significant private investments.

Using ACH 2.0, Hypothesis 2 is better supported due to the current market conditions and Ledger’s previous successful private funding rounds, which suggest a preference for private capital over public scrutiny.

3. Key Assumptions and Red Flags

Assumptions:

– The assumption that market volatility will continue, affecting IPO feasibility.

– Belief that private investors will continue to support Ledger’s growth.

Red Flags:

– Lack of specific details on the timing and scale of the potential IPO.

– Potential overestimation of New York’s role in Ledger’s strategic decisions.

4. Implications and Strategic Risks

The decision between an IPO and private financing carries significant implications for Ledger’s market positioning and operational transparency. An IPO could increase scrutiny and regulatory obligations, while private financing might limit public exposure but also restrict capital influx. The broader economic implications include potential shifts in investor confidence in cryptocurrency security solutions, especially amid rising cyber threats.

5. Recommendations and Outlook

- Monitor Ledger’s financial announcements and market conditions to anticipate strategic shifts.

- Prepare for scenarios where Ledger’s decision impacts the broader cryptocurrency market, particularly in terms of security solutions.

- Best case: Ledger successfully raises capital, enhancing its market position. Worst case: Market volatility undermines fundraising efforts, affecting operational capabilities. Most likely: Ledger opts for private financing, maintaining growth trajectory with limited public exposure.

6. Key Individuals and Entities

Pascal Gauthier, Ledger CEO

7. Thematic Tags

cryptocurrency, financial strategy, market volatility, cybersecurity