SUI Slides as 116M DeFi Exploit Rattles Crypto Markets – CoinDesk

Published on: 2025-11-04

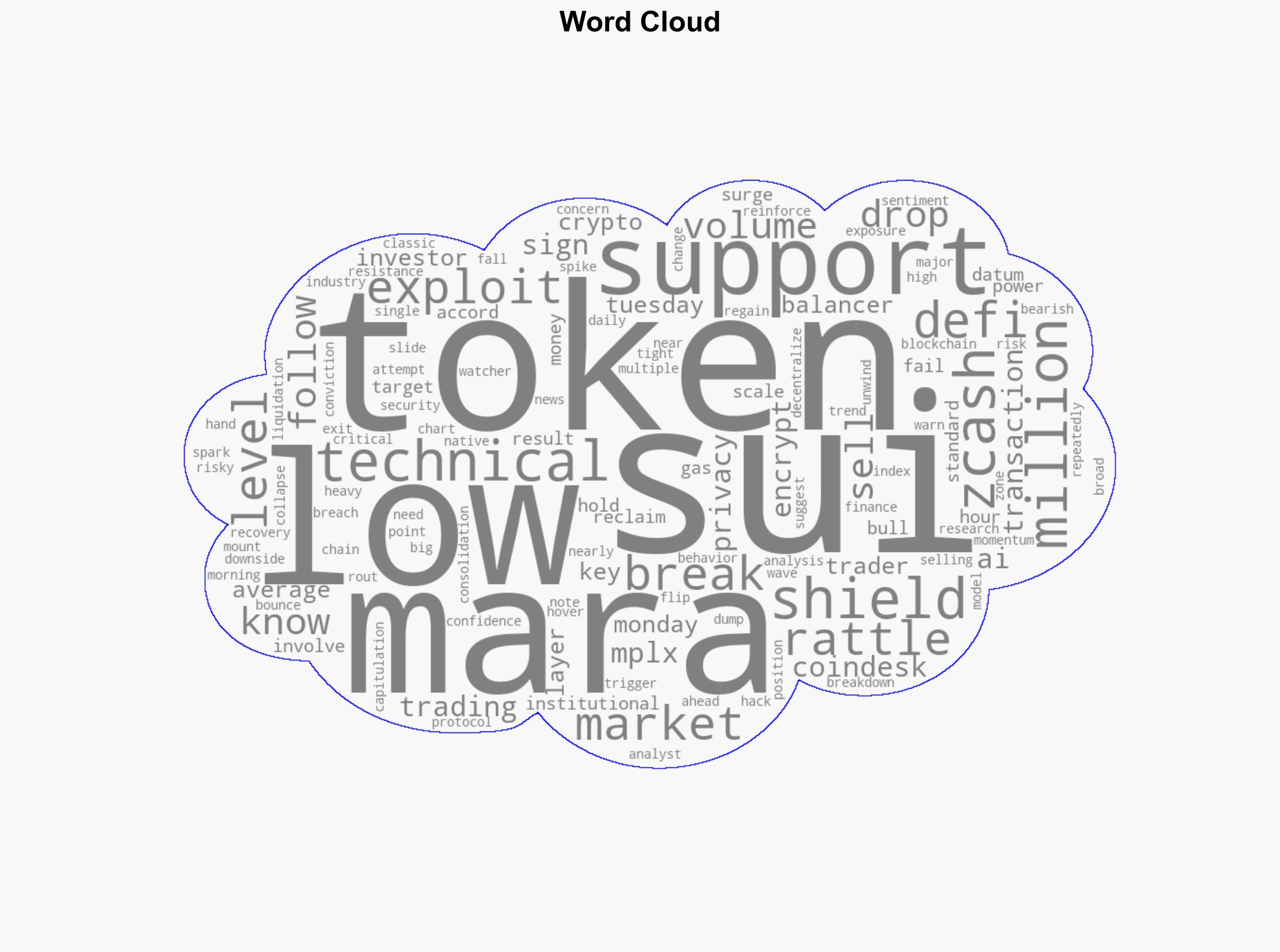

Intelligence Report: SUI Slides as 116M DeFi Exploit Rattles Crypto Markets – CoinDesk

1. BLUF (Bottom Line Up Front)

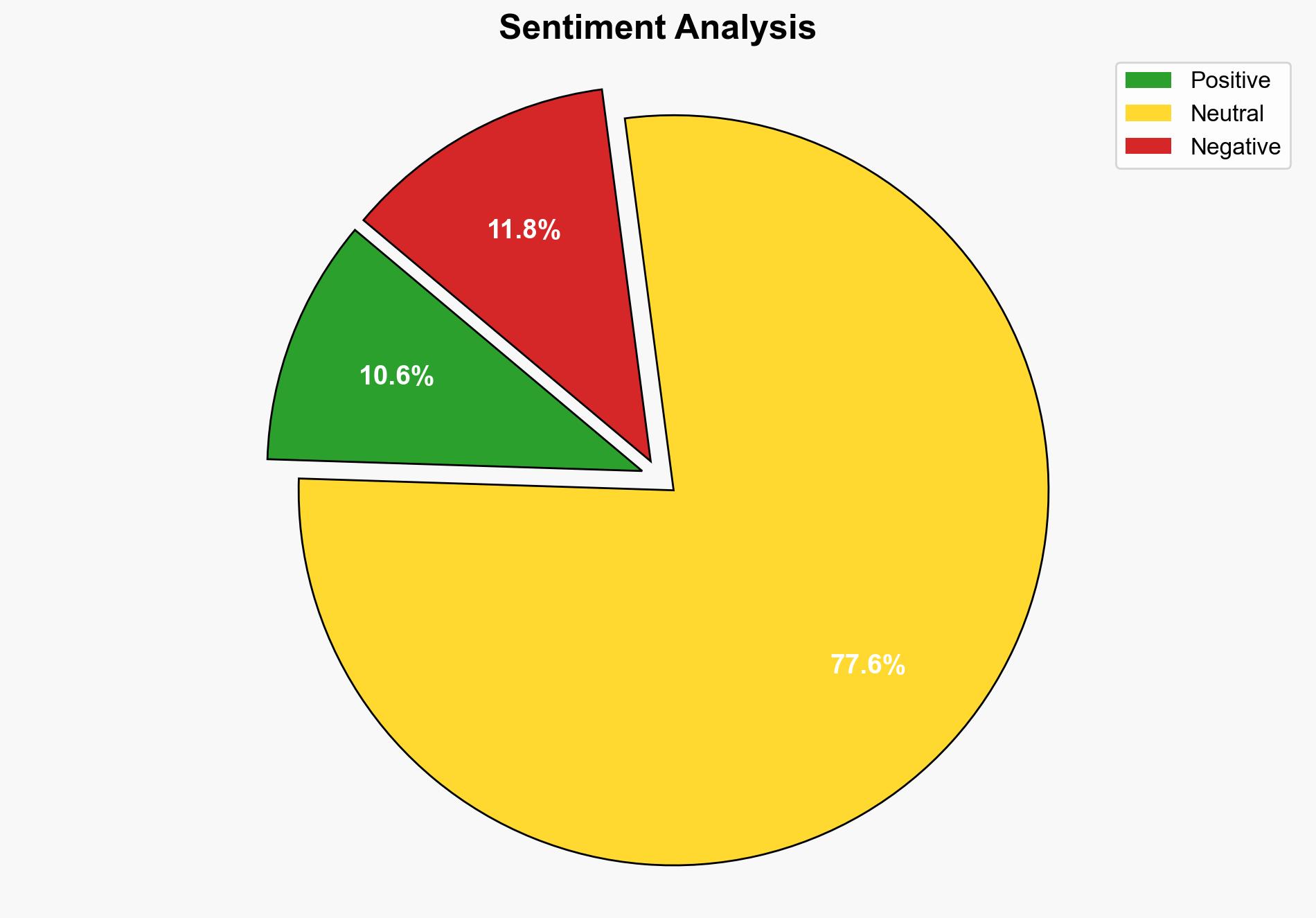

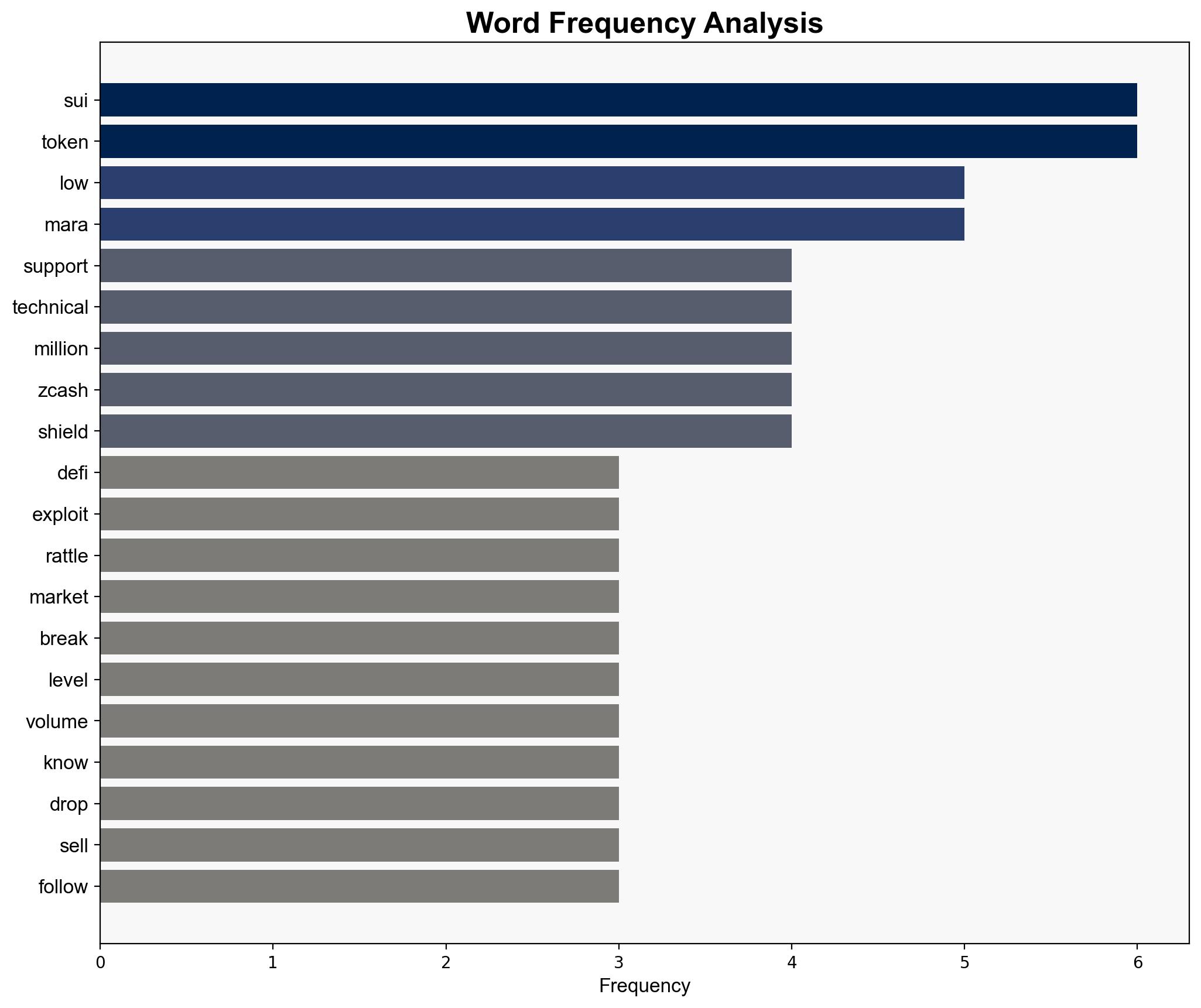

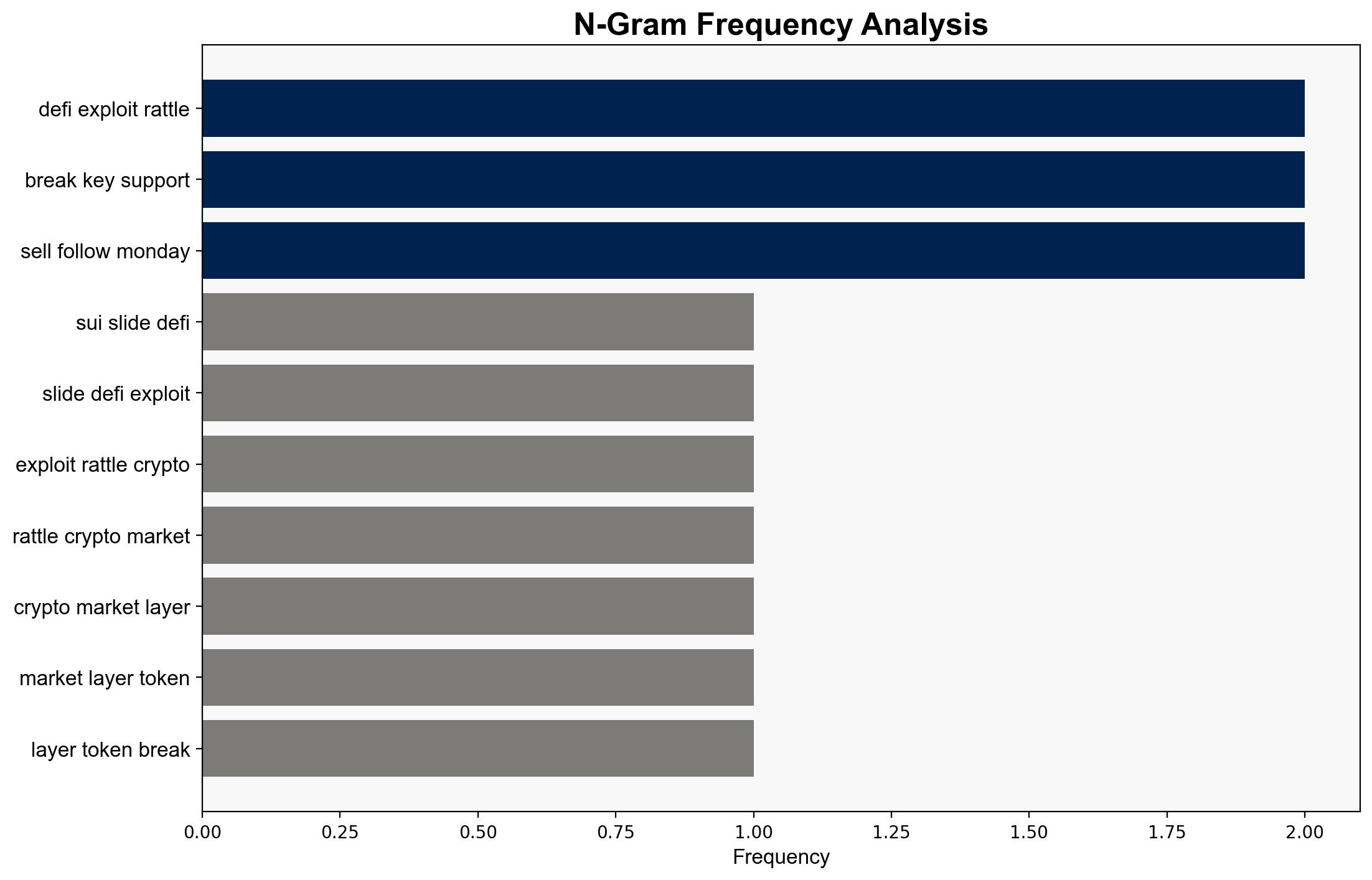

The recent $116 million DeFi exploit has significantly impacted the SUI token and broader crypto market, with signs of institutional exits and bearish trends. The most supported hypothesis suggests that the exploit has triggered a loss of investor confidence, leading to a sell-off and potential long-term bearish market conditions. Confidence level: Moderate. Recommended action: Monitor market sentiment and institutional movements closely, and consider risk mitigation strategies for crypto investments.

2. Competing Hypotheses

Hypothesis 1: The DeFi exploit has directly caused a significant loss of investor confidence in the SUI token, leading to a sell-off and bearish market conditions.

Hypothesis 2: The market reaction is primarily driven by broader macroeconomic factors and not solely by the DeFi exploit, with the exploit acting as a catalyst rather than the root cause.

3. Key Assumptions and Red Flags

Hypothesis 1 Assumptions: Assumes a direct correlation between the exploit and market behavior, overlooking other potential influences.

Hypothesis 2 Assumptions: Assumes that macroeconomic factors are the primary drivers, potentially underestimating the exploit’s impact.

Red Flags: Lack of detailed data on institutional trading patterns and potential bias in attributing market movements solely to the exploit.

4. Implications and Strategic Risks

The exploit and subsequent market reaction could lead to increased regulatory scrutiny and a potential chilling effect on DeFi innovation. There is a risk of cascading sell-offs across other cryptocurrencies, exacerbating market volatility. Geopolitically, this could influence nations’ stances on crypto regulation and adoption.

5. Recommendations and Outlook

- Monitor regulatory developments and institutional trading patterns for early warning signs of further market shifts.

- Scenario Projections:

- Best Case: Market stabilizes as confidence is restored through improved security measures.

- Worst Case: Prolonged bearish market with increased regulatory crackdowns on DeFi platforms.

- Most Likely: Short-term volatility with a gradual recovery as security concerns are addressed.

6. Key Individuals and Entities

– Sean Bowe (Project Tachyon Lead)

– Balancer (DeFi Protocol involved in the exploit)

7. Thematic Tags

national security threats, cybersecurity, financial markets, blockchain technology