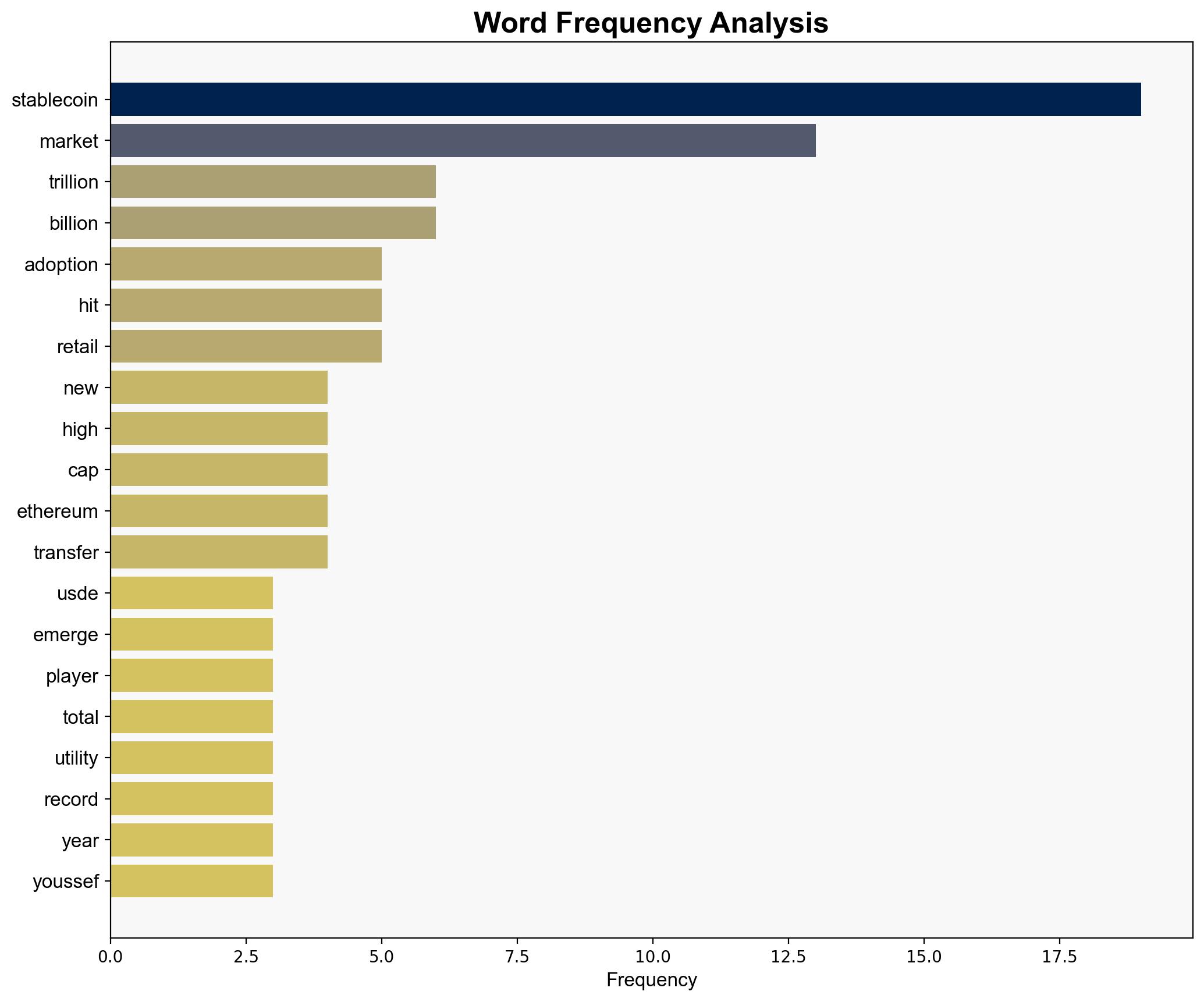

1 Trillion stablecoin market by 2026 Heres what needs to happen – Ambcrypto.com

Published on: 2025-09-11

Intelligence Report: 1 Trillion Stablecoin Market by 2026 – Ambcrypto.com

1. BLUF (Bottom Line Up Front)

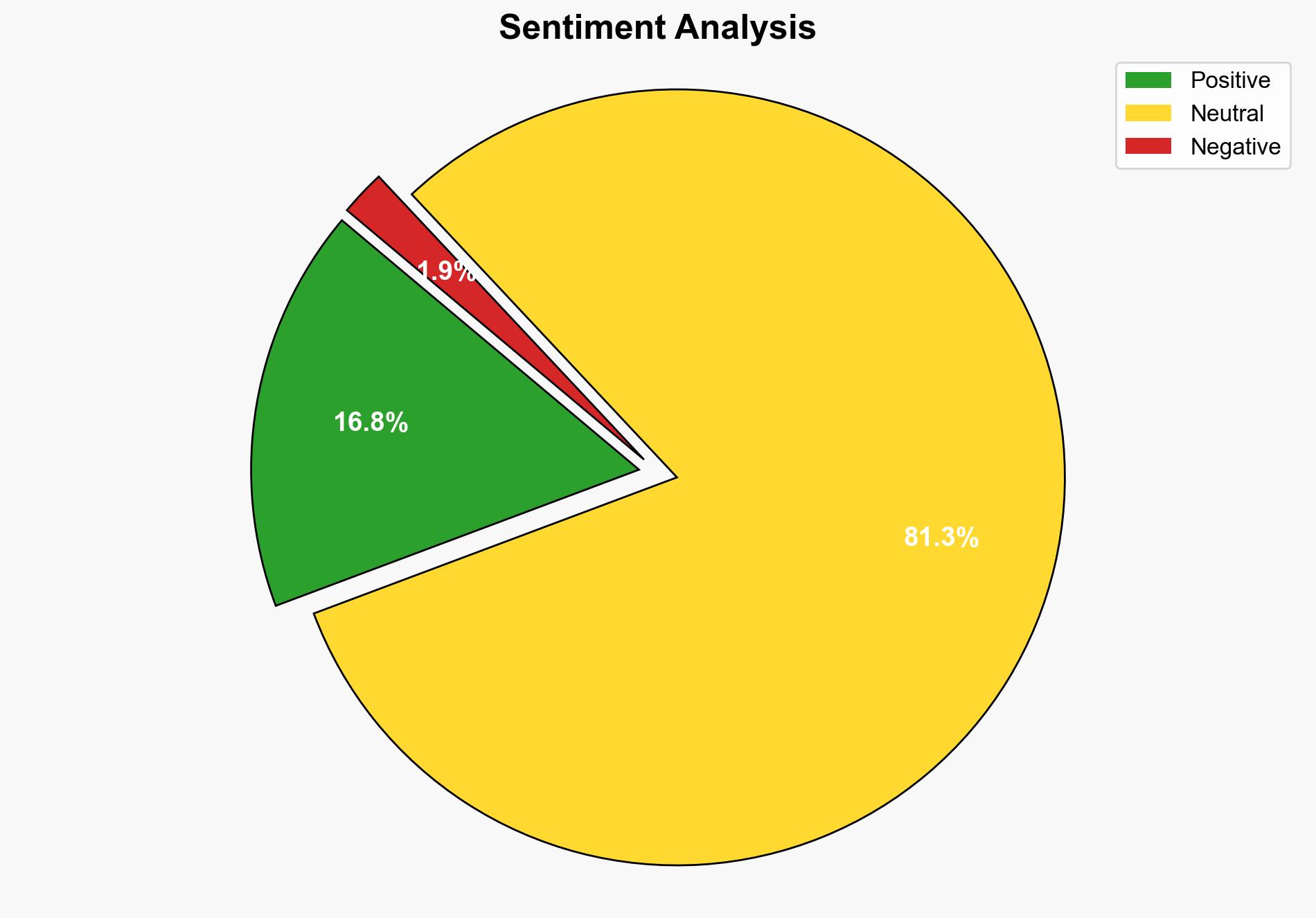

The hypothesis that stablecoin market capitalization could reach $1 trillion by 2026 is moderately supported, contingent on regulatory clarity and increased retail adoption. The recommendation is to monitor regulatory developments and technological advancements in blockchain to anticipate market shifts. Confidence Level: Moderate.

2. Competing Hypotheses

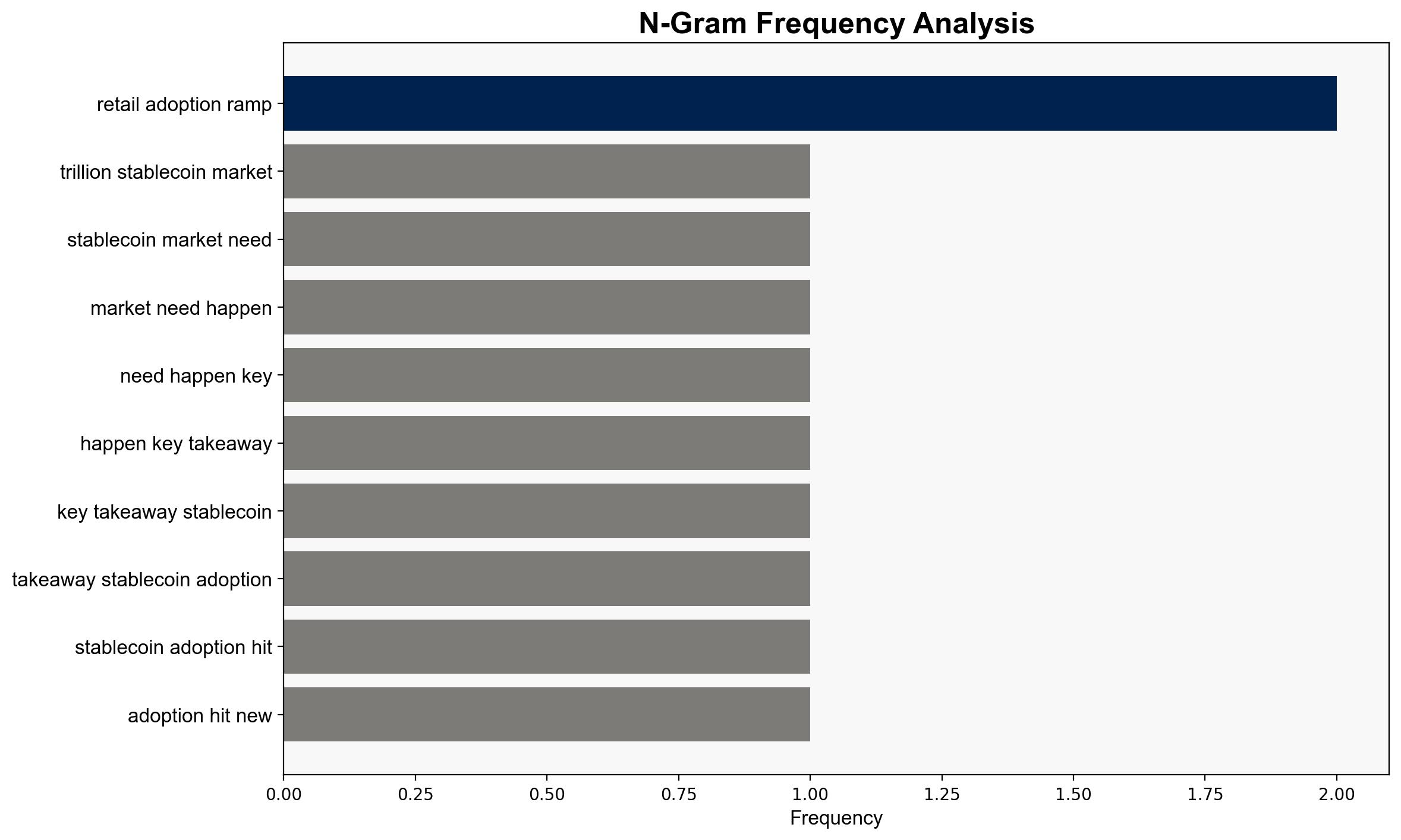

Hypothesis 1: The stablecoin market will reach a $1 trillion market cap by 2026 due to increased retail adoption and regulatory clarity.

– **Supporting Evidence:** Current trends indicate a significant increase in stablecoin usage for cross-border transactions, especially in emerging markets. Regulatory frameworks are evolving, which could facilitate growth.

– **SAT Applied:** Bayesian Scenario Modeling suggests a 60% probability based on current growth rates and regulatory trends.

Hypothesis 2: The stablecoin market will not reach a $1 trillion market cap by 2026 due to regulatory hurdles and competition from traditional financial systems.

– **Supporting Evidence:** Regulatory uncertainty remains a significant barrier, and traditional financial institutions may develop competitive solutions.

– **SAT Applied:** Cross-Impact Simulation indicates a 40% probability, factoring in potential regulatory setbacks and market competition.

3. Key Assumptions and Red Flags

– **Assumptions:** Both hypotheses assume continued technological advancements and stable economic conditions. Hypothesis 1 assumes regulatory frameworks will be favorable.

– **Red Flags:** Over-reliance on current growth trends without considering potential economic downturns or technological disruptions. Lack of detailed analysis on potential regulatory changes.

– **Blind Spots:** Potential geopolitical tensions affecting global financial systems and the impact of significant cyber threats on blockchain technology.

4. Implications and Strategic Risks

– **Economic Implications:** A $1 trillion stablecoin market could disrupt traditional banking and payment systems, potentially leading to economic shifts in countries heavily reliant on remittances.

– **Cyber Risks:** Increased stablecoin usage could attract cybercriminals, necessitating enhanced cybersecurity measures.

– **Geopolitical Risks:** Regulatory disparities between countries could lead to uneven adoption and potential conflicts over digital currency dominance.

5. Recommendations and Outlook

- Monitor regulatory developments closely, especially in key markets like the US, EU, and China.

- Invest in cybersecurity infrastructure to protect against potential threats as stablecoin usage increases.

- Scenario Projections:

- Best Case: Regulatory clarity and technological advancements lead to a $1 trillion market by 2026.

- Worst Case: Regulatory crackdowns and economic instability stall growth, keeping the market below $500 billion.

- Most Likely: Gradual growth with a market cap reaching approximately $800 billion by 2026, driven by selective adoption and partial regulatory clarity.

6. Key Individuals and Entities

– Ray Youssef, CEO of Noone

– Tether (USDT)

– Ethereum (ETH)

– Ethena (USDE)

7. Thematic Tags

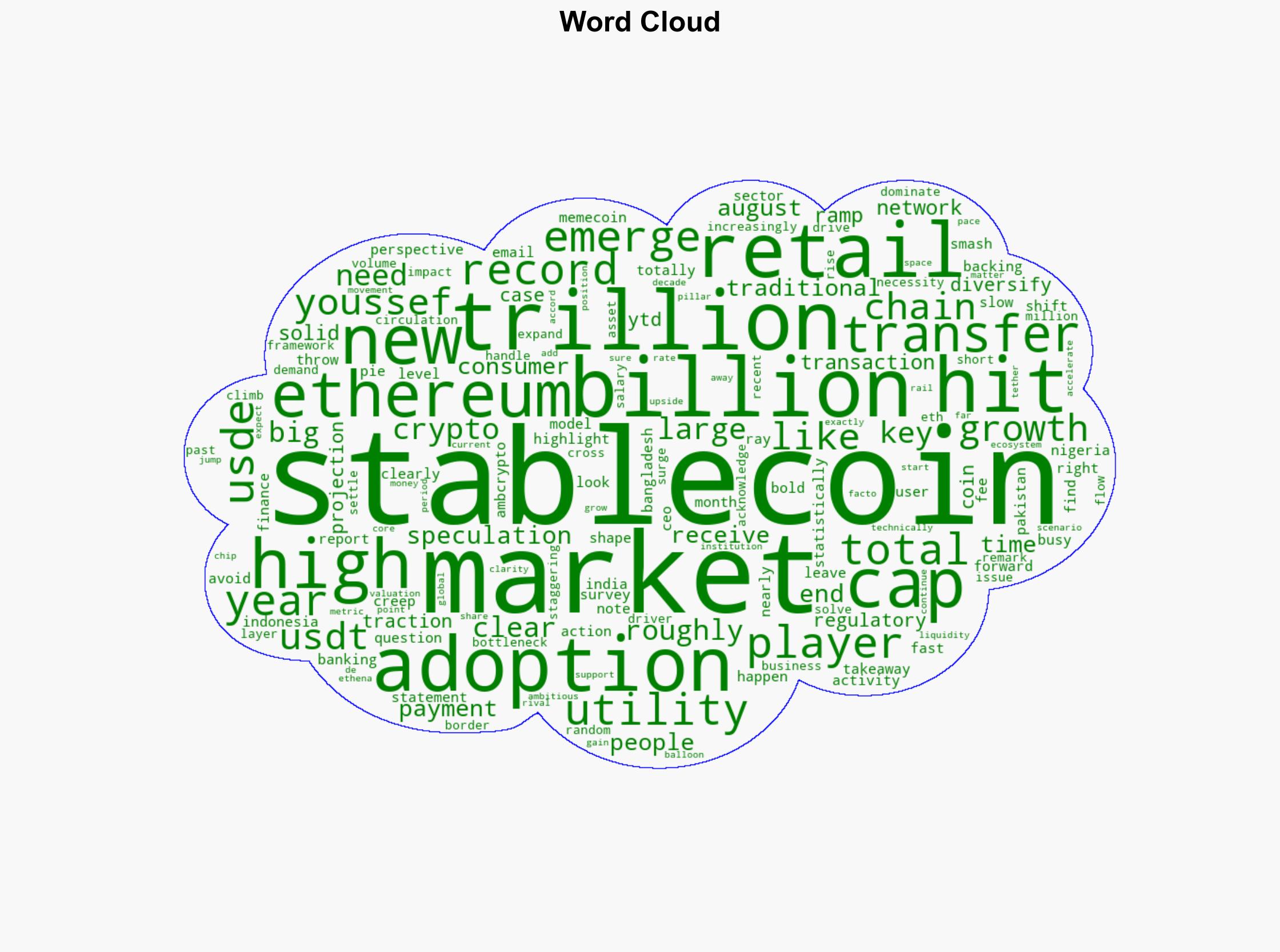

financial technology, regulatory compliance, blockchain innovation, global finance