100 billion for OpenAI by 2027 Sam Altman confirms the one reason he’d actually back an IPO revenge – Windows Central

Published on: 2025-11-05

Intelligence Report: 100 billion for OpenAI by 2027 Sam Altman confirms the one reason he’d actually back an IPO revenge – Windows Central

1. BLUF (Bottom Line Up Front)

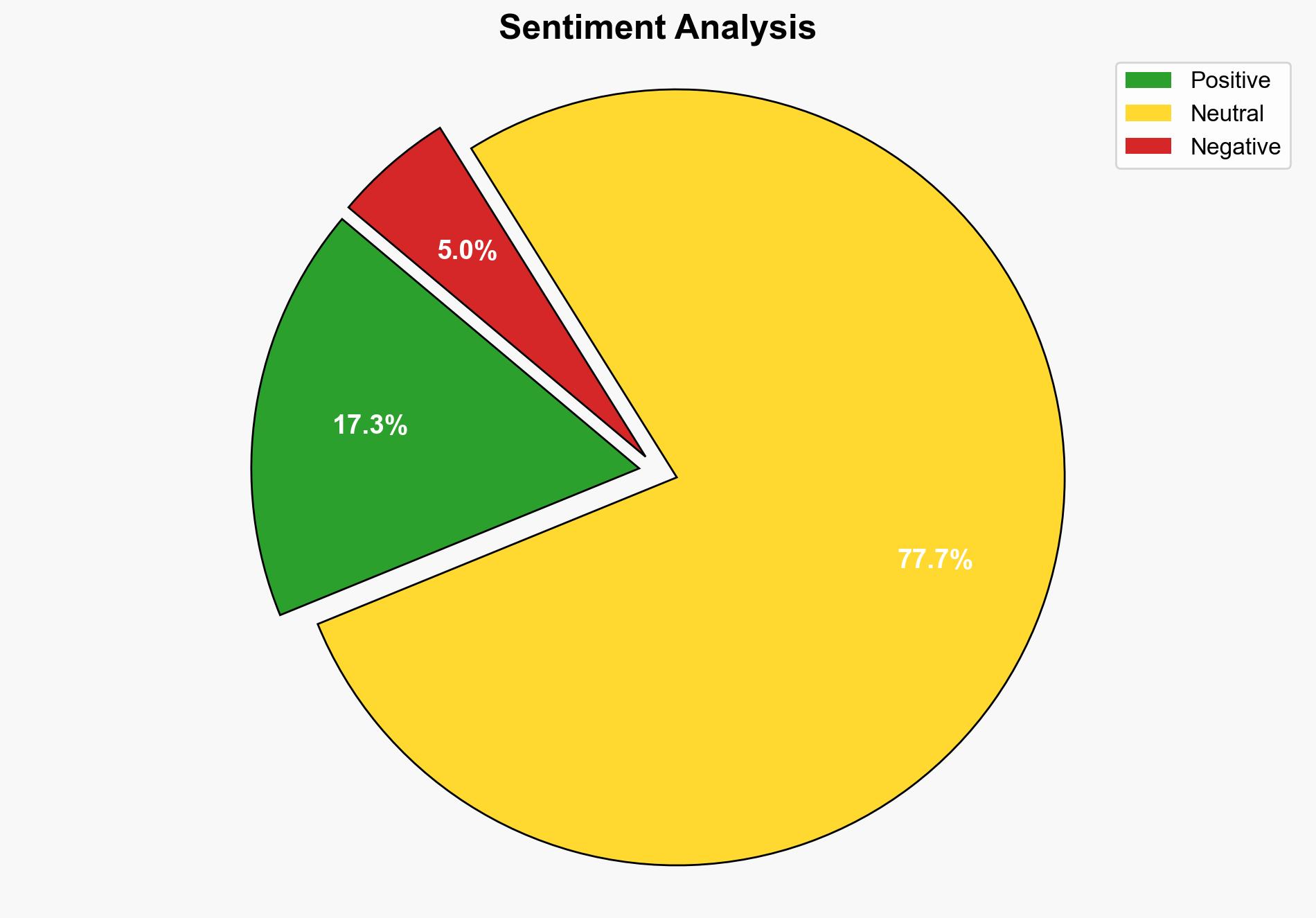

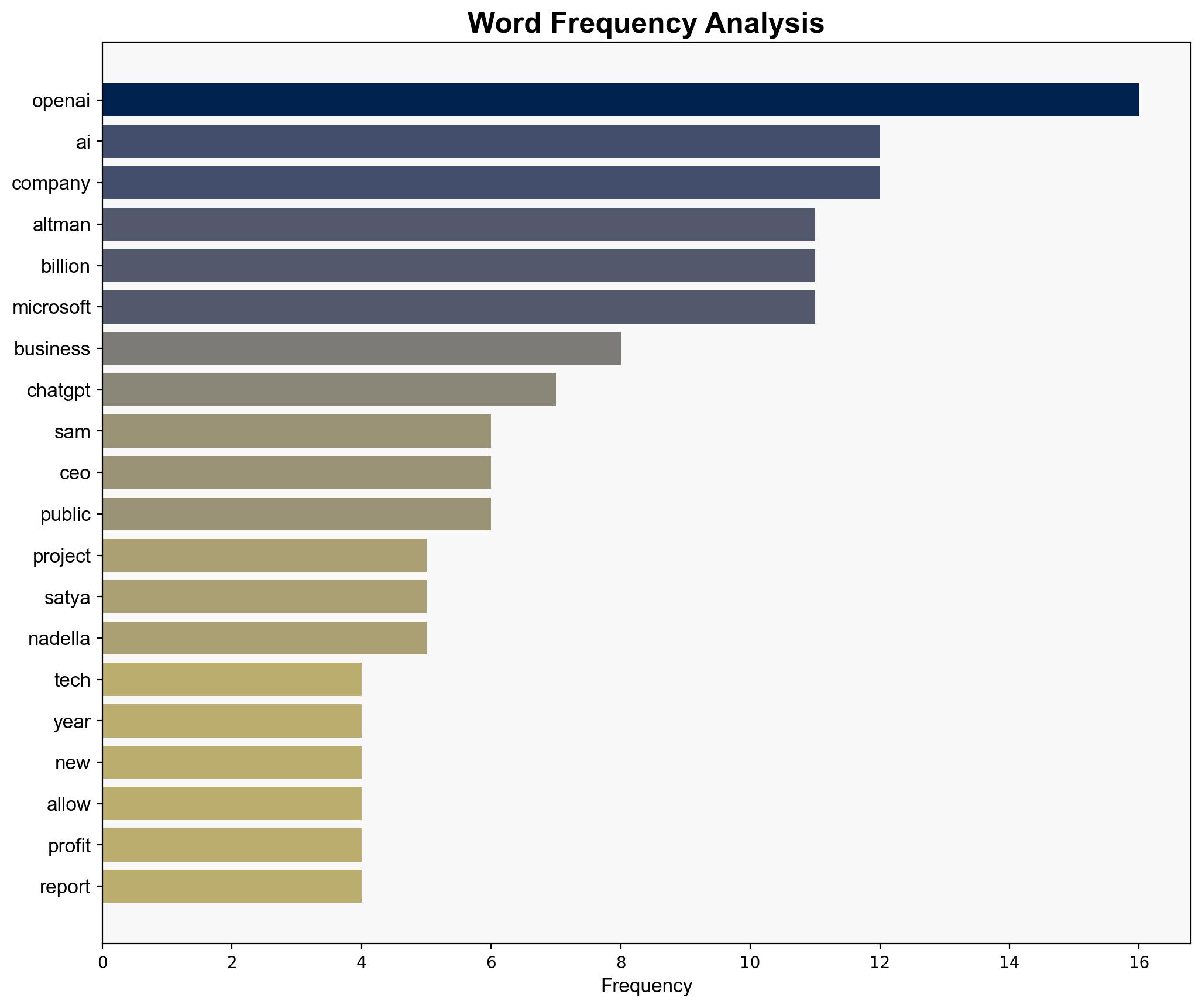

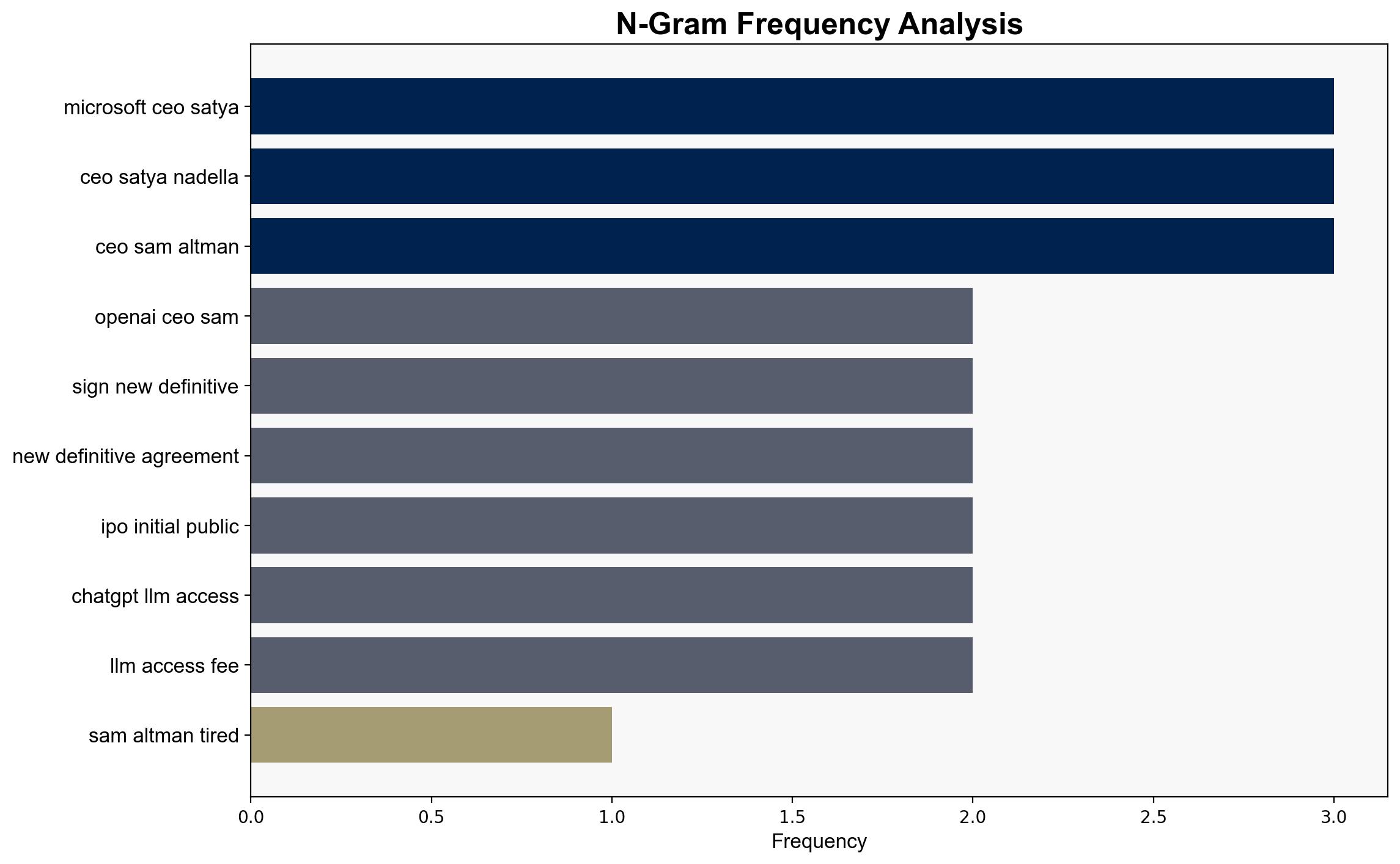

OpenAI’s projected valuation of $100 billion by 2027 is ambitious but plausible, given its strategic partnerships and technological advancements. The most supported hypothesis is that OpenAI will pursue an IPO to capitalize on its growth and secure further investment. Confidence Level: Moderate. Recommended action is to closely monitor OpenAI’s financial maneuvers and market positioning, particularly its relationship with Microsoft.

2. Competing Hypotheses

1. **Hypothesis A**: OpenAI will pursue an IPO by 2027 to leverage its projected growth and secure additional funding, driven by its partnership with Microsoft and advancements in AI technology.

2. **Hypothesis B**: OpenAI will remain private, focusing on strategic partnerships and internal growth to avoid the volatility and scrutiny of public markets.

Using Bayesian Scenario Modeling, Hypothesis A is more likely due to the strategic benefits of an IPO in attracting investment and enhancing market presence, despite Altman’s public dismissal of immediate IPO plans.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes continued growth in AI demand and successful monetization of OpenAI’s technologies. Hypothesis B assumes that OpenAI can sustain growth without public market pressures.

– **Red Flags**: Altman’s public dismissal of IPO plans could be a strategic misdirection. The reported financial losses and high spending raise questions about sustainability without public funding.

– **Blind Spots**: The potential impact of regulatory changes on AI development and market dynamics is not addressed.

4. Implications and Strategic Risks

– **Economic**: An IPO could significantly impact AI market dynamics, influencing investor behavior and competitive strategies.

– **Cyber**: Increased public scrutiny may expose OpenAI to cybersecurity risks and intellectual property challenges.

– **Geopolitical**: OpenAI’s growth could shift global AI leadership dynamics, affecting international collaborations and tensions.

– **Psychological**: Public perception of AI’s role in society may influence OpenAI’s strategic decisions and market reception.

5. Recommendations and Outlook

- Monitor OpenAI’s financial disclosures and partnership developments for signs of IPO preparation.

- Engage with regulatory bodies to anticipate potential changes affecting AI market operations.

- Scenario Projections:

- Best Case: Successful IPO with strong market reception, leading to increased investment and innovation.

- Worst Case: Market volatility and regulatory challenges hinder OpenAI’s growth, leading to financial instability.

- Most Likely: Gradual progression towards IPO as market conditions stabilize and AI demand grows.

6. Key Individuals and Entities

– Sam Altman

– Satya Nadella

– Bill Gates

– Microsoft

7. Thematic Tags

economic strategy, AI market dynamics, corporate finance, technological innovation