2 of NYCs 5 public pension funds are vulnerable to a mayor-backed Israel divestment push – Israelnationalnews.com

Published on: 2025-11-04

Intelligence Report: 2 of NYCs 5 public pension funds are vulnerable to a mayor-backed Israel divestment push – Israelnationalnews.com

1. BLUF (Bottom Line Up Front)

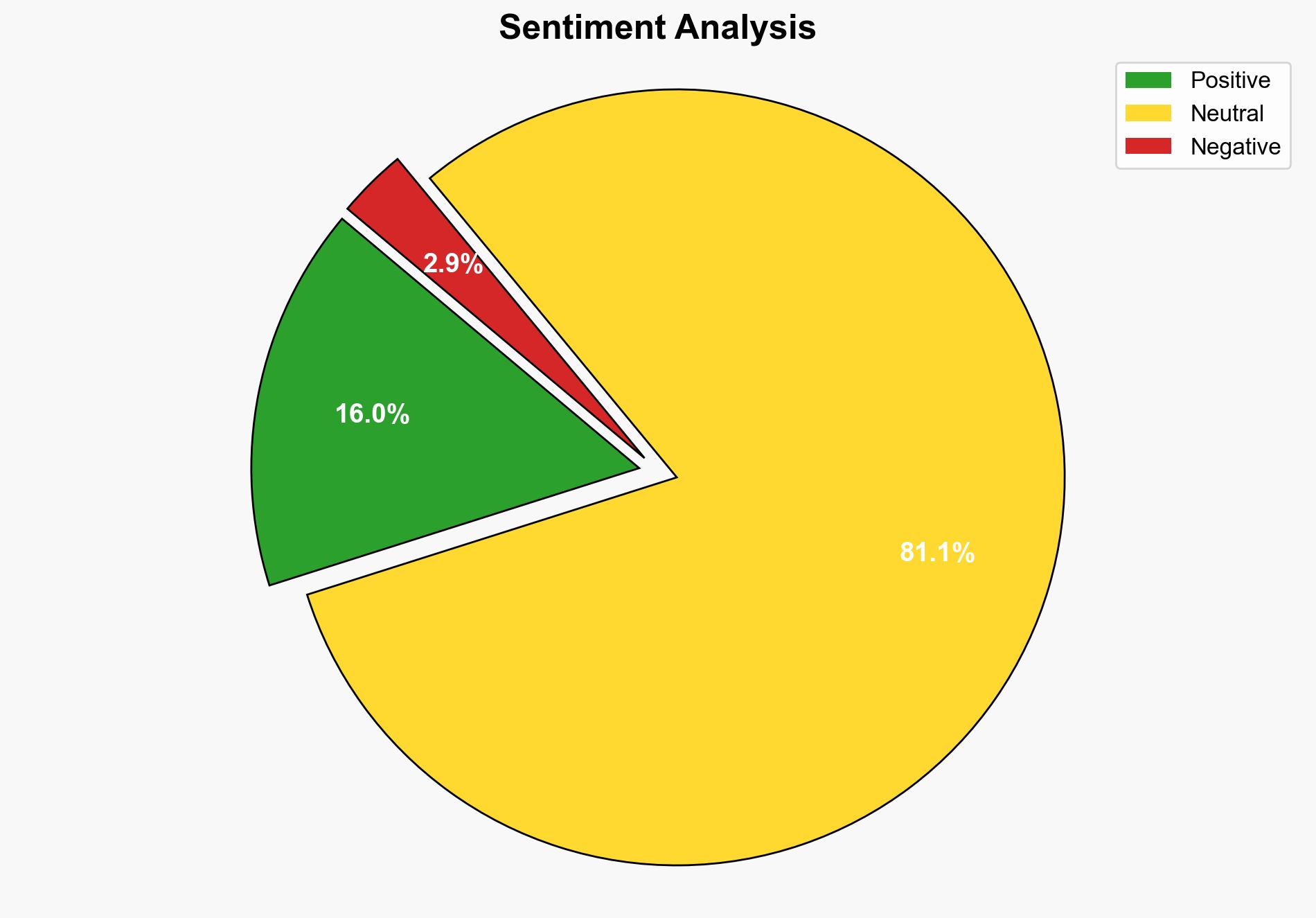

There is a moderate confidence level that the potential divestment from Israeli assets by New York City’s public pension funds could proceed if key political figures align. The most supported hypothesis is that the divestment initiative will gain traction due to political support and strategic board appointments. Recommended action includes monitoring political developments and preparing for potential financial and diplomatic repercussions.

2. Competing Hypotheses

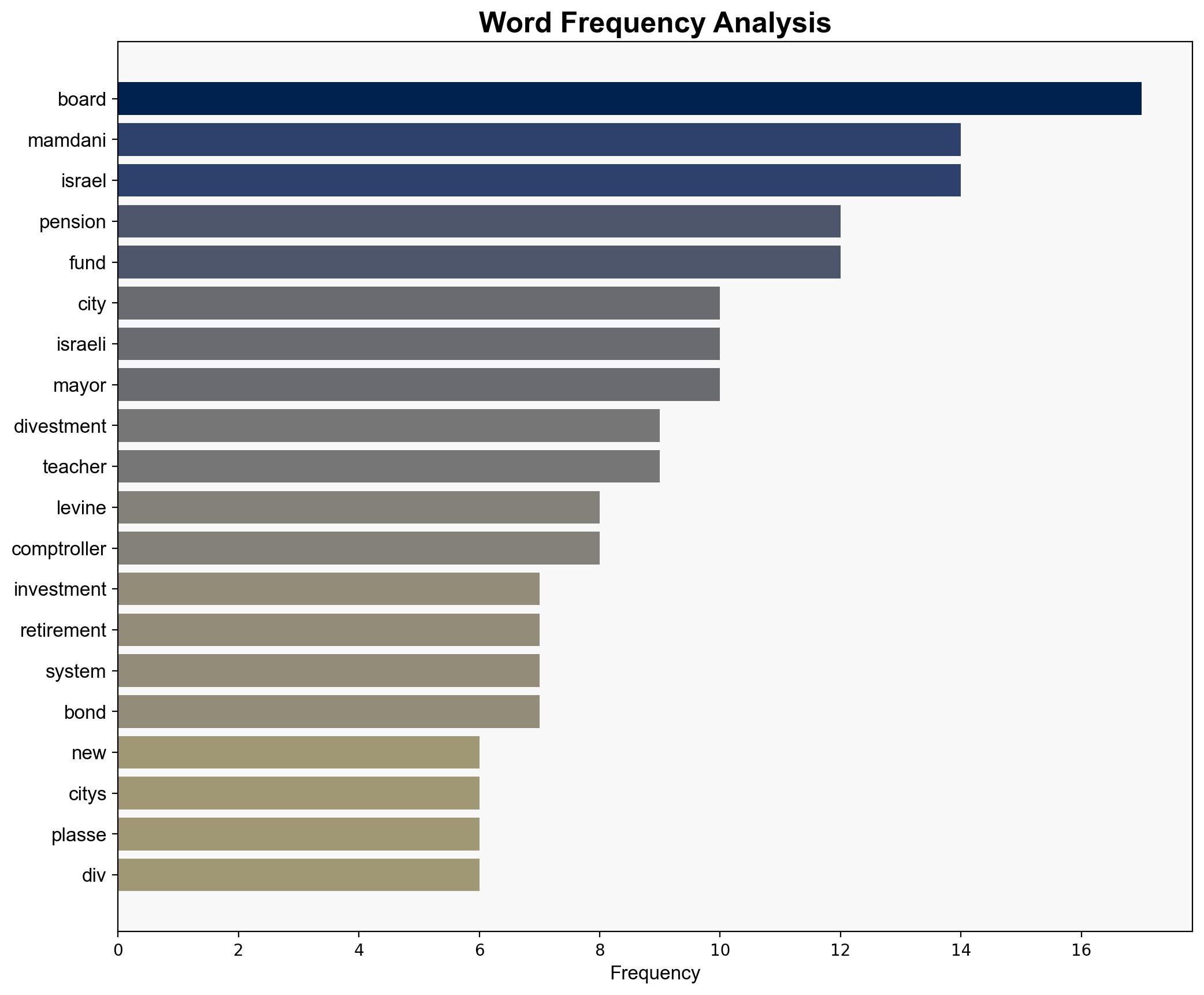

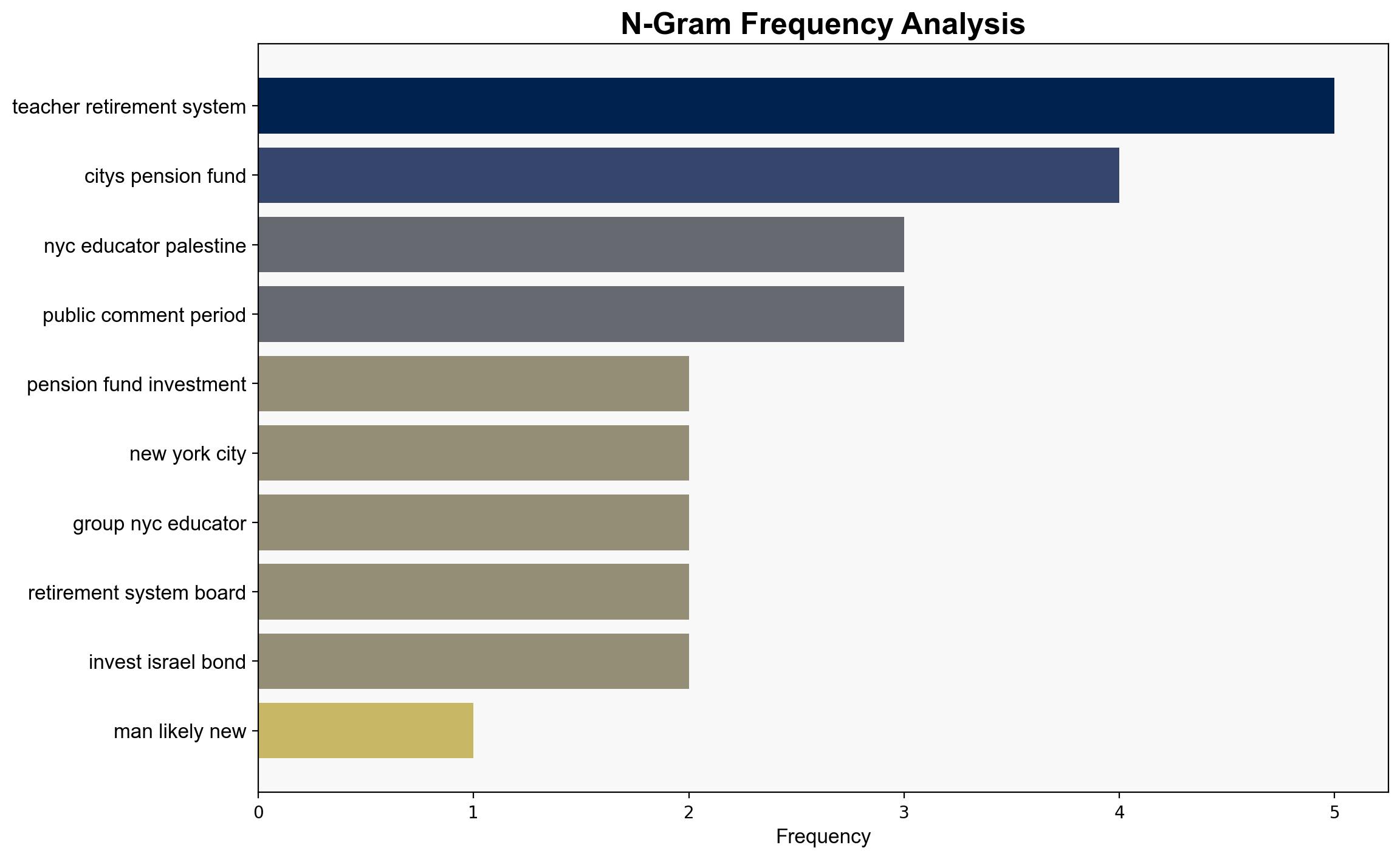

Hypothesis 1: The divestment initiative will succeed due to political support from key figures like Zohran Mamdani and strategic appointments to pension fund boards. This hypothesis is supported by Mamdani’s lead in polls and his stated intentions to pursue divestment, as well as the influence of mayoral appointees on the boards.

Hypothesis 2: The divestment initiative will face significant resistance and ultimately fail due to opposition from influential stakeholders and the complexity of altering pension fund investments. This is supported by the historical lack of traction for similar initiatives and potential resistance from entities with vested interests in maintaining current investments.

3. Key Assumptions and Red Flags

– Assumption: Political figures like Mamdani will maintain their current positions and influence after the election.

– Red Flag: The lack of explicit support from other key stakeholders, such as the current comptroller, could indicate potential resistance.

– Blind Spot: The potential impact of external geopolitical events on local political dynamics is not fully considered.

4. Implications and Strategic Risks

– Economic: Divestment could lead to financial instability within the pension funds and affect their long-term viability.

– Geopolitical: The move may strain diplomatic relations with Israel and impact New York City’s international standing.

– Psychological: The initiative could polarize communities within New York City, leading to increased social tensions.

5. Recommendations and Outlook

- Monitor political developments closely, particularly the outcomes of relevant elections and board appointments.

- Engage with stakeholders to assess the potential financial impact of divestment and develop contingency plans.

- Scenario Projections:

- Best Case: The initiative is shelved, maintaining financial stability and diplomatic relations.

- Worst Case: Divestment proceeds, leading to financial losses and diplomatic fallout.

- Most Likely: Partial divestment occurs, with some financial and diplomatic consequences.

6. Key Individuals and Entities

– Zohran Mamdani

– Mark Levine

– Brad Lander

– Leah Plasse

– Eric Adams

7. Thematic Tags

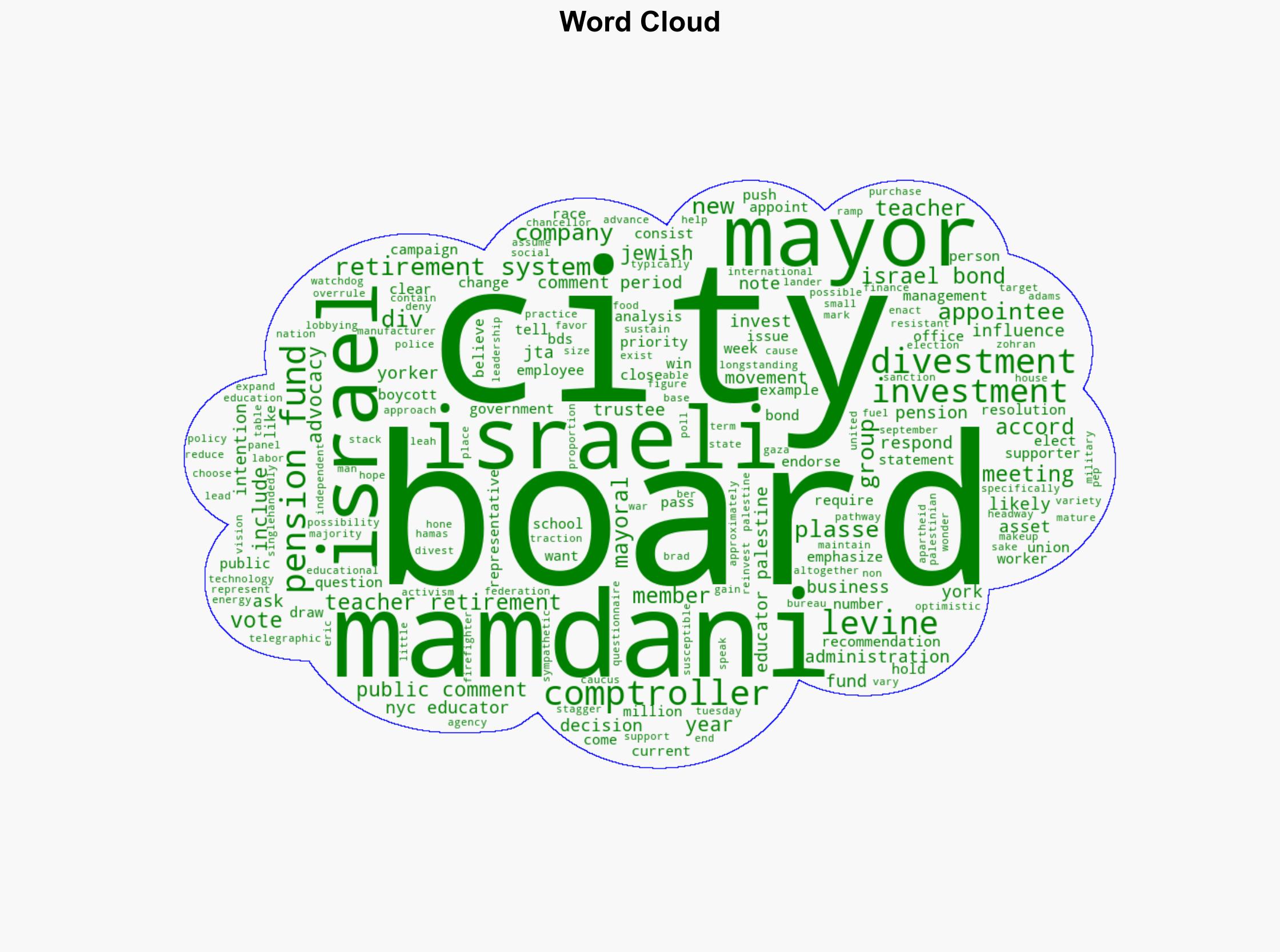

national security threats, geopolitical dynamics, financial stability, political influence