SP 500 hits record high as stock market surges – ABC News

Published on: 2025-06-27

Intelligence Report: SP 500 hits record high as stock market surges – ABC News

1. BLUF (Bottom Line Up Front)

The SP 500 and Nasdaq have reached record highs, driven by investor optimism despite geopolitical tensions and trade uncertainties. The market’s resilience suggests a robust economic outlook, though potential risks from ongoing trade disputes and geopolitical conflicts remain. It is recommended to monitor these developments closely to anticipate market shifts and economic impacts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

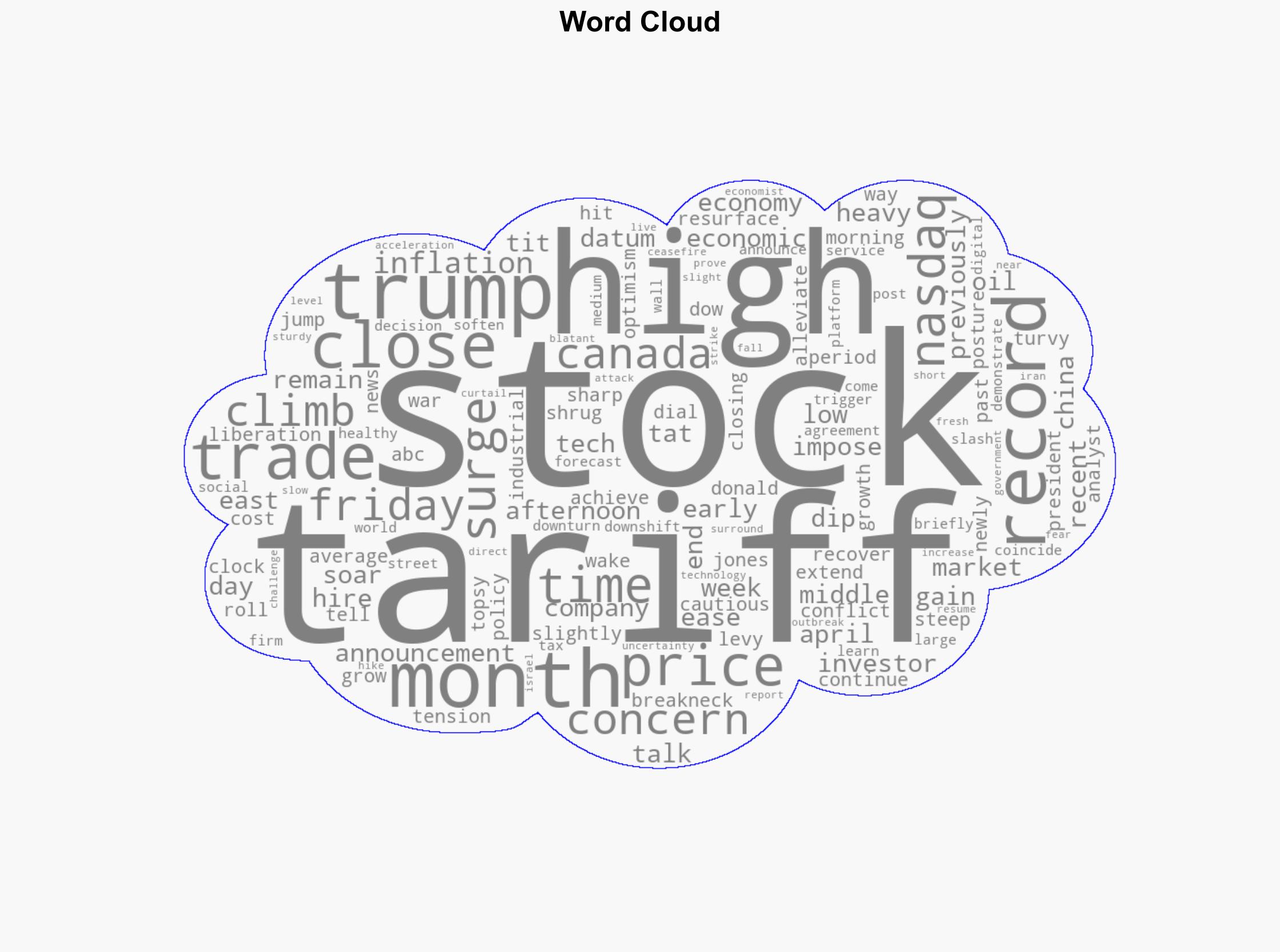

– **Surface Events**: Record highs in SP 500 and Nasdaq.

– **Systemic Structures**: Economic policies, trade tariffs, and geopolitical tensions.

– **Worldviews**: Investor confidence in economic growth despite uncertainties.

– **Myths**: Belief in market resilience against geopolitical and economic pressures.

Cross-Impact Simulation

– Trade tensions with China and tariff policies could impact global supply chains, affecting market stability.

– Middle East conflicts may influence oil prices, impacting energy sectors and broader economic conditions.

Scenario Generation

– **Optimistic Scenario**: Resolution of trade tensions leads to sustained market growth.

– **Pessimistic Scenario**: Escalation in geopolitical conflicts and trade wars triggers market volatility.

– **Moderate Scenario**: Continued market growth with intermittent volatility due to unresolved tensions.

3. Implications and Strategic Risks

– **Economic Risks**: Prolonged trade disputes could dampen economic growth and investor confidence.

– **Geopolitical Risks**: Escalation in Middle East tensions may disrupt global markets.

– **Systemic Vulnerabilities**: Over-reliance on tech sector growth could expose markets to sector-specific downturns.

4. Recommendations and Outlook

- Monitor trade negotiations and geopolitical developments to anticipate market impacts.

- Diversify investment strategies to mitigate risks from sector-specific downturns.

- Scenario-based projections:

- **Best Case**: Trade agreements and geopolitical stability lead to sustained market growth.

- **Worst Case**: Trade wars and conflicts result in significant market corrections.

- **Most Likely**: Markets experience growth with periodic volatility due to unresolved issues.

5. Key Individuals and Entities

– Donald Trump

6. Thematic Tags

economic growth, trade tensions, geopolitical risks, market resilience