Trump’s new China trade deal is still bad for US business consumers – AppleInsider

Published on: 2025-06-27

Intelligence Report: Trump’s new China trade deal is still bad for US business consumers – AppleInsider

1. BLUF (Bottom Line Up Front)

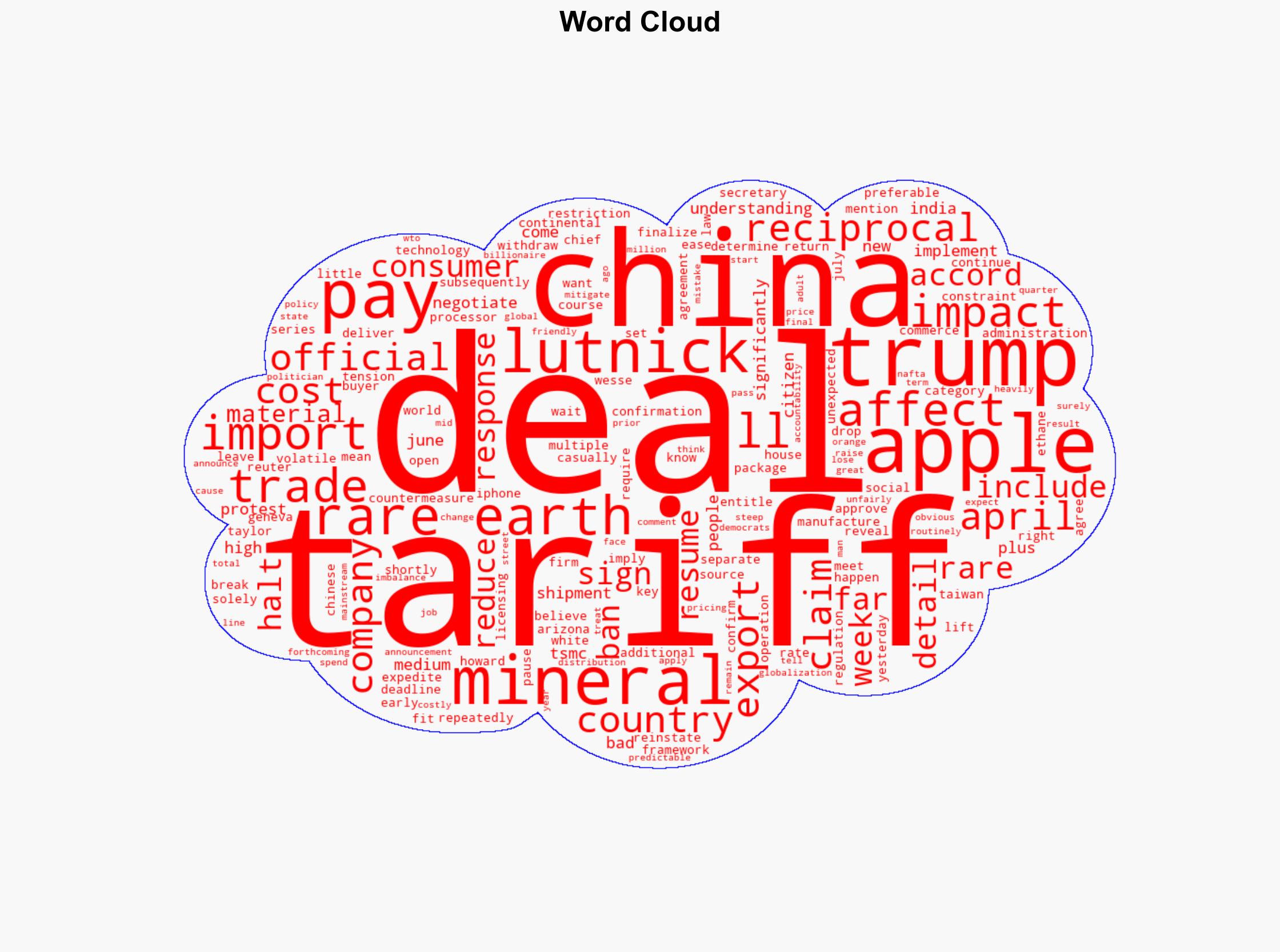

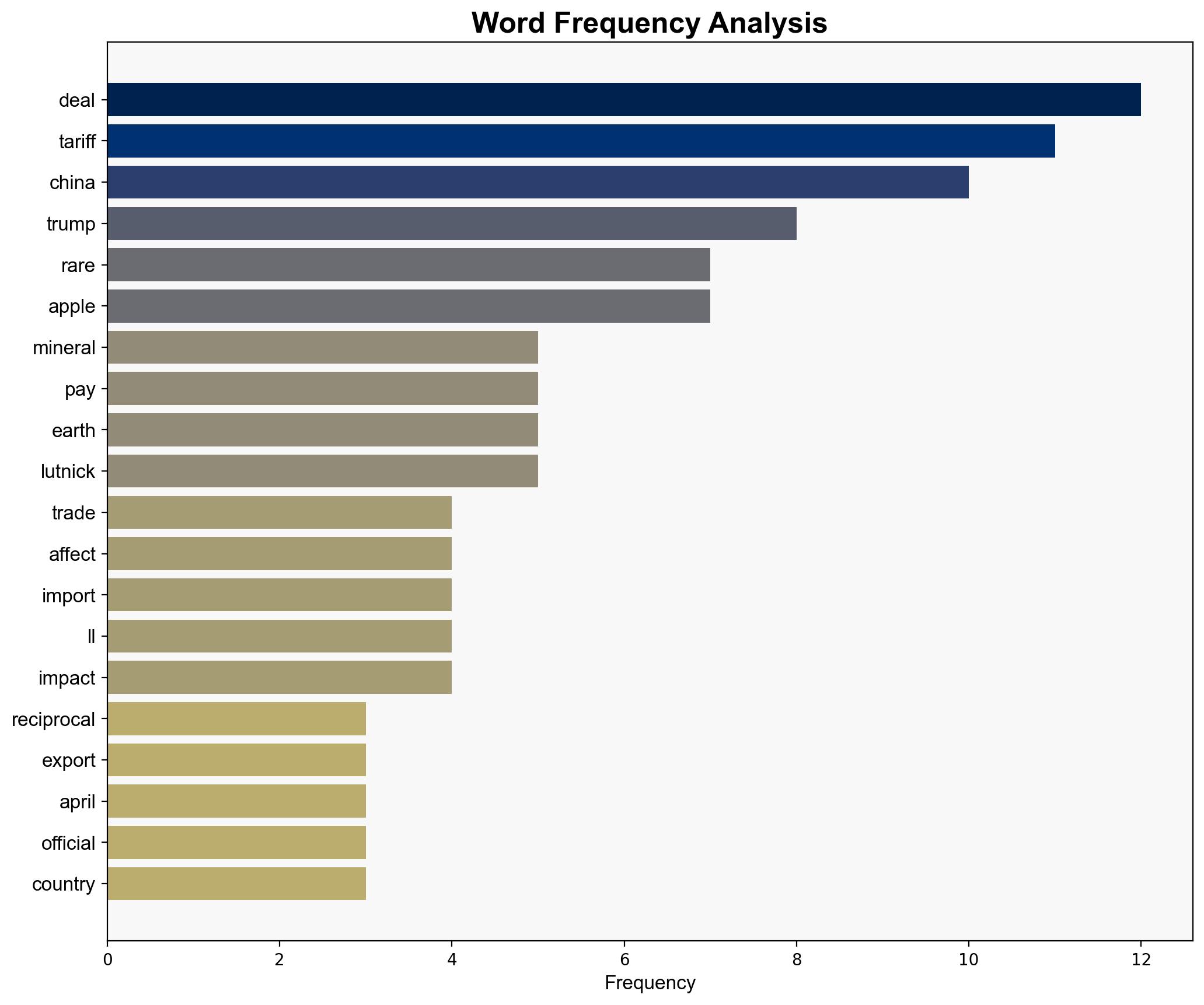

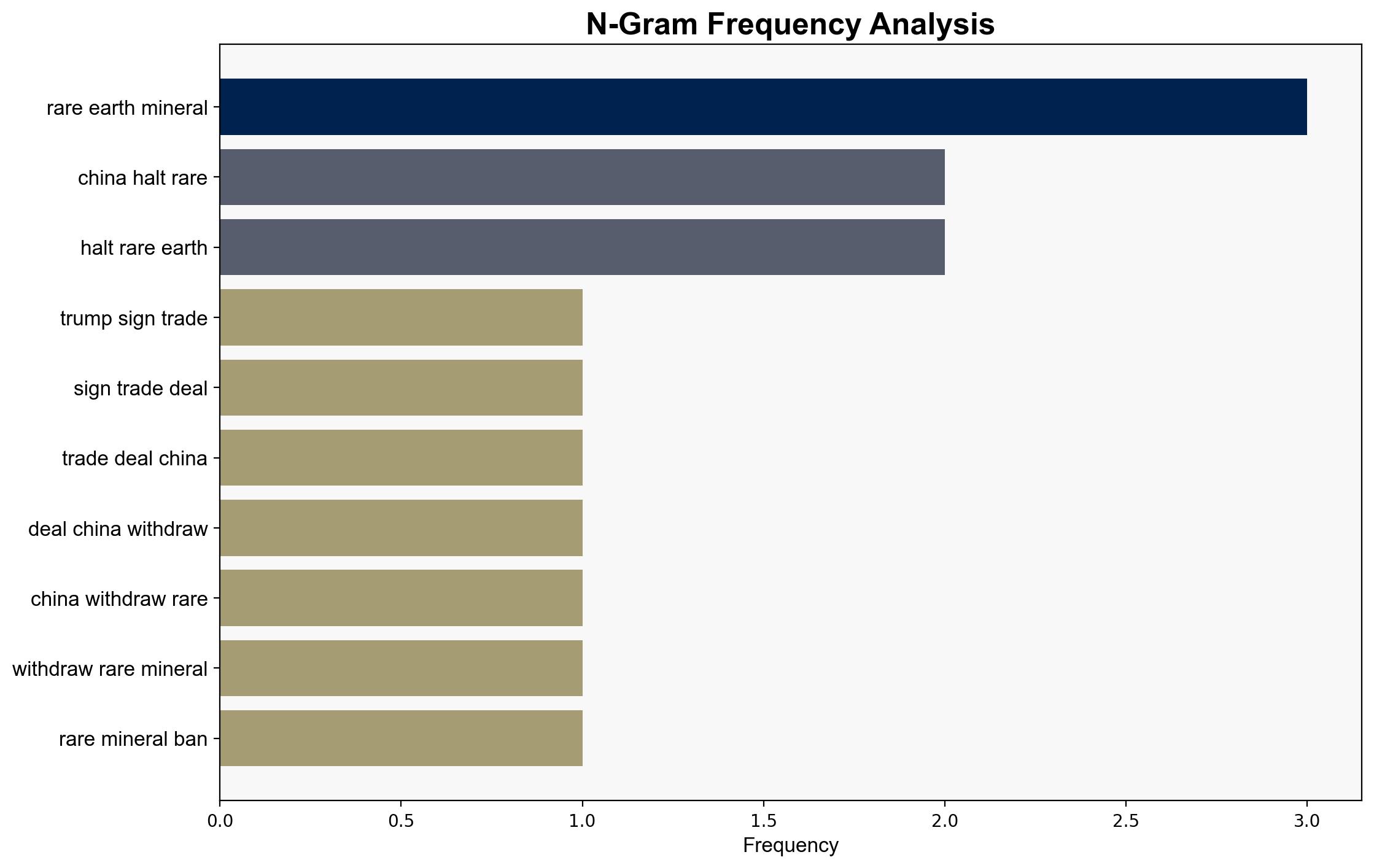

The recent trade deal between the United States and China, as reported, poses significant challenges for US businesses and consumers. The agreement, which involves the lifting of a rare earth mineral export ban by China, is expected to result in increased costs for US companies importing goods from China. This could lead to higher consumer prices, particularly affecting technology companies like Apple. The strategic recommendation is to evaluate alternative supply chains and negotiate more favorable terms to mitigate these impacts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

The surface event is the signing of the trade deal, which temporarily eases restrictions on rare earth minerals. Systemically, this reflects ongoing trade tensions and dependency on Chinese exports. The worldview is shaped by competitive nationalism and economic protectionism, while the myth is the belief in unilateral trade victories.

Cross-Impact Simulation

The deal’s ripple effects include potential disruptions in technology manufacturing and increased costs for US consumers. Neighboring states may experience shifts in trade dynamics, particularly those involved in rare earth mineral production.

Scenario Generation

Divergent narratives include a scenario where China fully resumes rare earth exports, stabilizing supply chains, versus a scenario where regulatory hurdles delay shipments, exacerbating costs for US companies.

3. Implications and Strategic Risks

The primary risk is economic, with potential for increased consumer prices and strained business operations. There is also a geopolitical risk of escalating trade tensions if the deal’s terms are not met. Systemic vulnerabilities include reliance on Chinese exports and the potential for retaliatory measures.

4. Recommendations and Outlook

- Encourage diversification of supply chains to reduce dependency on Chinese rare earth minerals.

- Engage in diplomatic negotiations to secure more favorable trade terms and reduce tariff impacts.

- Best case: Successful diversification and negotiation lead to stabilized prices and improved trade relations.

- Worst case: Continued dependency and regulatory delays result in significant economic strain.

- Most likely: Gradual adaptation with moderate price increases and ongoing trade negotiations.

5. Key Individuals and Entities

Donald Trump, Howard Lutnick, Apple, TSMC

6. Thematic Tags

national security threats, economic impact, trade relations, technology sector