OPEC to ramp up oil output even higher in August with eye on market share – Fortune

Published on: 2025-07-05

Intelligence Report: OPEC to Ramp Up Oil Output Even Higher in August with Eye on Market Share – Fortune

1. BLUF (Bottom Line Up Front)

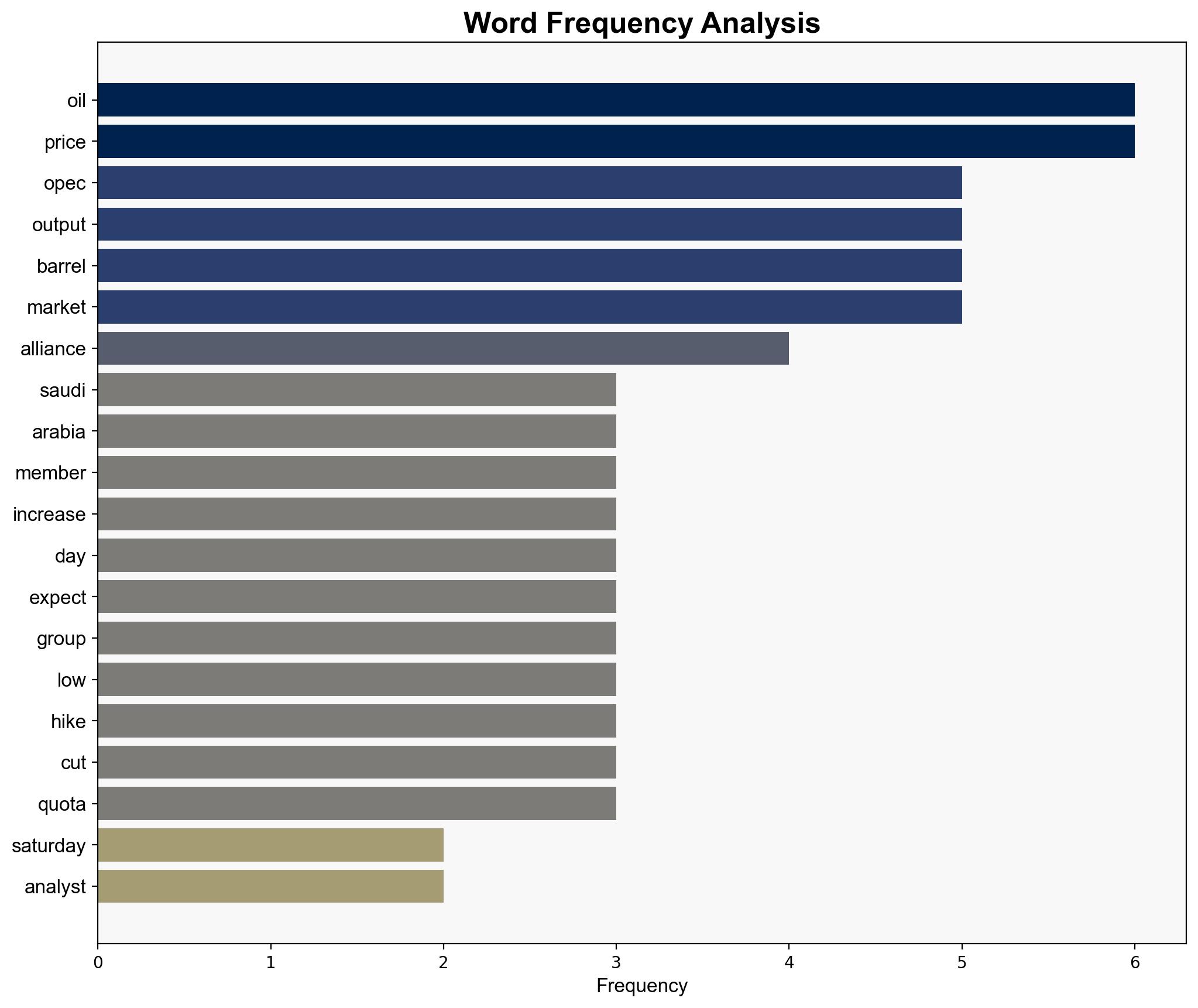

OPEC, led by key members Saudi Arabia and Russia, plans to increase oil output in August, aiming to capture greater market share. This decision reflects a strategic pivot towards market dominance, potentially impacting global oil prices and geopolitical stability. Analysts anticipate this move could unsettle oil markets, especially given current geopolitical tensions.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

Surface events indicate a strategic shift by OPEC towards increasing market share. Systemic structures reveal a coordinated effort among OPEC members to influence global oil prices. The worldview suggests a competitive stance amidst geopolitical uncertainties. The underlying myth is the belief in OPEC’s ability to stabilize or destabilize global markets.

Cross-Impact Simulation

The increase in oil output could lead to lower prices, affecting economies reliant on oil exports. Potential conflicts in regions like the Middle East and tensions in Ukraine and Libya may exacerbate market volatility.

Scenario Generation

In a best-case scenario, increased output stabilizes prices and enhances global economic growth. A worst-case scenario sees geopolitical tensions leading to supply disruptions, causing price spikes. The most likely scenario involves moderate price fluctuations with ongoing geopolitical risks.

3. Implications and Strategic Risks

The decision to increase oil output poses economic risks, including potential price wars and reduced revenues for oil-dependent nations. Geopolitical tensions, particularly in the Middle East, could disrupt supply chains. The strategic chokepoint at the Strait of Hormuz remains a critical vulnerability.

4. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly in the Middle East, to anticipate potential disruptions.

- Engage with international partners to ensure energy security and diversify energy sources.

- Prepare for fluctuating oil prices by developing strategic reserves and enhancing energy efficiency.

- Scenario-based projections suggest maintaining diplomatic channels to mitigate regional tensions.

5. Key Individuals and Entities

Jorge Leon, Giovanni Staunovo

6. Thematic Tags

energy security, geopolitical risks, market dynamics, regional stability