Robinhood Up 160 in 2025 But May Face Obstacles – Slashdot.org

Published on: 2025-07-12

Intelligence Report: Robinhood Up 160 in 2025 But May Face Obstacles – Slashdot.org

1. BLUF (Bottom Line Up Front)

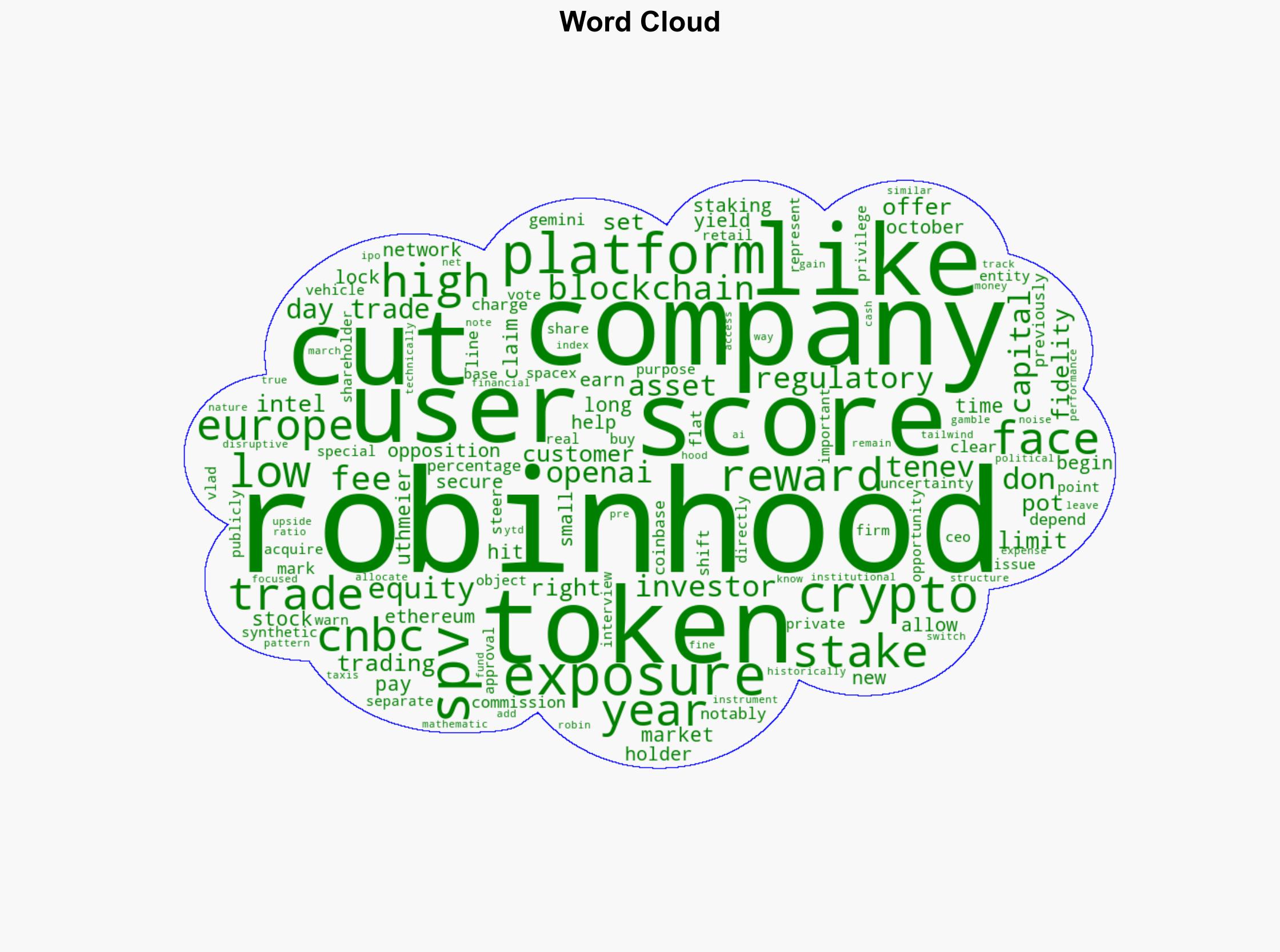

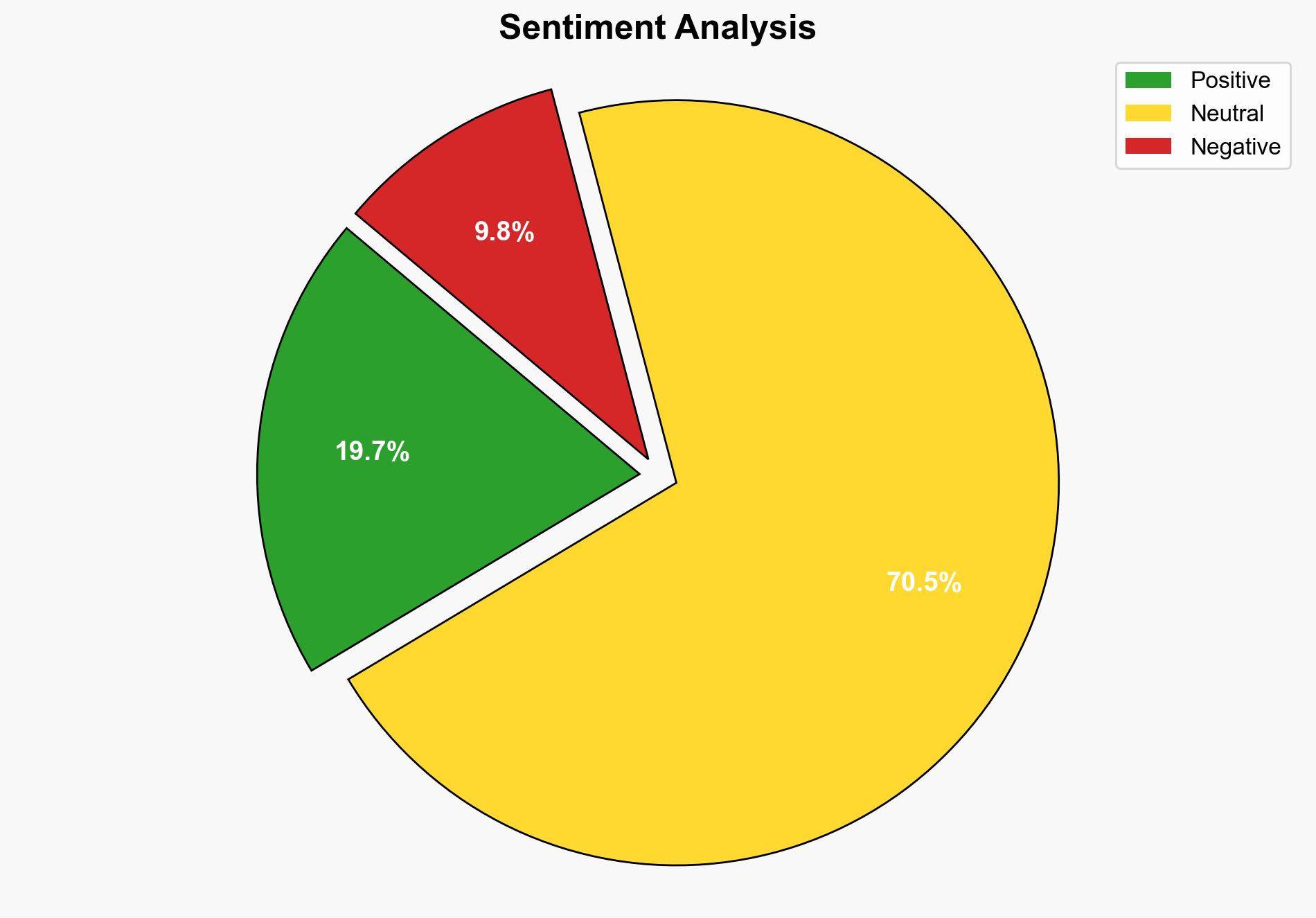

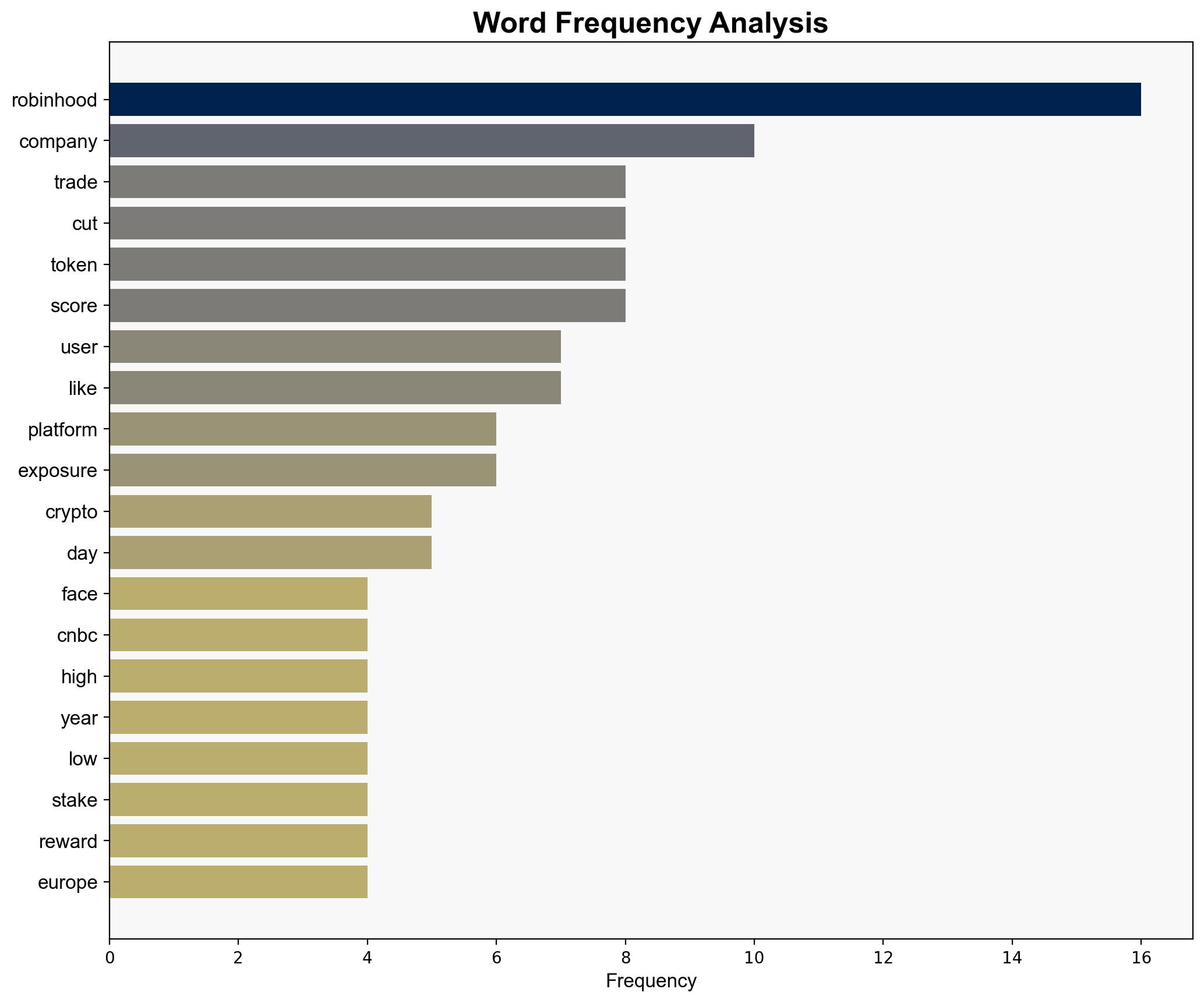

Robinhood’s projected growth of 160% by 2025 is tempered by potential regulatory and operational challenges. Key findings indicate that the platform’s involvement in cryptocurrency trading and staking, alongside its use of Special Purpose Vehicles (SPVs) for asset exposure, may attract increased scrutiny and legal challenges. Recommendations focus on enhancing compliance frameworks and diversifying revenue streams to mitigate these risks.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Adversarial Threat Simulation

Potential adversarial actions include regulatory investigations and legal challenges, particularly concerning Robinhood’s payment for order flow practices and its crypto trading claims.

Indicators Development

Monitoring regulatory announcements and legal actions in the financial technology sector will be crucial for early detection of threats to Robinhood’s operations.

Bayesian Scenario Modeling

Scenarios predict increased regulatory scrutiny may lead to operational constraints, impacting Robinhood’s growth trajectory.

Network Influence Mapping

Mapping relationships with regulatory bodies and industry stakeholders to assess potential impacts on Robinhood’s strategic initiatives.

3. Implications and Strategic Risks

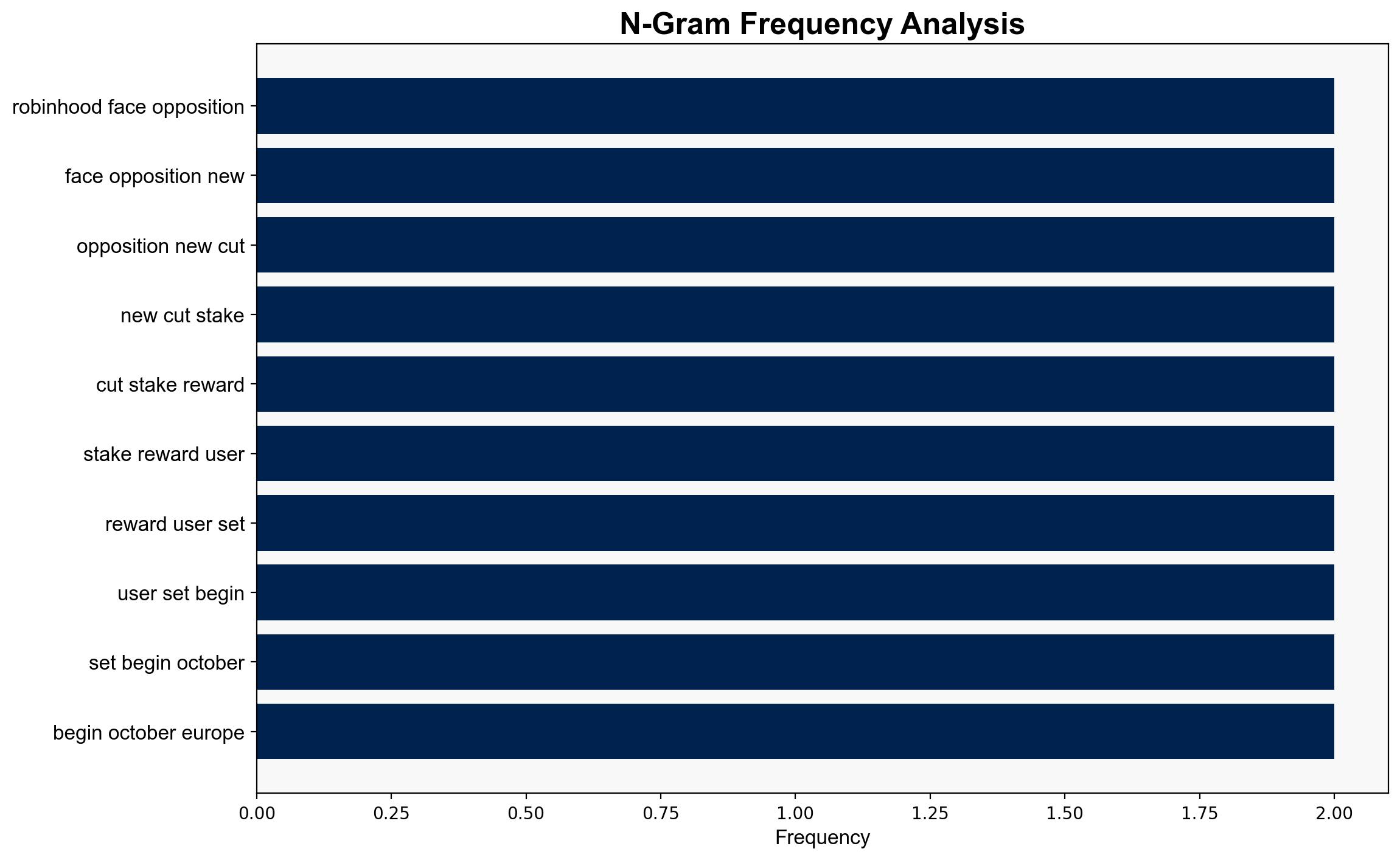

Robinhood’s expansion into cryptocurrency and SPVs poses significant regulatory risks, potentially leading to legal challenges and reputational damage. The Florida Attorney General’s investigation could set a precedent, influencing other jurisdictions. Additionally, changes in staking rewards may affect user retention and market competitiveness.

4. Recommendations and Outlook

- Enhance compliance and legal advisory teams to navigate regulatory landscapes effectively.

- Explore alternative revenue models to reduce dependency on current practices under scrutiny.

- Scenario-based projections suggest a best-case scenario of regulatory adaptation and continued growth, a worst-case scenario of significant legal penalties and operational restrictions, and a most likely scenario of moderate regulatory adjustments with sustained growth.

5. Key Individuals and Entities

Vlad Tenev, James Uthmeier

6. Thematic Tags

financial technology, regulatory compliance, cryptocurrency, strategic risk management