Digicel eyes 2bn refinancing as junk bond yields slide – The Irish Times

Published on: 2025-07-18

Intelligence Report: Digicel eyes 2bn refinancing as junk bond yields slide – The Irish Times

1. BLUF (Bottom Line Up Front)

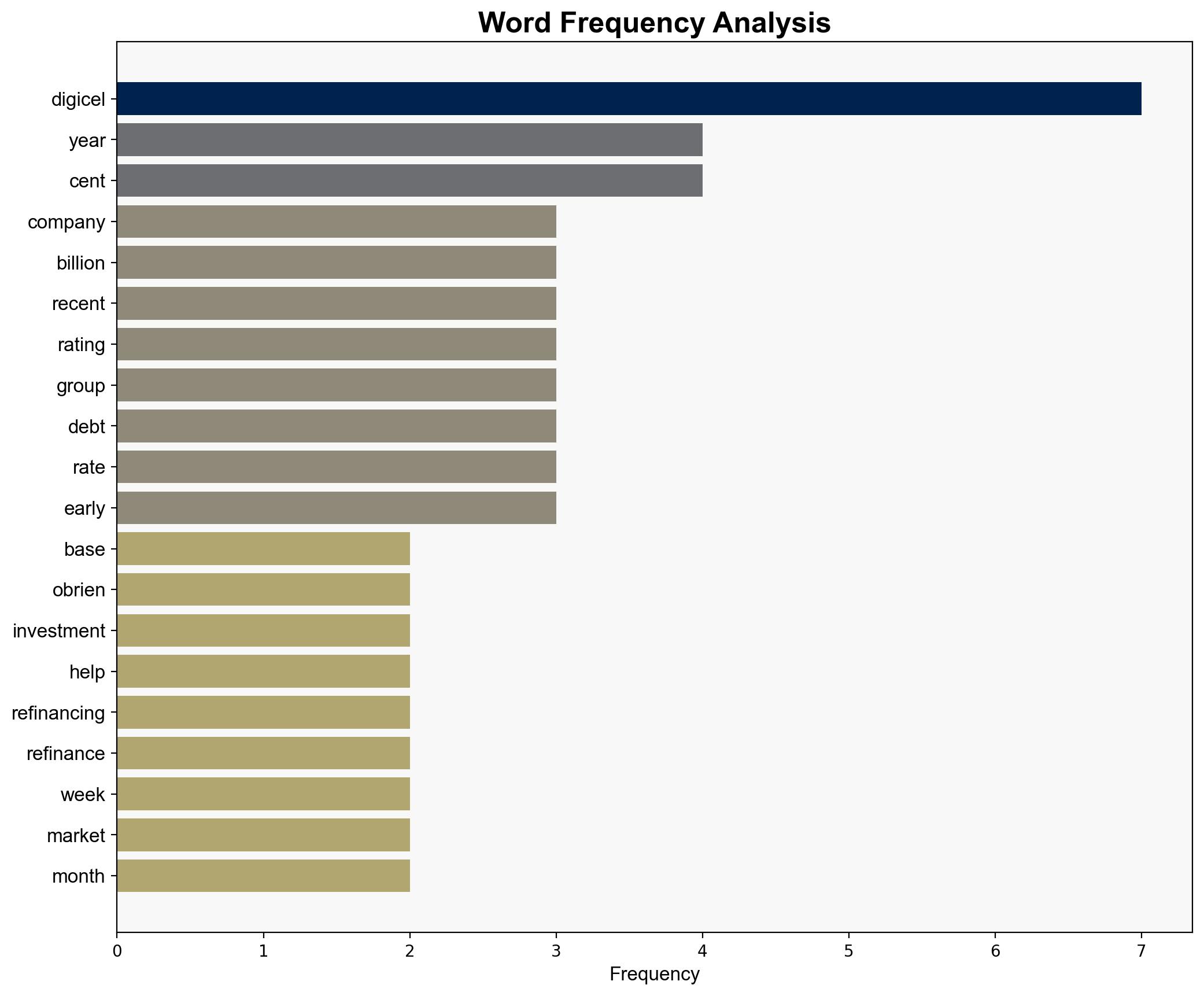

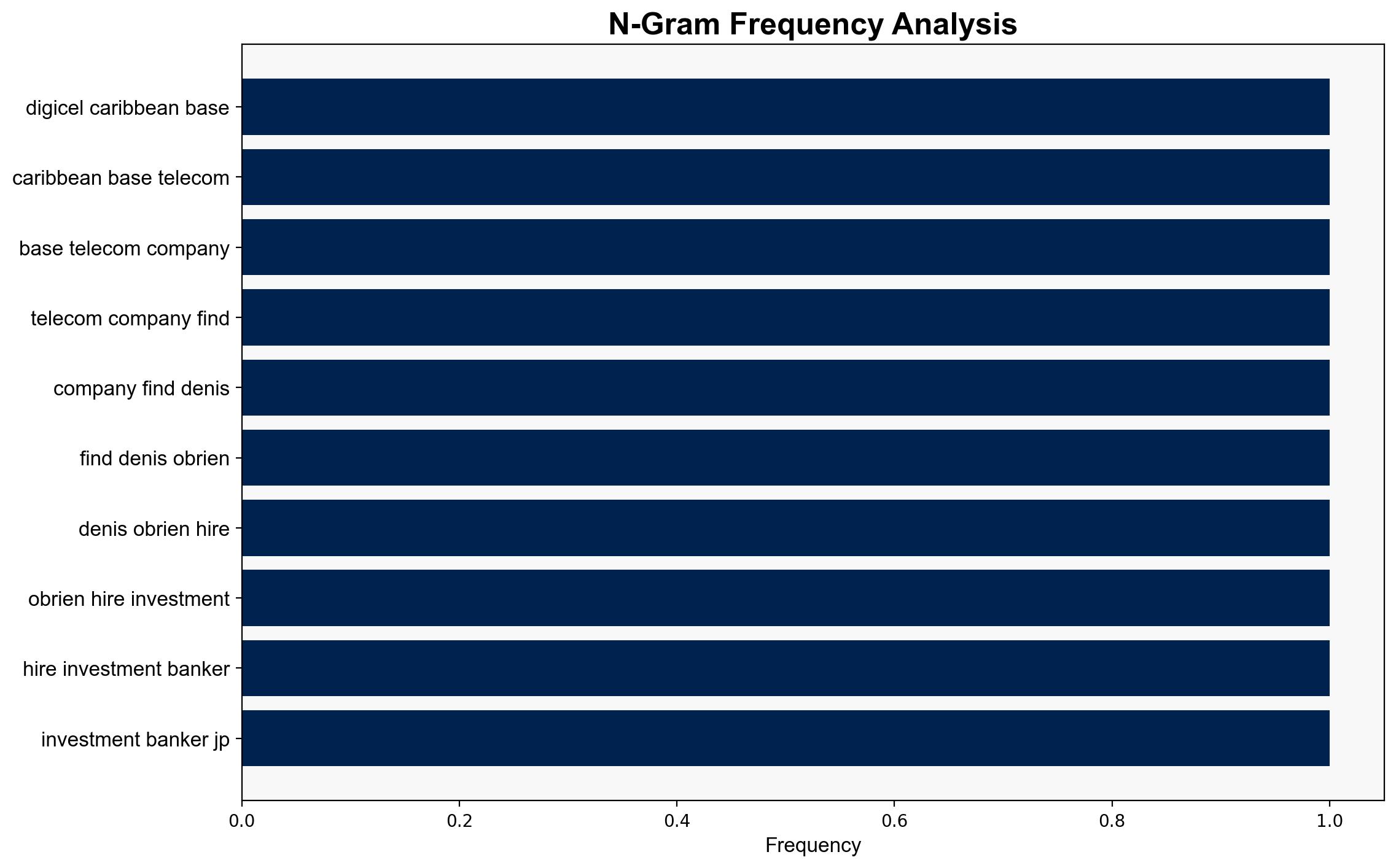

Digicel is pursuing a $2 billion refinancing initiative amid declining junk bond yields, potentially improving its financial stability. The company has engaged JP Morgan for this process, indicating a strategic move to manage its debt more effectively. This refinancing could impact regional economic dynamics, especially in the Caribbean, where Digicel operates extensively.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

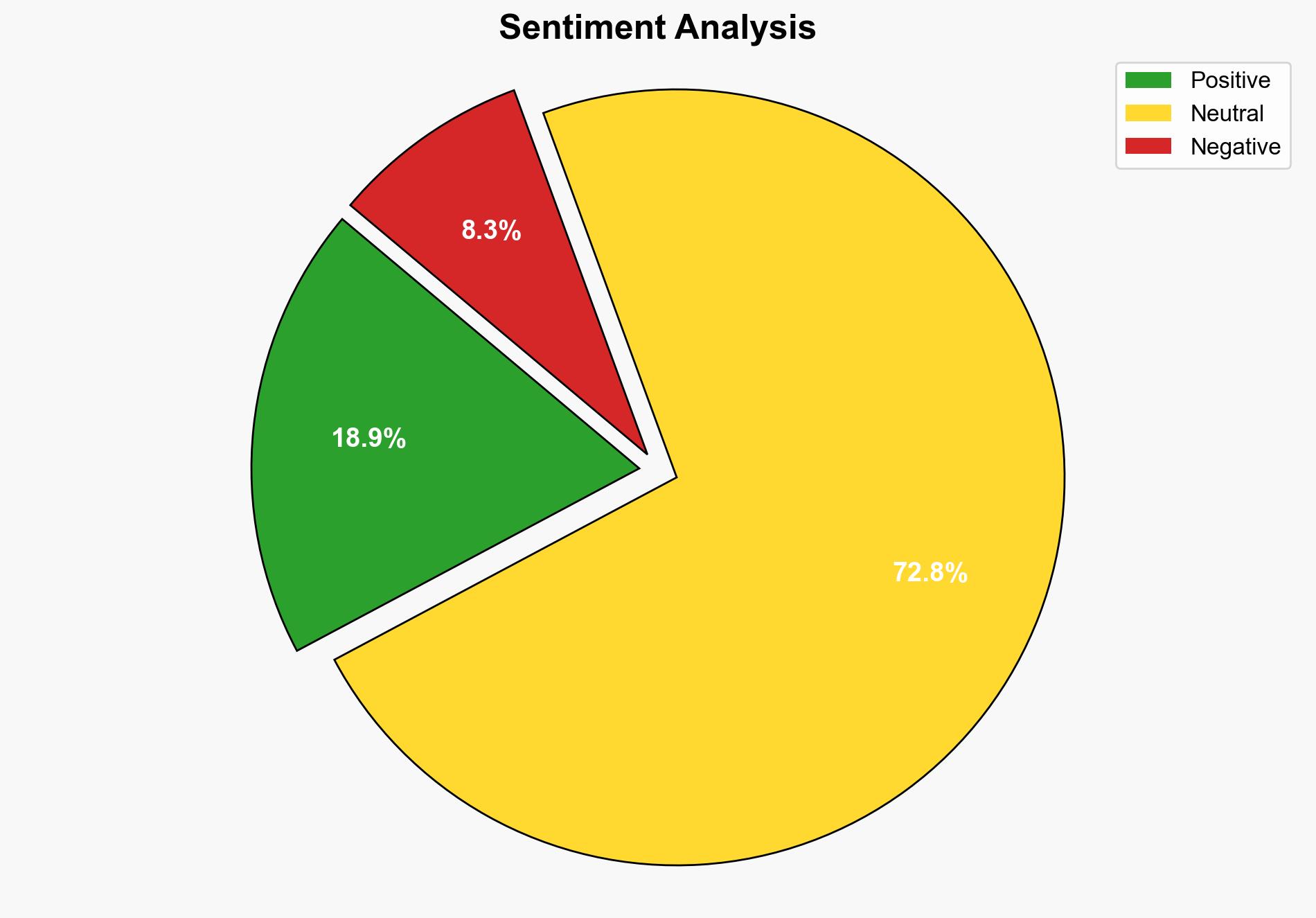

– **Surface Events**: Digicel’s refinancing efforts are driven by favorable market conditions with declining junk bond yields.

– **Systemic Structures**: The telecommunications market in the Caribbean faces financial restructuring pressures due to high debt levels.

– **Worldviews**: Investors perceive the Caribbean telecom market as volatile but potentially lucrative with strategic financial management.

– **Myths**: The narrative of overcoming financial instability through strategic refinancing.

Cross-Impact Simulation

– The refinancing could stabilize Digicel’s operations, influencing regional telecom markets and potentially leading to competitive pricing and service improvements.

– Economic dependencies on Digicel’s financial health may affect local economies, especially in Jamaica.

Scenario Generation

– **Best Case**: Successful refinancing leads to enhanced financial stability and market competitiveness for Digicel.

– **Worst Case**: Refinancing fails, exacerbating financial instability and leading to potential market exits.

– **Most Likely**: Partial success in refinancing stabilizes operations but does not significantly alter market dynamics.

3. Implications and Strategic Risks

– **Economic Risks**: Failure to refinance could lead to financial instability, affecting regional economies reliant on Digicel’s operations.

– **Political Risks**: Potential regulatory scrutiny due to past investigations into foreign bribery laws.

– **Systemic Vulnerabilities**: High debt levels remain a concern, necessitating ongoing financial oversight.

4. Recommendations and Outlook

- Monitor the refinancing process closely to assess its impact on regional economic stability.

- Engage with regional stakeholders to mitigate potential economic disruptions.

- Develop contingency plans for scenarios where refinancing efforts do not meet expectations.

5. Key Individuals and Entities

– Denis O’Brien

– JP Morgan

– PGIM

– Contrarian Capital Management

– Goldentree Asset Management

6. Thematic Tags

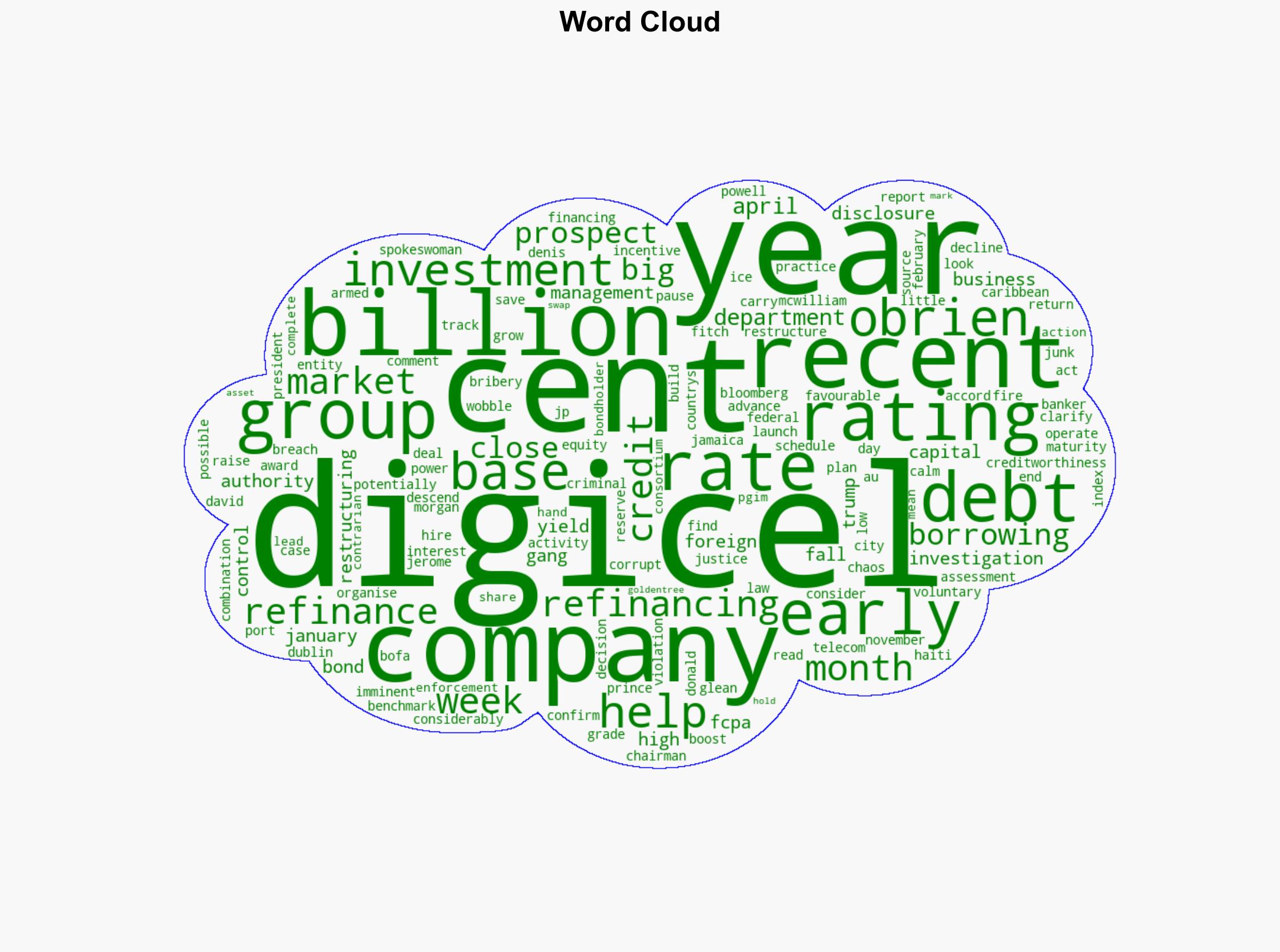

economic stability, financial restructuring, Caribbean telecom market, debt management