SLB anticipates decrease in global upstream investment in 2025 – Offshore Technology

Published on: 2025-07-21

Intelligence Report: SLB Anticipates Decrease in Global Upstream Investment in 2025 – Offshore Technology

1. BLUF (Bottom Line Up Front)

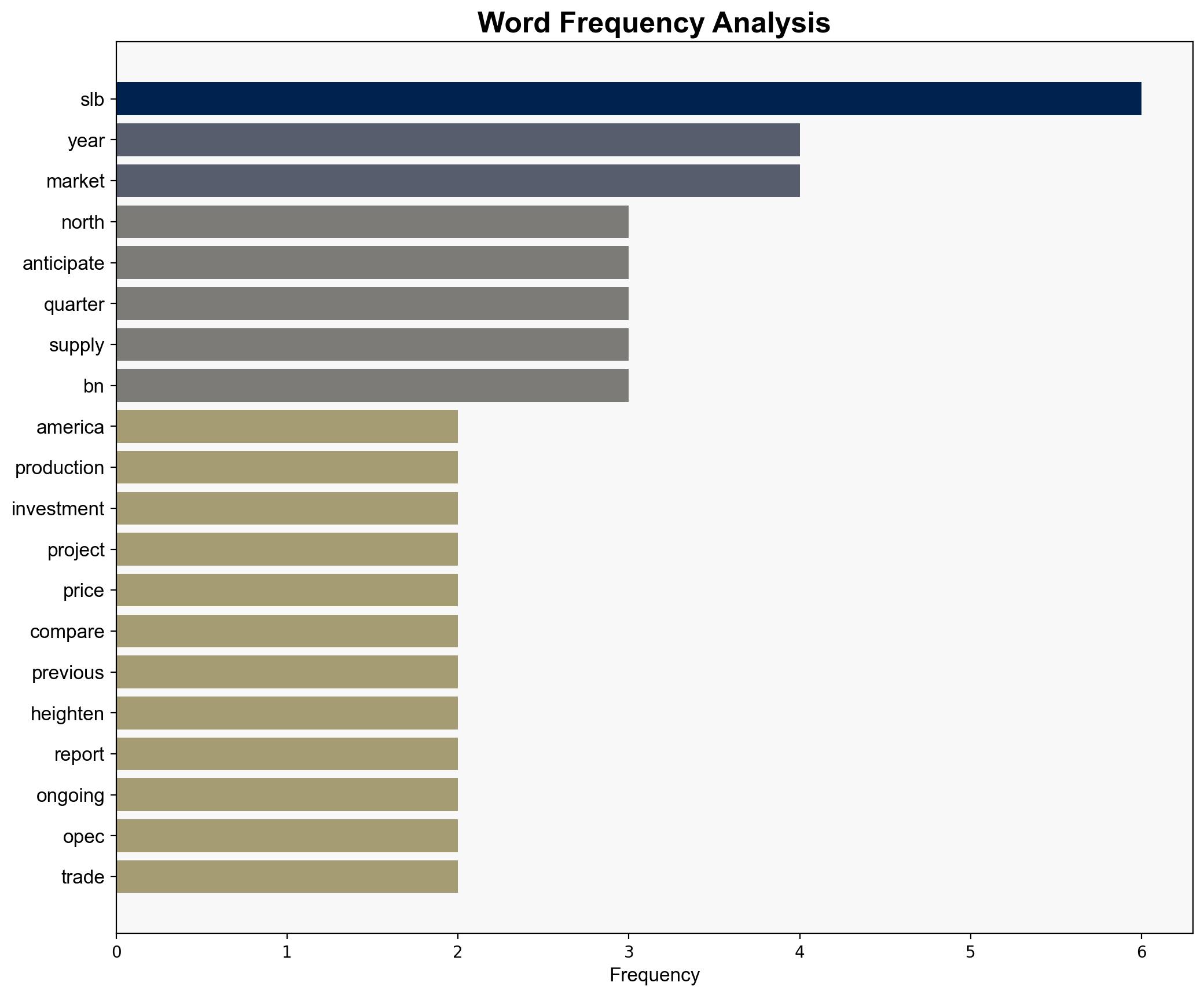

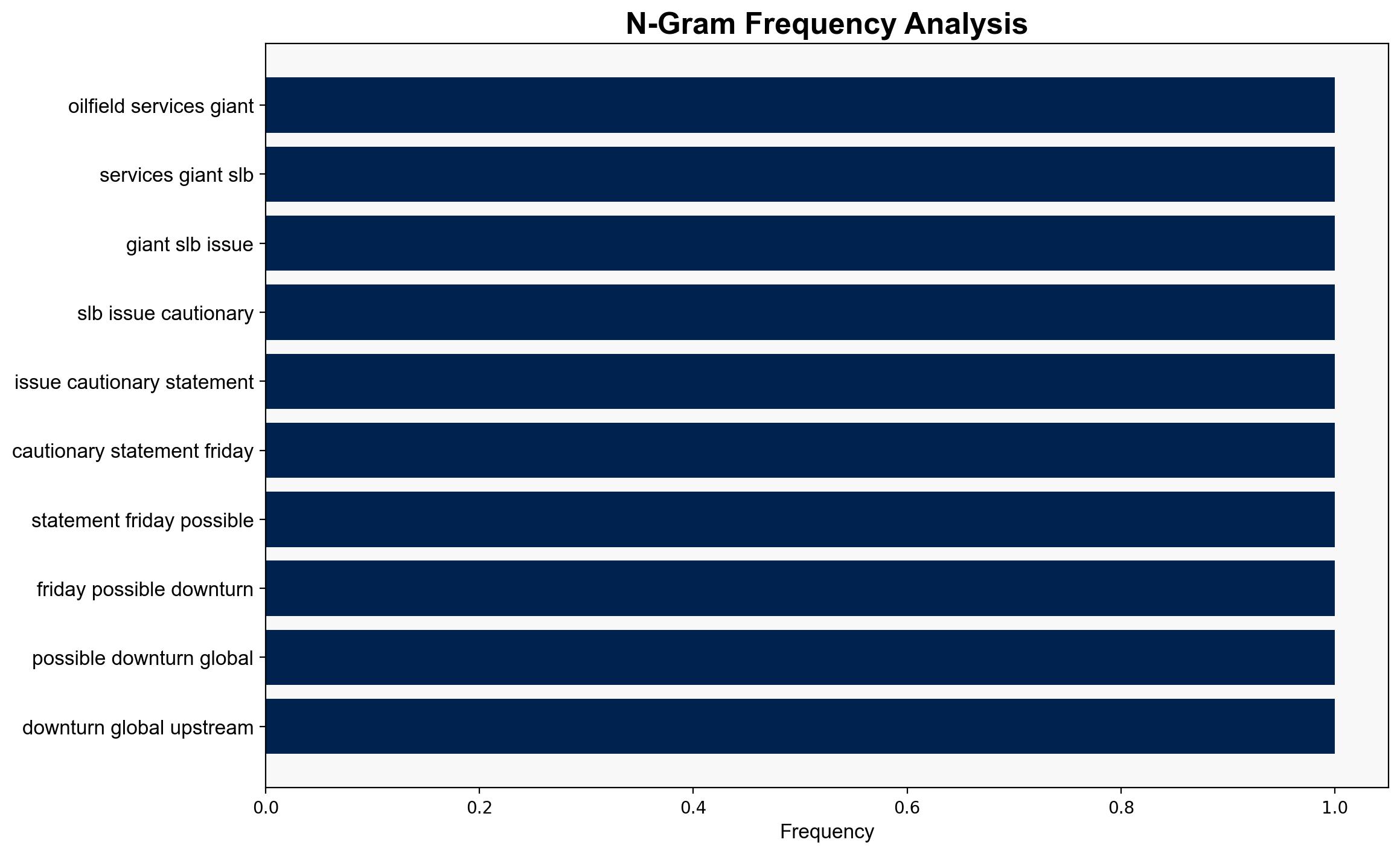

SLB forecasts a downturn in global upstream investment by 2025, with significant impacts expected in North America and Latin America. This projection is attributed to potential reductions in short-cycle expenditures, influenced by geopolitical tensions, OPEC supply decisions, and fluctuating commodity prices. The report recommends strategic adjustments to mitigate risks and capitalize on opportunities in robust markets like Asia and the Middle East.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

– **Surface Events**: Decline in crude prices and potential reduction in upstream spending.

– **Systemic Structures**: Economic dependencies on oil prices, geopolitical tensions, and trade negotiations.

– **Worldviews**: National energy security imperatives and low production costs in Asia and the Middle East.

– **Myths**: Belief in perpetual growth of oil demand.

Cross-Impact Simulation

– Analyzed potential ripple effects of reduced investment on regional economies, particularly in North America.

– Examined the impact of geopolitical conflicts on trade and energy markets.

Scenario Generation

– Developed scenarios considering varying OPEC supply decisions and geopolitical tensions.

– Identified plausible futures with differing levels of investment and market stability.

Narrative Pattern Analysis

– Deconstructed narratives around energy security and economic resilience.

– Assessed ideological shifts influencing investment strategies.

3. Implications and Strategic Risks

– Potential economic vulnerabilities in North and Latin America due to reduced upstream investment.

– Risks of geopolitical tensions exacerbating market instability.

– Opportunities in Asia and the Middle East due to low production costs and energy security priorities.

4. Recommendations and Outlook

- Encourage diversification of energy portfolios to mitigate dependency on volatile markets.

- Enhance monitoring of geopolitical developments to anticipate market shifts.

- Scenario-based projections:

- Best Case: Stabilization of crude prices and increased investment in resilient regions.

- Worst Case: Escalation of geopolitical tensions leading to widespread investment pullbacks.

- Most Likely: Gradual adjustment of investment strategies with selective focus on key projects.

5. Key Individuals and Entities

– Olivier Le Peuch

6. Thematic Tags

national security threats, geopolitical tensions, energy markets, regional focus