Meta Stock Pops as Earnings Blow Past Estimates – Investopedia

Published on: 2025-07-30

Intelligence Report: Meta Stock Pops as Earnings Blow Past Estimates – Investopedia

1. BLUF (Bottom Line Up Front)

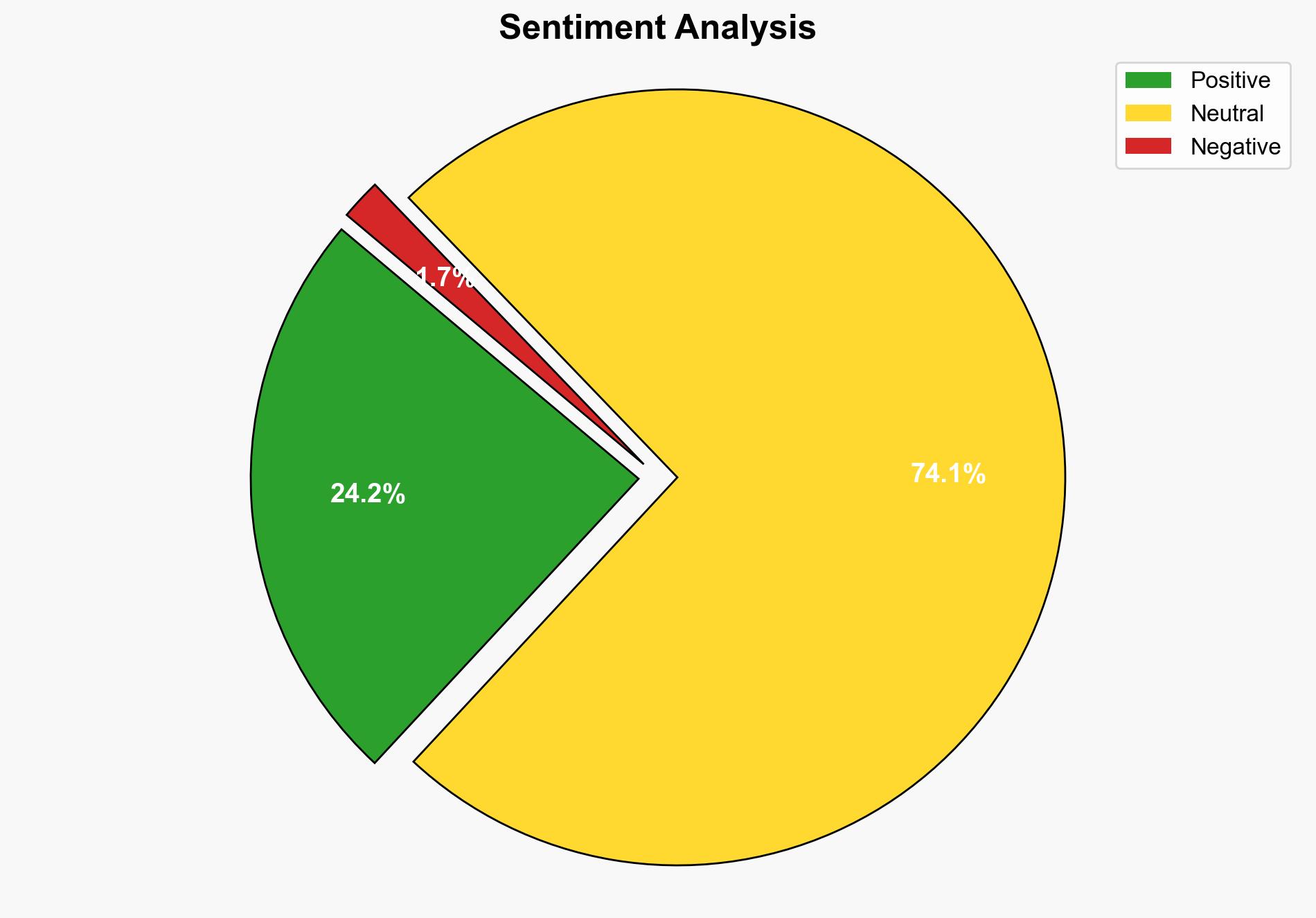

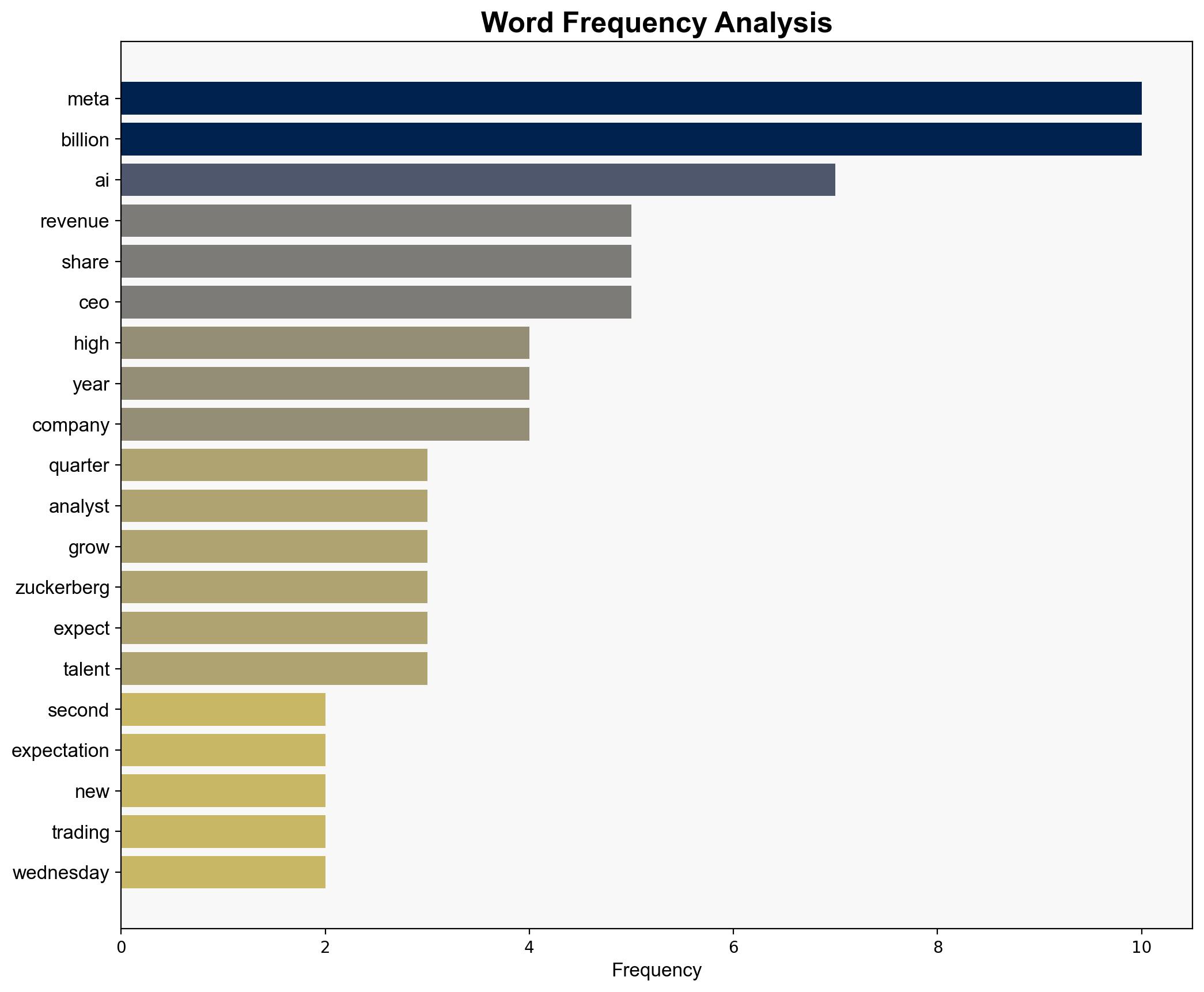

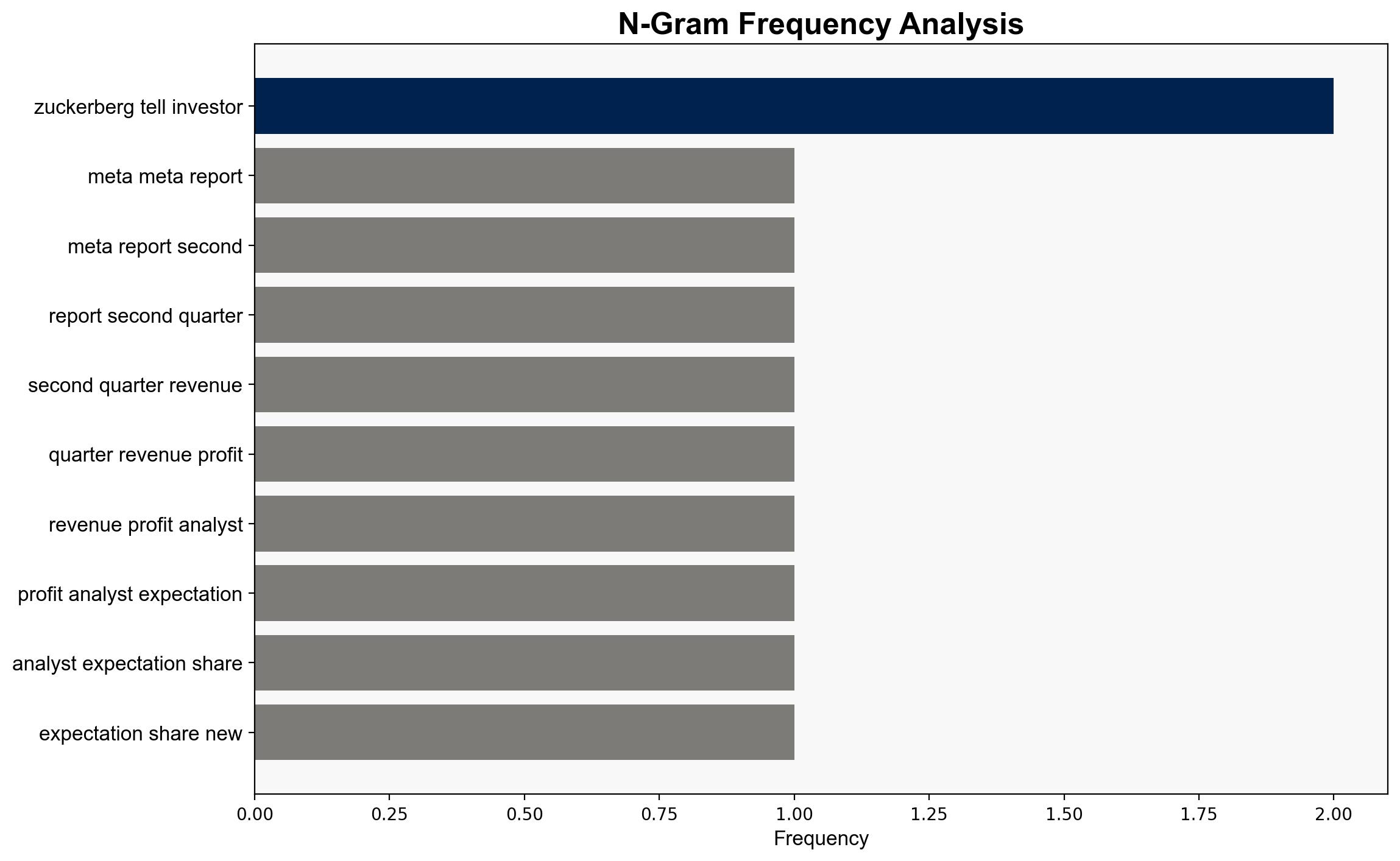

Meta’s recent financial performance, driven by advancements in AI and strategic hiring, has led to a significant increase in stock value. The most supported hypothesis suggests that Meta’s aggressive investment in AI and infrastructure will sustain its growth trajectory. Confidence level: Moderate. Recommended action: Monitor Meta’s AI developments and market reactions closely, as these will be critical indicators of future performance.

2. Competing Hypotheses

Hypothesis 1: Meta’s stock surge is primarily due to successful AI integration and operational efficiencies, which will continue to drive growth.

Hypothesis 2: The stock increase is a short-term reaction to earnings reports and may not be sustainable if AI advancements do not meet expectations or if market conditions change.

3. Key Assumptions and Red Flags

Assumptions:

– AI advancements will continue to enhance Meta’s advertising efficiency.

– Market conditions remain favorable for tech stocks.

Red Flags:

– Over-reliance on AI without clear evidence of sustained operational improvements.

– Potential market volatility affecting tech sector valuations.

4. Implications and Strategic Risks

Meta’s focus on AI could set industry standards, impacting competitors and market dynamics. However, failure to deliver on AI promises could lead to investor disillusionment. Economic risks include potential regulatory scrutiny and increased competition. Geopolitical tensions could also affect global operations and talent acquisition.

5. Recommendations and Outlook

- Monitor AI development progress and its impact on Meta’s operational efficiency.

- Evaluate market conditions and investor sentiment regularly to anticipate potential shifts.

- Scenario Projections:

- Best Case: Continued AI advancements lead to sustained growth and market leadership.

- Worst Case: AI initiatives fail to deliver, resulting in stock decline and strategic setbacks.

- Most Likely: Moderate growth as AI developments gradually improve operations.

6. Key Individuals and Entities

– Mark Zuckerberg

– Susan Li

– Nat Friedman

– Alexandr Wang

7. Thematic Tags

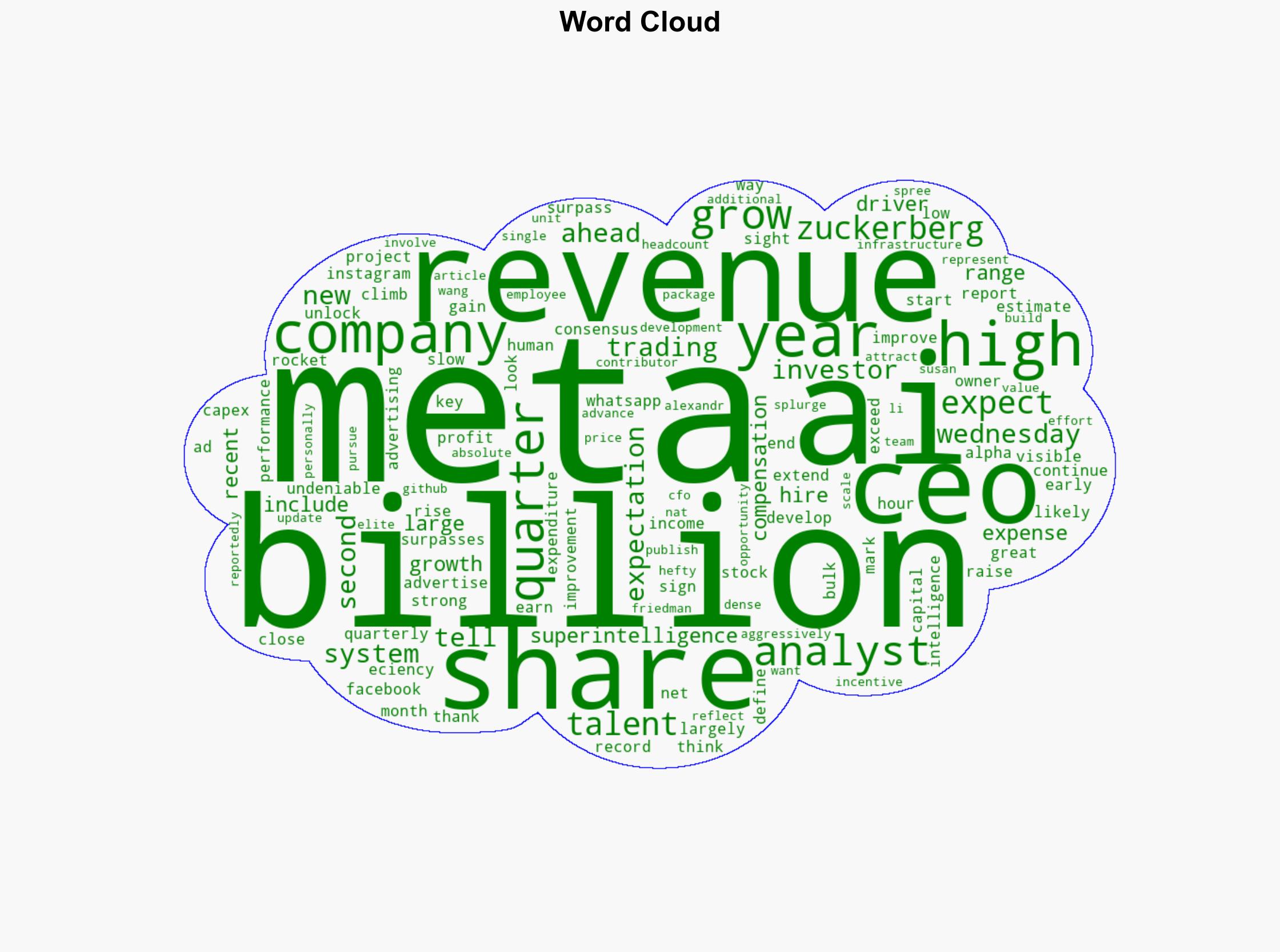

artificial intelligence, stock market, technology sector, corporate strategy