Libya Makes Deal with ExxonMobil After Decade-Long Oil Freeze – Breitbart News

Published on: 2025-08-06

Intelligence Report: Libya Makes Deal with ExxonMobil After Decade-Long Oil Freeze – Breitbart News

1. BLUF (Bottom Line Up Front)

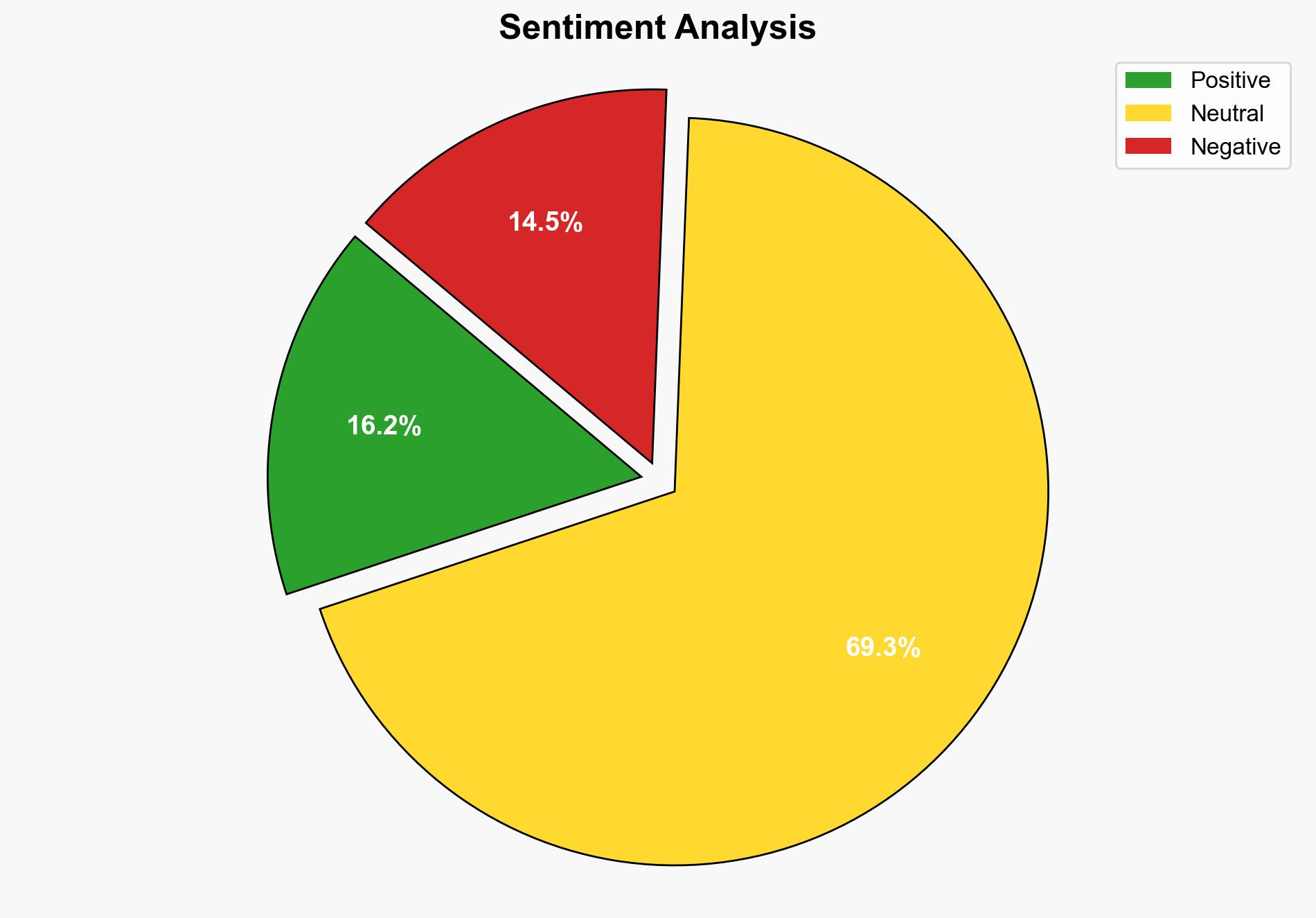

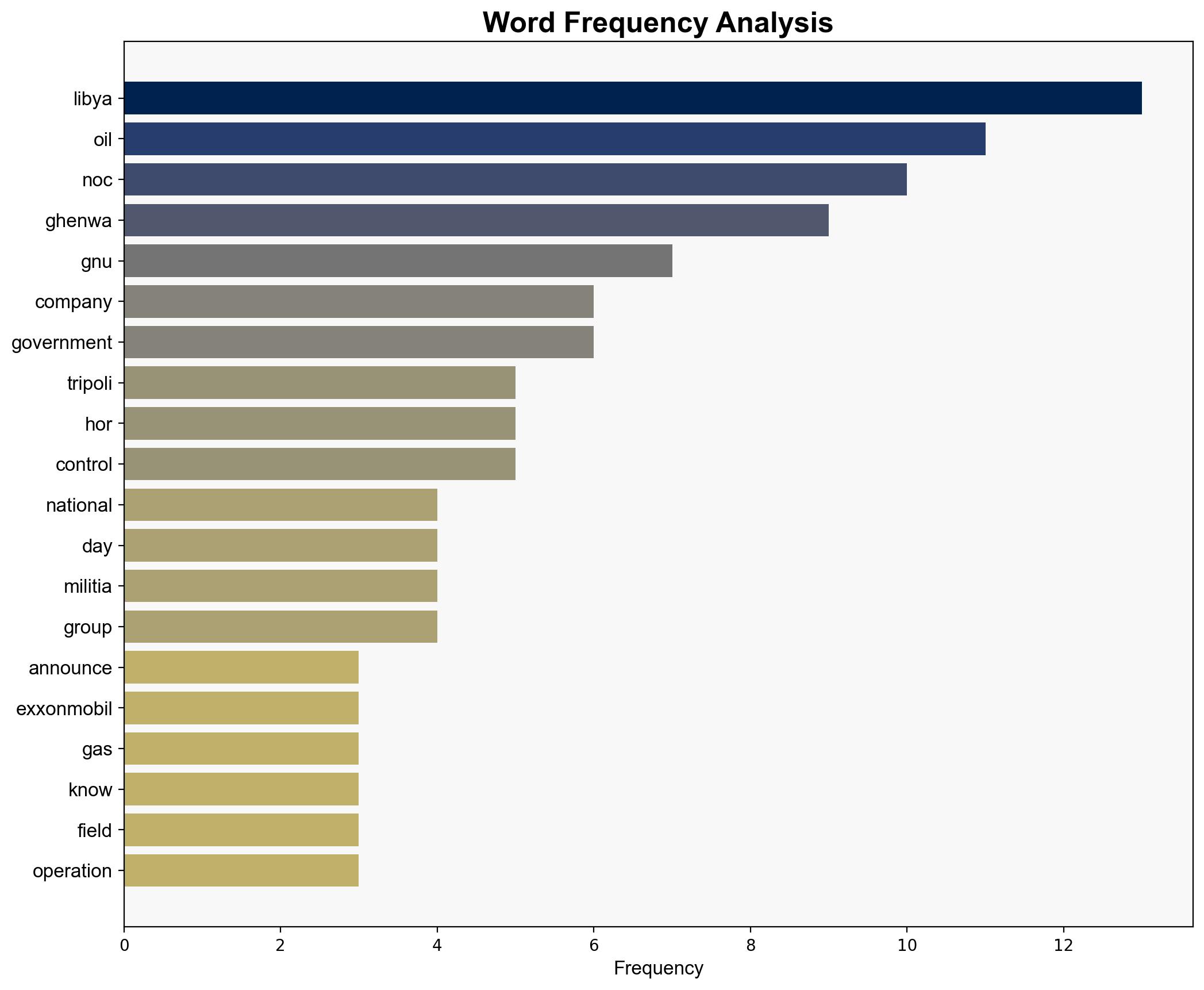

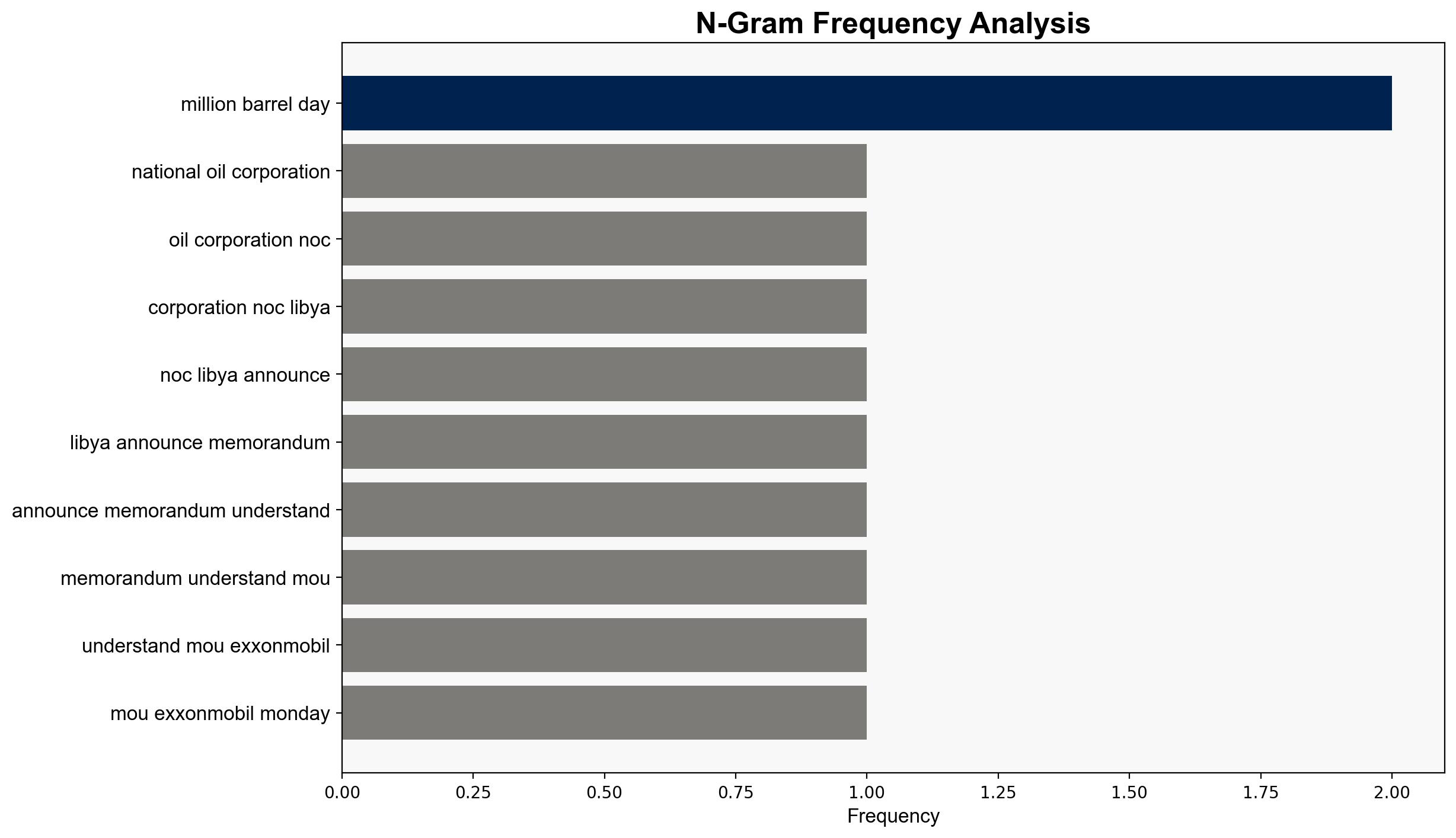

The most supported hypothesis is that Libya’s National Oil Corporation (NOC) is strategically leveraging partnerships with international oil companies like ExxonMobil to stabilize and boost its oil production amidst internal political turmoil. Confidence level: Moderate. Recommended action: Monitor the security situation and political developments in Libya closely, as they could impact the stability of oil operations and international investments.

2. Competing Hypotheses

1. **Hypothesis A**: The NOC’s agreement with ExxonMobil is primarily a strategic move to revitalize Libya’s oil industry and stabilize the national economy by attracting foreign expertise and investment.

2. **Hypothesis B**: The agreement is a tactical maneuver by the Government of National Unity (GNU) to consolidate power and gain international legitimacy amidst ongoing political fragmentation and security challenges.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis A assumes that the NOC has the capacity to manage foreign partnerships effectively despite internal divisions.

– Hypothesis B assumes that the GNU can maintain control over oil resources and infrastructure without significant interference from rival factions.

– **Red Flags**:

– The presence of rival governments and militias poses a significant risk to the stability of any agreements.

– The assassination of militia leader Abdulghani Ghenwa highlights ongoing security challenges that could disrupt operations.

4. Implications and Strategic Risks

– **Economic Risks**: Continued instability could deter foreign investment and hinder oil production, affecting global oil markets.

– **Geopolitical Risks**: Rival factions may exploit the deal to gain leverage, potentially escalating conflicts.

– **Security Risks**: The potential for attacks on oil infrastructure remains high, threatening both local and international stakeholders.

5. Recommendations and Outlook

- **Mitigation**: Encourage diplomatic engagement with all Libyan factions to ensure the security of oil operations and infrastructure.

- **Exploitation**: Leverage international partnerships to enhance Libya’s oil production capabilities and stabilize the national economy.

- **Scenario Projections**:

– **Best Case**: Successful stabilization of oil production and increased foreign investment lead to economic recovery.

– **Worst Case**: Escalation of internal conflicts disrupts oil operations, leading to economic downturn and international withdrawal.

– **Most Likely**: Incremental progress in oil production with intermittent disruptions due to security challenges.

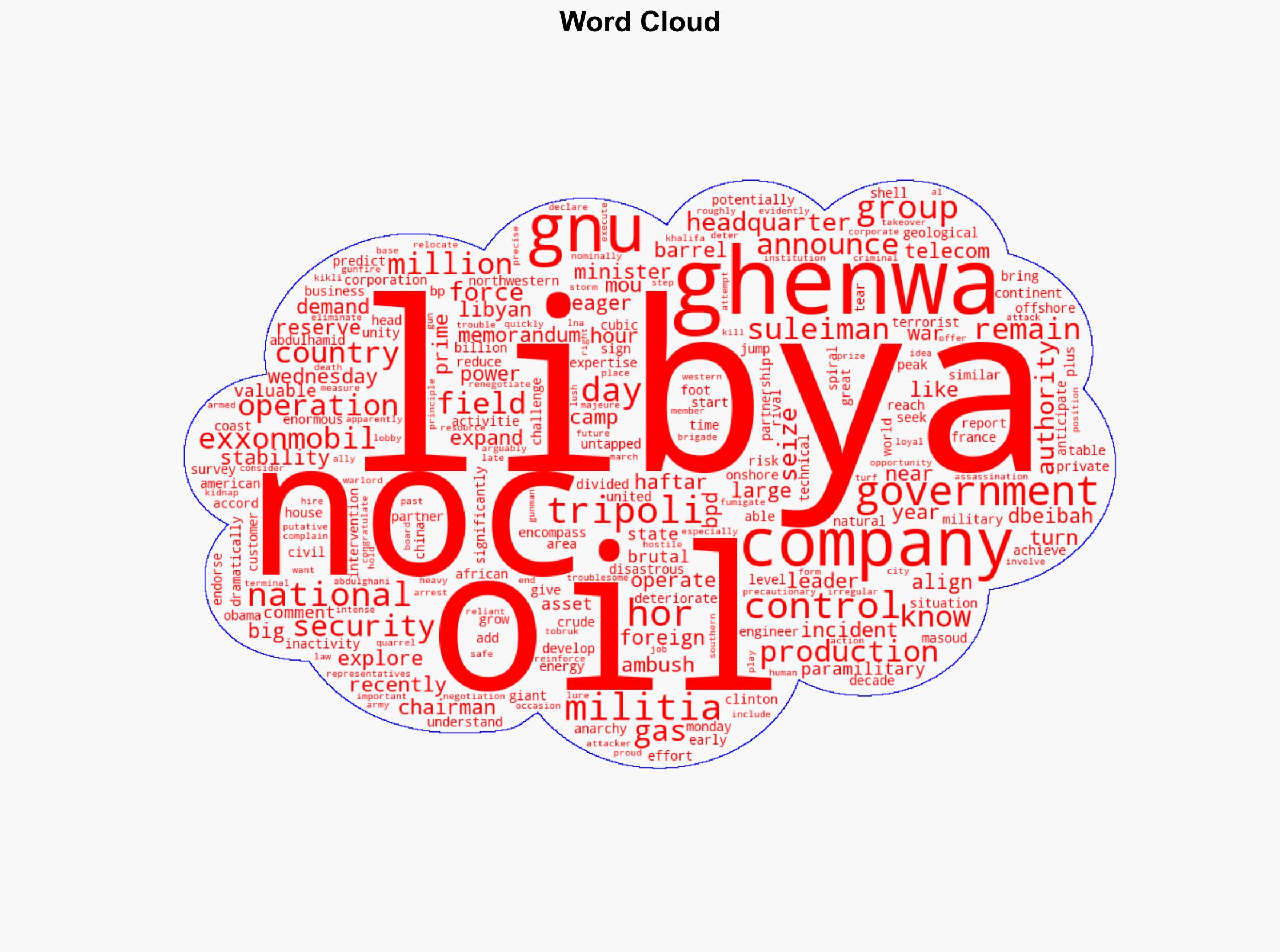

6. Key Individuals and Entities

– Masoud Suleiman

– Abdulhamid Dbeibah

– Khalifa Haftar

– Abdulghani Ghenwa

– ExxonMobil

– National Oil Corporation (NOC)

7. Thematic Tags

national security threats, economic stability, geopolitical dynamics, regional focus