FTC Reports Surge in Consumers Losses to Impersonation Scams – pymnts.com

Published on: 2025-08-11

Intelligence Report: FTC Reports Surge in Consumers Losses to Impersonation Scams – pymnts.com

1. BLUF (Bottom Line Up Front)

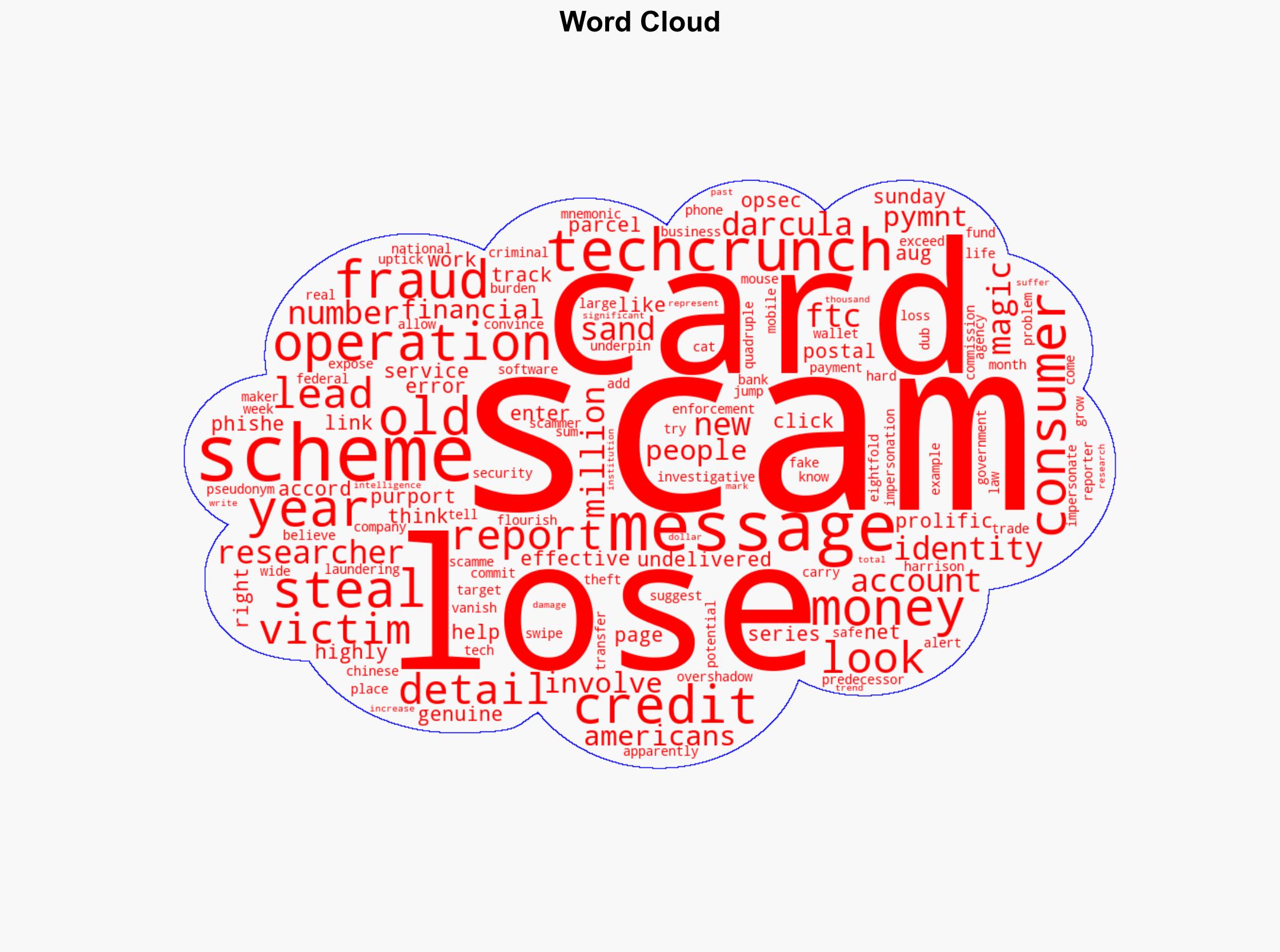

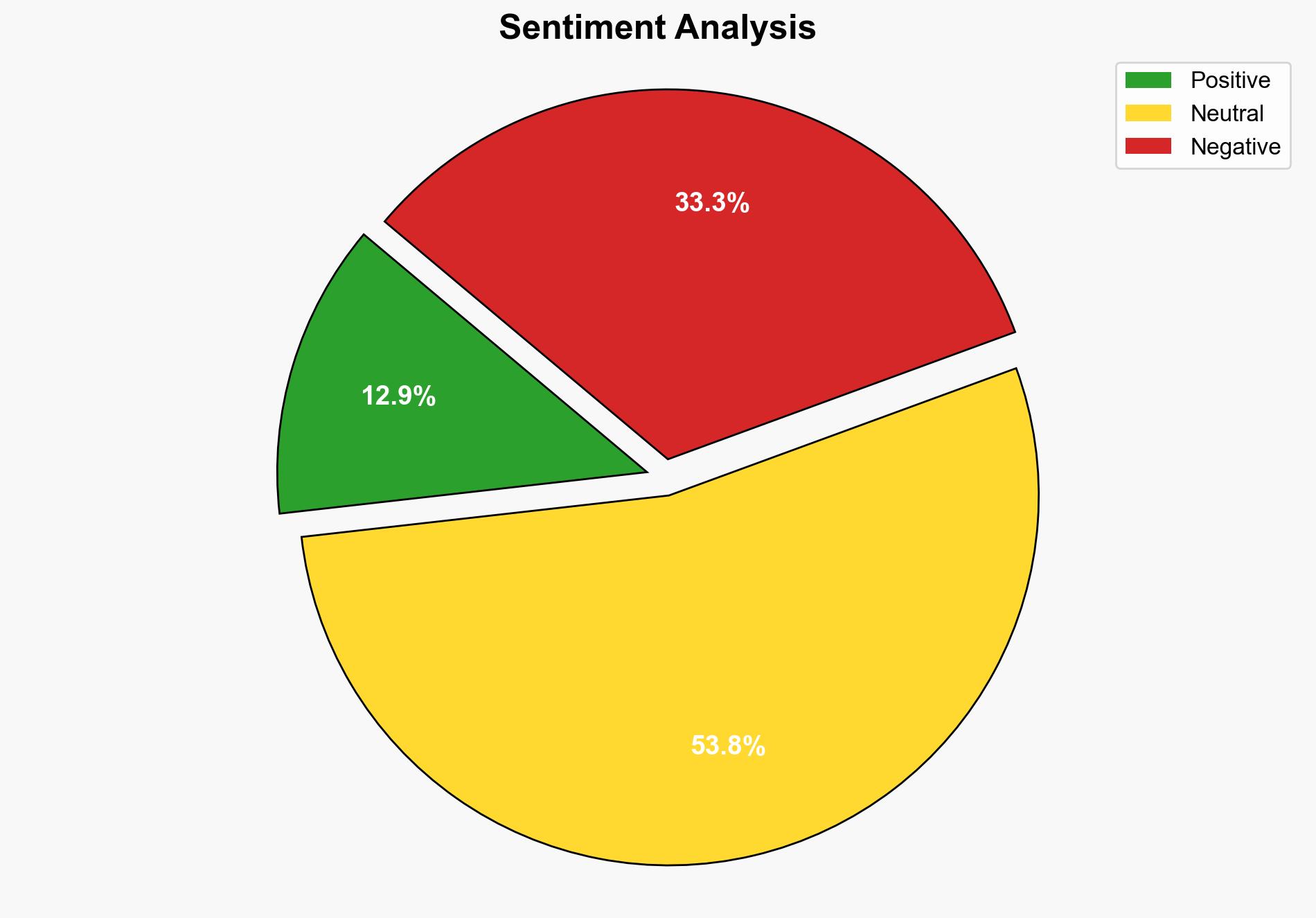

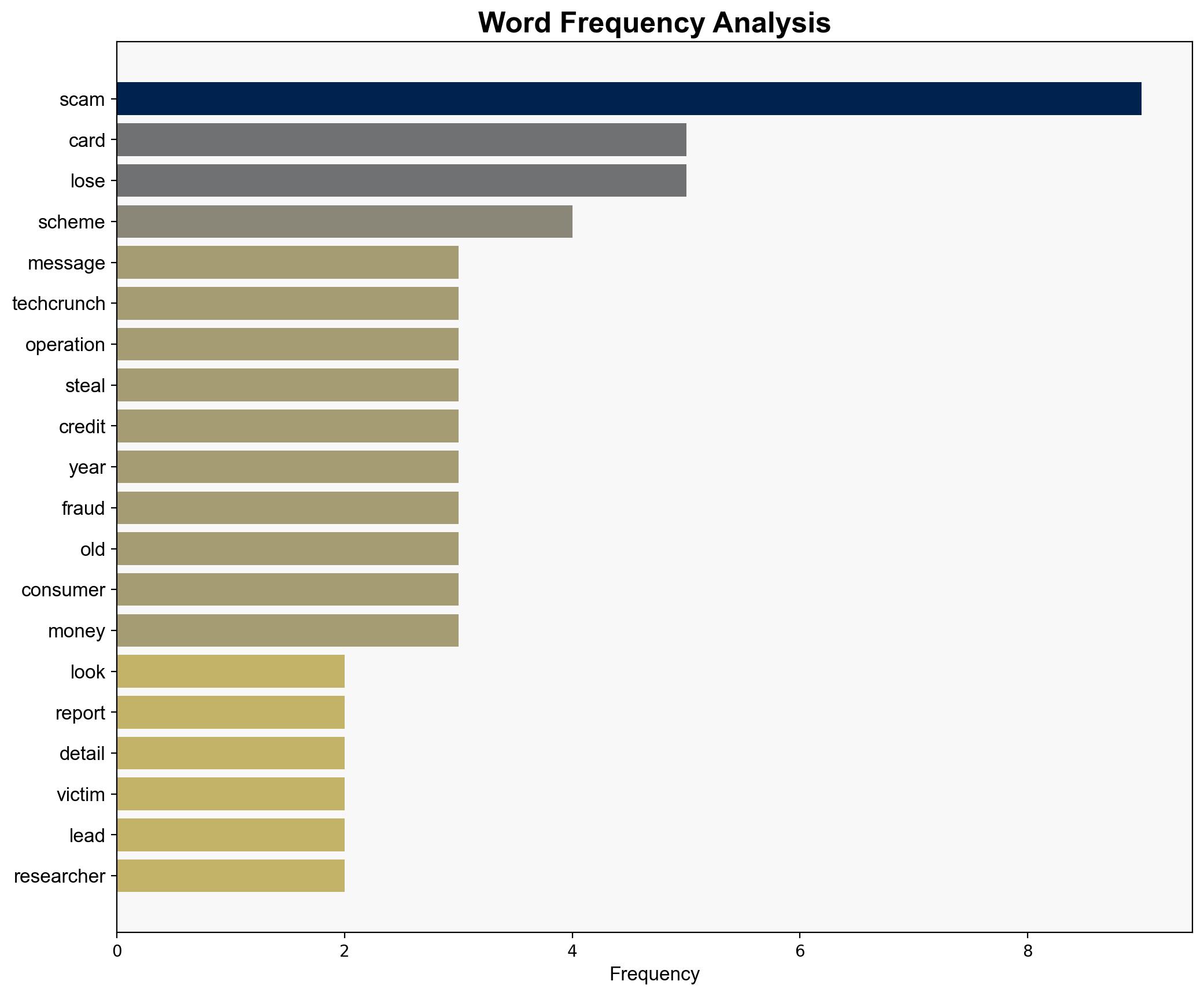

The most supported hypothesis is that a sophisticated and evolving network of cybercriminals is exploiting systemic vulnerabilities in financial and technological systems to conduct impersonation scams. Confidence Level: Moderate. Recommended action includes enhancing inter-agency collaboration and strengthening cybersecurity measures across financial institutions and tech companies.

2. Competing Hypotheses

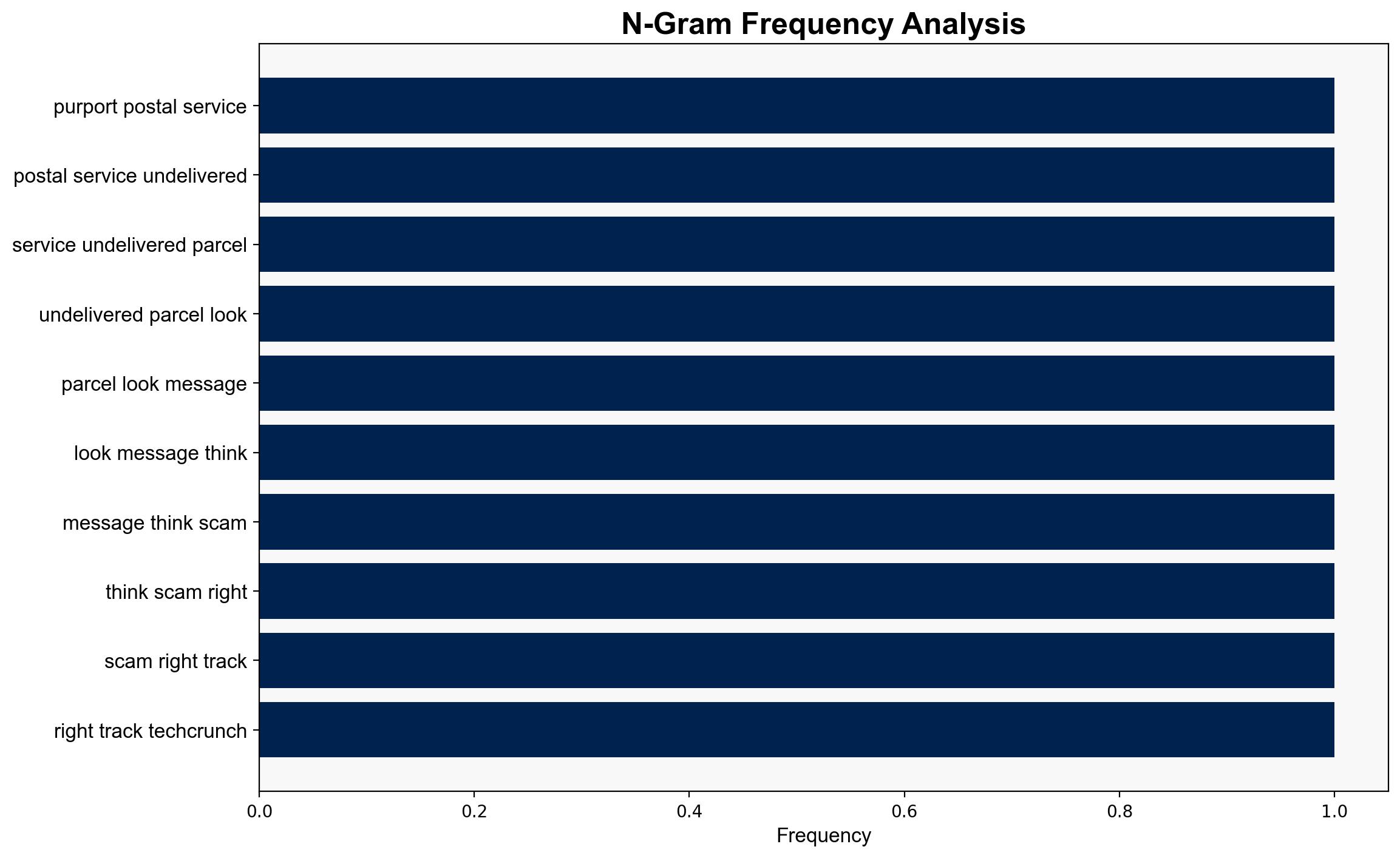

1. **Hypothesis A**: A single, highly organized cybercriminal group, possibly led by the individual known as “Darcula,” is responsible for the surge in impersonation scams, leveraging advanced phishing techniques and exploiting operational security errors.

2. **Hypothesis B**: Multiple independent cybercriminal entities are simultaneously exploiting similar vulnerabilities in financial and tech systems, leading to a perceived increase in scam activities without a central orchestrator.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the identification of a specific individual and operation, “Magic Mouse,” linked to significant scam activities. However, the disappearance of “Darcula” and emergence of new operations suggest a potential shift or fragmentation in the network.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the identified individual “Darcula” is central to the operations and that operational security errors are unique to this group.

– **Red Flags**: The sudden disappearance of “Darcula” and the emergence of new operations could indicate either a strategic withdrawal or a deliberate deception to mislead investigators.

– **Blind Spots**: Lack of comprehensive data on the scale and scope of independent operations could skew the understanding of the threat landscape.

4. Implications and Strategic Risks

The continuation of these scams poses significant economic risks, potentially undermining consumer trust in digital financial systems. The psychological impact on victims, particularly older adults, could lead to broader societal distrust in technology. If left unchecked, these scams could escalate, leading to increased regulatory scrutiny and potential geopolitical tensions if foreign actors are implicated.

5. Recommendations and Outlook

- Enhance cybersecurity protocols across financial and tech sectors, focusing on phishing prevention and detection.

- Foster international cooperation to track and dismantle cybercriminal networks.

- Best-case scenario: Successful disruption of major scam networks through coordinated law enforcement action.

- Worst-case scenario: Proliferation of scams leading to widespread financial instability and loss of consumer confidence.

- Most likely scenario: Continued evolution of scam tactics, necessitating ongoing vigilance and adaptation of security measures.

6. Key Individuals and Entities

– “Darcula” (pseudonym), believed to be a key figure in the scam operations.

– Harrison Sand, a security researcher providing insights into the scam dynamics.

7. Thematic Tags

national security threats, cybersecurity, financial fraud, consumer protection