Nvidia AMD to pay US 15 of AI chip sales to China – DW (English)

Published on: 2025-08-11

Intelligence Report: Nvidia AMD to pay US 15% of AI chip sales to China – DW (English)

1. BLUF (Bottom Line Up Front)

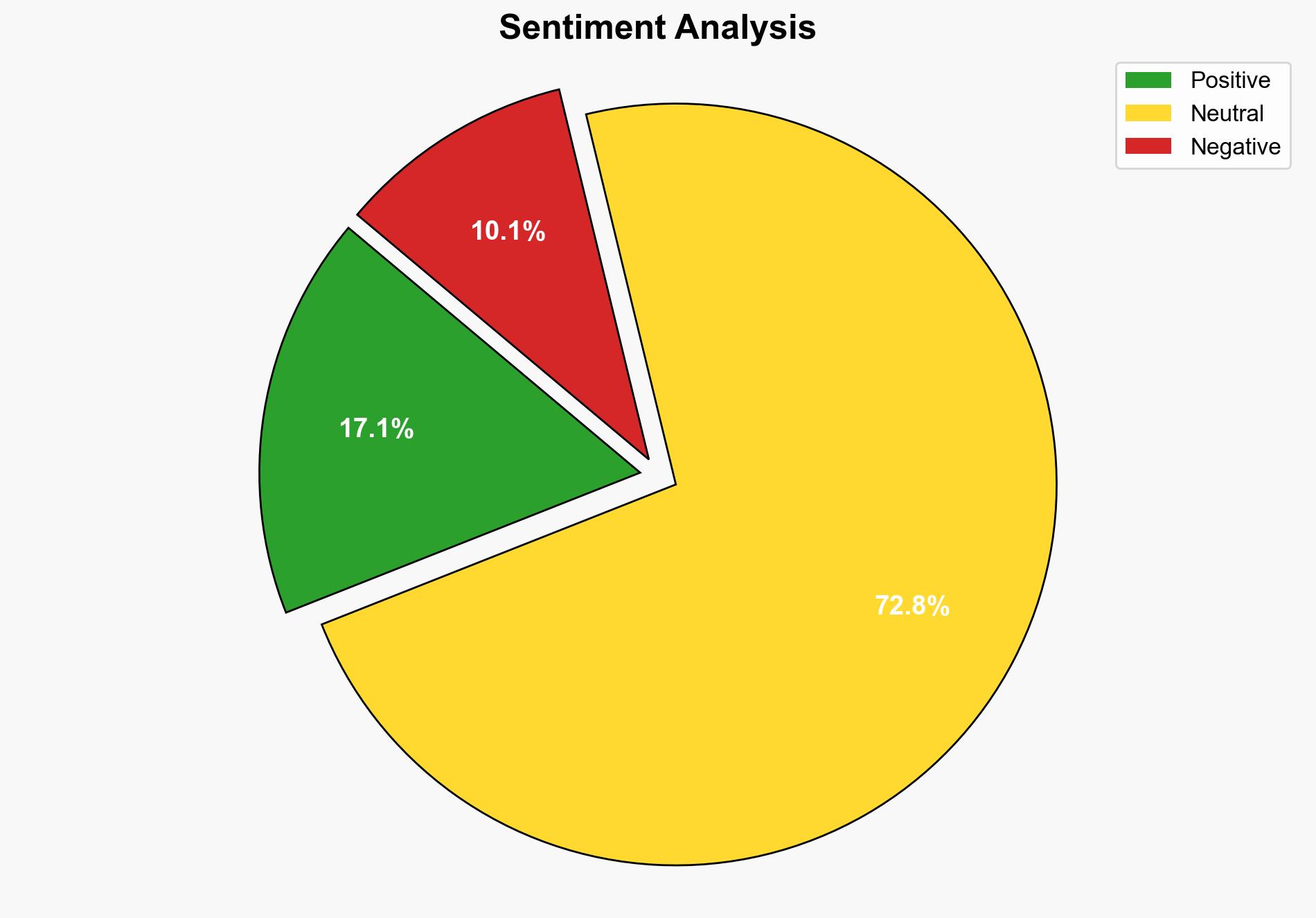

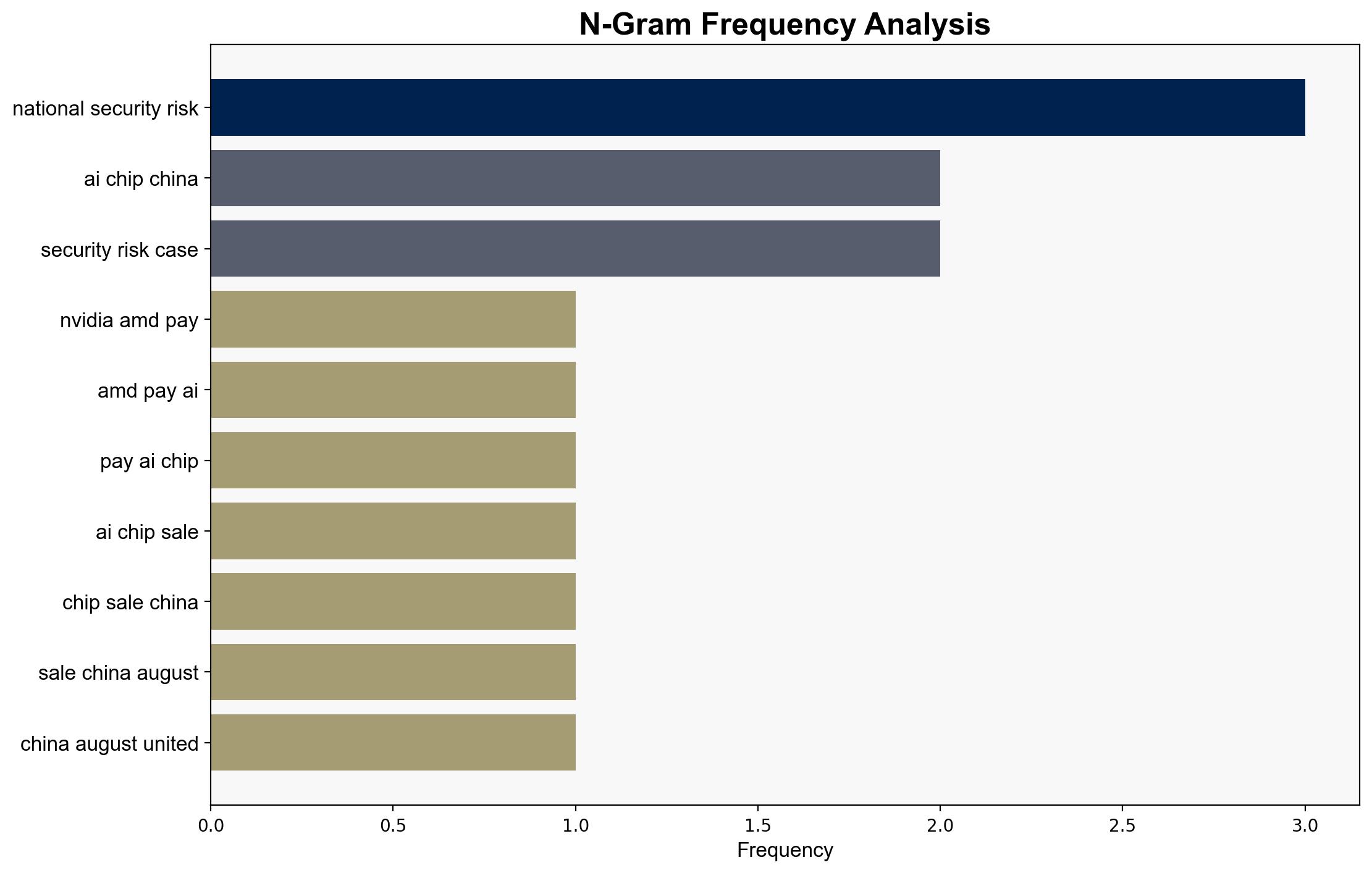

The strategic judgment indicates a moderate confidence level in the hypothesis that the agreement between Nvidia, AMD, and the U.S. government is primarily a revenue-driven decision rather than a strategic trade-off of national security for economic gain. The recommended action is to closely monitor the implementation of the agreement and its impact on U.S.-China relations and technological advancements.

2. Competing Hypotheses

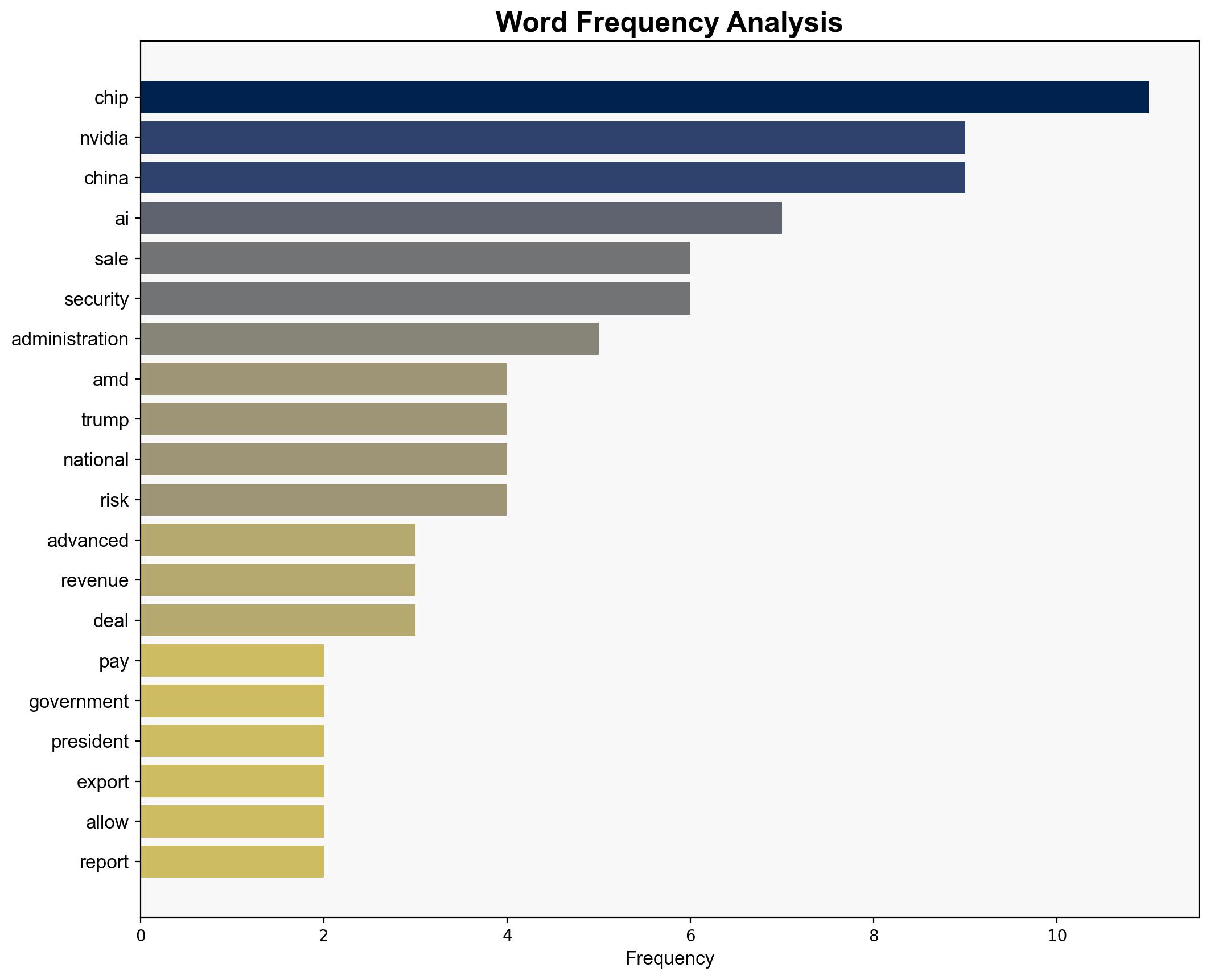

1. **Revenue-Driven Agreement Hypothesis**: The deal is primarily motivated by economic interests, aiming to capitalize on the lucrative Chinese market while ensuring a revenue stream for the U.S. government. This hypothesis suggests that the U.S. administration is prioritizing economic gains over potential national security concerns.

2. **Strategic Trade-Off Hypothesis**: The agreement represents a strategic trade-off, where the U.S. government is willing to accept certain national security risks in exchange for maintaining technological influence and market presence in China. This hypothesis implies a calculated risk to balance economic and security interests.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The U.S. administration believes that the economic benefits outweigh the potential national security risks.

– Nvidia and AMD are capable of ensuring that their products do not compromise U.S. security interests.

– **Red Flags**:

– Lack of transparency regarding the specific terms of the agreement and the criteria for export license approval.

– Potential cognitive bias in underestimating the long-term strategic implications of enhancing China’s AI capabilities.

– Inconsistent messaging from the U.S. government regarding the balance between economic interests and national security.

4. Implications and Strategic Risks

– **Economic Dimension**: The agreement could bolster U.S. semiconductor companies’ revenues but may also lead to increased dependency on the Chinese market.

– **Cybersecurity Risks**: Potential for increased cyber espionage or exploitation of AI technologies by China, raising concerns about backdoors or vulnerabilities.

– **Geopolitical Tensions**: The deal may strain U.S. relations with allies who perceive it as compromising security for economic gain.

– **Technological Escalation**: Accelerated AI development in China could shift the balance of technological power, impacting global AI leadership.

5. Recommendations and Outlook

- Implement stringent monitoring and compliance measures to ensure that AI chip exports do not compromise U.S. national security.

- Engage in diplomatic efforts with allies to communicate the rationale and safeguards of the agreement.

- Scenario Projections:

- Best Case: The agreement strengthens U.S. economic interests without compromising security, maintaining technological leadership.

- Worst Case: The deal leads to significant national security breaches and deteriorates U.S. relations with allies.

- Most Likely: A balanced outcome where economic benefits are realized with manageable security risks.

6. Key Individuals and Entities

– Jensen Huang

– Alasdair Phillips

– Robin

– Geoff Gertz

– Karl Sexton

7. Thematic Tags

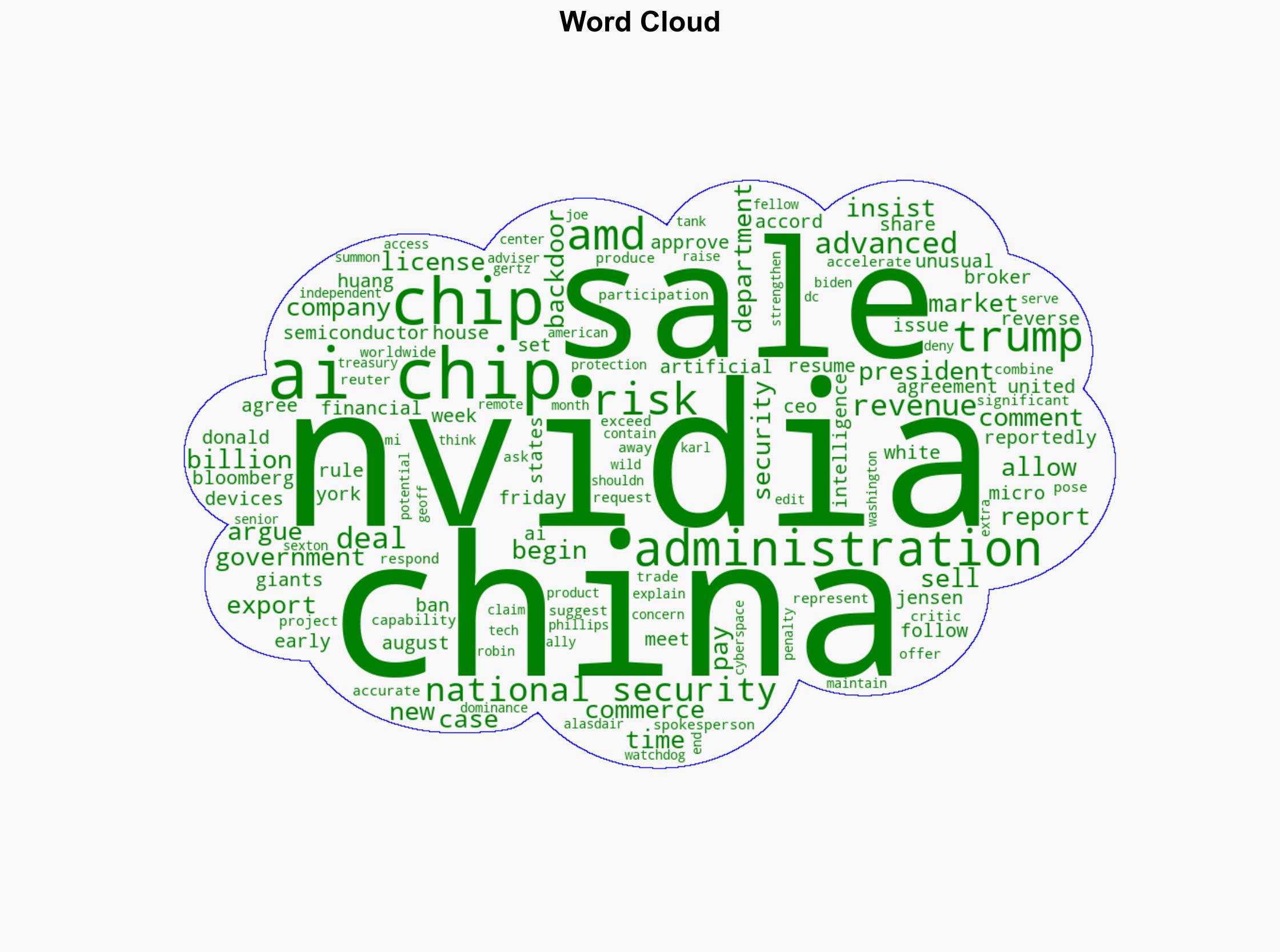

national security threats, cybersecurity, economic strategy, U.S.-China relations