HMRC using AI to scour suspected tax cheats’ social media – BBC News

Published on: 2025-08-12

Intelligence Report: HMRC using AI to scour suspected tax cheats’ social media – BBC News

1. BLUF (Bottom Line Up Front)

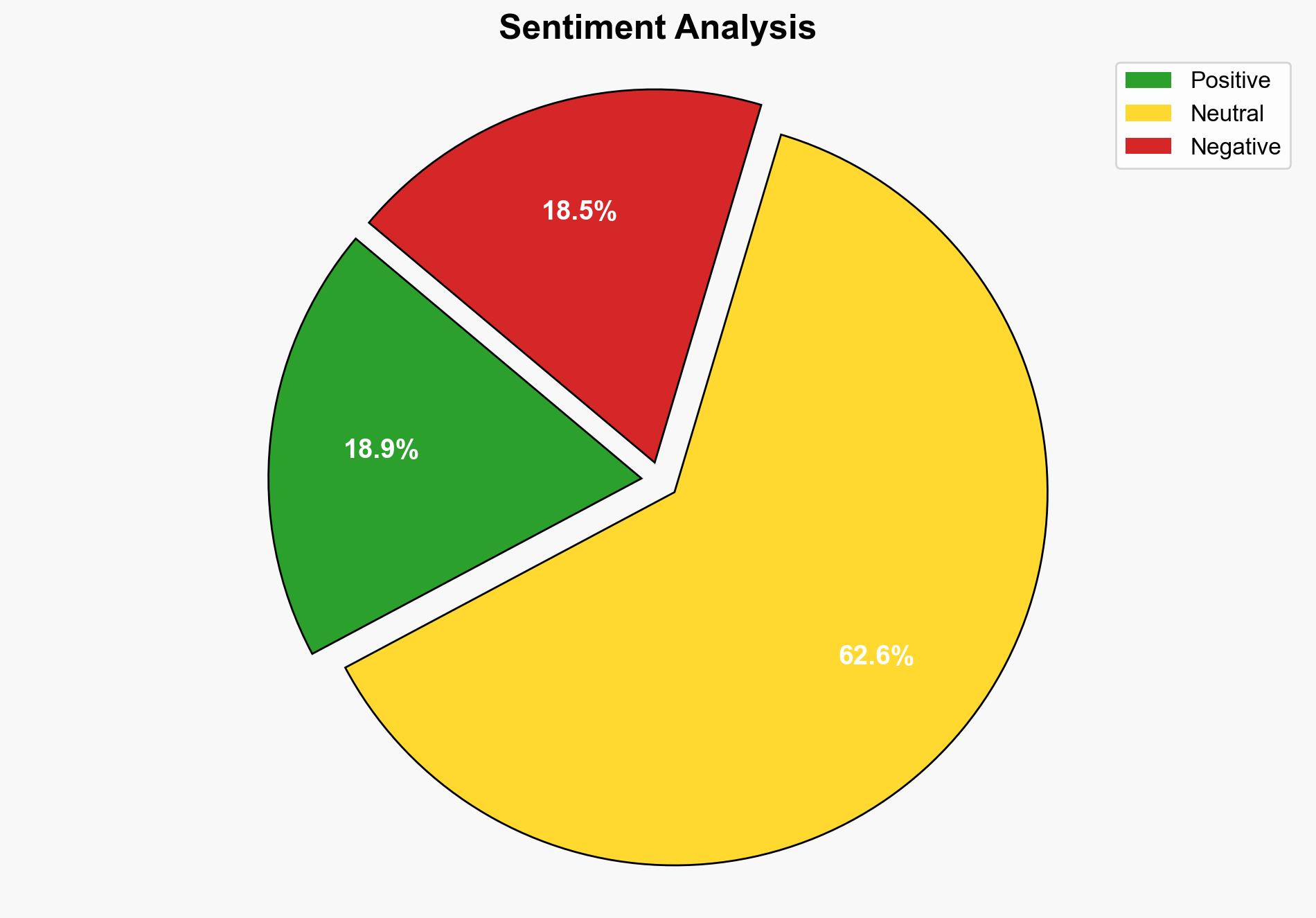

The integration of AI by HMRC to monitor social media for tax evasion presents both opportunities and risks. The most supported hypothesis suggests that AI will enhance HMRC’s efficiency in identifying tax fraud, though it may lead to privacy concerns and potential misuse. Confidence level: Moderate. Recommended action: Implement robust oversight mechanisms to ensure ethical use and accuracy of AI systems.

2. Competing Hypotheses

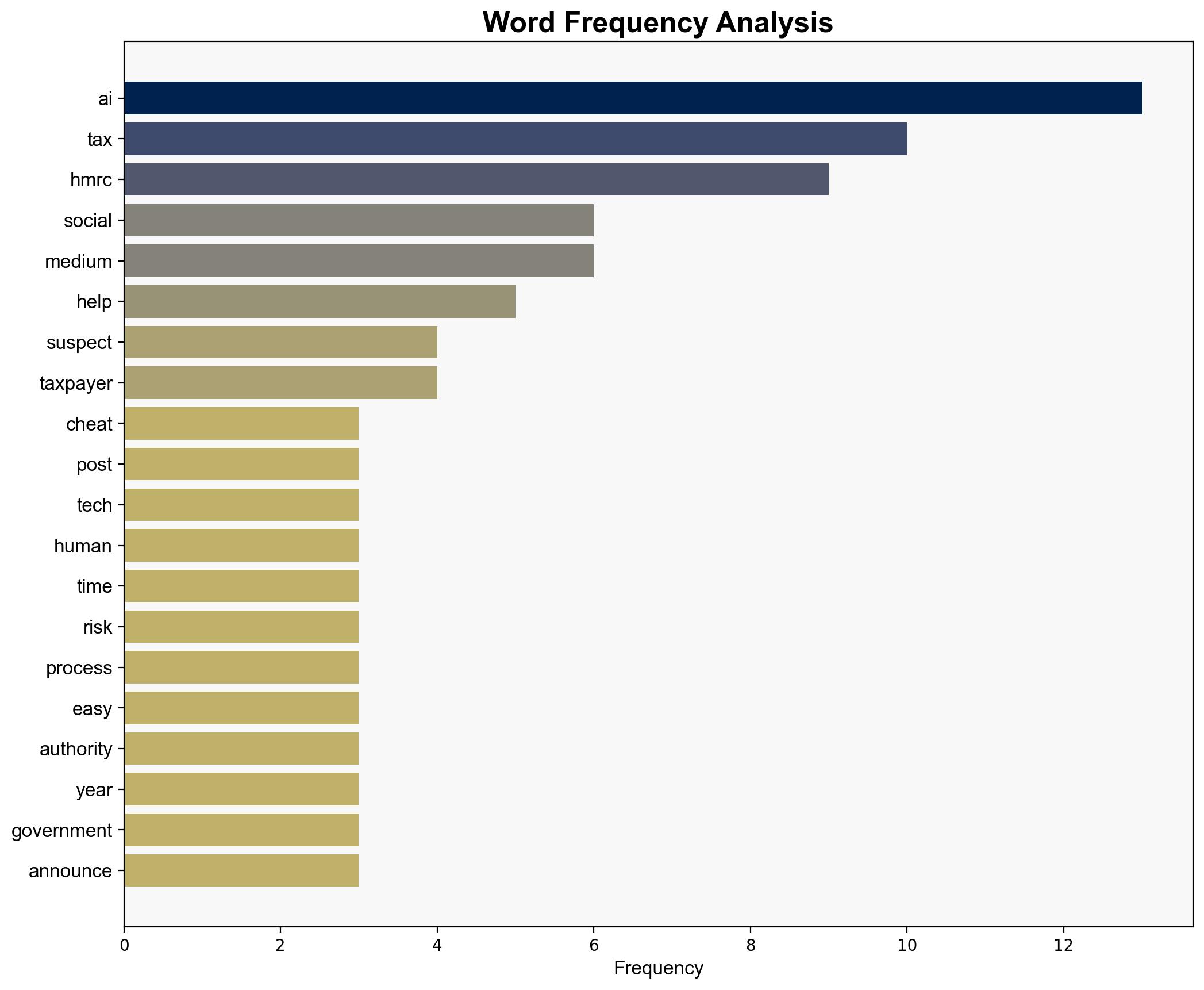

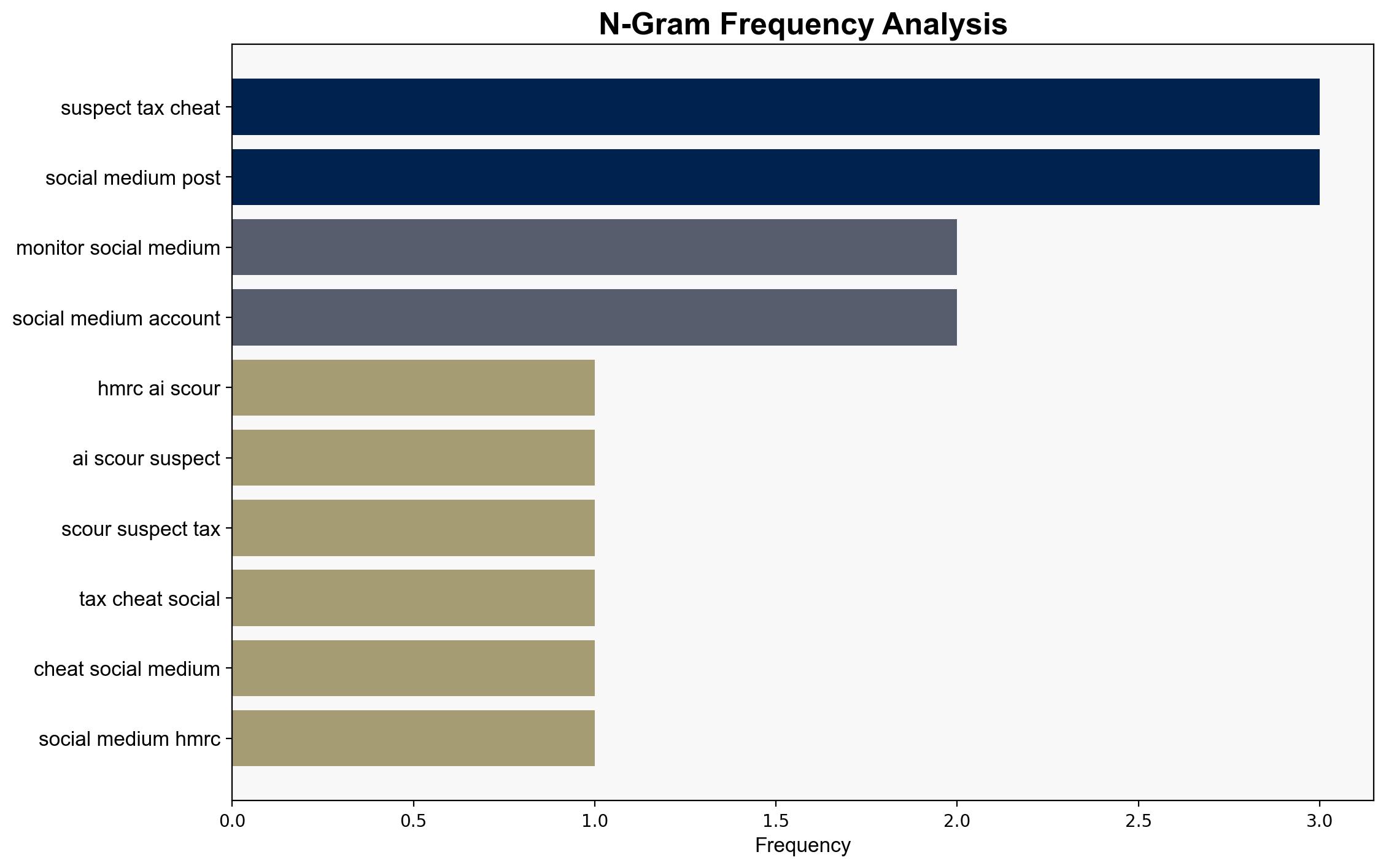

Hypothesis 1: HMRC’s use of AI will significantly improve the detection and prevention of tax fraud by efficiently analyzing large volumes of social media data, leading to increased revenue recovery.

Hypothesis 2: The deployment of AI in this manner will lead to significant privacy violations and potential errors, such as false positives, due to over-reliance on automated systems without sufficient human oversight.

Using ACH 2.0, Hypothesis 1 is better supported by the evidence of AI’s potential to streamline processes and the historical success of AI in data analysis. However, Hypothesis 2 highlights critical risks that require mitigation.

3. Key Assumptions and Red Flags

Assumptions:

– AI systems can accurately interpret social media data without significant errors.

– Legal frameworks will adapt to support AI use in tax investigations.

Red Flags:

– Potential for AI to misinterpret social media context, leading to wrongful accusations.

– Lack of transparency in AI decision-making processes.

4. Implications and Strategic Risks

The use of AI in tax investigations may lead to improved compliance and revenue recovery. However, it also poses risks such as public backlash over privacy concerns, potential legal challenges, and the ethical implications of surveillance. Economically, successful implementation could enhance public service funding, but missteps could erode public trust in government institutions.

5. Recommendations and Outlook

- Implement comprehensive oversight and accountability frameworks to ensure AI systems are used ethically and effectively.

- Conduct regular audits and updates of AI algorithms to minimize errors and biases.

- Engage with stakeholders, including privacy advocates, to address concerns and build public trust.

- Scenario Projections:

- Best Case: AI leads to significant fraud detection improvements with minimal privacy concerns.

- Worst Case: AI misuse results in widespread privacy violations and public distrust.

- Most Likely: AI improves efficiency but requires ongoing adjustments to address privacy and accuracy issues.

6. Key Individuals and Entities

Chris Etherington (RSM UK partner) is mentioned as an expert providing insights into the risks and benefits of AI in tax investigations.

7. Thematic Tags

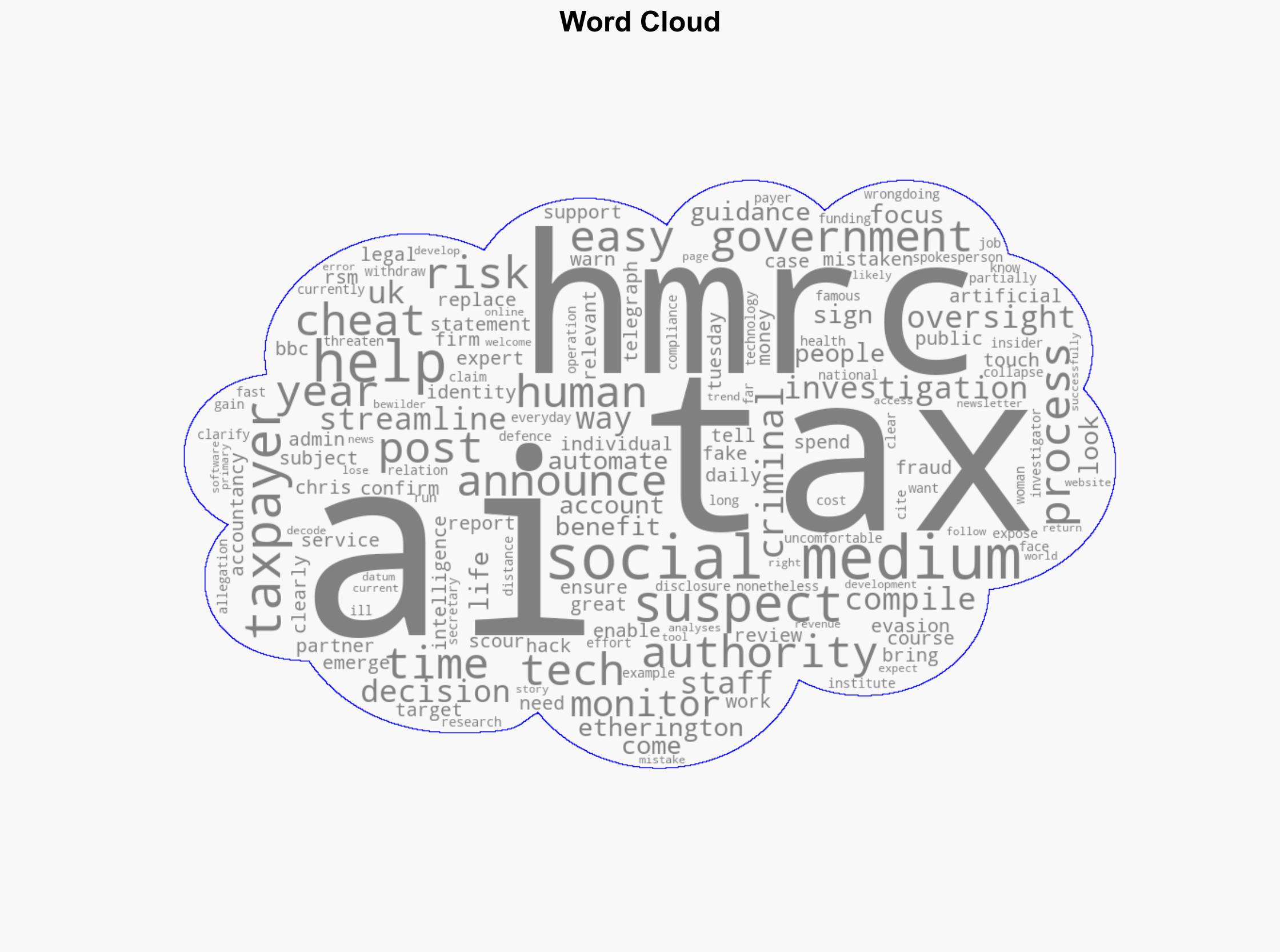

national security threats, cybersecurity, privacy concerns, tax compliance, AI ethics