TD Securities taps Layer 6 and OpenAI to deliver real-time equity insights to sales and trading teams – VentureBeat

Published on: 2025-08-11

Intelligence Report: TD Securities taps Layer 6 and OpenAI to deliver real-time equity insights to sales and trading teams – VentureBeat

1. BLUF (Bottom Line Up Front)

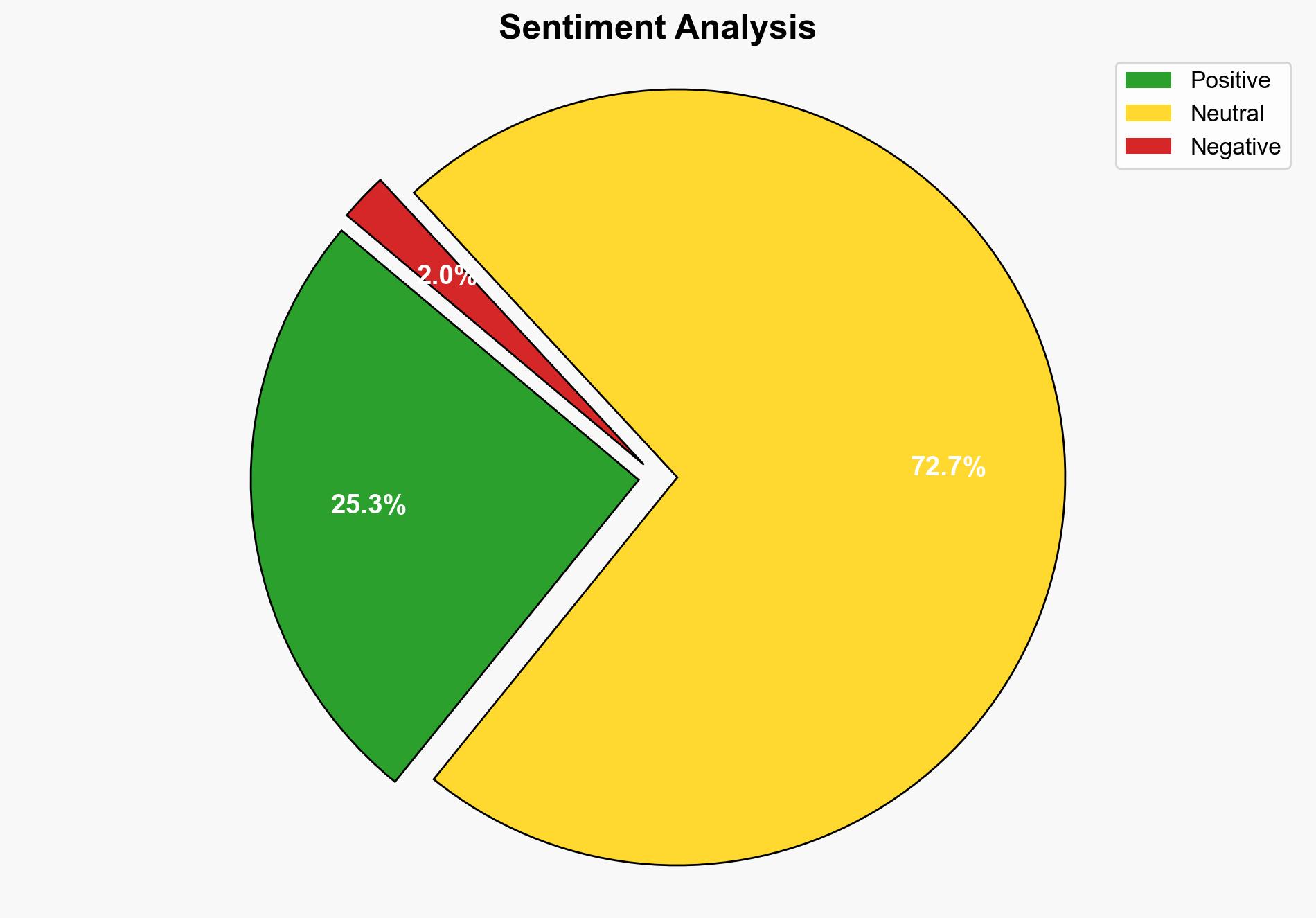

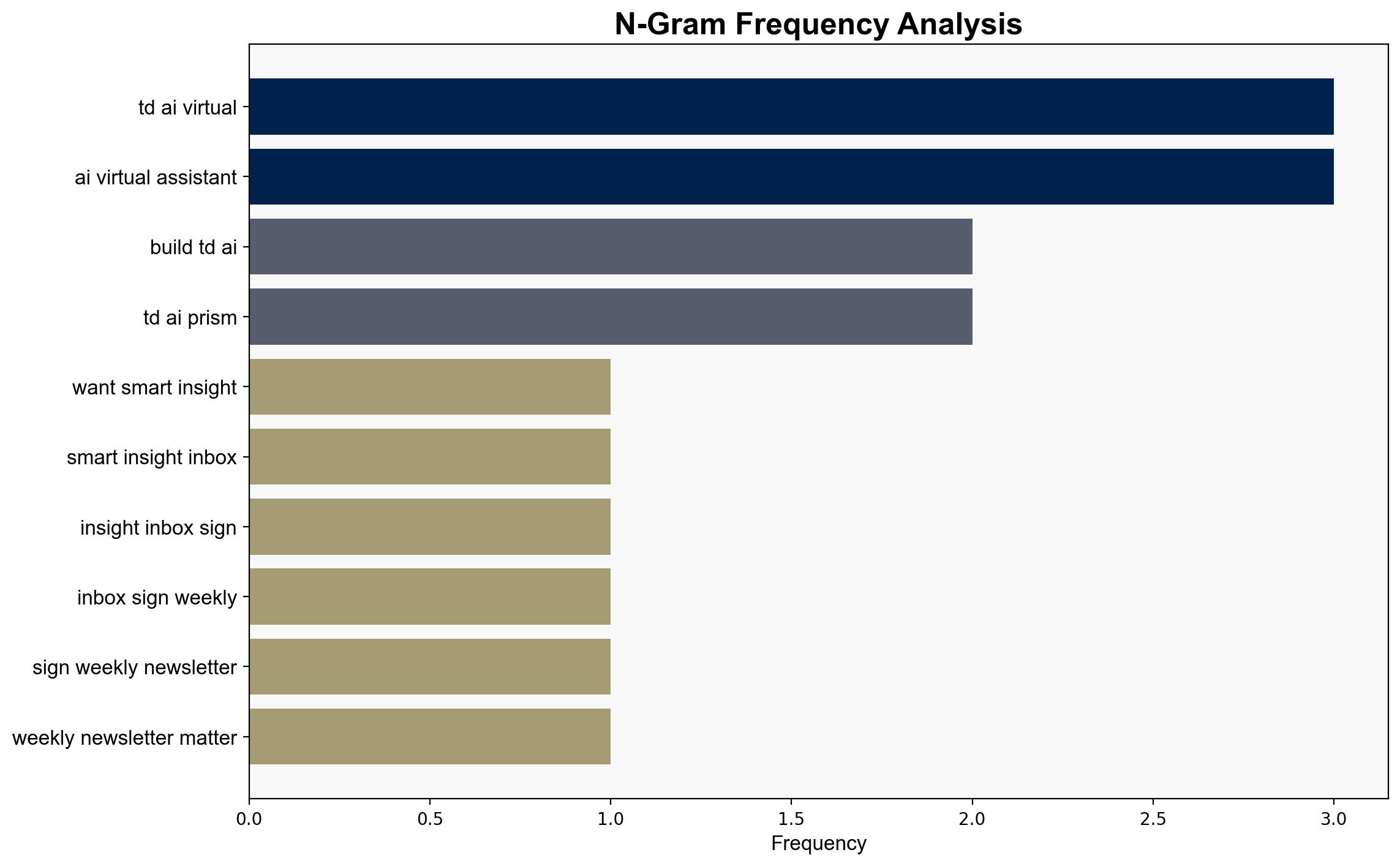

TD Securities’ integration of AI technologies from Layer 6 and OpenAI aims to enhance real-time equity insights for sales and trading teams. The most supported hypothesis suggests that this initiative will significantly improve operational efficiency and client engagement. Confidence Level: Moderate. Recommended Action: Monitor the implementation for potential security vulnerabilities and ensure alignment with regulatory standards.

2. Competing Hypotheses

Hypothesis 1: The integration of AI technologies will lead to significant improvements in operational efficiency and client engagement for TD Securities. This hypothesis is supported by the strategic use of AI to streamline workflows and provide enhanced insights to sales teams.

Hypothesis 2: The integration may face challenges such as high operational costs, data security concerns, and potential resistance from staff, which could limit its effectiveness. This hypothesis considers the complexities of AI adoption in highly regulated industries and the potential for unforeseen technical or cultural barriers.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the structured approach TD Securities is taking, including partnerships with established AI firms and a focus on internal data security.

3. Key Assumptions and Red Flags

Key Assumptions:

– AI technologies will integrate seamlessly with existing systems.

– Sales teams will adapt quickly to AI-driven insights.

Red Flags:

– Potential underestimation of the costs associated with AI implementation.

– Lack of detailed information on data security measures.

– Possible resistance from employees accustomed to traditional methods.

Blind Spots:

– The impact of AI on client relationships and trust.

– Long-term sustainability of AI-driven strategies in fluctuating market conditions.

4. Implications and Strategic Risks

Implications include enhanced decision-making capabilities and competitive advantage in the equity trading sector. However, strategic risks involve potential data breaches, increased regulatory scrutiny, and the need for continuous AI model updates to maintain relevance. Economic implications could include cost savings and increased revenue, while cyber risks pertain to data integrity and confidentiality.

5. Recommendations and Outlook

- Conduct regular audits to ensure data security and compliance with financial regulations.

- Implement training programs to facilitate staff adaptation to AI tools.

- Scenario Projections:

- Best Case: Successful integration leads to increased market share and client satisfaction.

- Worst Case: Security breaches or operational failures result in financial losses and reputational damage.

- Most Likely: Gradual improvement in efficiency with manageable challenges in adaptation and security.

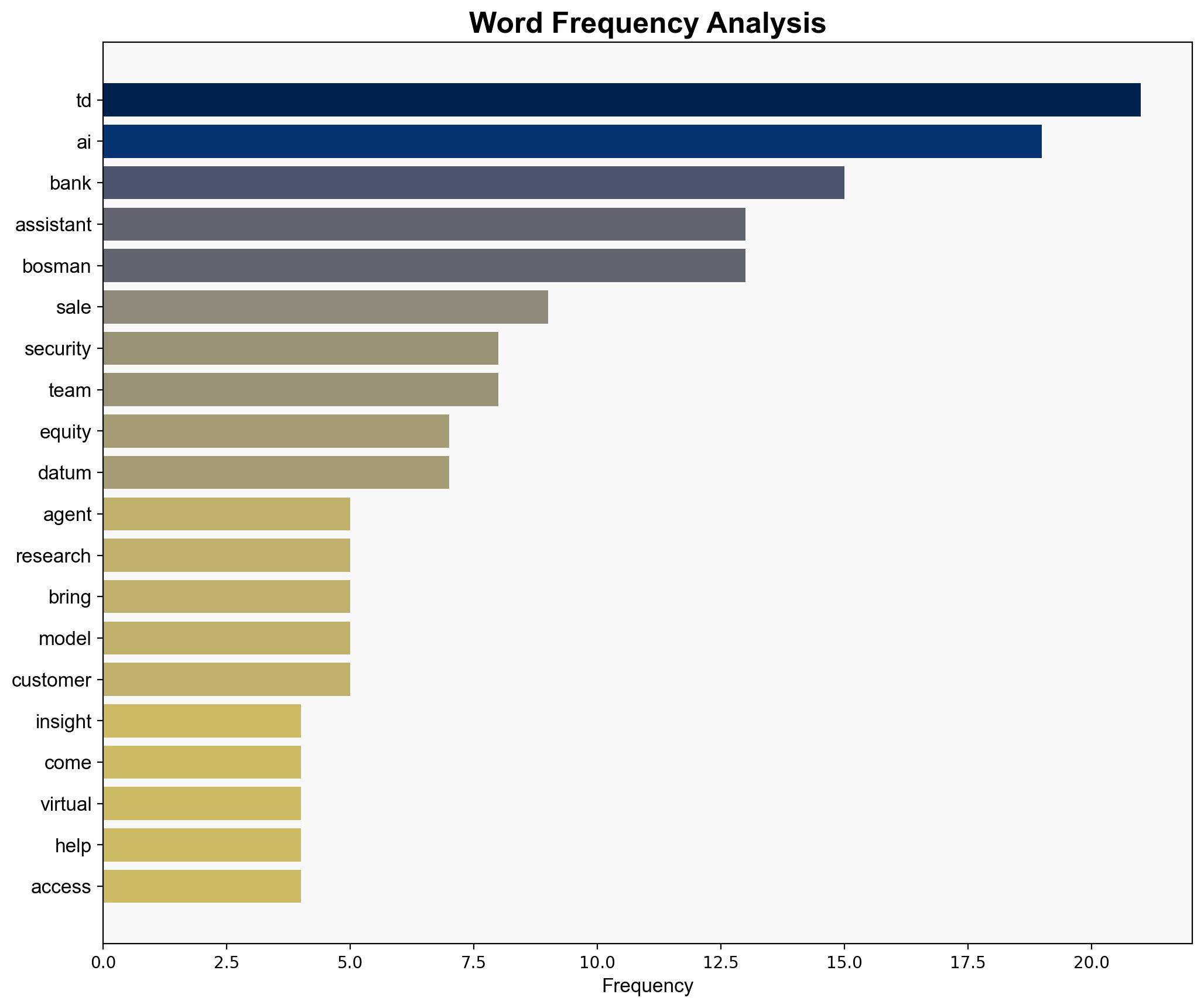

6. Key Individuals and Entities

– Dan Bosman

– TD Securities

– Layer 6

– OpenAI

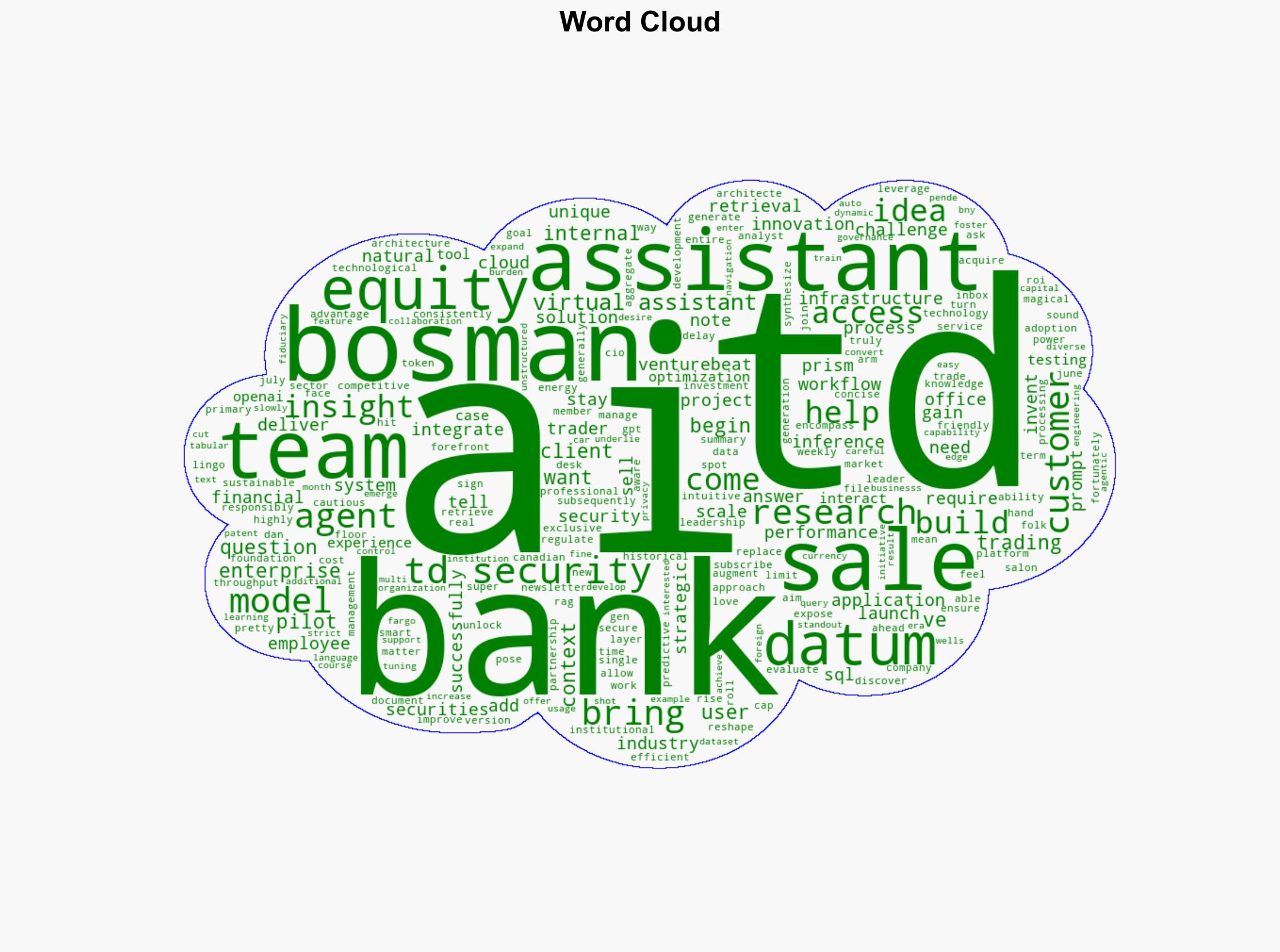

7. Thematic Tags

financial technology, AI integration, data security, operational efficiency, regulatory compliance