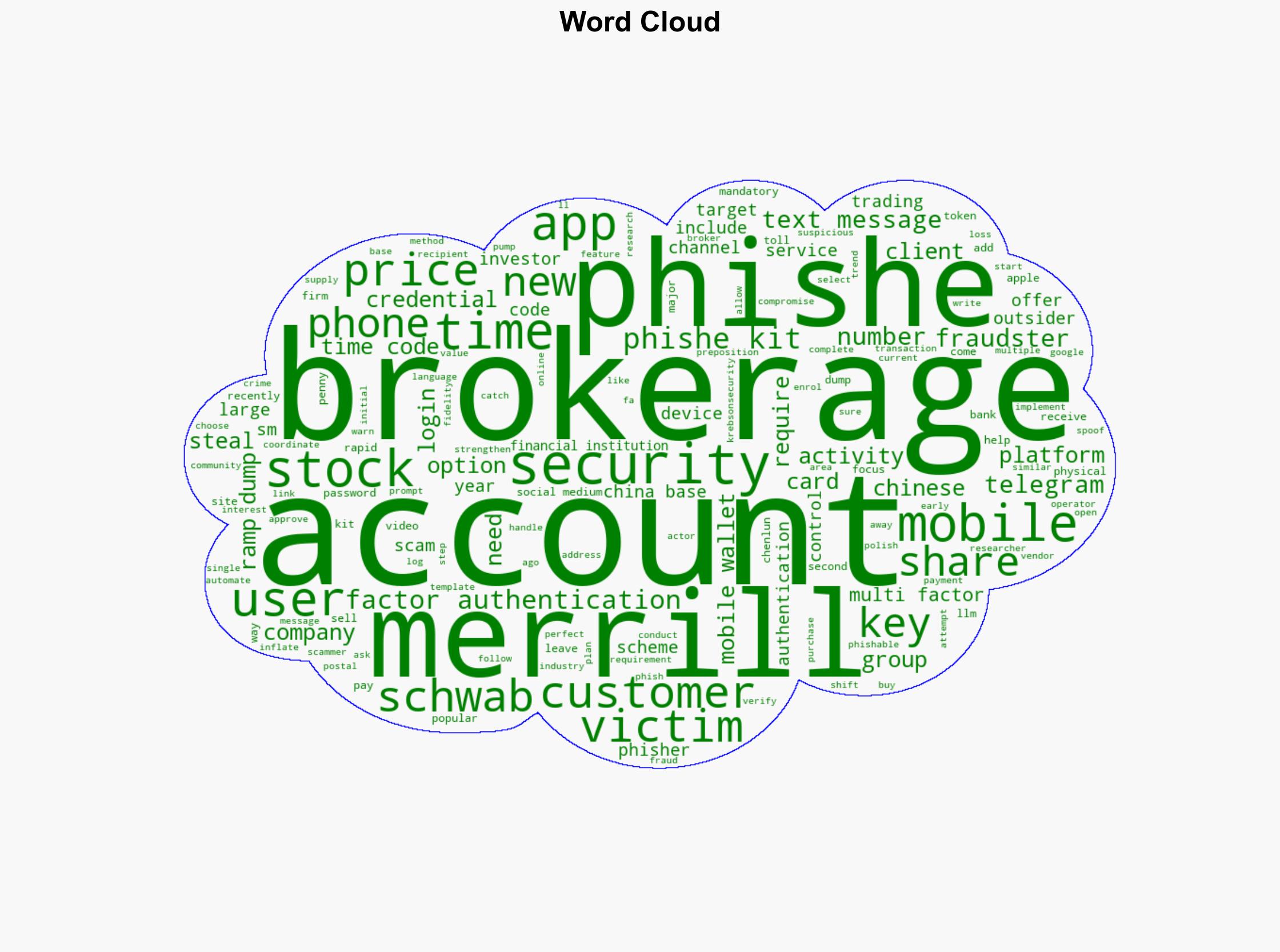

Mobile Phishers Target Brokerage Accounts in Ramp and Dump Cashout Scheme – Krebs on Security

Published on: 2025-08-15

Intelligence Report: Mobile Phishers Target Brokerage Accounts in Ramp and Dump Cashout Scheme – Krebs on Security

1. BLUF (Bottom Line Up Front)

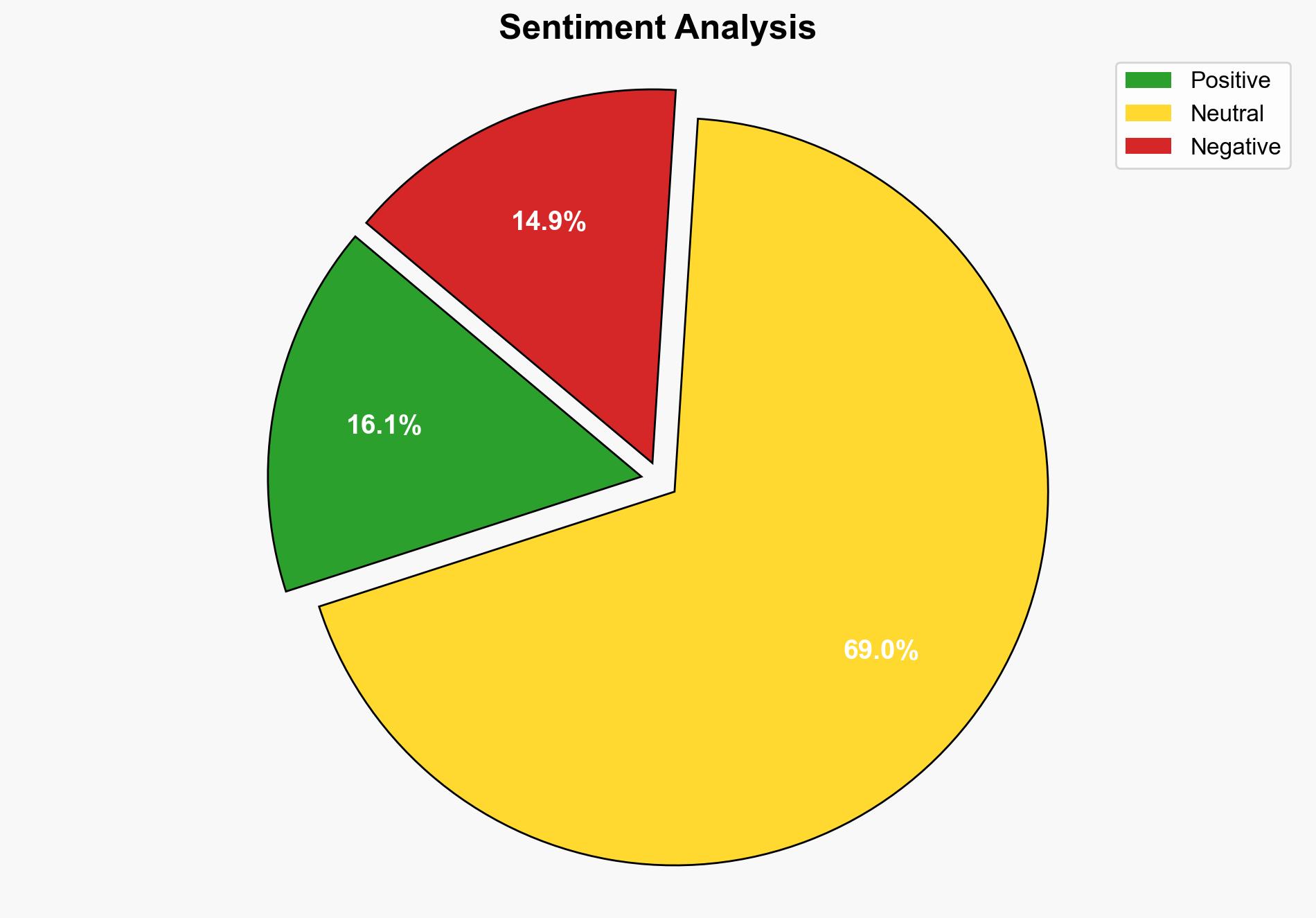

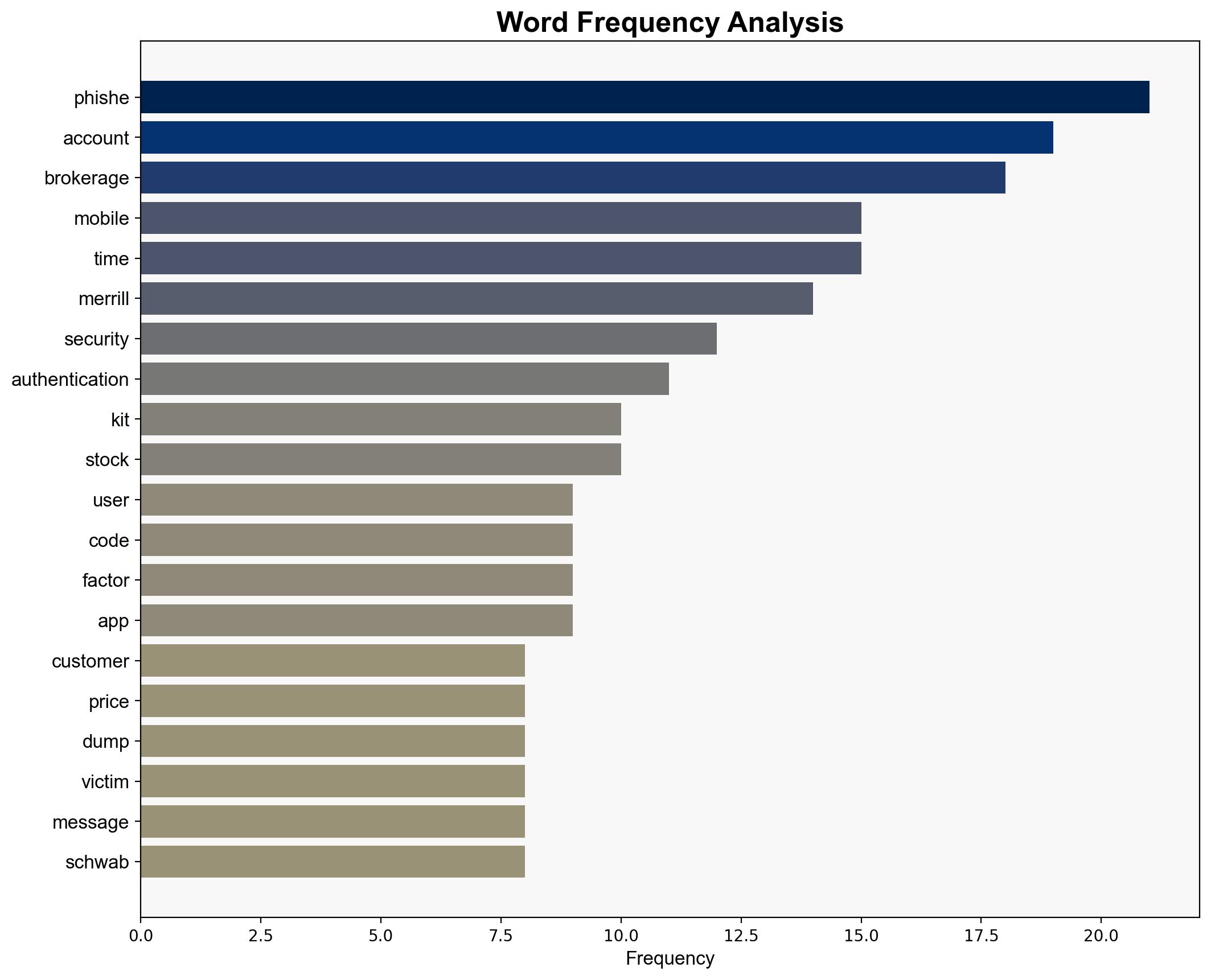

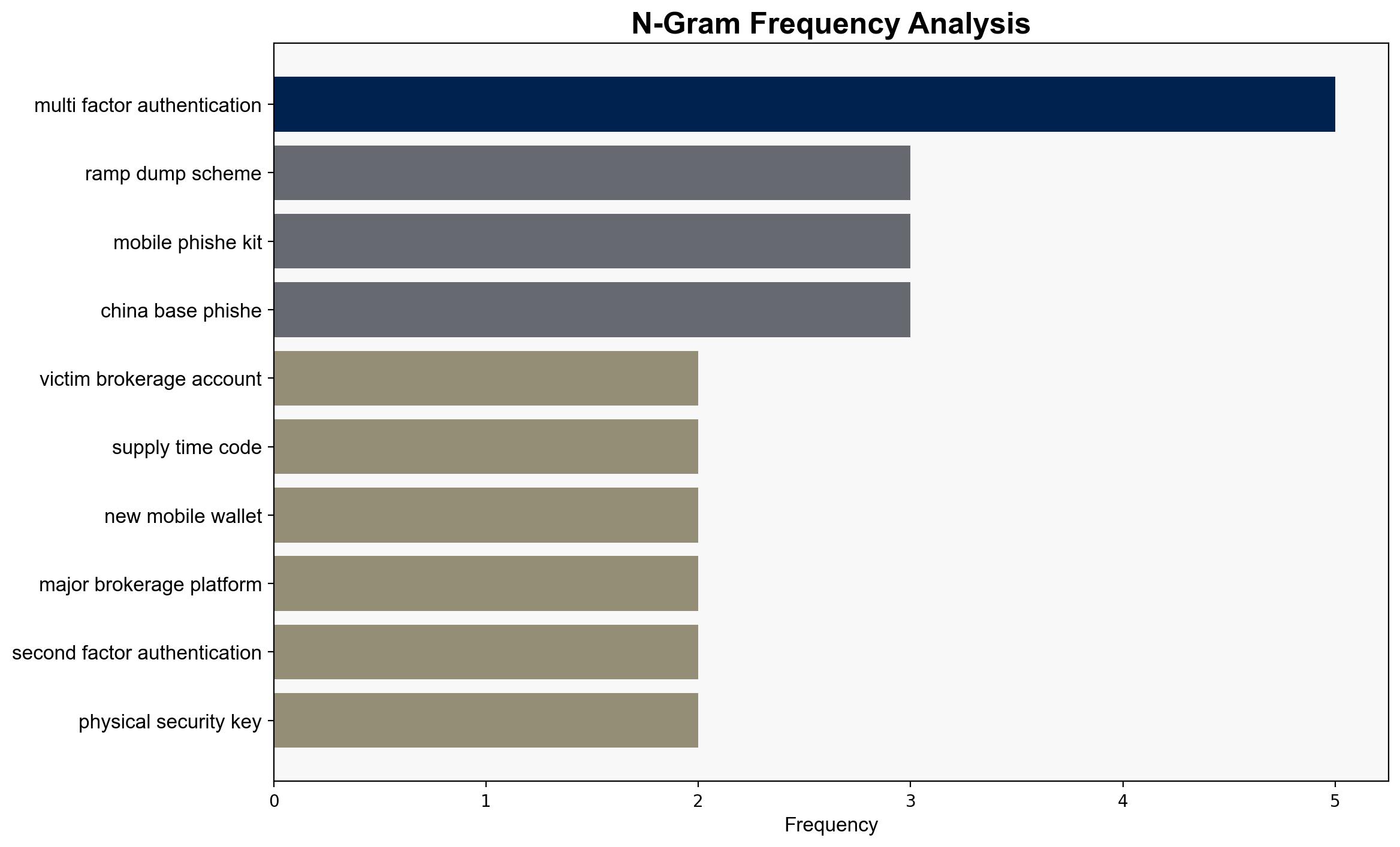

The most supported hypothesis is that cybercriminal groups are exploiting weaknesses in brokerage account security to conduct ramp and dump schemes, leveraging compromised accounts to manipulate stock prices. Confidence in this assessment is moderate due to the complexity of the operations and the potential for evolving tactics. Recommended actions include enhancing multi-factor authentication and monitoring for unusual trading patterns.

2. Competing Hypotheses

1. **Hypothesis A**: Cybercriminals are primarily targeting brokerage accounts to execute ramp and dump schemes, exploiting security gaps in trading platforms.

2. **Hypothesis B**: The primary goal of the cybercriminals is to steal financial data for broader financial fraud, with ramp and dump schemes being a secondary or opportunistic activity.

Using ACH 2.0, Hypothesis A is better supported due to the specific focus on brokerage accounts and the detailed description of ramp and dump activities. The intelligence highlights the use of compromised accounts to manipulate stock prices, indicating a strategic focus on this method.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the cybercriminals have sufficient technical capability and access to execute these schemes effectively. It is also assumed that the brokerage platforms have not fully adapted to counter these specific threats.

– **Red Flags**: The reliance on Chinese language communities and Telegram channels suggests potential geopolitical dimensions. The rapid adaptation of phishing tactics indicates a high level of sophistication and resource availability.

4. Implications and Strategic Risks

The ramp and dump schemes pose significant risks to market stability and investor confidence. If unchecked, these activities could lead to broader financial instability and loss of trust in digital trading platforms. The potential for these schemes to evolve into more complex financial frauds is a critical concern.

5. Recommendations and Outlook

- Enhance security protocols for brokerage accounts, focusing on multi-factor authentication and anomaly detection systems.

- Increase collaboration between financial institutions and cybersecurity firms to share threat intelligence and develop countermeasures.

- Scenario Projections:

- **Best Case**: Rapid implementation of enhanced security measures significantly reduces the incidence of ramp and dump schemes.

- **Worst Case**: Cybercriminals adapt to new security measures, leading to more sophisticated and widespread financial fraud.

- **Most Likely**: A gradual improvement in security reduces but does not eliminate the threat, requiring ongoing vigilance and adaptation.

6. Key Individuals and Entities

– **Merrill**: Security researcher tracking ramp and dump activities.

– **SecAlliance**: Security group involved in monitoring phishing activities.

– **CSIS Security Group**: Company engaged in tracking cybercriminal activities.

7. Thematic Tags

national security threats, cybersecurity, financial fraud, market manipulation