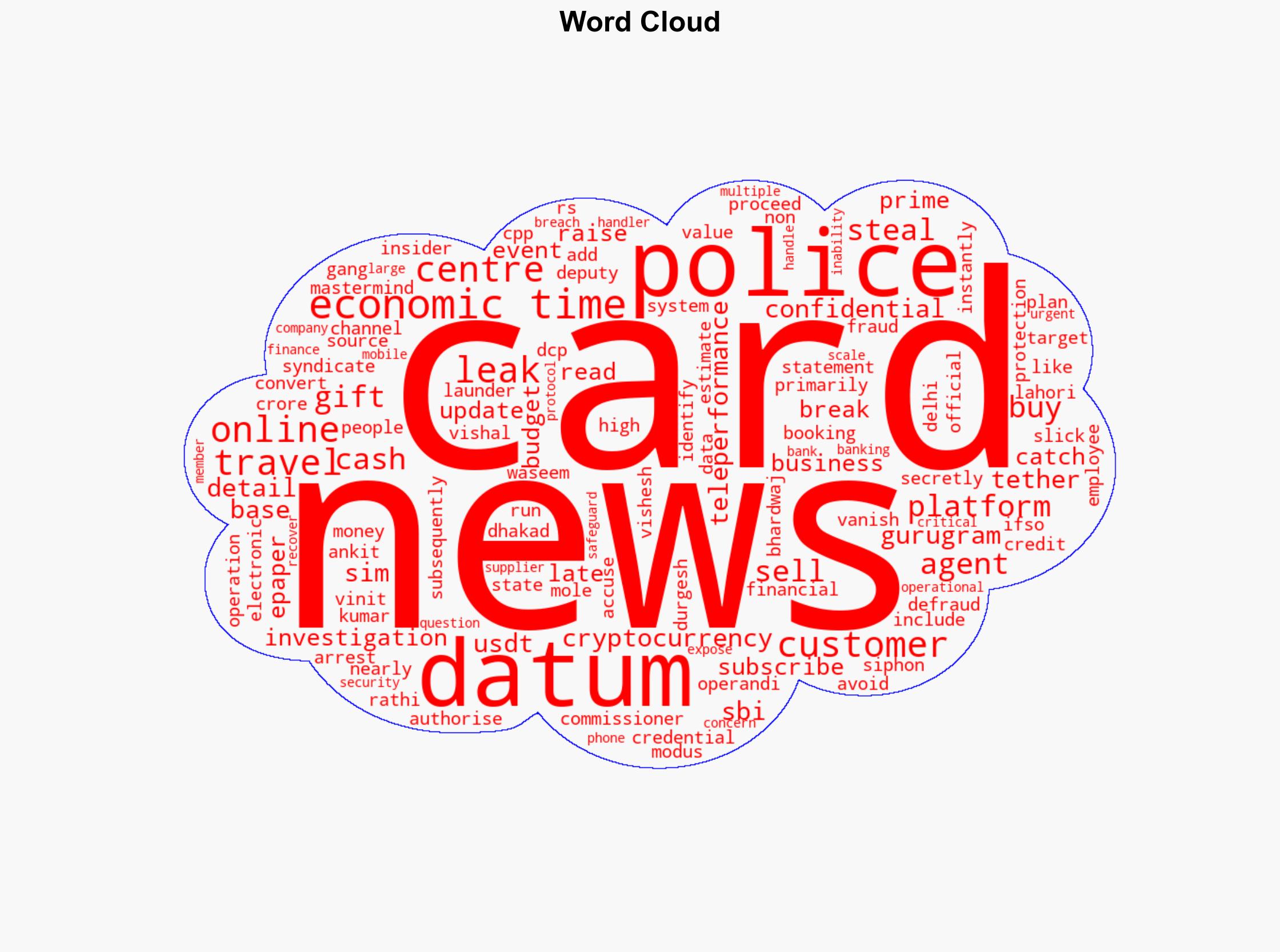

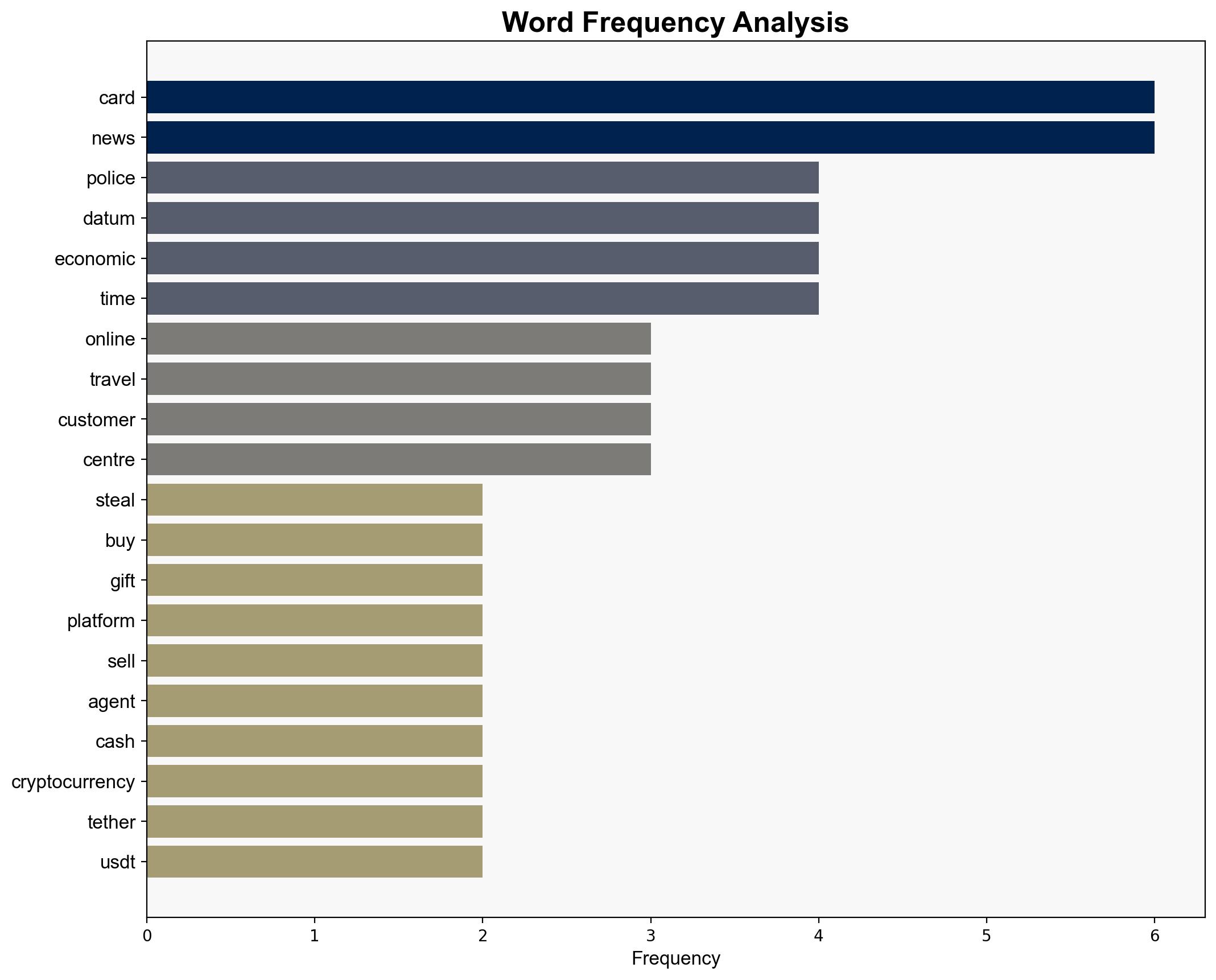

Data leak from Gurugram call centre leads to Rs 260 cr credit card fraud 18 nabbed – The Times of India

Published on: 2025-08-16

Intelligence Report: Data leak from Gurugram call centre leads to Rs 260 cr credit card fraud 18 nabbed – The Times of India

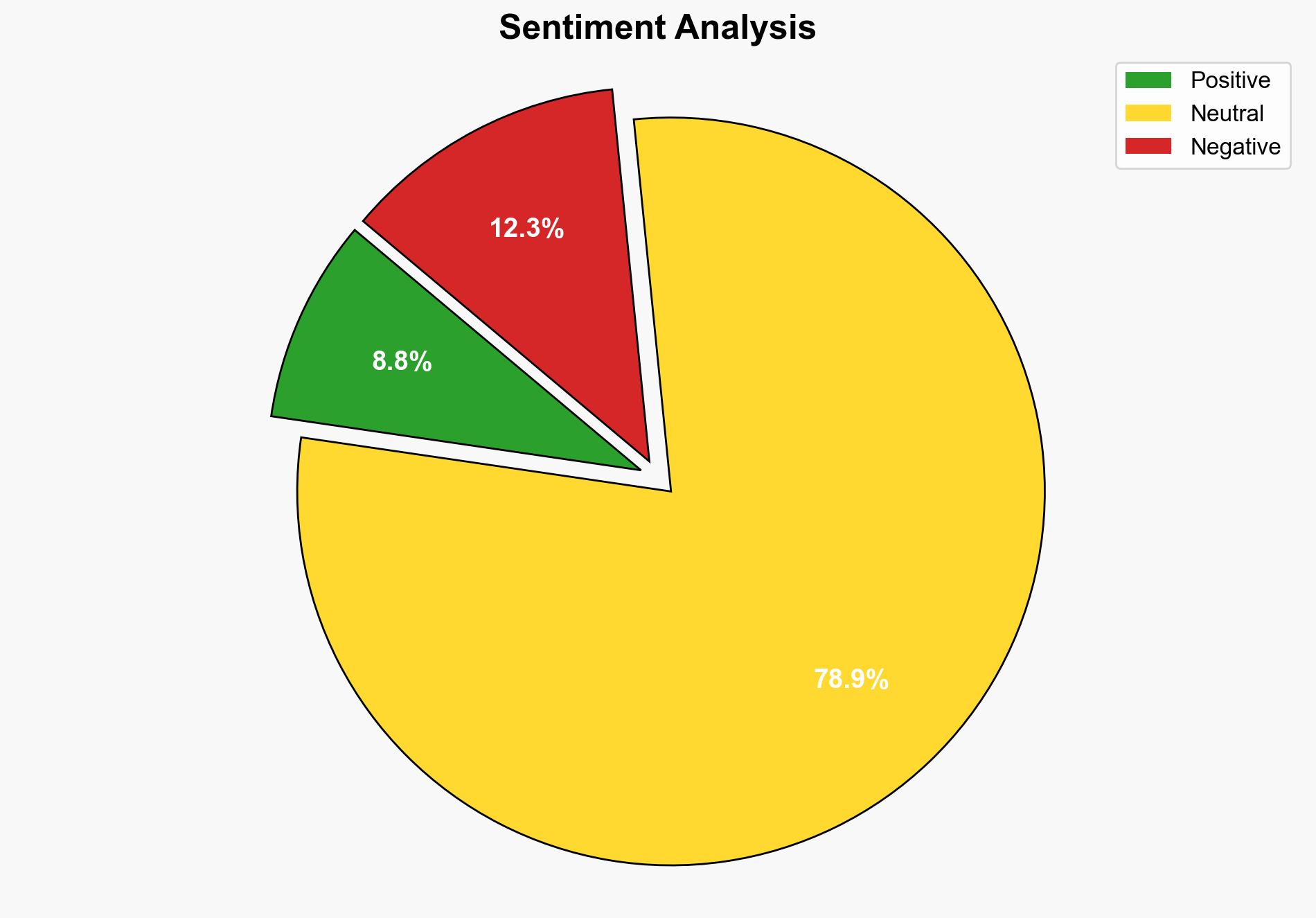

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the data leak was orchestrated by a well-coordinated internal syndicate exploiting vulnerabilities in the call center’s security protocols. Confidence level: Moderate. Recommended action: Immediate enhancement of cybersecurity measures and internal audits at similar facilities to prevent future breaches.

2. Competing Hypotheses

1. **Internal Syndicate Hypothesis**: The fraud was primarily driven by an organized internal group within the call center, leveraging insider access to siphon sensitive data and execute the fraud.

2. **External Breach Hypothesis**: The data leak resulted from an external cyber-attack that exploited weak security measures, with internal actors being unwitting participants or scapegoats.

Using ACH 2.0, the Internal Syndicate Hypothesis is better supported due to the identification of specific individuals involved and the sophisticated nature of the operation, which suggests insider knowledge and coordination.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that all identified individuals were complicit and that the breach was not facilitated by external actors.

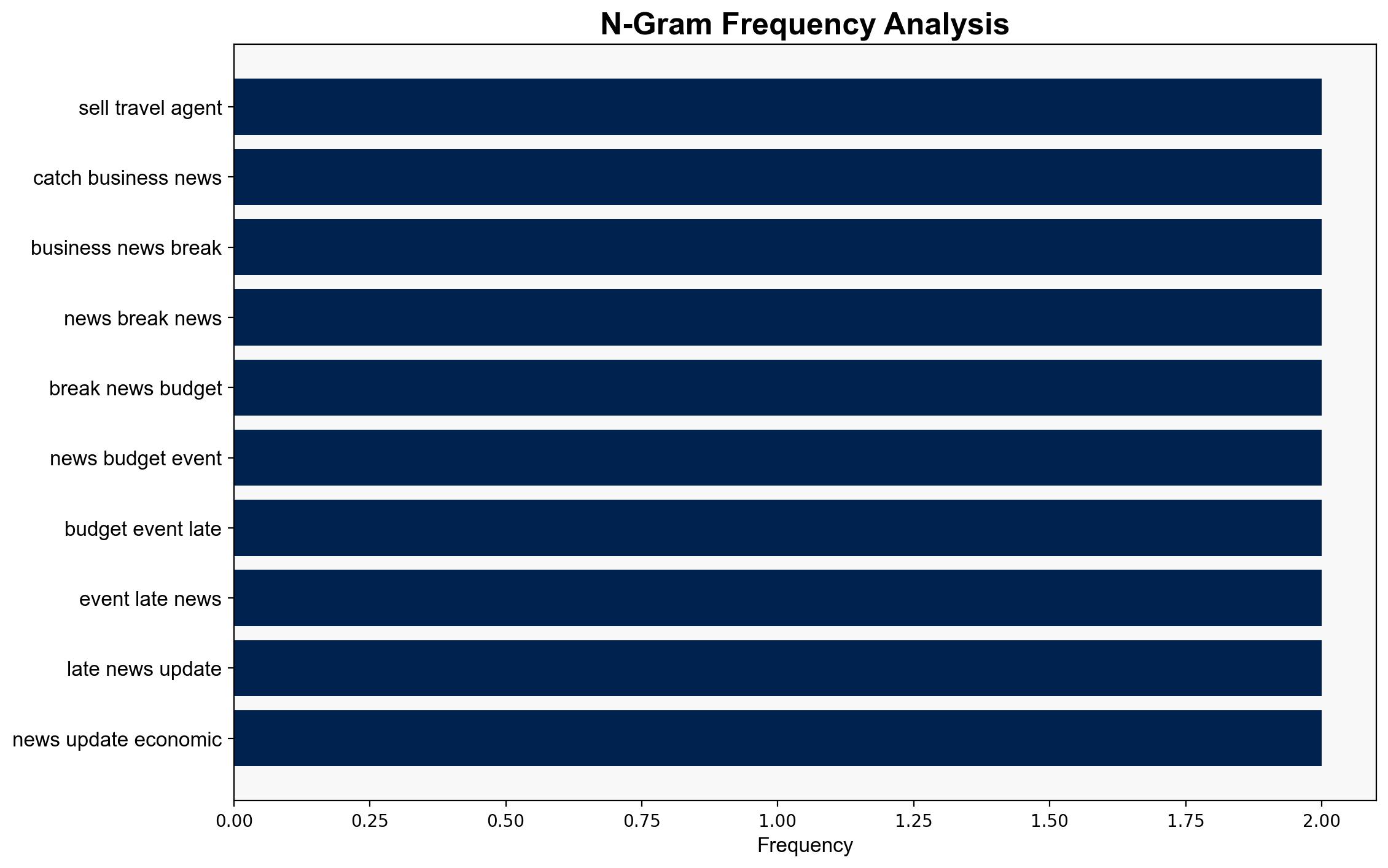

– **Red Flags**: The rapid conversion of stolen assets into cryptocurrency suggests potential external facilitation. The lack of detailed information on how the data was initially accessed raises questions about the depth of internal involvement.

– **Blind Spots**: The possibility of a broader network beyond the identified individuals remains unexplored.

4. Implications and Strategic Risks

– **Economic Impact**: The fraud undermines trust in financial institutions and could lead to increased regulatory scrutiny.

– **Cybersecurity Threats**: Highlights vulnerabilities in data protection protocols, potentially encouraging further cybercriminal activities.

– **Geopolitical Risks**: If linked to international crime syndicates, this could strain diplomatic relations, especially if cross-border transactions are involved.

– **Psychological Impact**: Erodes consumer confidence in digital financial transactions, potentially slowing the adoption of digital payment systems.

5. Recommendations and Outlook

- Conduct comprehensive cybersecurity audits across similar institutions to identify and rectify vulnerabilities.

- Implement stringent access controls and employee monitoring to detect insider threats.

- Scenario Projections:

- **Best Case**: Improved security measures prevent future breaches, restoring consumer confidence.

- **Worst Case**: Continued data leaks result in significant financial losses and regulatory penalties.

- **Most Likely**: Incremental improvements in security with occasional breaches due to evolving cyber threats.

6. Key Individuals and Entities

Ankit Rathi, Waseem, Vishal Bhardwaj, Vishesh Lahori, Durgesh Dhakad.

7. Thematic Tags

national security threats, cybersecurity, financial crime, data protection