Allianz Life Data Breach Exposes Personal Data of 11 Million Customers – Infosecurity Magazine

Published on: 2025-08-19

Intelligence Report: Allianz Life Data Breach Exposes Personal Data of 11 Million Customers – Infosecurity Magazine

1. BLUF (Bottom Line Up Front)

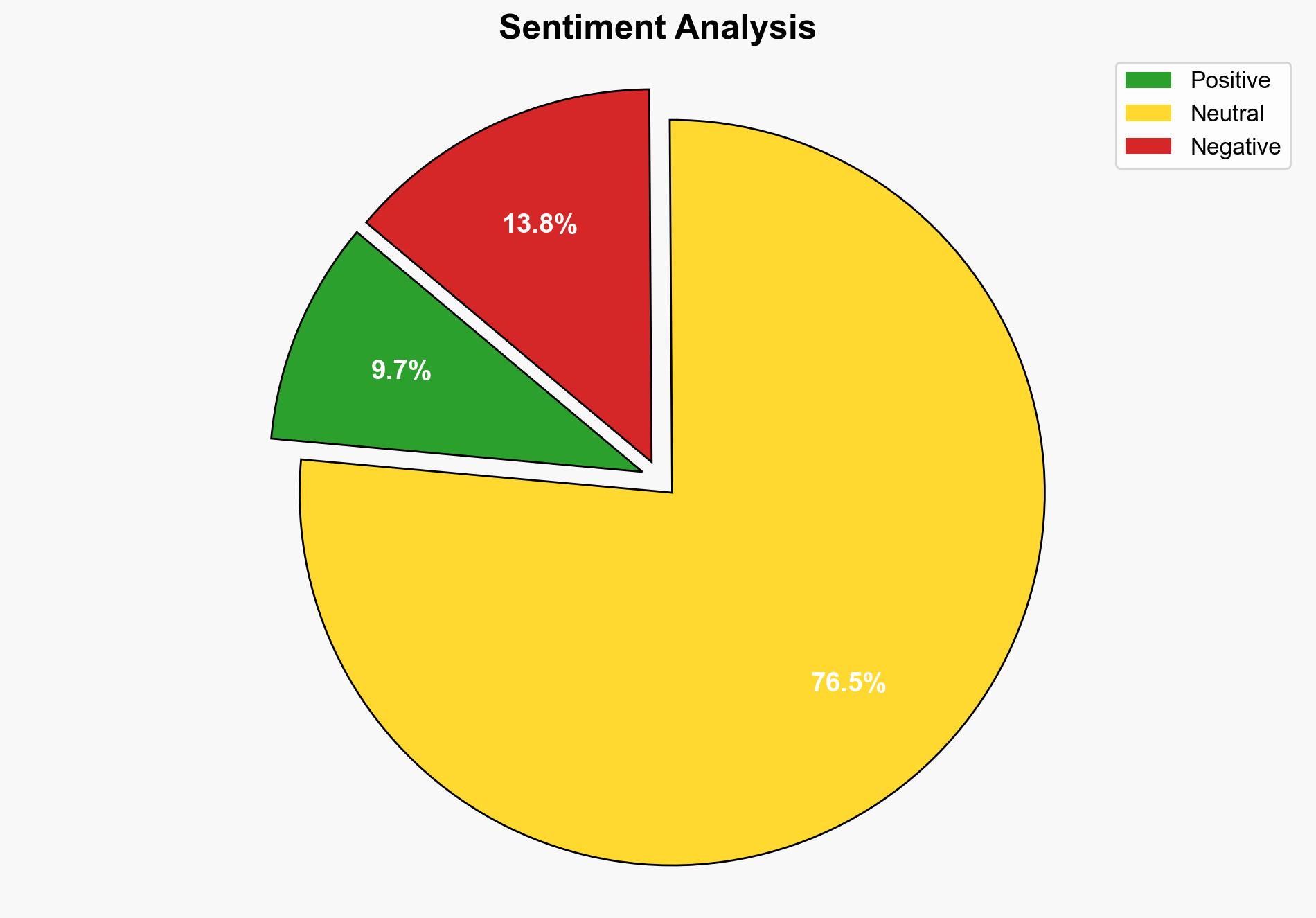

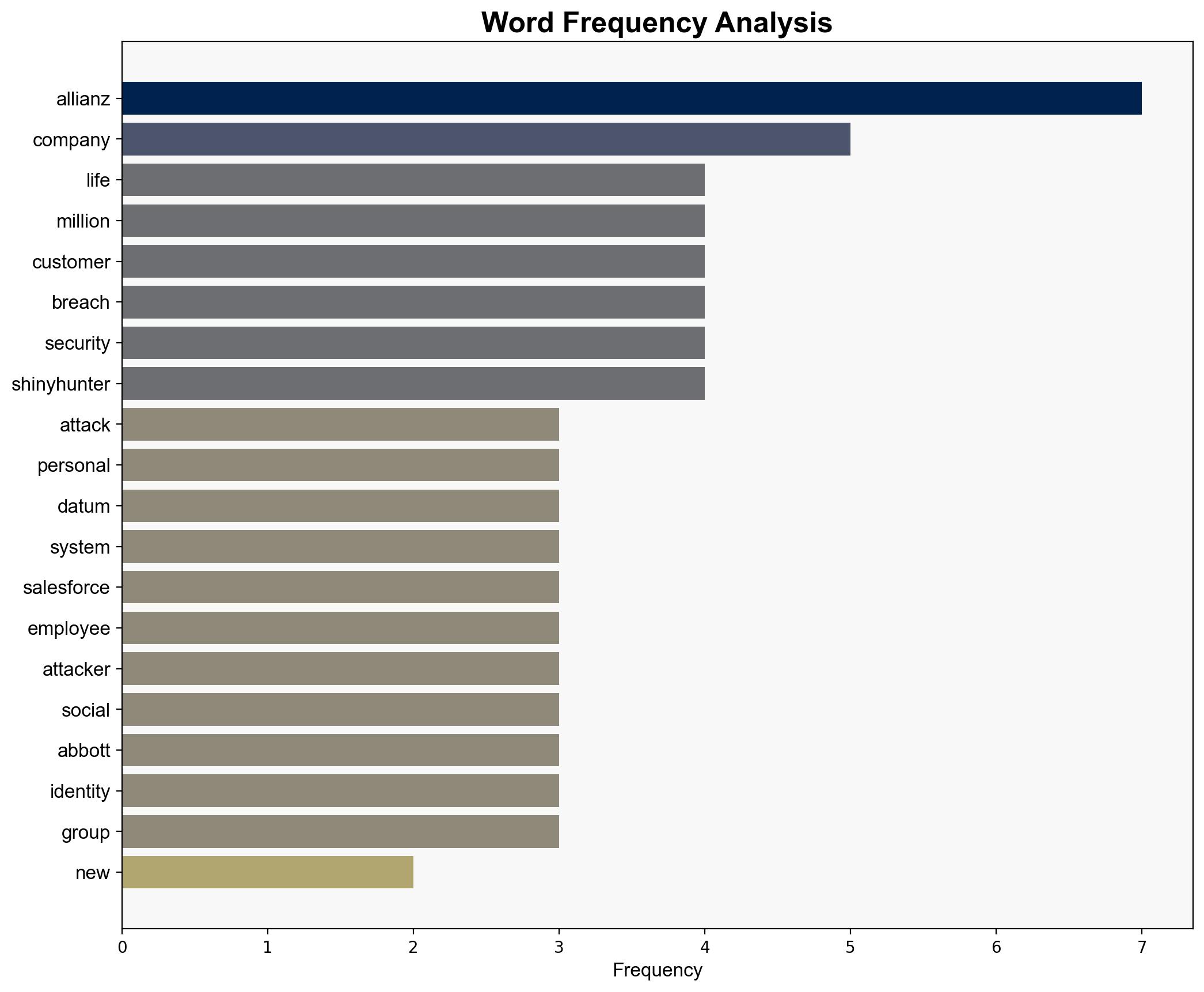

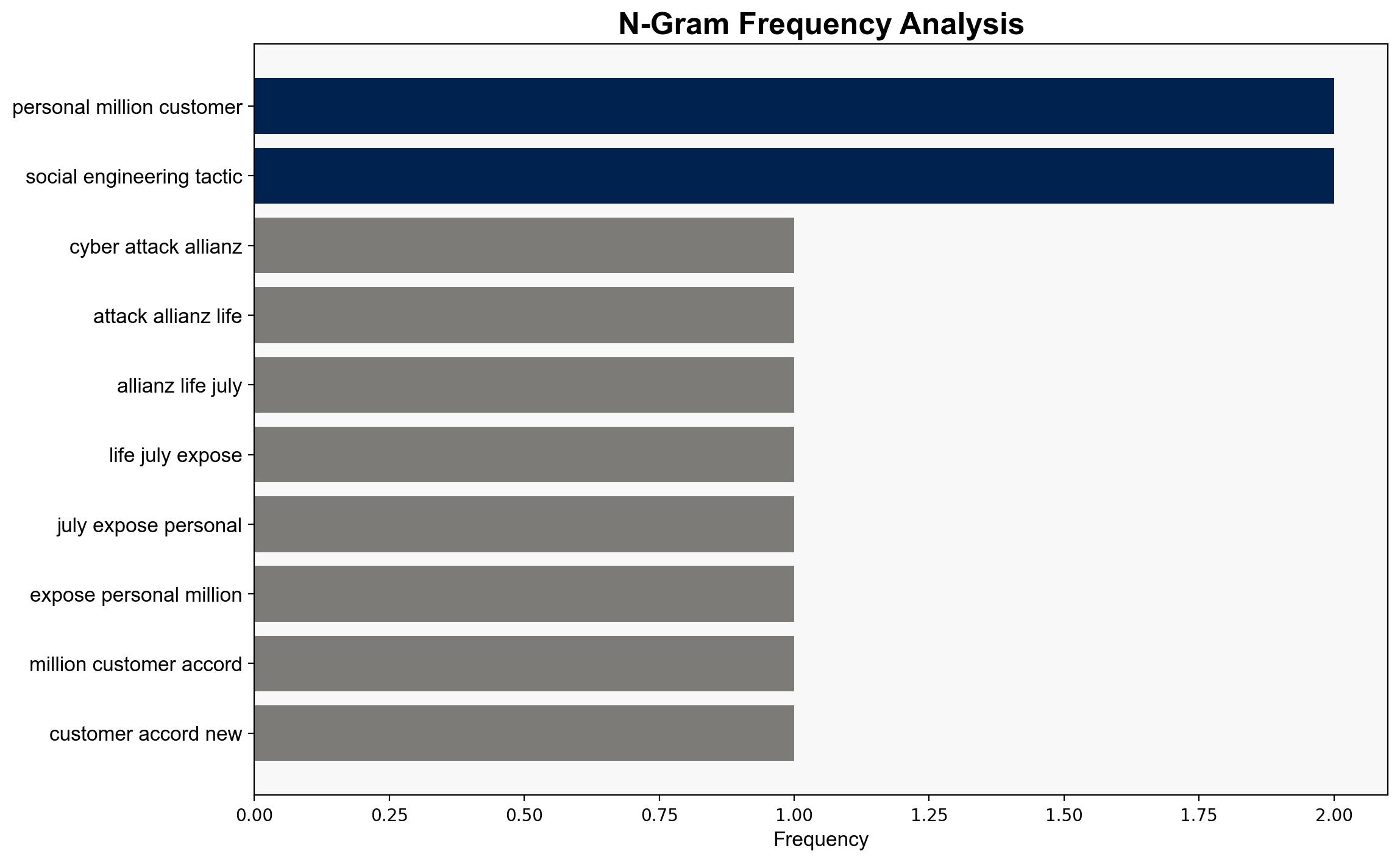

The data breach at Allianz Life, potentially orchestrated by the ShinyHunter group, exposed sensitive information of 11 million customers. The most supported hypothesis is that the breach was primarily aimed at identity theft and phishing campaigns. A high confidence level is assigned to this hypothesis due to the group’s known tactics and the nature of the data accessed. Immediate enhancement of cybersecurity measures, particularly around CRM systems, is recommended.

2. Competing Hypotheses

Hypothesis 1: The breach was executed by ShinyHunter to facilitate identity theft and phishing campaigns. This is supported by their history of targeting CRM systems and using social engineering tactics to gain unauthorized access.

Hypothesis 2: The breach was a state-sponsored attack aimed at gathering intelligence on Allianz Life’s operations and clientele. This hypothesis considers the possibility of geopolitical motivations, although there is less direct evidence supporting this scenario.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported due to the alignment of the attack’s characteristics with ShinyHunter’s known methods and objectives.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the belief that ShinyHunter’s primary motivation is financial gain through identity theft. For Hypothesis 2, it assumes a geopolitical interest in Allianz Life’s data. Red flags include the lack of detailed information on the breach’s technical specifics and the absence of direct attribution to ShinyHunter beyond circumstantial evidence.

4. Implications and Strategic Risks

The breach underscores vulnerabilities in cloud-based CRM systems, posing risks of cascading cyber threats across the financial sector. Economically, the breach could lead to significant financial losses for Allianz Life and erode customer trust. Psychologically, it may increase anxiety among customers about data security. Geopolitically, if state-sponsored, it could escalate tensions in cyber diplomacy.

5. Recommendations and Outlook

- Enhance cybersecurity protocols, focusing on CRM systems and employee training to counter social engineering tactics.

- Implement tamper-proof identity verification and robust asset inventory management.

- Scenario Projections:

- Best Case: Allianz Life strengthens its cybersecurity posture, preventing future breaches and restoring customer confidence.

- Worst Case: Further breaches occur, leading to severe financial and reputational damage.

- Most Likely: Allianz Life mitigates immediate risks but faces ongoing challenges in securing customer data.

6. Key Individuals and Entities

Jon Abbott, CEO of ThreatAware, provided insights into the breach’s implications. The ShinyHunter group is identified as a potential perpetrator.

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus