Streamlining supplier onboarding The power of automated bank account ownership verification – Electronicpaymentsinternational.com

Published on: 2025-08-23

Intelligence Report: Streamlining Supplier Onboarding – The Power of Automated Bank Account Ownership Verification

1. BLUF (Bottom Line Up Front)

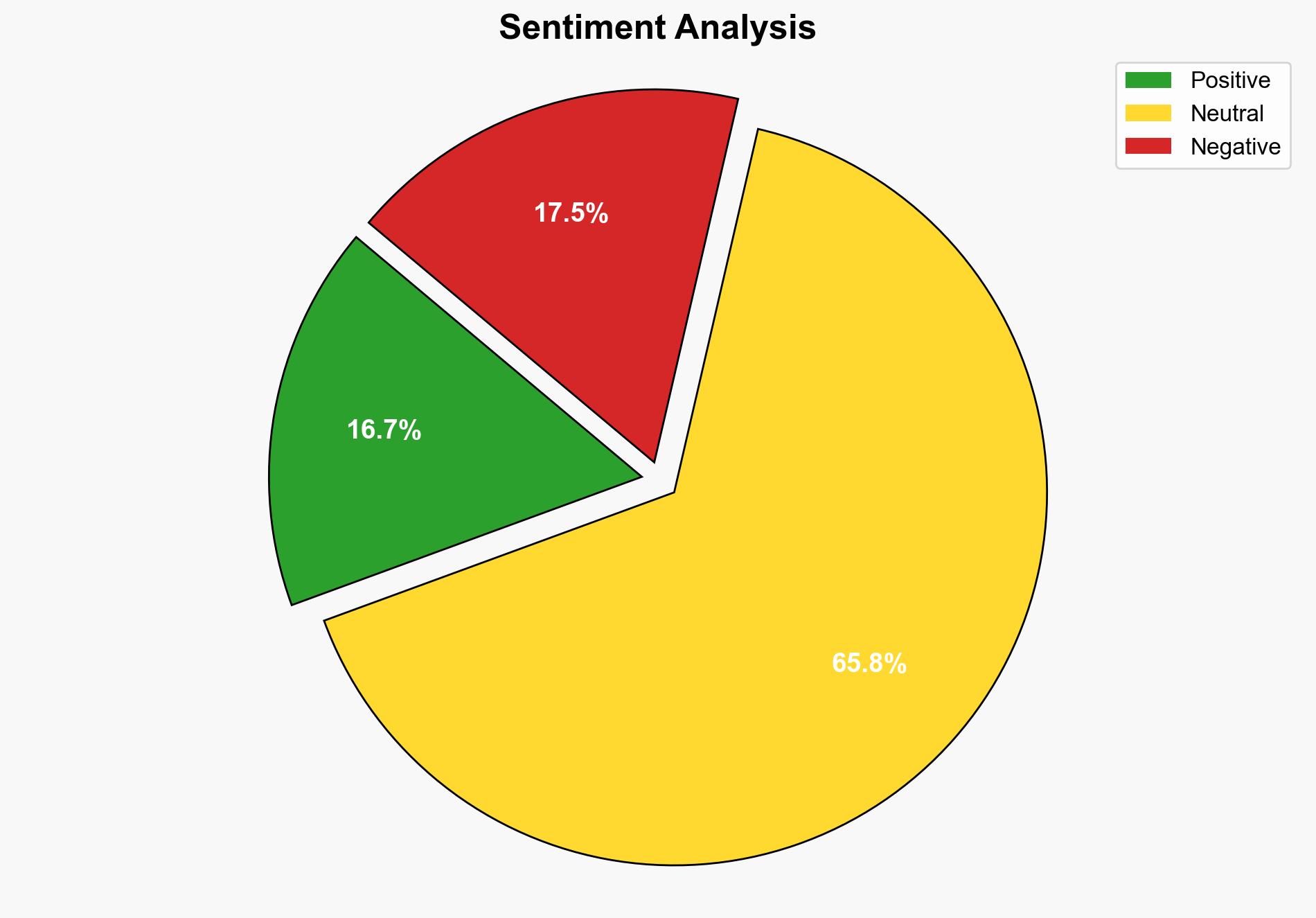

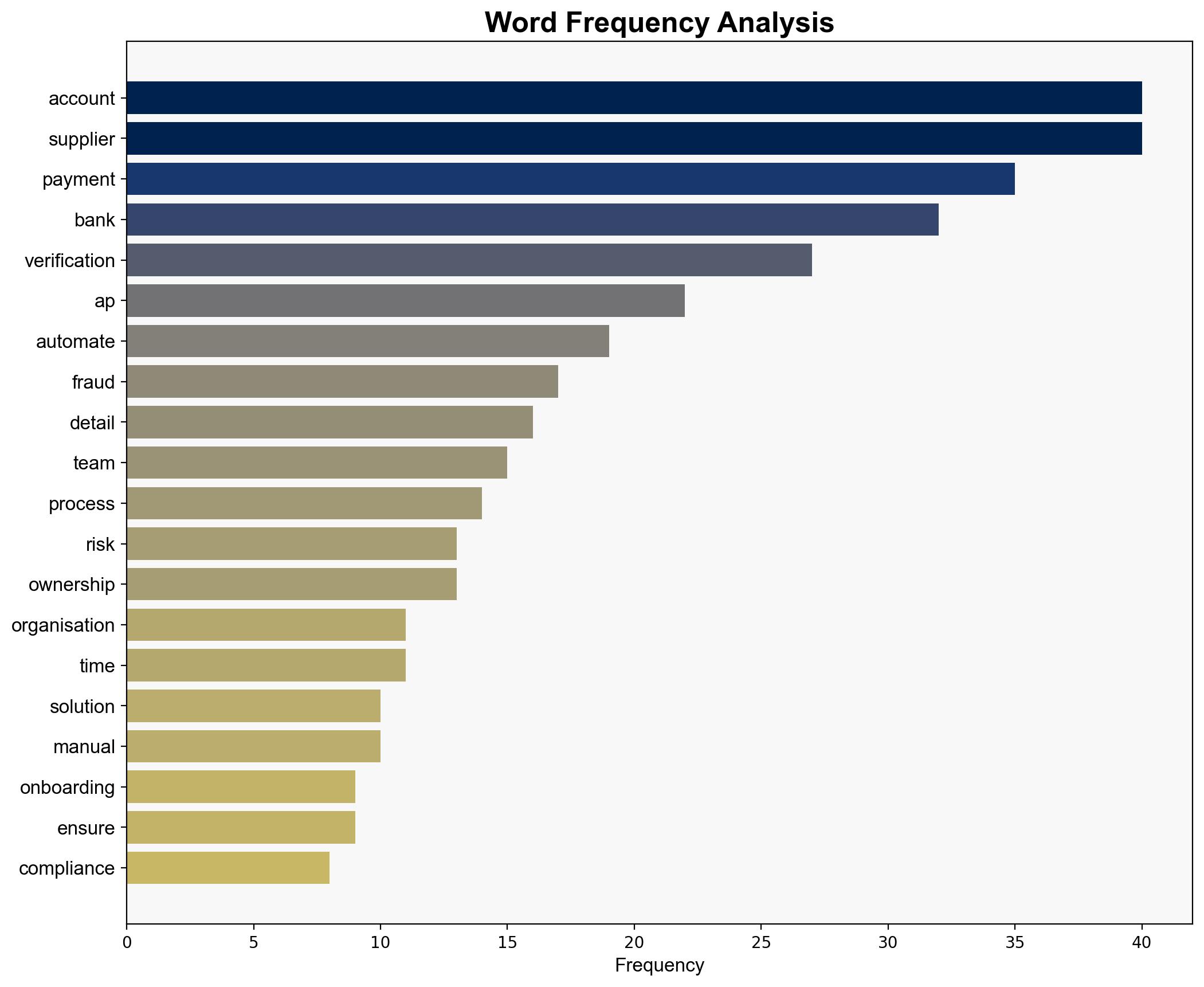

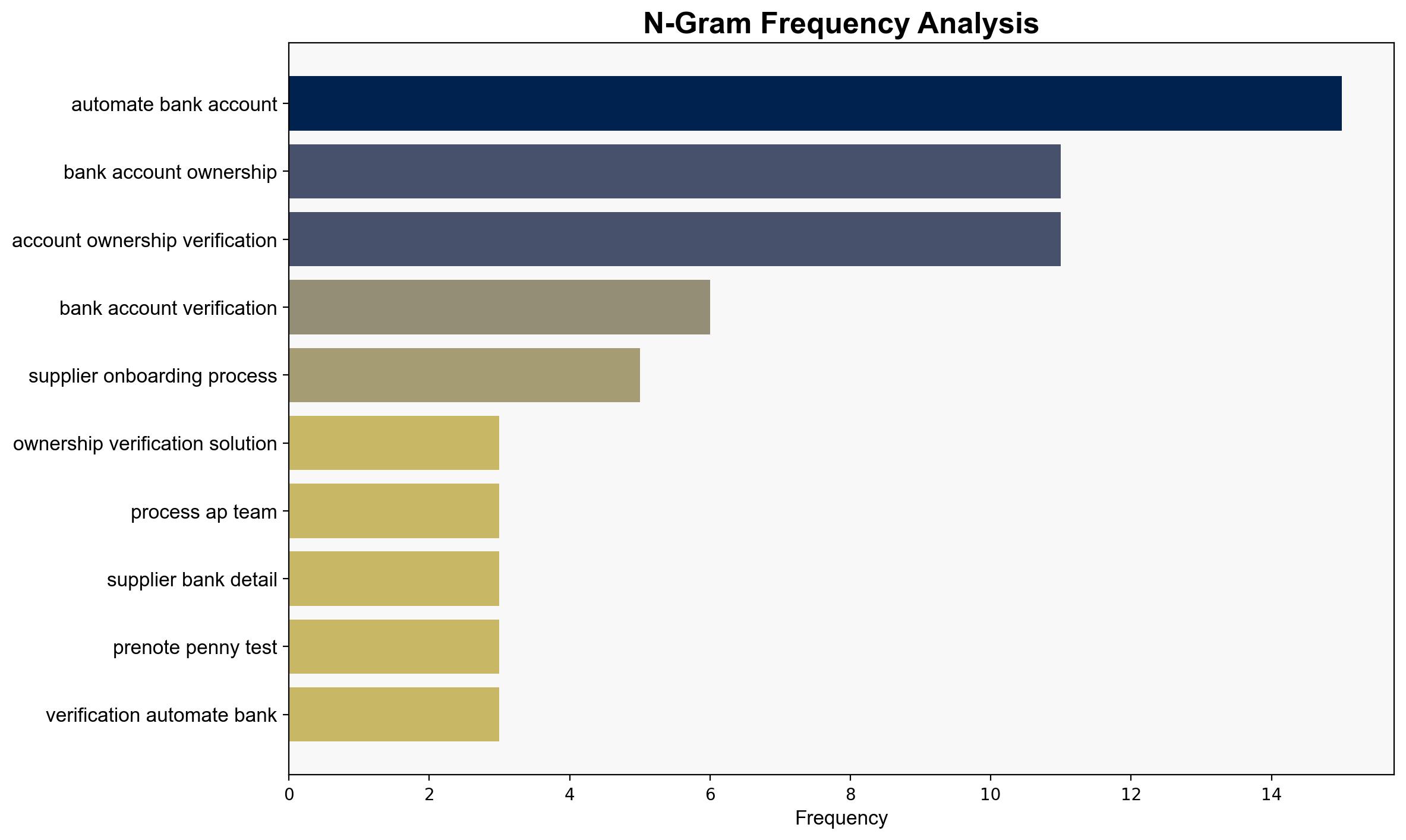

The most supported hypothesis is that implementing automated bank account ownership verification significantly reduces fraud risk and increases efficiency in supplier onboarding. Confidence level: High. Recommended action: Organizations should invest in automated verification systems to streamline processes and enhance security.

2. Competing Hypotheses

1. **Automated Verification Enhances Security and Efficiency**: Automated bank account ownership verification systems reduce the risk of fraud and increase onboarding efficiency by eliminating manual errors and delays.

2. **Automated Systems Introduce New Vulnerabilities**: While automation reduces certain risks, it may introduce new vulnerabilities, such as system failures or cyber-attacks, which could compromise supplier data and financial transactions.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Automated systems are assumed to be secure and reliable.

– Organizations have the necessary infrastructure to support automation.

– **Red Flags**:

– Lack of detailed analysis on the potential cyber vulnerabilities of automated systems.

– Over-reliance on technology without adequate human oversight.

4. Implications and Strategic Risks

– **Economic**: Increased efficiency can lead to cost savings and faster supplier payments, enhancing business relationships.

– **Cyber**: Automation reduces manual errors but may become a target for sophisticated cyber-attacks.

– **Operational**: Transitioning to automated systems requires investment and training, which could temporarily disrupt operations.

5. Recommendations and Outlook

- Invest in robust cybersecurity measures to protect automated systems from potential attacks.

- Conduct regular audits and updates of automated systems to ensure reliability and security.

- Best-case scenario: Seamless integration of automated systems leads to significant reductions in fraud and operational costs.

- Worst-case scenario: Cyber vulnerabilities in automated systems lead to major data breaches and financial losses.

- Most likely scenario: Gradual improvements in efficiency and security with ongoing adjustments and updates to the system.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Key entities include organizations implementing supplier onboarding processes and vendors providing automated verification solutions.

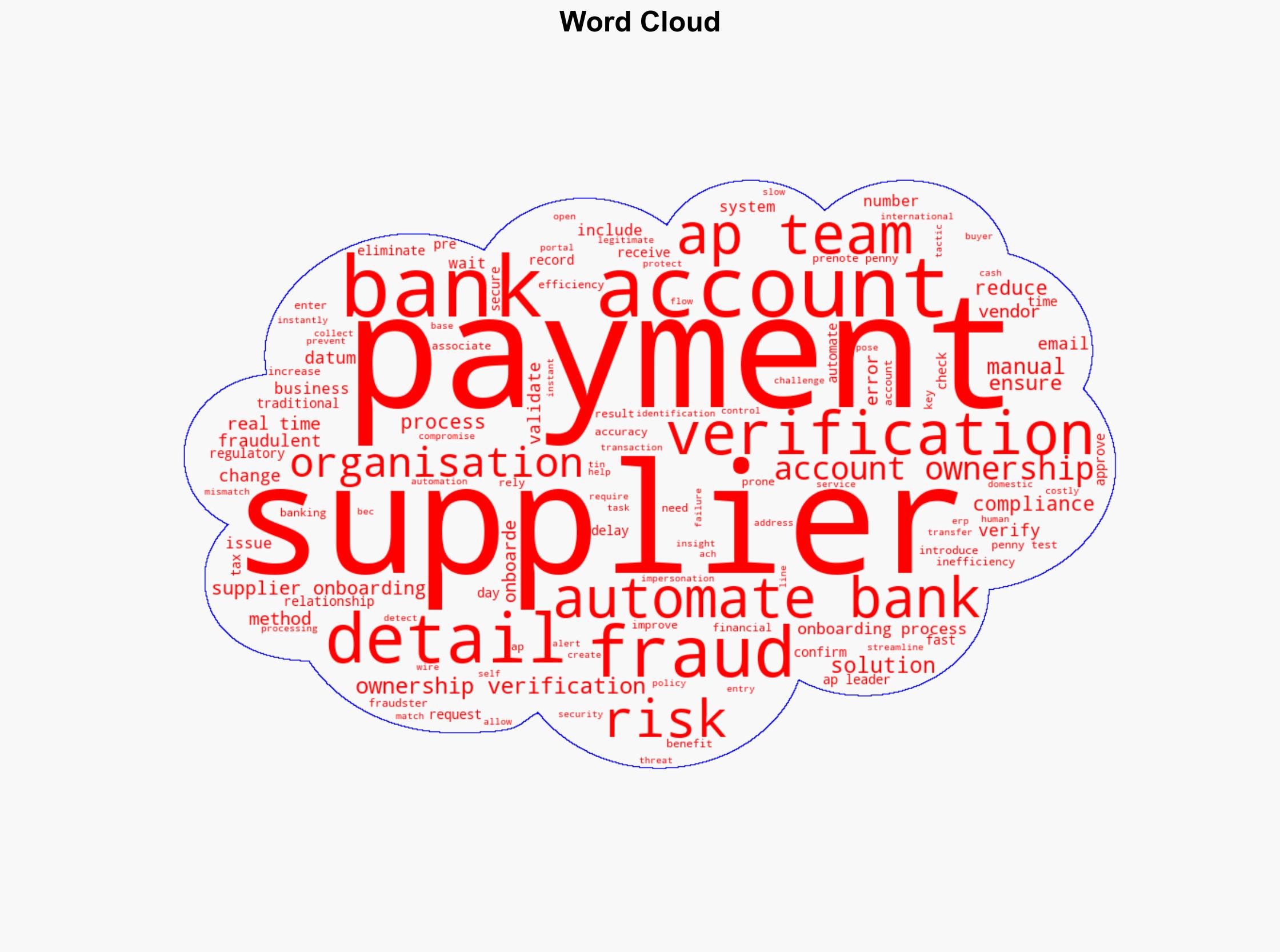

7. Thematic Tags

cybersecurity, financial fraud prevention, operational efficiency, supplier management