TransUnion Data Breach 44 Million US Consumers Data Stolen – HackRead

Published on: 2025-08-29

Intelligence Report: TransUnion Data Breach 44 Million US Consumers Data Stolen – HackRead

1. BLUF (Bottom Line Up Front)

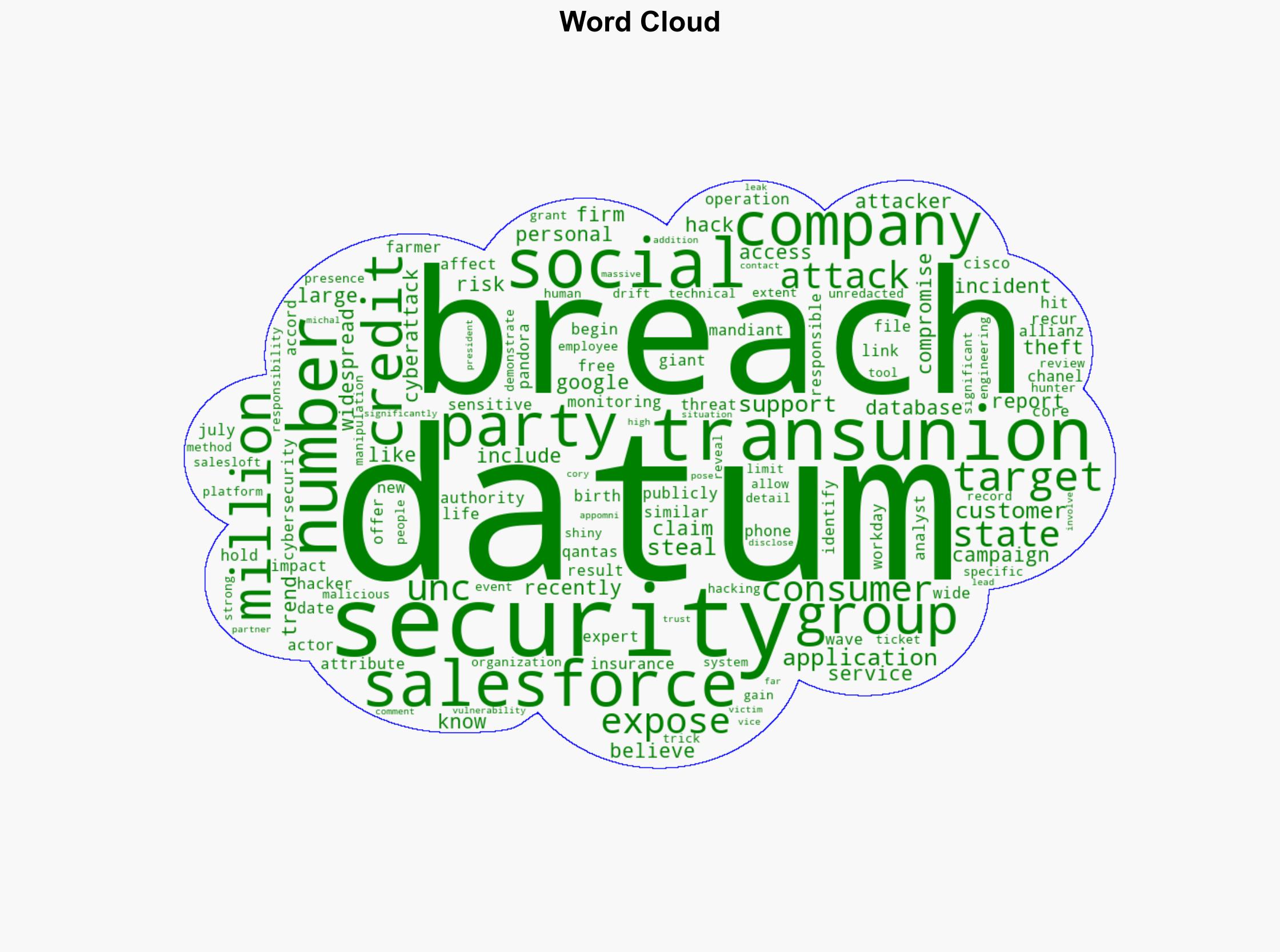

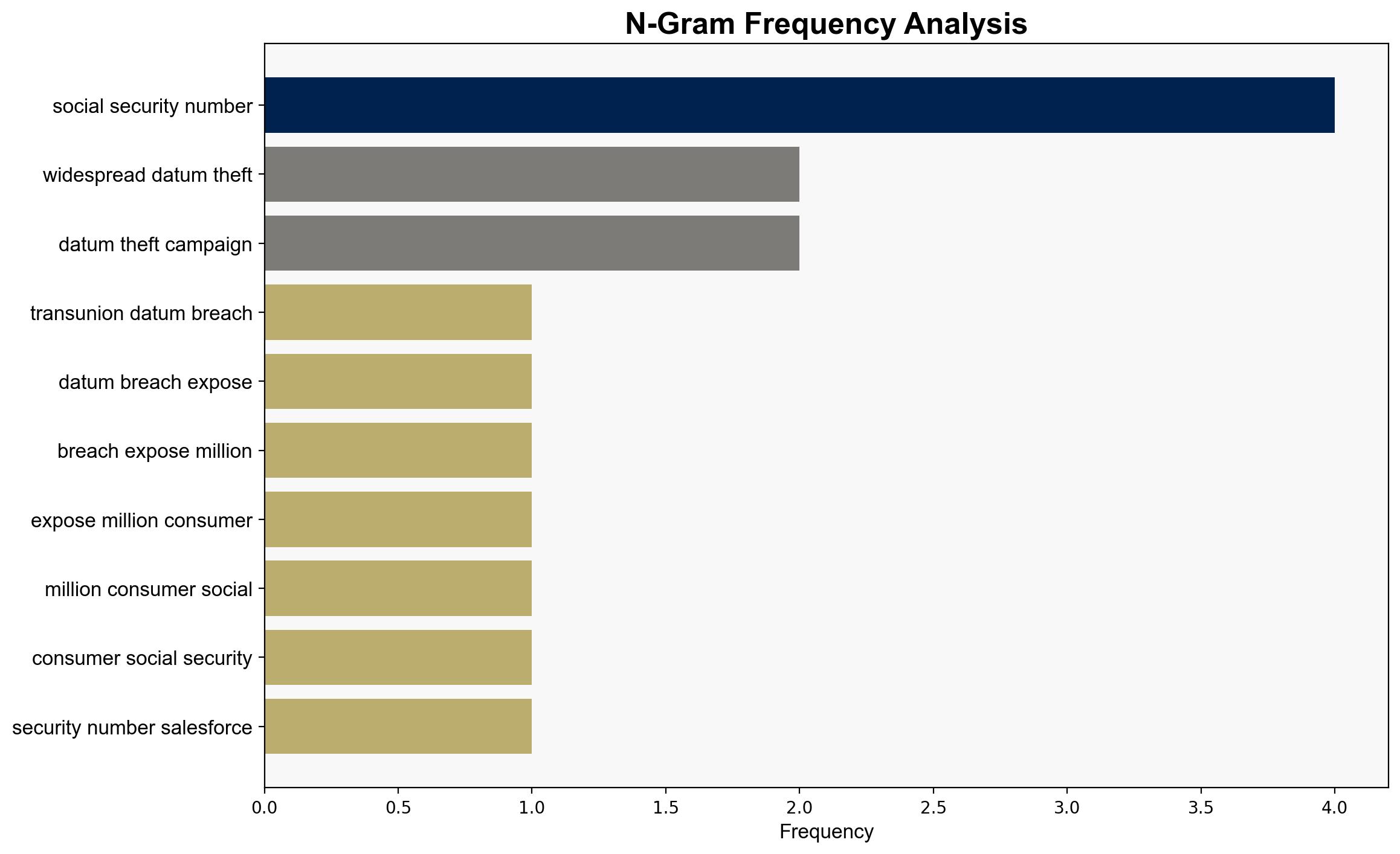

The most supported hypothesis is that the TransUnion data breach was orchestrated by the hacker group UNC, leveraging social engineering and technical hacking to exploit vulnerabilities in third-party applications like Salesforce. Confidence level: Moderate. Recommended action: Enhance cybersecurity protocols focusing on third-party integrations and employee training to mitigate social engineering risks.

2. Competing Hypotheses

Hypothesis 1: The breach was executed by the hacker group UNC, targeting Salesforce databases using social engineering and technical hacking methods. This hypothesis is supported by the attribution from cybersecurity firm Mandiant and the known tactics of UNC.

Hypothesis 2: The breach was a result of an insider threat within TransUnion or its partners, exploiting access to sensitive data. This hypothesis considers the potential for internal manipulation or negligence, given the scale and specificity of the data accessed.

Using ACH 2.0, Hypothesis 1 is better supported due to the alignment of known UNC tactics with the breach details and the attribution by a credible cybersecurity firm. Hypothesis 2 lacks direct evidence and relies on circumstantial assumptions about insider threats.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the reliability of Mandiant’s attribution and the effectiveness of UNC’s known methods. For Hypothesis 2, the assumption is that insider threats are plausible given the data access level. Red flags include the absence of direct evidence linking UNC to the breach and potential bias in attributing the attack to a known group without considering other actors.

4. Implications and Strategic Risks

The breach highlights vulnerabilities in third-party applications and the increasing sophistication of social engineering attacks. It poses significant risks to consumer privacy and trust in credit reporting agencies. Economically, it could lead to increased regulatory scrutiny and financial penalties for TransUnion. Geopolitically, it may exacerbate tensions if linked to state-sponsored actors.

5. Recommendations and Outlook

- Enhance security protocols for third-party applications and conduct regular audits.

- Implement comprehensive employee training programs to mitigate social engineering risks.

- Scenario-based projections:

- Best Case: Strengthened cybersecurity measures prevent future breaches.

- Worst Case: Continued breaches lead to significant financial and reputational damage.

- Most Likely: Incremental improvements in security reduce breach frequency but do not eliminate risk entirely.

6. Key Individuals and Entities

Cory Michal, Vice President of Security at AppOmni, commented on the high risk posed by the incident. The hacker group UNC and the cybersecurity firm Mandiant are key entities involved in the analysis and attribution of the breach.

7. Thematic Tags

national security threats, cybersecurity, data privacy, third-party risk management