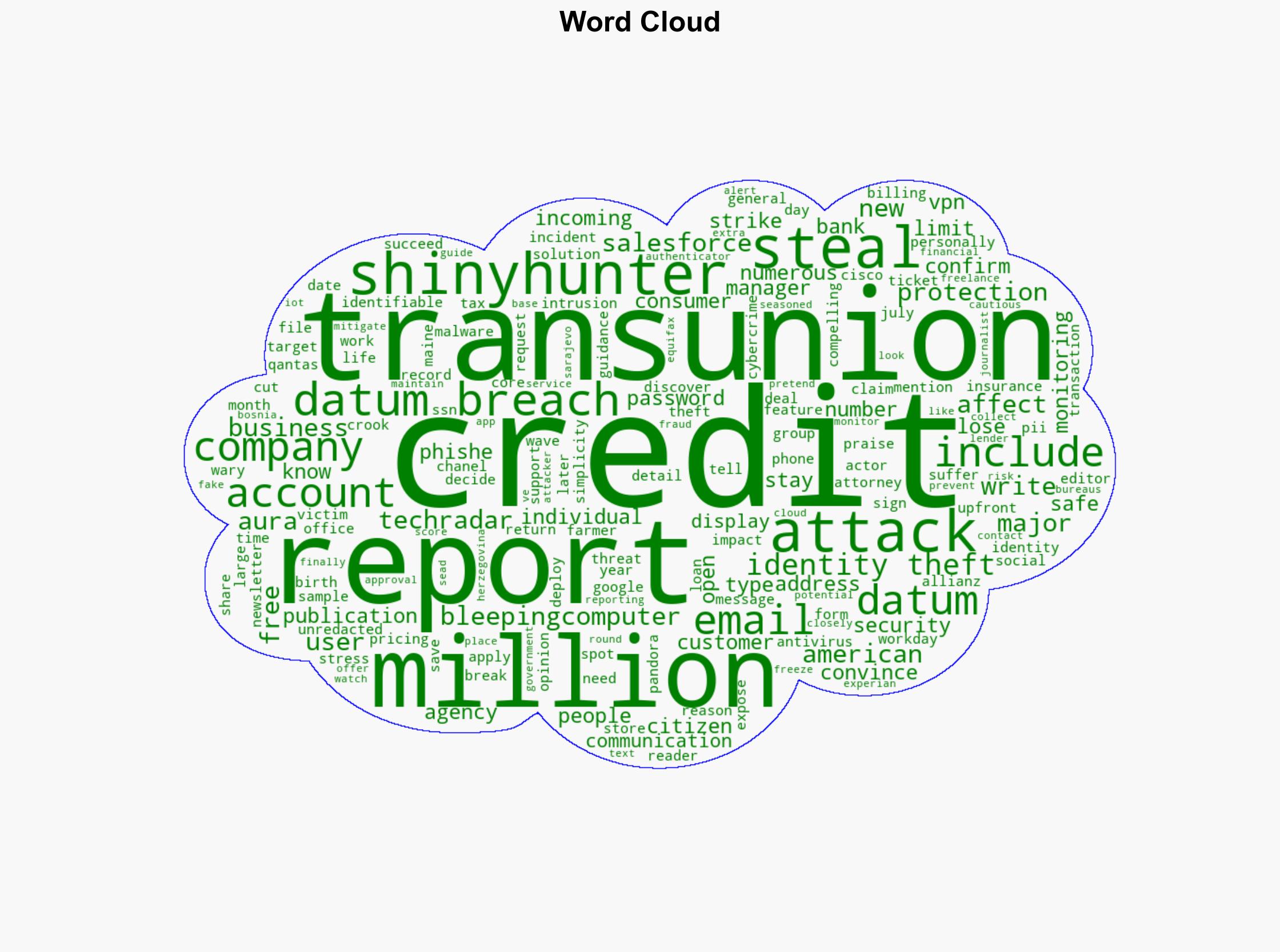

TransUnion data breach may have affected 44 million users – here’s what we know and how to stay safe – TechRadar

Published on: 2025-08-29

Intelligence Report: TransUnion Data Breach May Have Affected 44 Million Users – Here’s What We Know and How to Stay Safe – TechRadar

1. BLUF (Bottom Line Up Front)

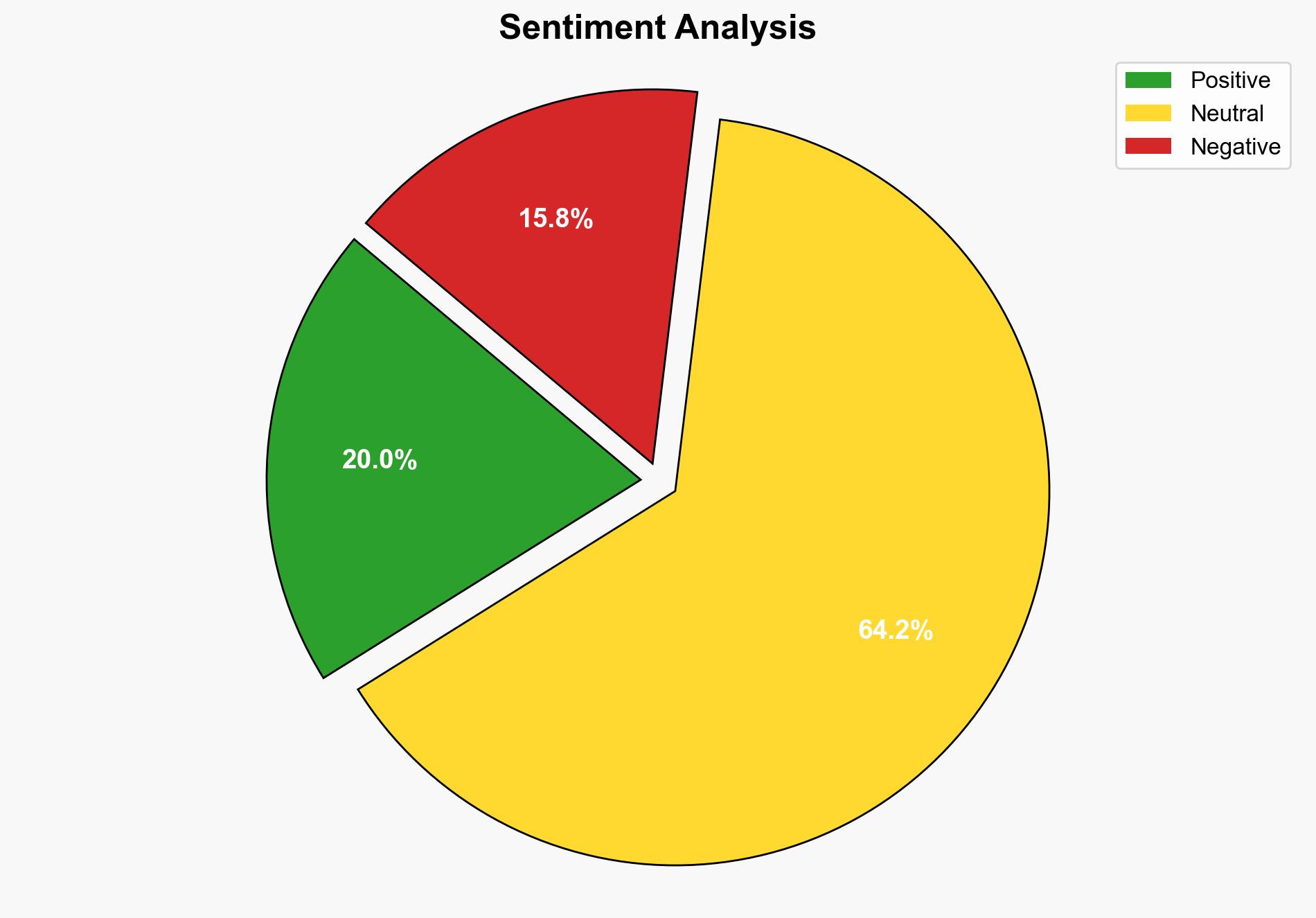

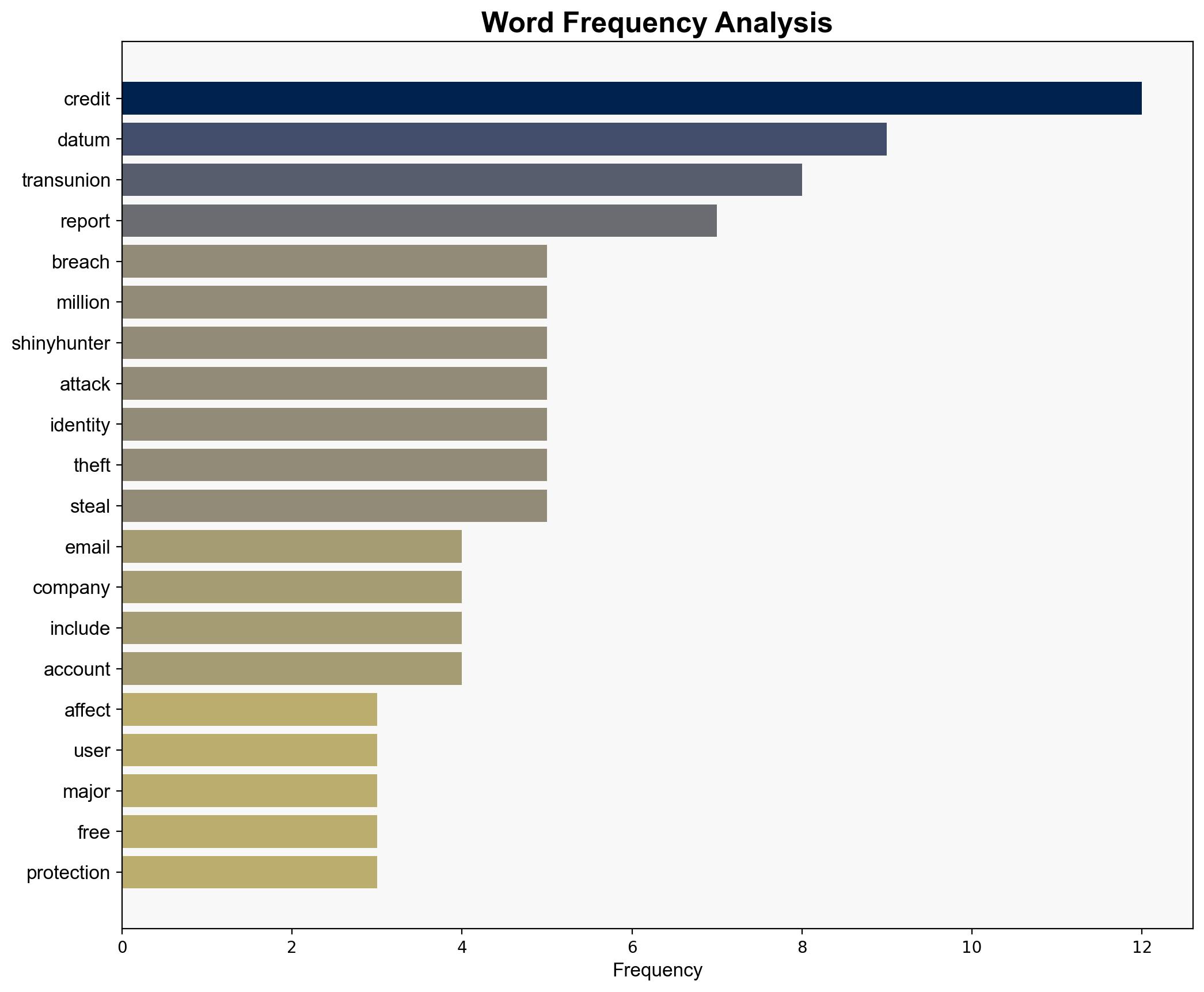

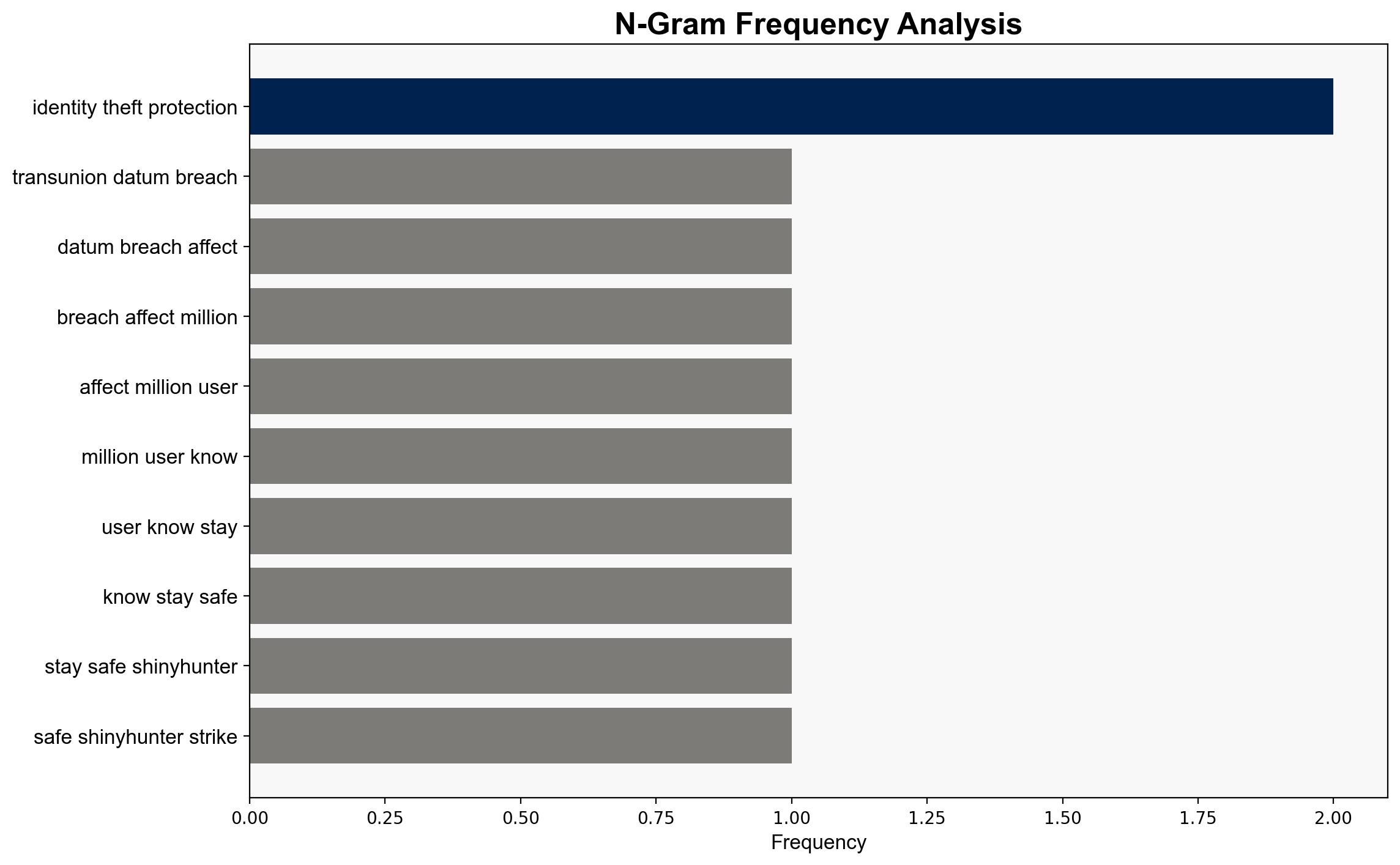

The TransUnion data breach, potentially affecting 44 million users, poses significant risks of identity theft and financial fraud. The most supported hypothesis suggests that the breach was orchestrated by the ShinyHunters group, leveraging vulnerabilities in Salesforce accounts. Immediate actions include enhancing cybersecurity measures and offering comprehensive identity protection services. Confidence level: Moderate.

2. Competing Hypotheses

1. **Hypothesis A**: The breach was conducted by the ShinyHunters group, exploiting Salesforce vulnerabilities to access TransUnion data.

2. **Hypothesis B**: The breach resulted from an internal security lapse at TransUnion, unrelated to external threat actors.

Using ACH 2.0, Hypothesis A is better supported due to the group’s known history of similar attacks and their claim of responsibility. Hypothesis B lacks corroborative evidence and does not align with the pattern of previous breaches.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes ShinyHunters’ capability and intent to target TransUnion. Hypothesis B assumes internal security weaknesses.

– **Red Flags**: Lack of detailed technical evidence from TransUnion about the breach method. Absence of third-party verification of ShinyHunters’ claims.

– **Blind Spots**: Potential underestimation of insider threats or alternative external actors.

4. Implications and Strategic Risks

– **Economic**: Potential financial losses for affected individuals and increased costs for TransUnion in legal fees and security enhancements.

– **Cyber**: Escalation of cyber threats targeting credit reporting agencies, increasing the need for robust cybersecurity frameworks.

– **Geopolitical**: Potential international implications if foreign actors are involved.

– **Psychological**: Erosion of consumer trust in credit reporting agencies, impacting their business models.

5. Recommendations and Outlook

- Enhance cybersecurity protocols, focusing on third-party service integrations like Salesforce.

- Offer extended identity protection services to affected users beyond the initial period.

- Conduct a thorough forensic investigation to identify breach specifics and prevent recurrence.

- Best Case: Rapid containment and mitigation of the breach impact with minimal financial loss.

- Worst Case: Prolonged exploitation of stolen data leading to widespread identity theft and financial fraud.

- Most Likely: Gradual recovery with increased cybersecurity measures and partial restoration of consumer trust.

6. Key Individuals and Entities

– ShinyHunters (threat actor group)

– TransUnion (affected entity)

– Salesforce (platform exploited in the breach)

7. Thematic Tags

national security threats, cybersecurity, data breach, identity theft, financial fraud