C3is Inc reports second quarter and six months 2025 financial and operating results – GlobeNewswire

Published on: 2025-09-02

Intelligence Report: C3is Inc reports second quarter and six months 2025 financial and operating results – GlobeNewswire

1. BLUF (Bottom Line Up Front)

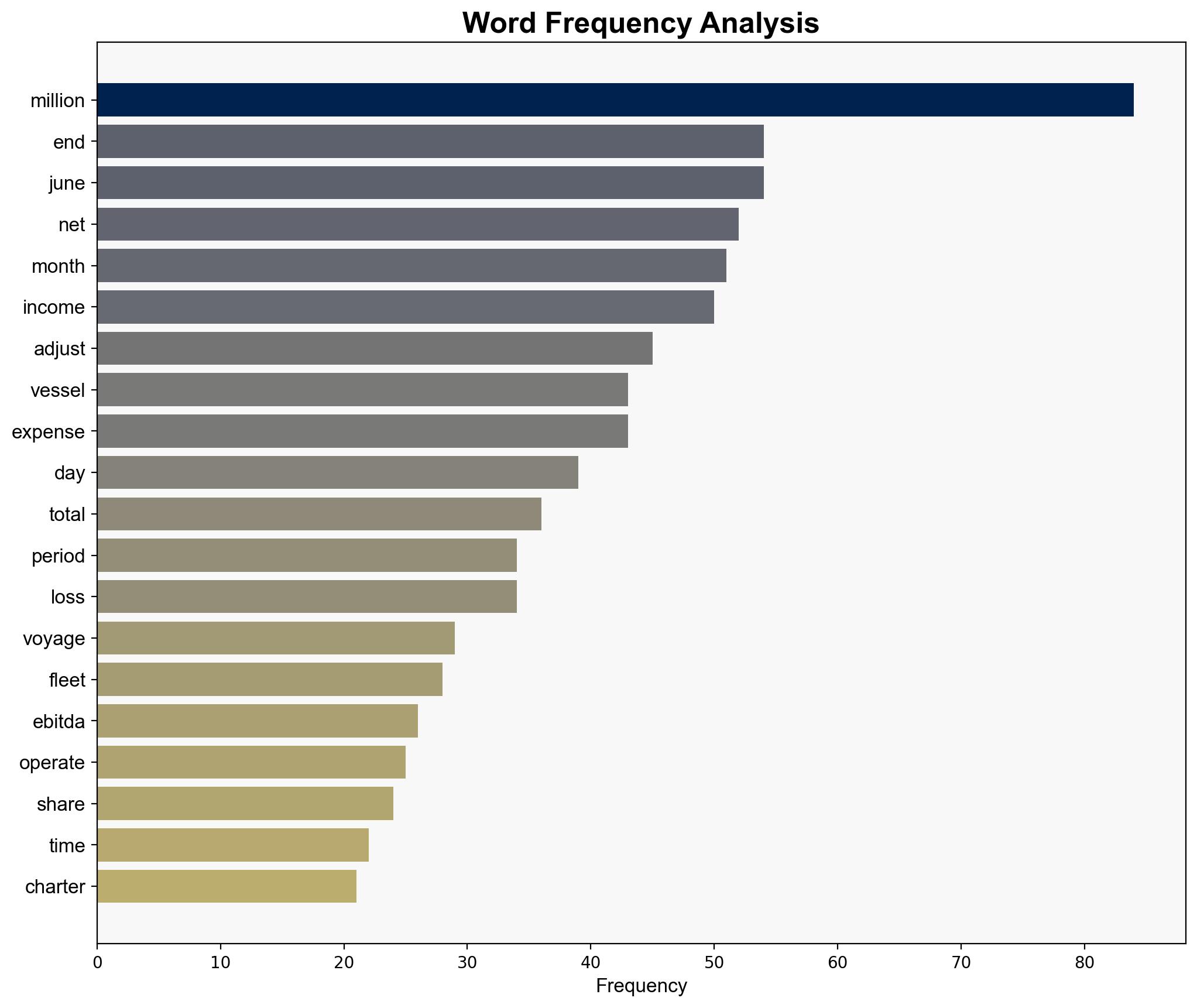

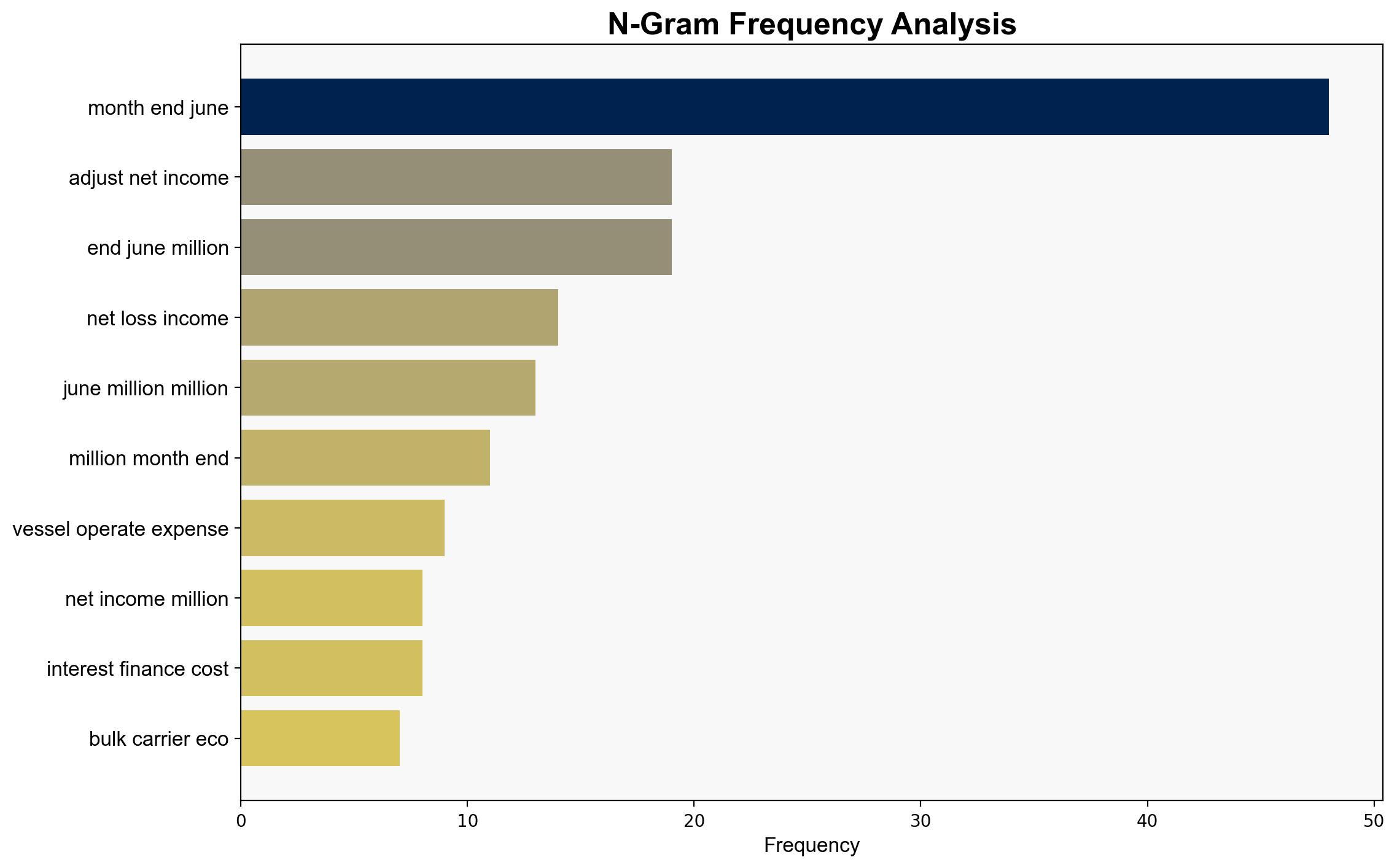

The strategic judgment indicates a moderate confidence level that C3is Inc is experiencing operational challenges due to decreased revenue and increased expenses, which may impact its financial stability. The most supported hypothesis suggests that the company’s current strategy of operating in the spot market is not yielding expected returns. Recommended action includes a reassessment of market strategy and cost management to stabilize financial performance.

2. Competing Hypotheses

Hypothesis 1: C3is Inc’s financial downturn is primarily due to external market conditions affecting the spot market rates, leading to decreased revenue and increased operational costs.

Hypothesis 2: The financial challenges are largely internal, stemming from strategic missteps such as over-reliance on the spot market and inadequate cost control measures.

Using ACH 2.0, Hypothesis 2 is better supported. The consistent decrease in TCE rates and increased operational expenses, despite a stable fleet size, suggest internal strategic issues rather than purely external market conditions.

3. Key Assumptions and Red Flags

– Assumption: The spot market will recover, improving TCE rates.

– Red Flag: The consistent decline in revenue despite operational adjustments.

– Potential Bias: Overestimation of market recovery and underestimation of internal inefficiencies.

– Missing Data: Detailed breakdown of strategic initiatives to counteract financial losses.

4. Implications and Strategic Risks

The current financial trajectory poses risks of liquidity issues and potential inability to meet capital commitments. If unaddressed, this could lead to asset liquidation or increased borrowing, impacting long-term viability. Economic implications include reduced investor confidence and potential market share loss. Geopolitically, reliance on volatile markets could expose the company to regional instabilities.

5. Recommendations and Outlook

- Reassess market strategy to reduce reliance on the spot market; consider long-term charters to stabilize revenue.

- Implement stringent cost control measures to manage operational expenses.

- Scenario Projections:

- Best Case: Successful strategic pivot leads to stabilized revenue and reduced costs.

- Worst Case: Continued financial decline necessitates asset sales or restructuring.

- Most Likely: Incremental improvements with moderate financial recovery.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. The focus remains on C3is Inc as the primary entity.

7. Thematic Tags

financial stability, strategic management, market analysis, operational efficiency