Venture capital investments are reshaping the defense tech landscape – Techpinions.com

Published on: 2025-09-05

Intelligence Report: Venture capital investments are reshaping the defense tech landscape – Techpinions.com

1. BLUF (Bottom Line Up Front)

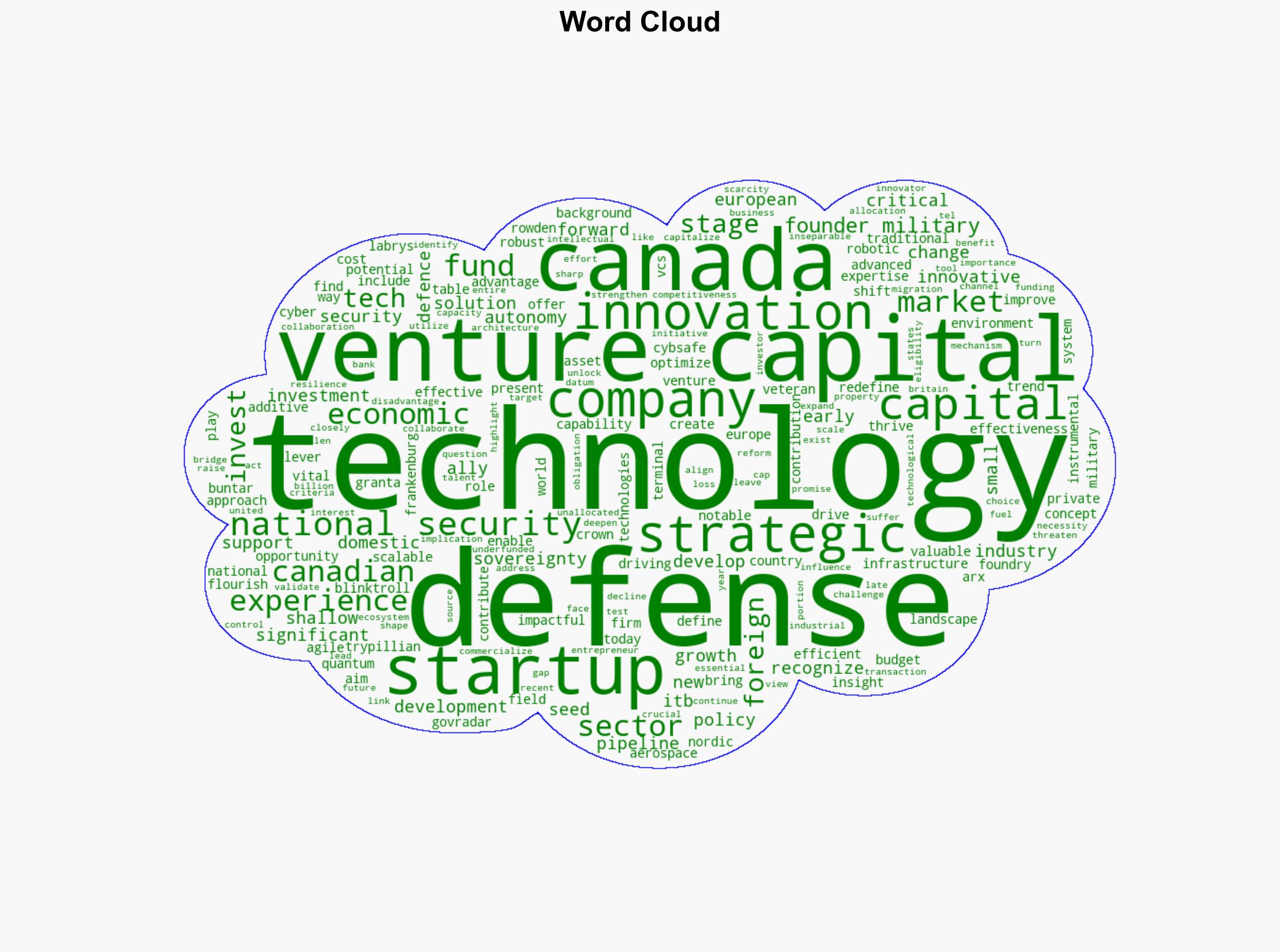

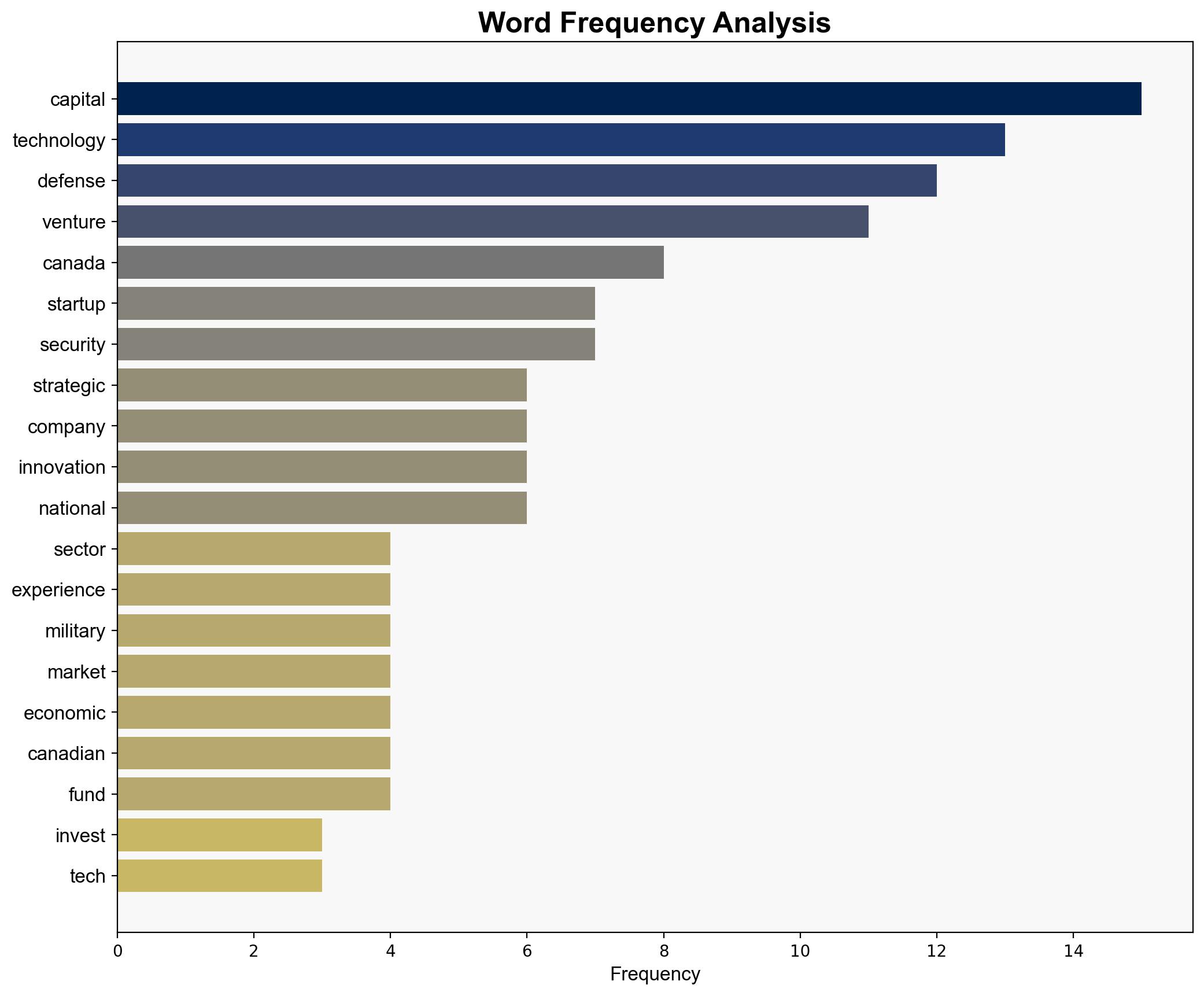

Venture capital is increasingly pivotal in transforming the defense technology landscape, offering both opportunities and risks. The most supported hypothesis is that venture capital investments are crucial for fostering innovation and maintaining national security competitiveness. However, Canada faces strategic vulnerabilities due to its shallow venture capital market. Confidence level: Moderate. Recommended action: Strengthen domestic venture capital frameworks to support defense tech innovation and mitigate foreign dependency.

2. Competing Hypotheses

Hypothesis 1: Venture capital investments are essential for driving innovation in the defense technology sector, enhancing national security capabilities and economic competitiveness.

Hypothesis 2: The reliance on venture capital, especially foreign investment, poses a risk to national security by potentially leading to foreign control over critical technologies and intellectual property.

3. Key Assumptions and Red Flags

Assumptions:

– Venture capital is assumed to be a primary driver of innovation in defense technology.

– The strategic importance of maintaining domestic control over defense tech is presumed.

Red Flags:

– Potential over-reliance on foreign venture capital could lead to loss of control over critical technologies.

– Lack of detailed data on the specific impact of venture capital on defense tech innovation.

4. Implications and Strategic Risks

– Economic: Insufficient domestic venture capital could hinder the growth of homegrown defense tech startups, leading to economic and technological dependence on foreign entities.

– Cyber: Increased foreign investment may expose sensitive technologies to cyber espionage.

– Geopolitical: Countries with robust venture capital markets may gain strategic advantages, influencing global defense dynamics.

– Psychological: Domestic innovators may feel discouraged by the lack of support, leading to talent migration.

5. Recommendations and Outlook

- Strengthen domestic venture capital initiatives to support defense tech startups, reducing reliance on foreign investment.

- Implement policies to protect intellectual property and critical technologies from foreign control.

- Scenario Projections:

- Best Case: Enhanced domestic venture capital leads to a thriving defense tech sector, boosting national security and economic growth.

- Worst Case: Continued reliance on foreign venture capital results in loss of control over critical technologies and increased national security risks.

- Most Likely: Incremental improvements in domestic venture capital support, with ongoing challenges in fully securing technology sovereignty.

6. Key Individuals and Entities

– Quantum System

– Terminal Autonomy

– Cybsafe

– Rowden Technology

– Frankenburg Technologies

– Arx Robotic

– Buntar Aerospace

– Blinktroll

– Trypillian Labrys Technology

– Ally Additive Industry

– Nordic Defence Innovation Foundry

– Crown Cyber Defence

– GovRadar

– Granta Autonomy

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus