Imperial Petroleum Inc Reports Second Quarter and Six Months 2025 Financial and Operating Results – GlobeNewswire

Published on: 2025-09-05

Intelligence Report: Imperial Petroleum Inc Reports Second Quarter and Six Months 2025 Financial and Operating Results – GlobeNewswire

1. BLUF (Bottom Line Up Front)

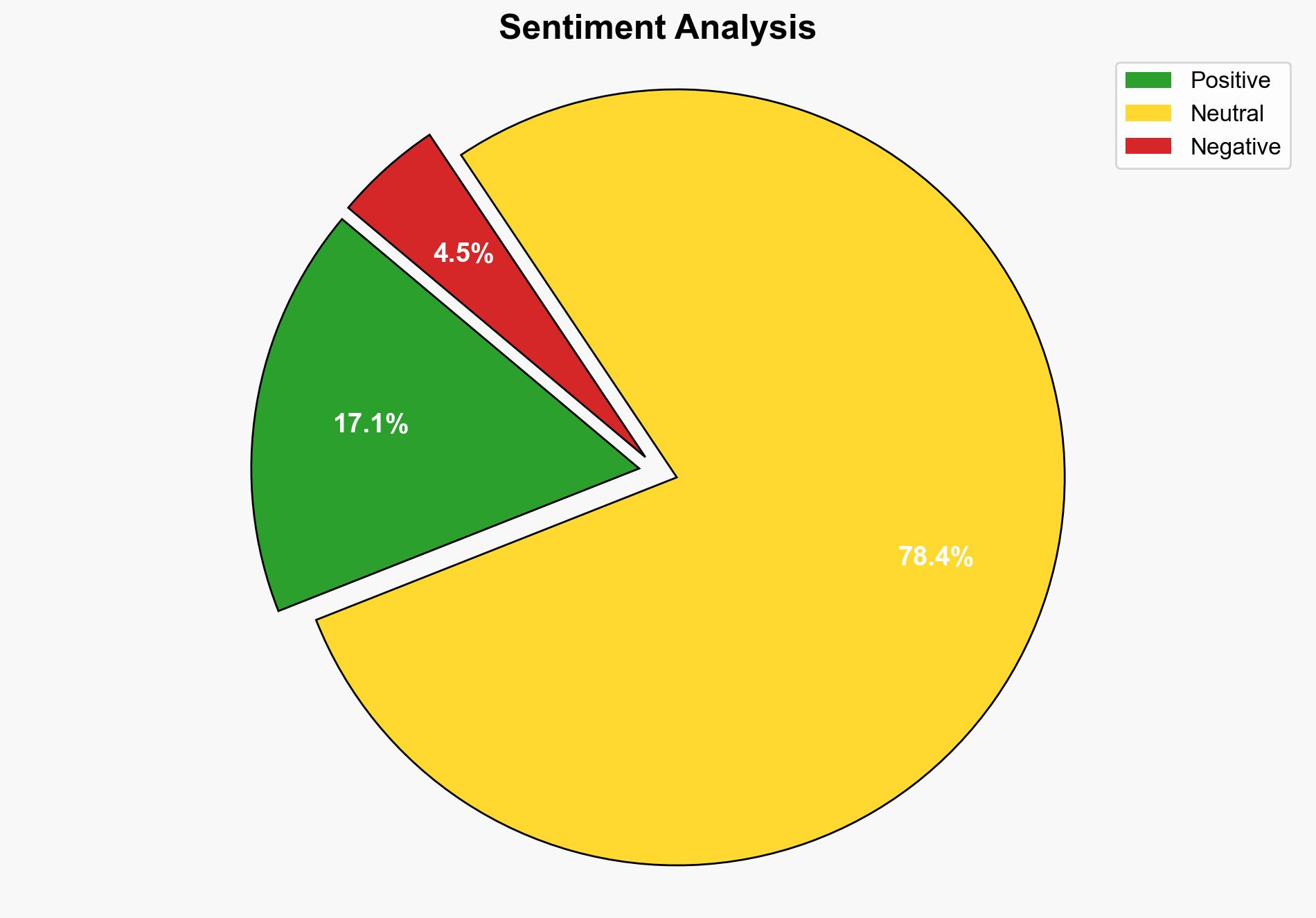

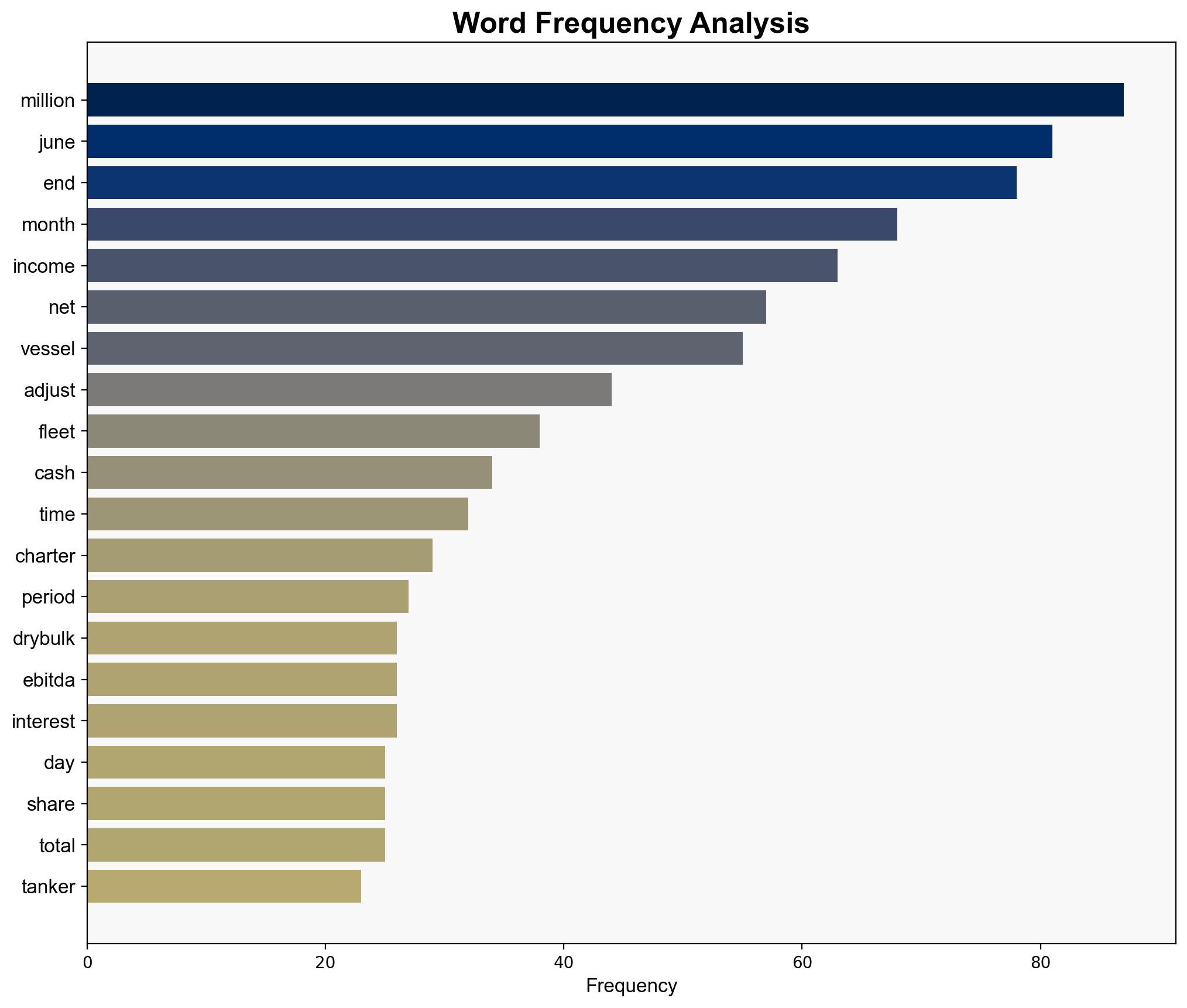

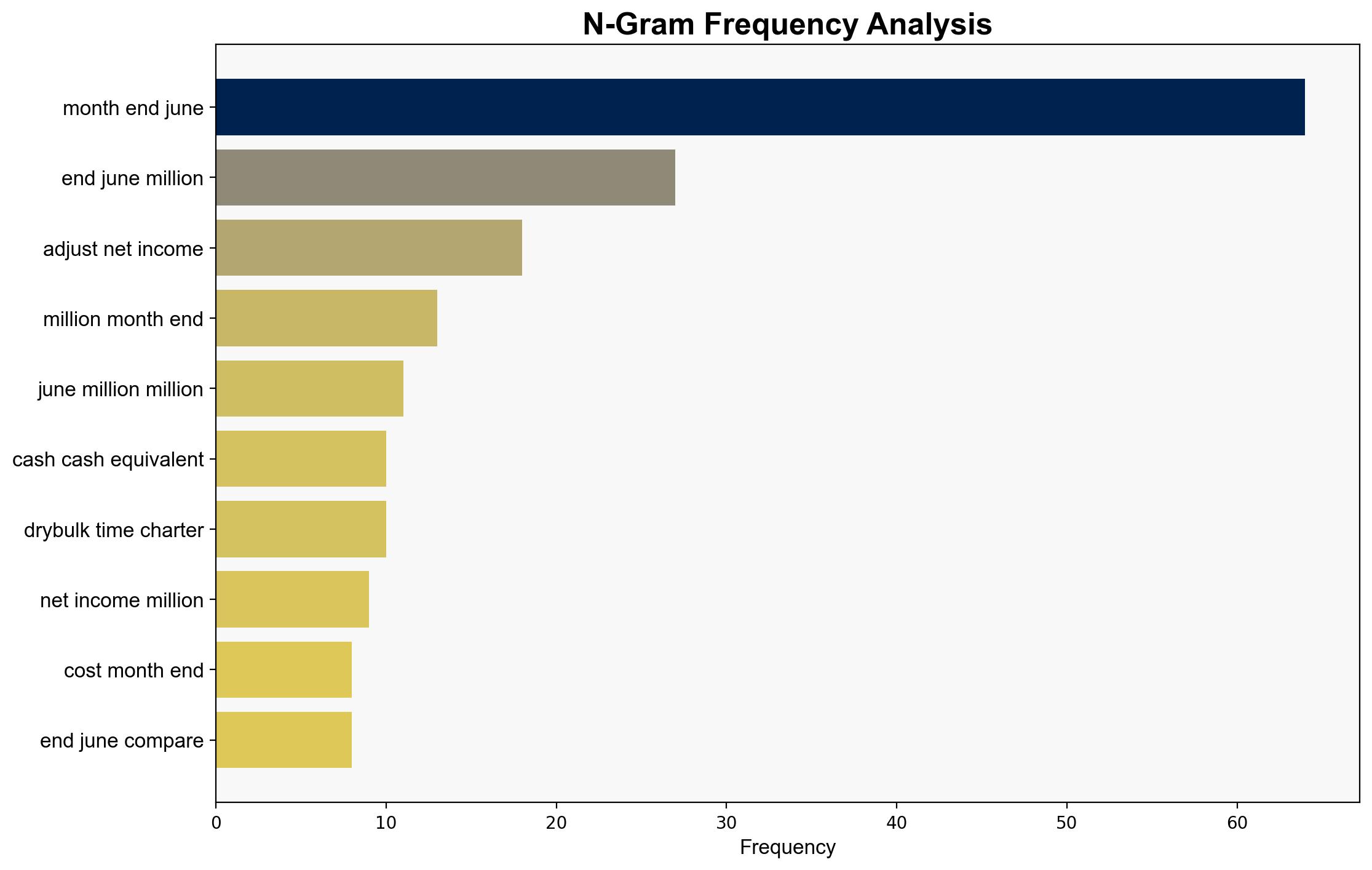

Imperial Petroleum Inc’s financial results for the second quarter of 2025 indicate a strategic shift towards expanding their fleet, despite a decrease in revenue due to lower tanker market rates. The most supported hypothesis is that the company is positioning itself for long-term growth by increasing its fleet capacity. Confidence level: Moderate. Recommended action: Monitor market rate trends and fleet utilization to assess the effectiveness of this expansion strategy.

2. Competing Hypotheses

Hypothesis 1: Imperial Petroleum is strategically expanding its fleet to capitalize on anticipated future increases in market rates and demand for seaborne transportation services.

Hypothesis 2: The expansion of the fleet is a defensive measure to offset declining revenues and market rates, aiming to maintain operational viability through increased volume.

Using ACH 2.0, Hypothesis 1 is better supported by the evidence of increased fleet size and the company’s investment in new vessels, suggesting a forward-looking strategy. Hypothesis 2 is less supported as the company has not indicated any immediate financial distress or need for defensive actions.

3. Key Assumptions and Red Flags

Assumptions: The primary assumption is that market rates will improve, justifying the fleet expansion. Another assumption is that the increased fleet will lead to higher future revenues.

Red Flags: The decrease in revenue and market rates poses a risk if these trends continue. The reliance on market rate recovery is a potential vulnerability.

4. Implications and Strategic Risks

If market rates do not recover, Imperial Petroleum may face financial strain due to increased operating expenses from a larger fleet. Additionally, geopolitical tensions or economic downturns could further depress market rates, impacting profitability. The expansion strategy could lead to overcapacity if demand does not materialize as expected.

5. Recommendations and Outlook

- Monitor global market rate trends and adjust fleet utilization strategies accordingly.

- Consider diversifying revenue streams to mitigate reliance on market rate recovery.

- Scenario Projections:

- Best Case: Market rates recover, leading to increased profitability from the expanded fleet.

- Worst Case: Continued decline in market rates results in financial losses and potential asset sales.

- Most Likely: Moderate recovery in market rates with gradual improvement in financial performance.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. The focus is on Imperial Petroleum Inc as an entity.

7. Thematic Tags

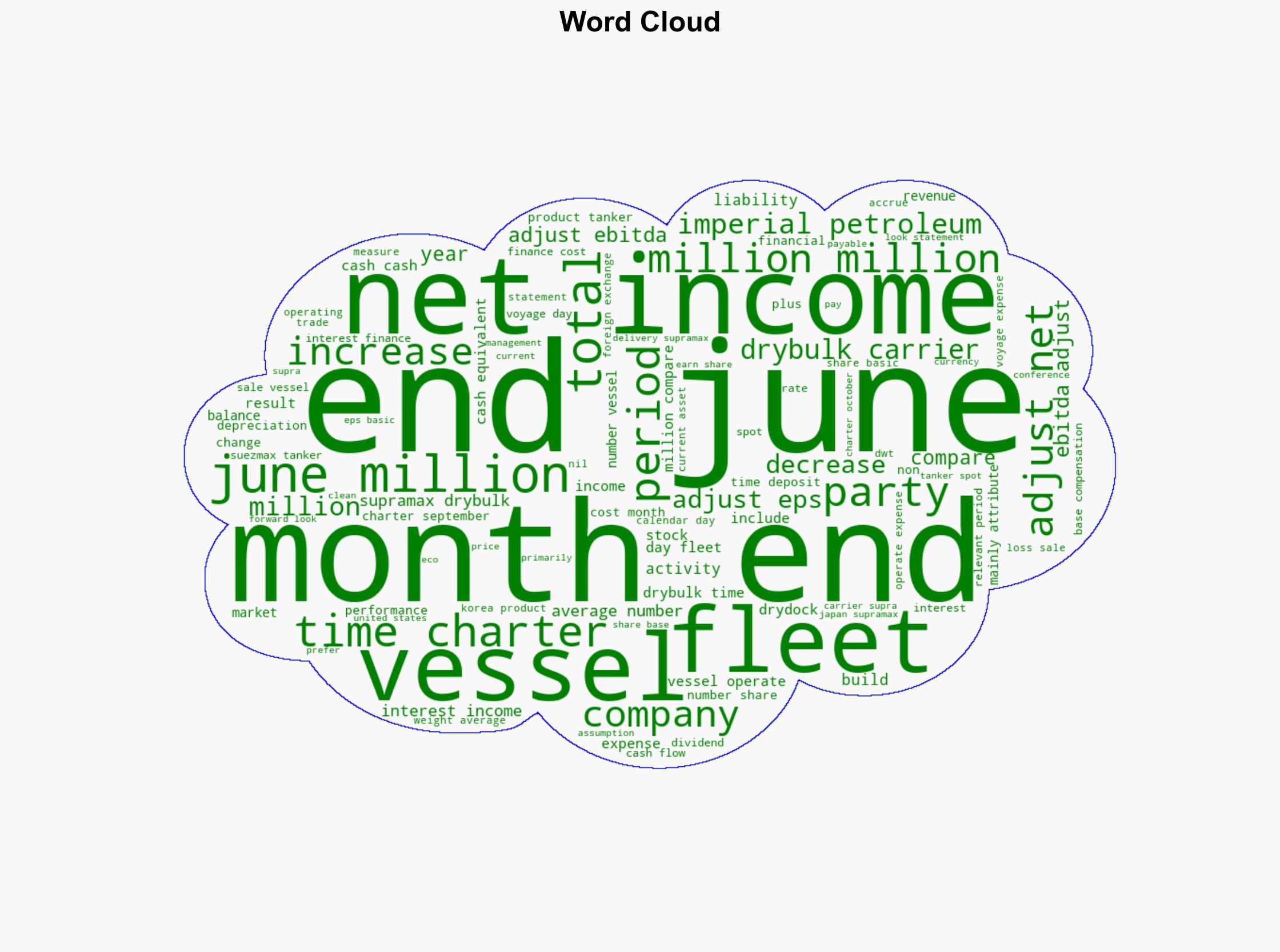

economic strategy, maritime industry, market analysis, fleet expansion