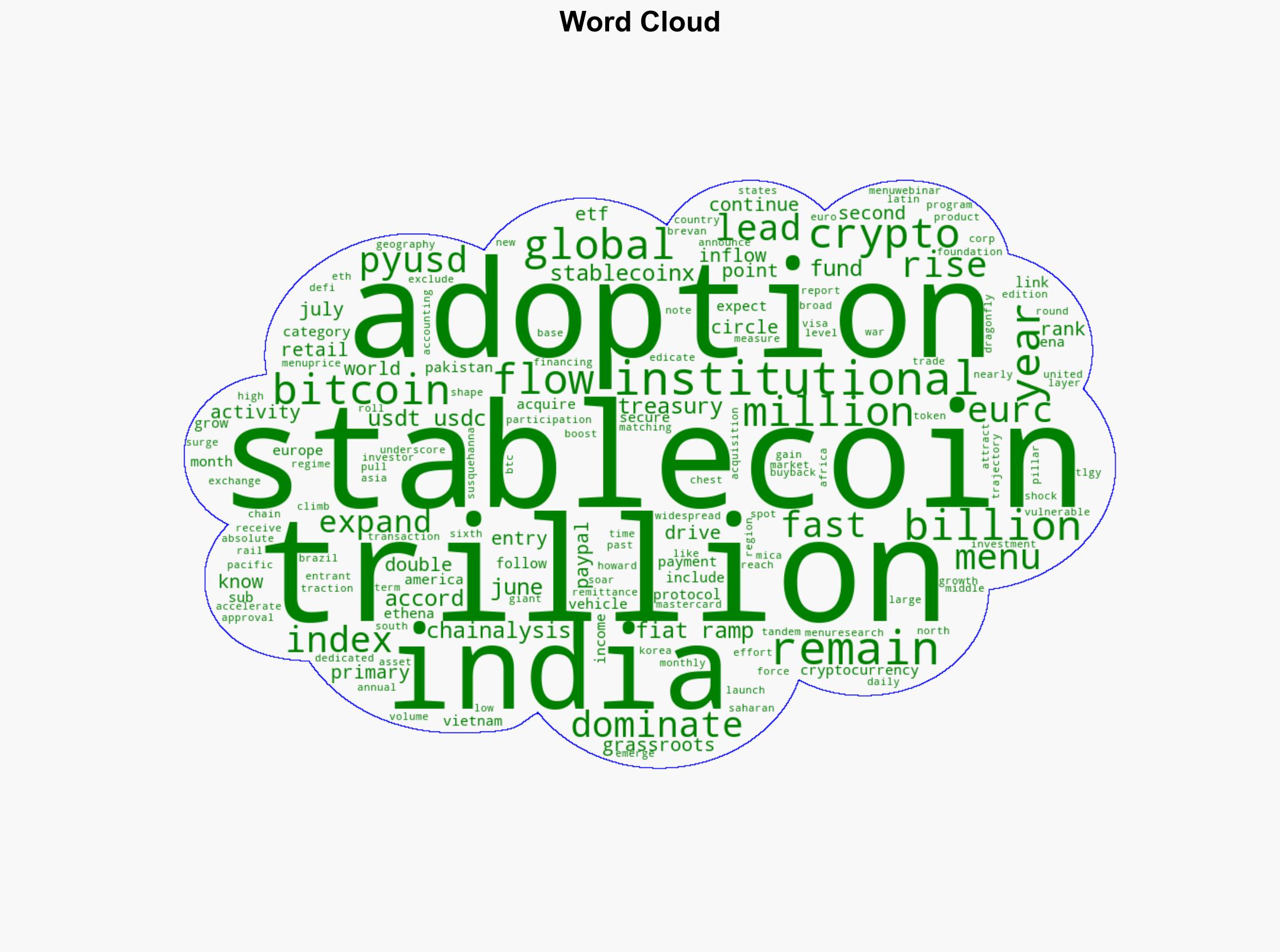

Bitcoin and Stablecoins Dominate as India US Top 2025 Crypto Adoption Index – CoinDesk

Published on: 2025-09-06

Intelligence Report: Bitcoin and Stablecoins Dominate as India US Top 2025 Crypto Adoption Index – CoinDesk

1. BLUF (Bottom Line Up Front)

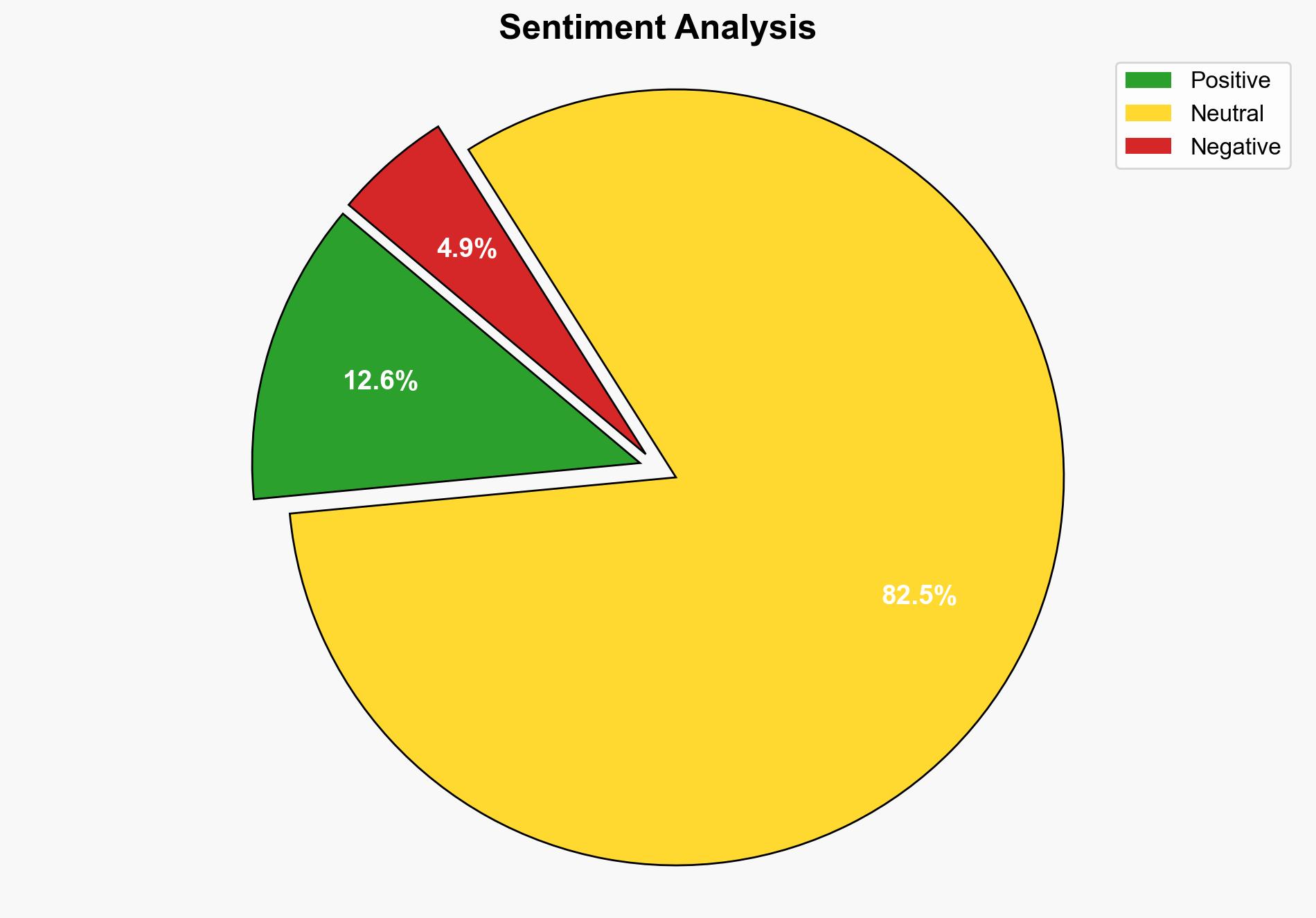

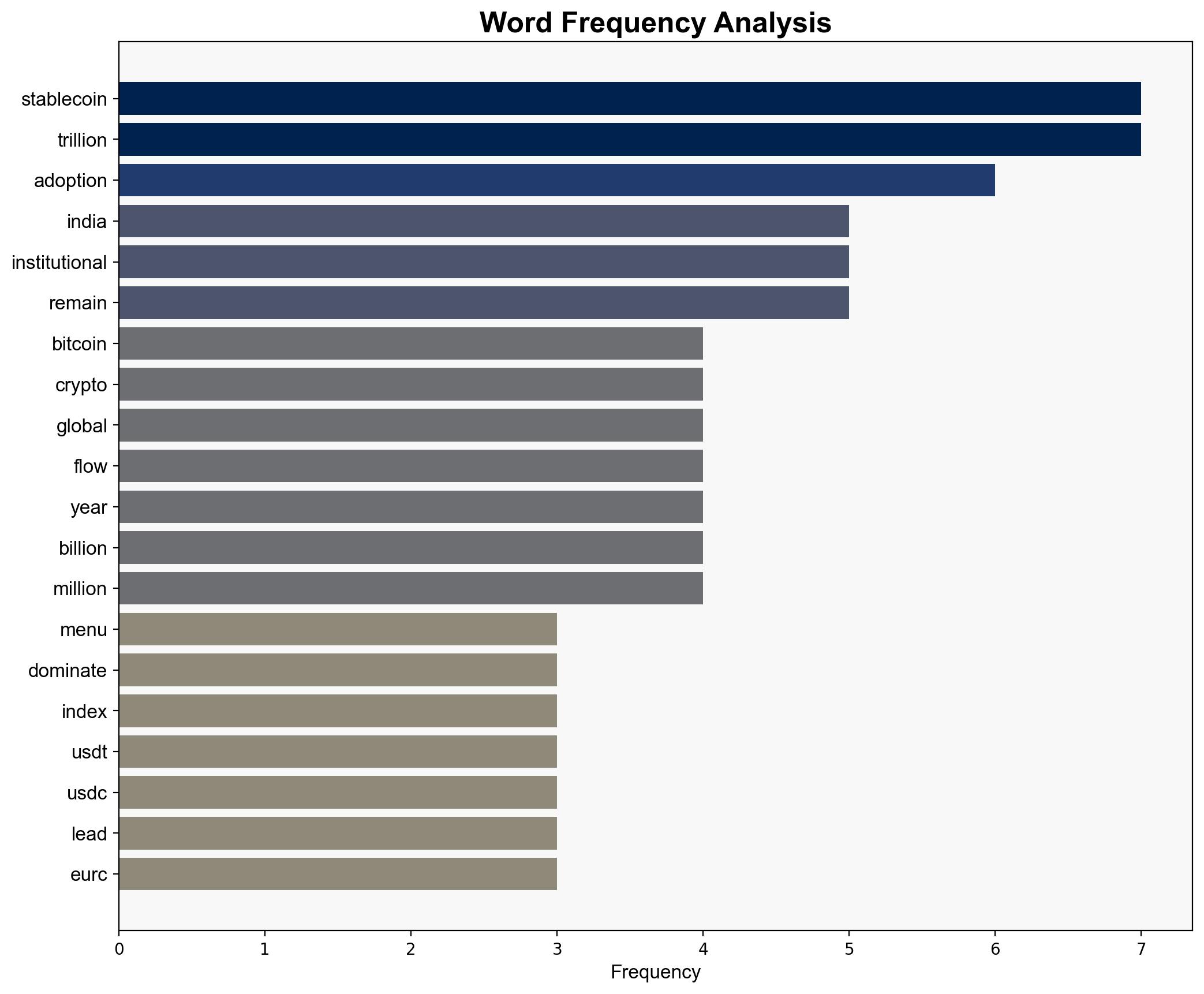

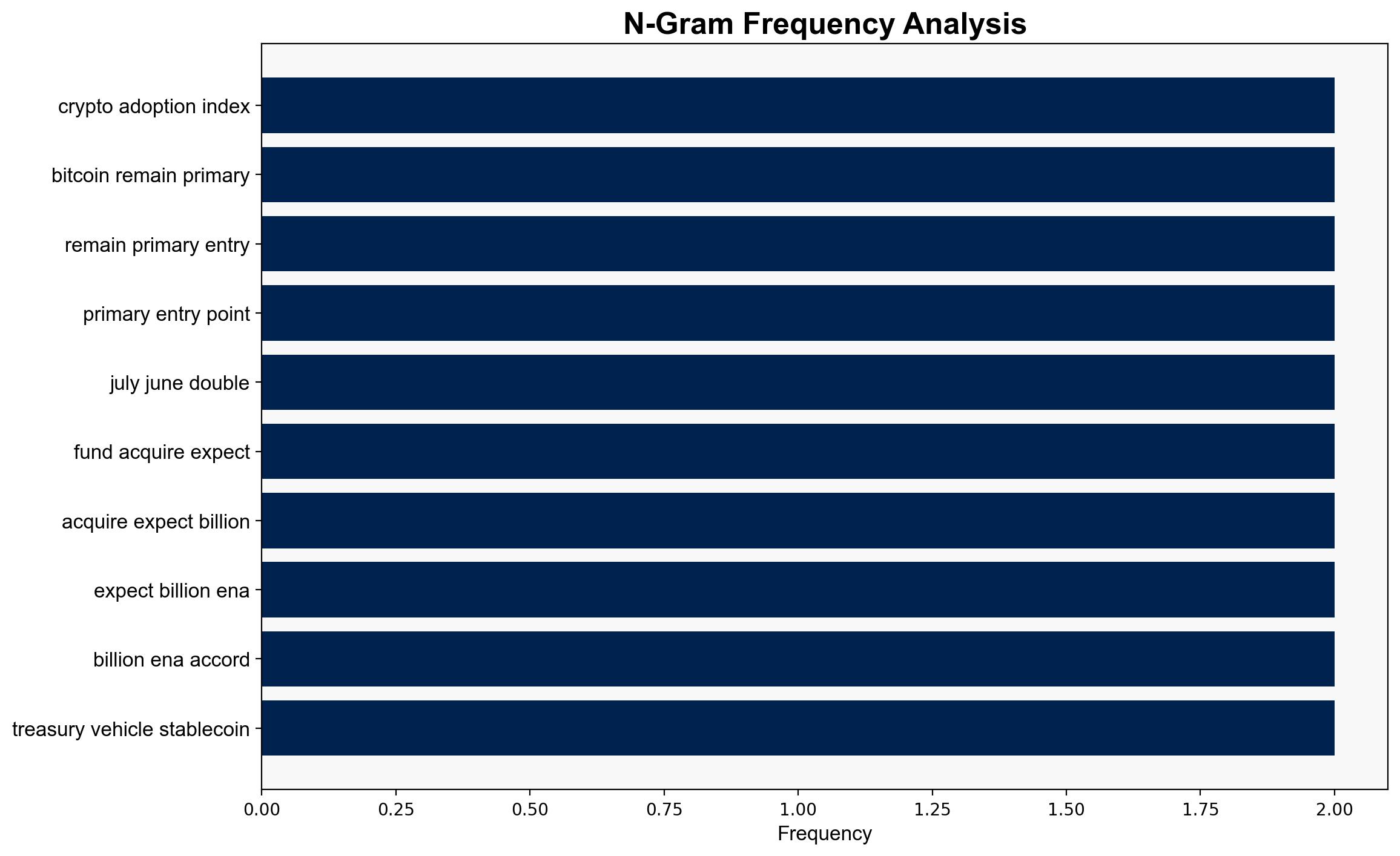

The strategic judgment is that the rise in cryptocurrency adoption, particularly Bitcoin and stablecoins, in India and the US is driven by both grassroots and institutional factors. The hypothesis that institutional adoption, spurred by regulatory clarity and financial innovation, is the primary driver is better supported. Confidence level: Moderate. Recommended action: Monitor regulatory developments and institutional investment trends to anticipate shifts in cryptocurrency market dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: The surge in cryptocurrency adoption in India and the US is primarily driven by grassroots movements and retail investors seeking alternative financial systems.

2. **Hypothesis B**: Institutional adoption, facilitated by regulatory clarity and the introduction of financial products like ETFs, is the primary driver of the increased cryptocurrency adoption in these regions.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis B is better supported due to the significant mention of institutional activities, such as the approval of spot Bitcoin ETFs and the involvement of major financial entities like Visa and Mastercard in stablecoin-linked products.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that regulatory clarity will continue to improve, facilitating institutional investment. There is also an assumption that grassroots adoption will maintain its momentum without significant regulatory pushback.

– **Red Flags**: Potential over-reliance on institutional data may overshadow grassroots activities. The volatility of regulatory environments in both India and the US could disrupt current trends.

4. Implications and Strategic Risks

The increased adoption of cryptocurrencies could lead to significant shifts in financial markets, potentially destabilizing traditional banking systems. Economic risks include increased volatility in national currencies. Geopolitically, countries lagging in crypto adoption may face competitive disadvantages. Cybersecurity threats may escalate as more financial activities move to digital platforms.

5. Recommendations and Outlook

- Monitor regulatory changes in major markets to anticipate shifts in institutional behavior.

- Encourage the development of cybersecurity measures to protect digital financial transactions.

- Scenario-based projections:

- Best: Regulatory frameworks stabilize, leading to increased institutional investment and market growth.

- Worst: Regulatory crackdowns lead to market contraction and increased volatility.

- Most Likely: Continued gradual adoption with periodic regulatory adjustments.

6. Key Individuals and Entities

– Circle (issuer of USDC)

– PayPal (issuer of PYUSD)

– Visa and Mastercard (involved in stablecoin-linked products)

7. Thematic Tags

national security threats, cybersecurity, financial innovation, regulatory developments