WLFI Rises 30 Elon Musks Grok Calls It Potential Scam – Coinspeaker

Published on: 2025-09-07

Intelligence Report: WLFI Rises 30 Elon Musks Grok Calls It Potential Scam – Coinspeaker

1. BLUF (Bottom Line Up Front)

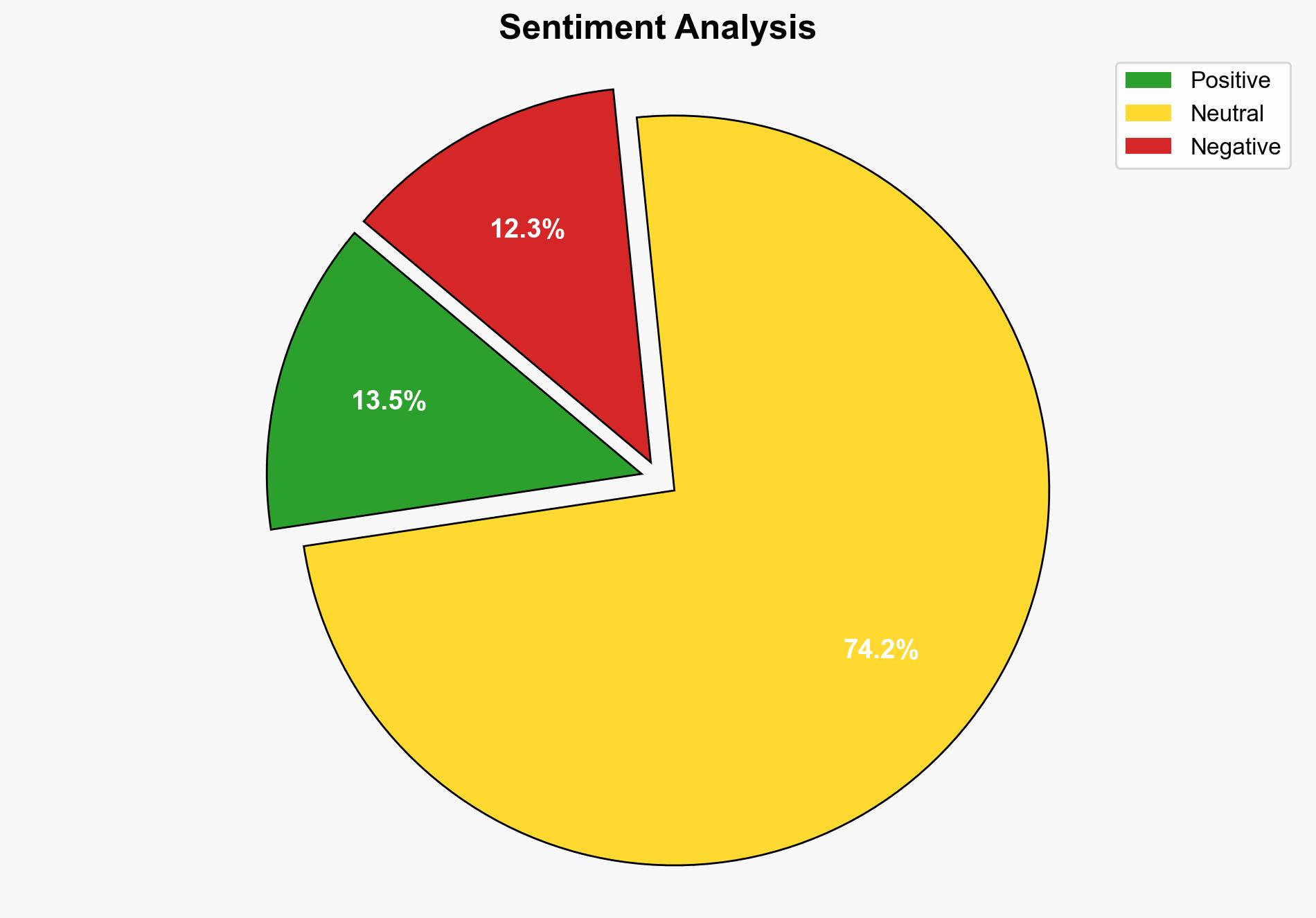

The analysis suggests a moderate confidence level that WLFI’s recent price surge is driven by speculative trading rather than fundamental value, with potential insider manipulation. The most supported hypothesis is that the project may be a speculative bubble with elements of deceptive practices. Recommended action includes heightened scrutiny and monitoring of trading activities and associated entities.

2. Competing Hypotheses

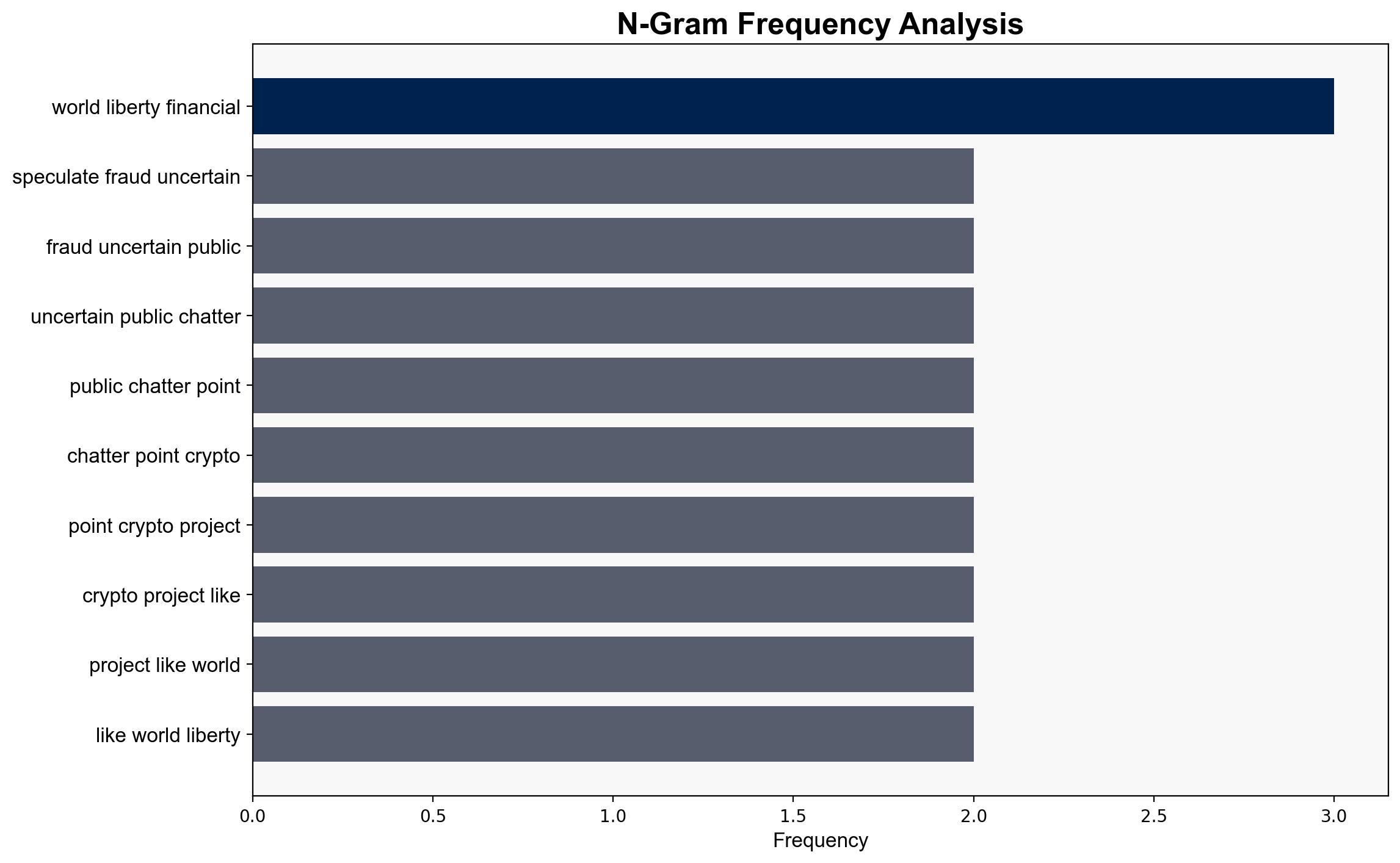

Hypothesis 1: WLFI’s price surge is primarily due to speculative trading and market manipulation, possibly involving insider activities linked to high-profile individuals like Justin Sun. This hypothesis is supported by the sharp sell-off patterns, blacklist wallet activities, and allegations of insider trading.

Hypothesis 2: WLFI’s rise is part of a legitimate market interest in decentralized finance (DeFi) projects, driven by genuine investor enthusiasm and strategic marketing. This hypothesis considers the involvement of prominent outlets and the potential for a genuine market-driven price increase.

Using ACH 2.0, Hypothesis 1 is better supported due to the presence of consistent selling pressures, allegations of insider trading, and the project’s association with controversial figures, which align with typical patterns of market manipulation.

3. Key Assumptions and Red Flags

– **Assumptions:** Hypothesis 1 assumes that insider trading and manipulation are feasible and that market participants are influenced by high-profile endorsements. Hypothesis 2 assumes that the DeFi market is mature enough to support genuine price surges.

– **Red Flags:** The involvement of Justin Sun and the blacklist of wallets suggest potential manipulation. The rapid price fluctuations and lack of transparency in project communications are also concerning.

– **Blind Spots:** The actual technological and business fundamentals of WLFI are not detailed, leaving a gap in understanding its intrinsic value.

4. Implications and Strategic Risks

The situation poses risks of financial loss for investors if WLFI is indeed a speculative bubble. There is also a reputational risk for associated individuals and platforms. If insider trading is confirmed, it could lead to legal repercussions and increased regulatory scrutiny on the DeFi sector.

5. Recommendations and Outlook

- Conduct a thorough investigation into the trading patterns and wallet activities associated with WLFI.

- Engage with regulatory bodies to ensure compliance and transparency in DeFi projects.

- Scenario Projections:

- Best Case: WLFI stabilizes, proving to be a legitimate project with long-term viability.

- Worst Case: WLFI collapses, leading to significant financial losses and regulatory crackdowns.

- Most Likely: Continued volatility with potential for further scrutiny and market corrections.

6. Key Individuals and Entities

– Justin Sun

– Elon Musk (via Grok)

– WLFI project developers

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus