Wealthsimple reveals data breach – users of financial firm warned to be on alert – TechRadar

Published on: 2025-09-08

Intelligence Report: Wealthsimple reveals data breach – users of financial firm warned to be on alert – TechRadar

1. BLUF (Bottom Line Up Front)

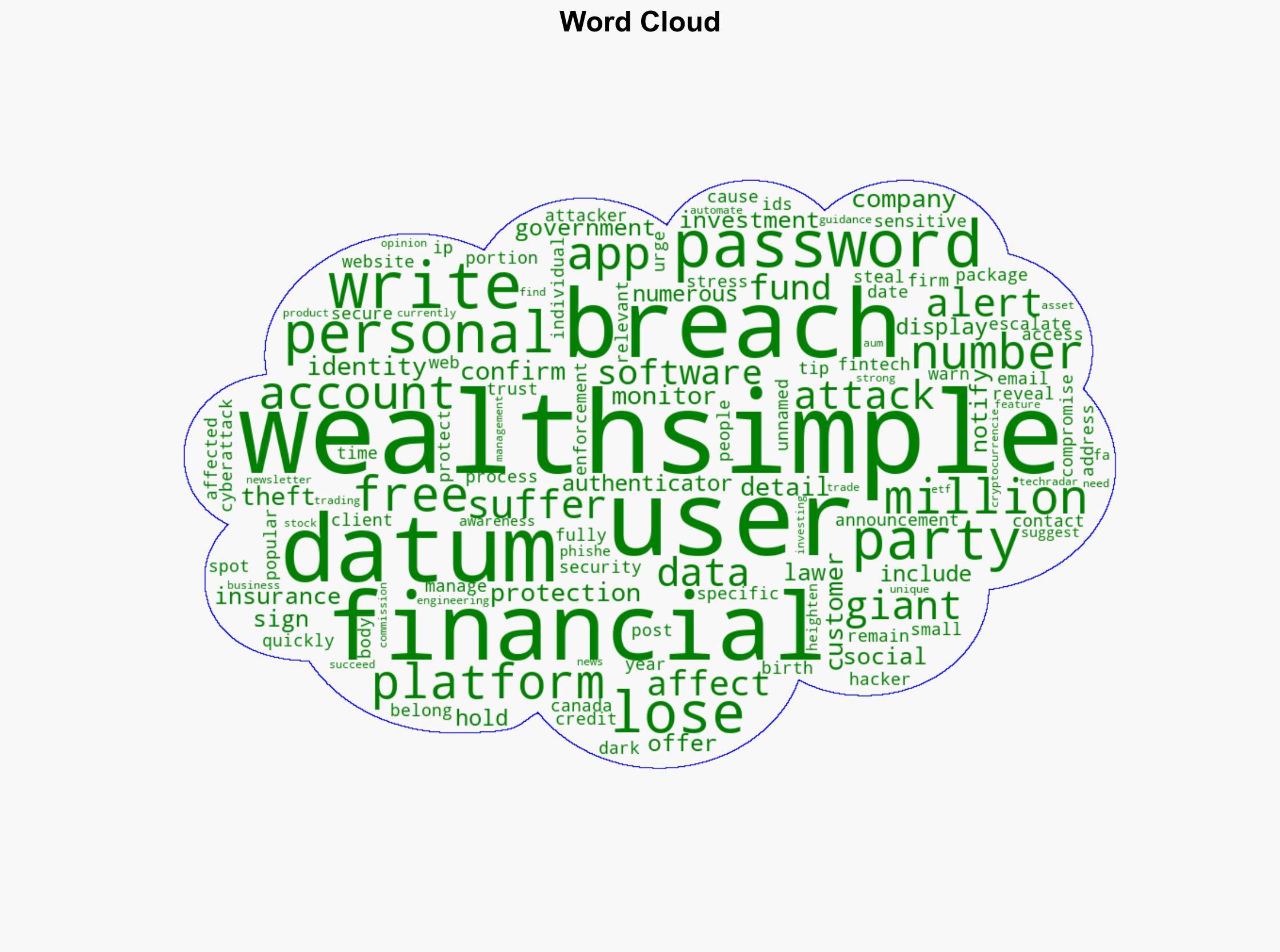

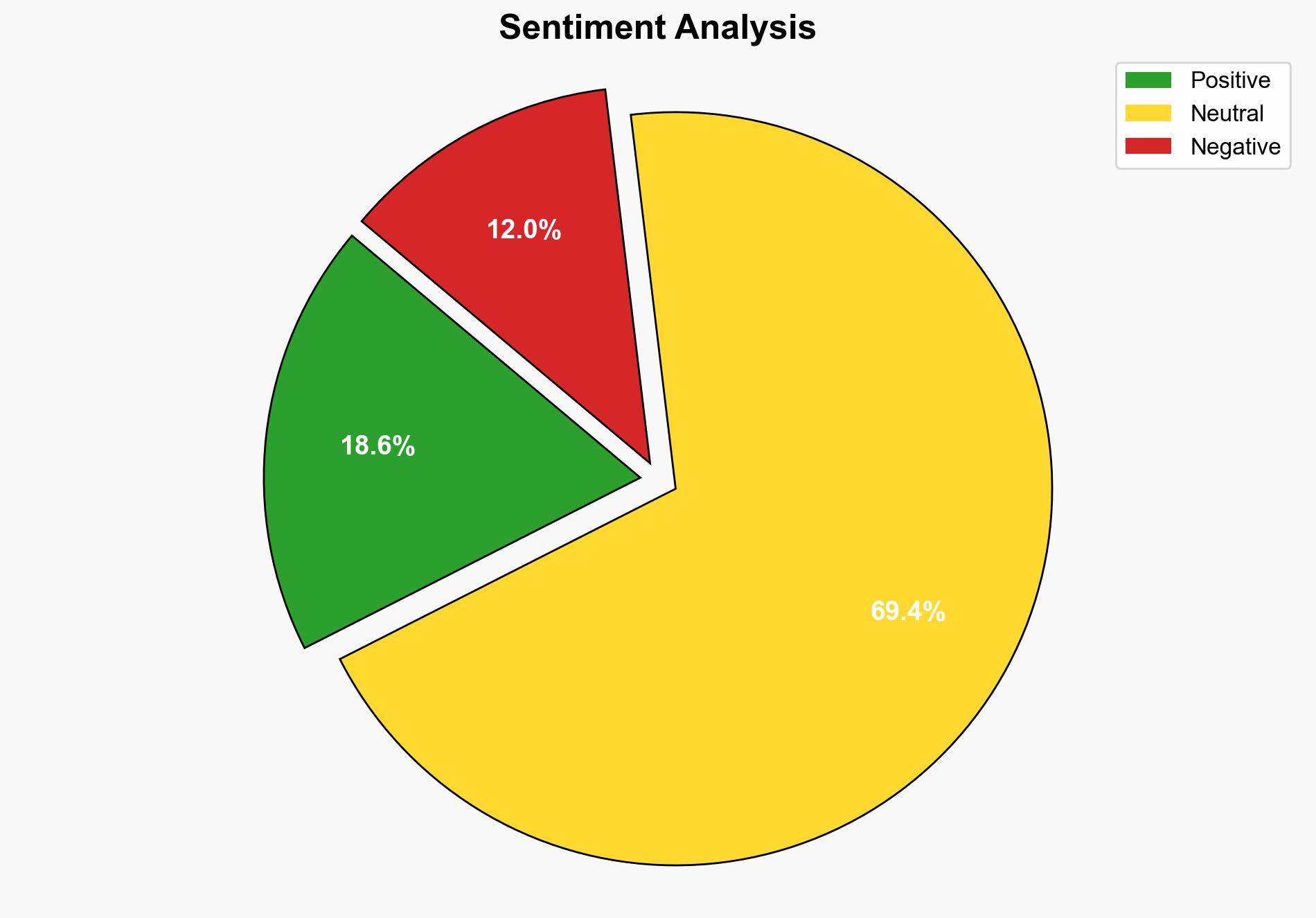

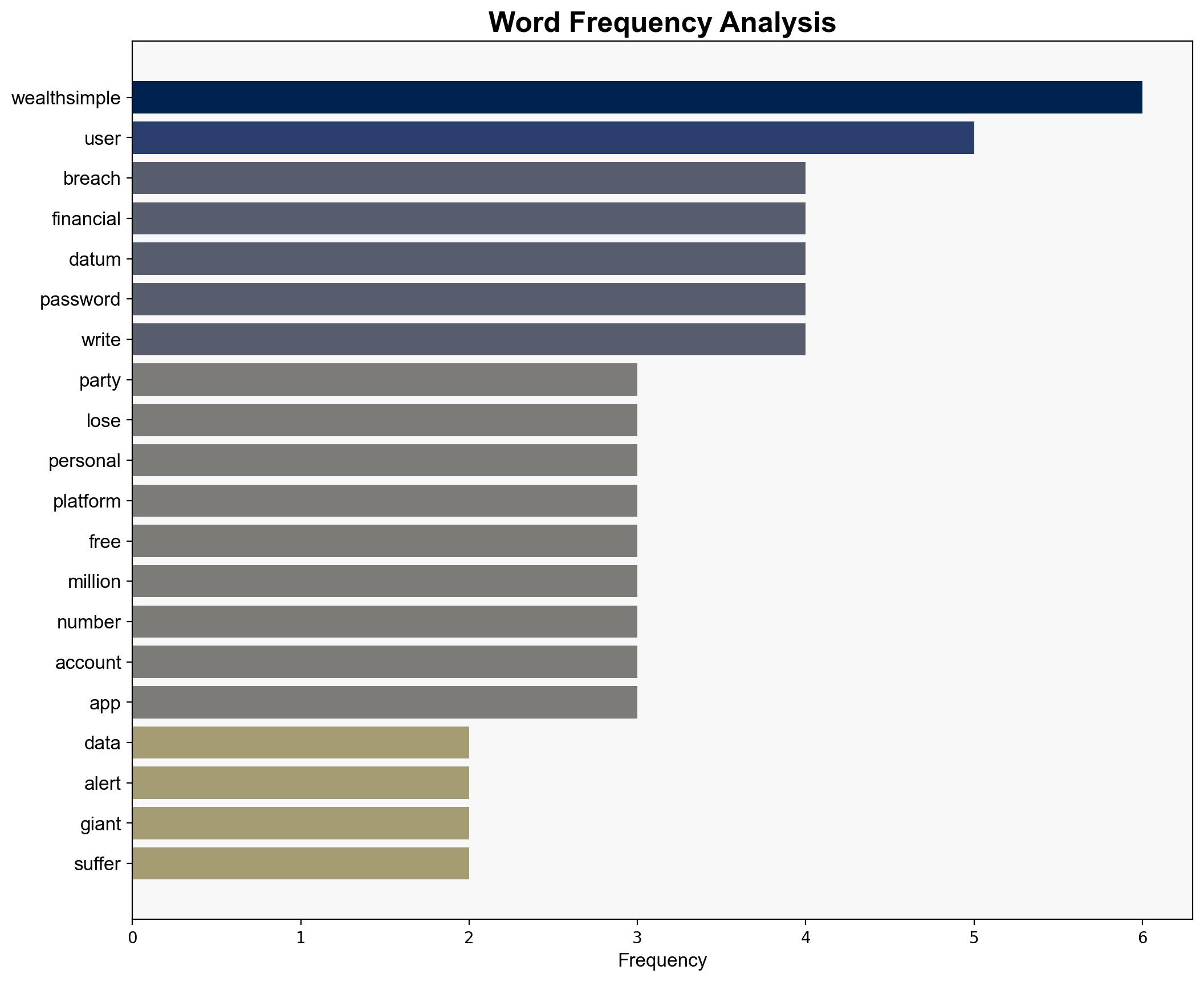

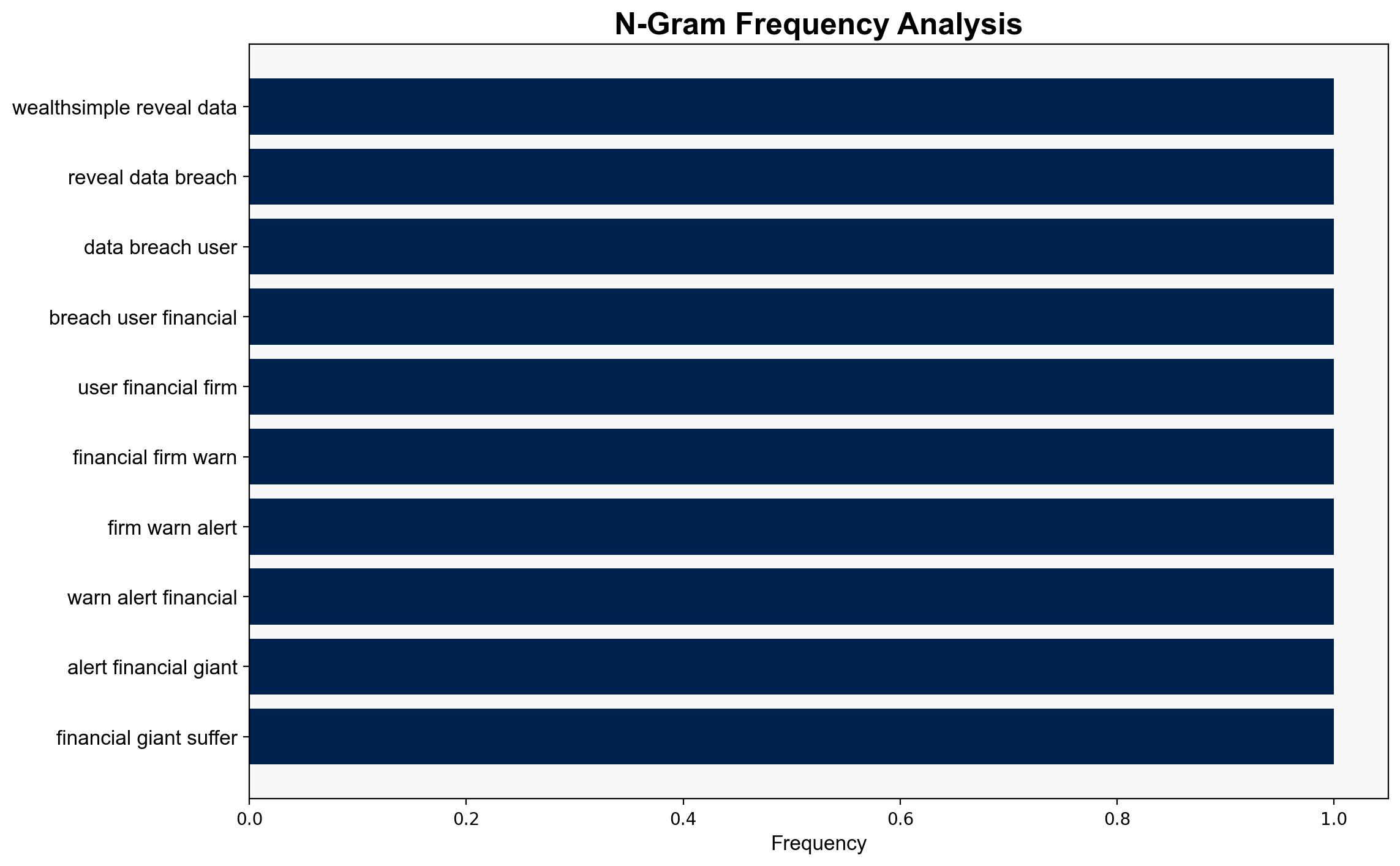

The most supported hypothesis is that the data breach at Wealthsimple was a targeted attack exploiting third-party software vulnerabilities. Confidence Level: Moderate. It is recommended that Wealthsimple enhances its third-party risk management and strengthens its cybersecurity measures to prevent future breaches.

2. Competing Hypotheses

1. **Hypothesis A**: The data breach was a targeted attack exploiting vulnerabilities in third-party software used by Wealthsimple. This hypothesis is supported by the mention of a “party attack” and the compromise of a “specific software package.”

2. **Hypothesis B**: The data breach was an opportunistic attack by hackers who stumbled upon a vulnerability in Wealthsimple’s systems. This hypothesis considers the possibility of a random attack due to the lack of specific details about the attackers’ intent or capabilities.

Using ACH 2.0, Hypothesis A is better supported due to the specificity of the attack vector (third-party software) and the rapid response by Wealthsimple, indicating prior awareness of such vulnerabilities.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the breach was limited to a small portion of customers and that Wealthsimple’s internal systems were not directly compromised.

– **Red Flags**: Lack of detailed information about the attackers and the specific software package compromised. The phrase “unnamed hacker” suggests potential obfuscation or lack of transparency.

– **Blind Spots**: The extent of collaboration with law enforcement and the effectiveness of the offered identity theft protection measures are unclear.

4. Implications and Strategic Risks

The breach could undermine customer trust and lead to financial losses for Wealthsimple. There is a risk of similar attacks on other financial platforms using the same third-party software. The incident highlights the broader vulnerability of fintech companies to cyberattacks, potentially impacting the sector’s reputation and regulatory landscape.

5. Recommendations and Outlook

- Enhance third-party risk management protocols and conduct comprehensive audits of all software dependencies.

- Increase investment in cybersecurity infrastructure and employee training to mitigate phishing and social engineering risks.

- Scenario Projections:

- **Best Case**: Rapid containment and transparency restore customer trust, with no further breaches.

- **Worst Case**: Additional vulnerabilities are exploited, leading to a larger-scale breach and regulatory penalties.

- **Most Likely**: Wealthsimple strengthens its defenses, but faces increased scrutiny and potential customer attrition.

6. Key Individuals and Entities

– Wealthsimple

– Unnamed hacker(s)

7. Thematic Tags

national security threats, cybersecurity, fintech vulnerabilities, data protection, financial sector risks