Asia stocks gain bonds fall as traders judge odds of bigger Fed cut – CNA

Published on: 2025-09-10

Intelligence Report: Asia stocks gain bonds fall as traders judge odds of bigger Fed cut – CNA

1. BLUF (Bottom Line Up Front)

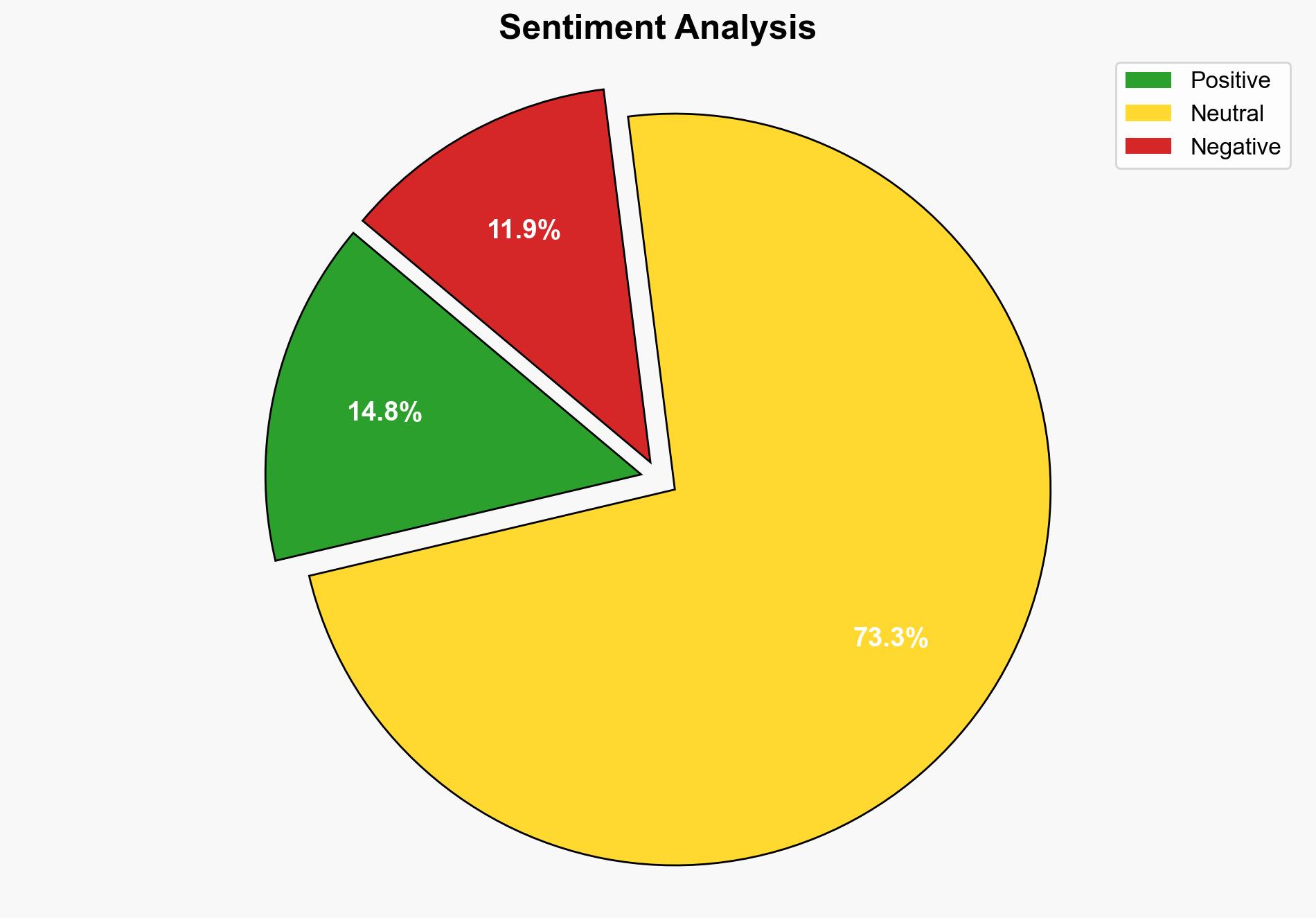

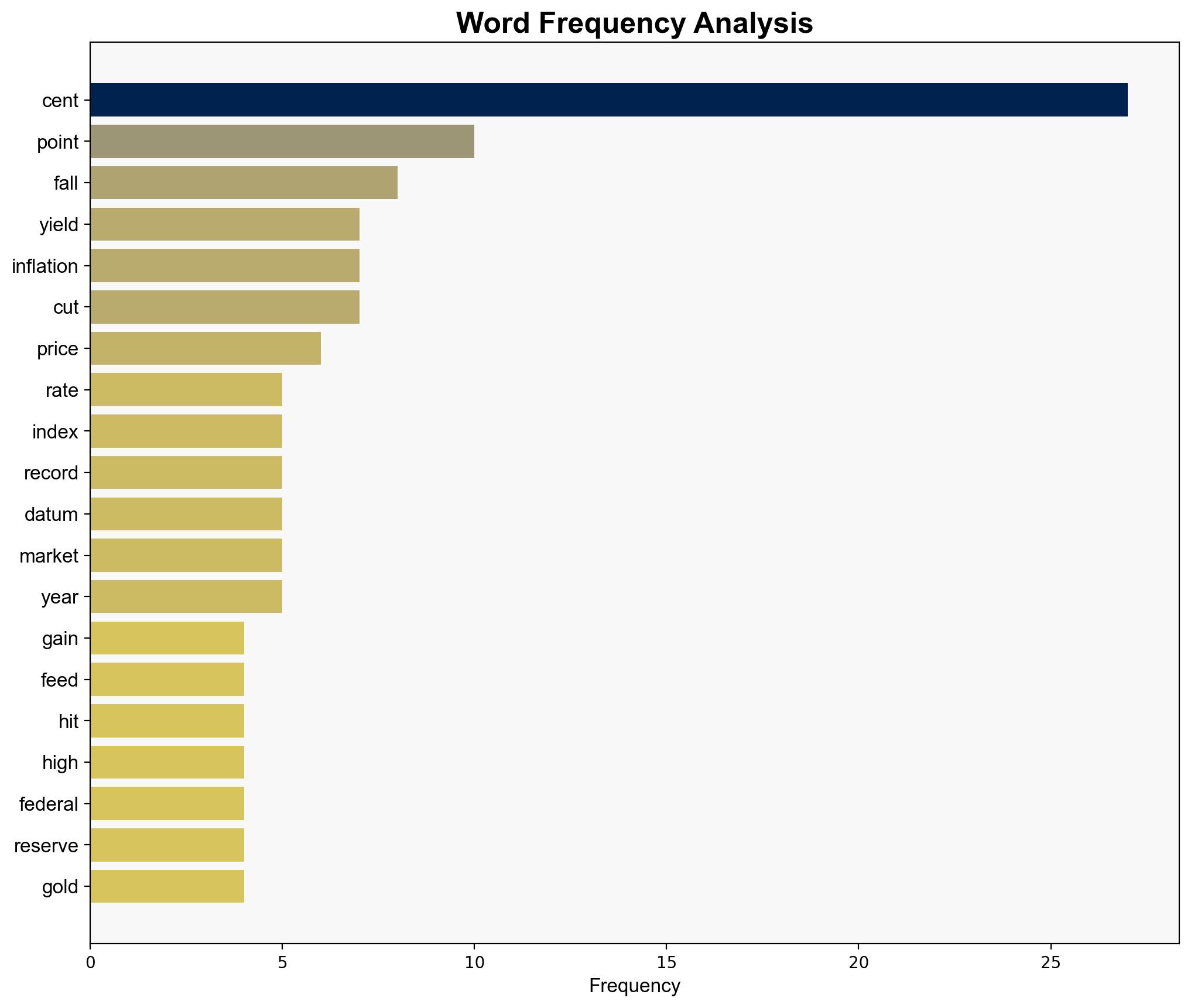

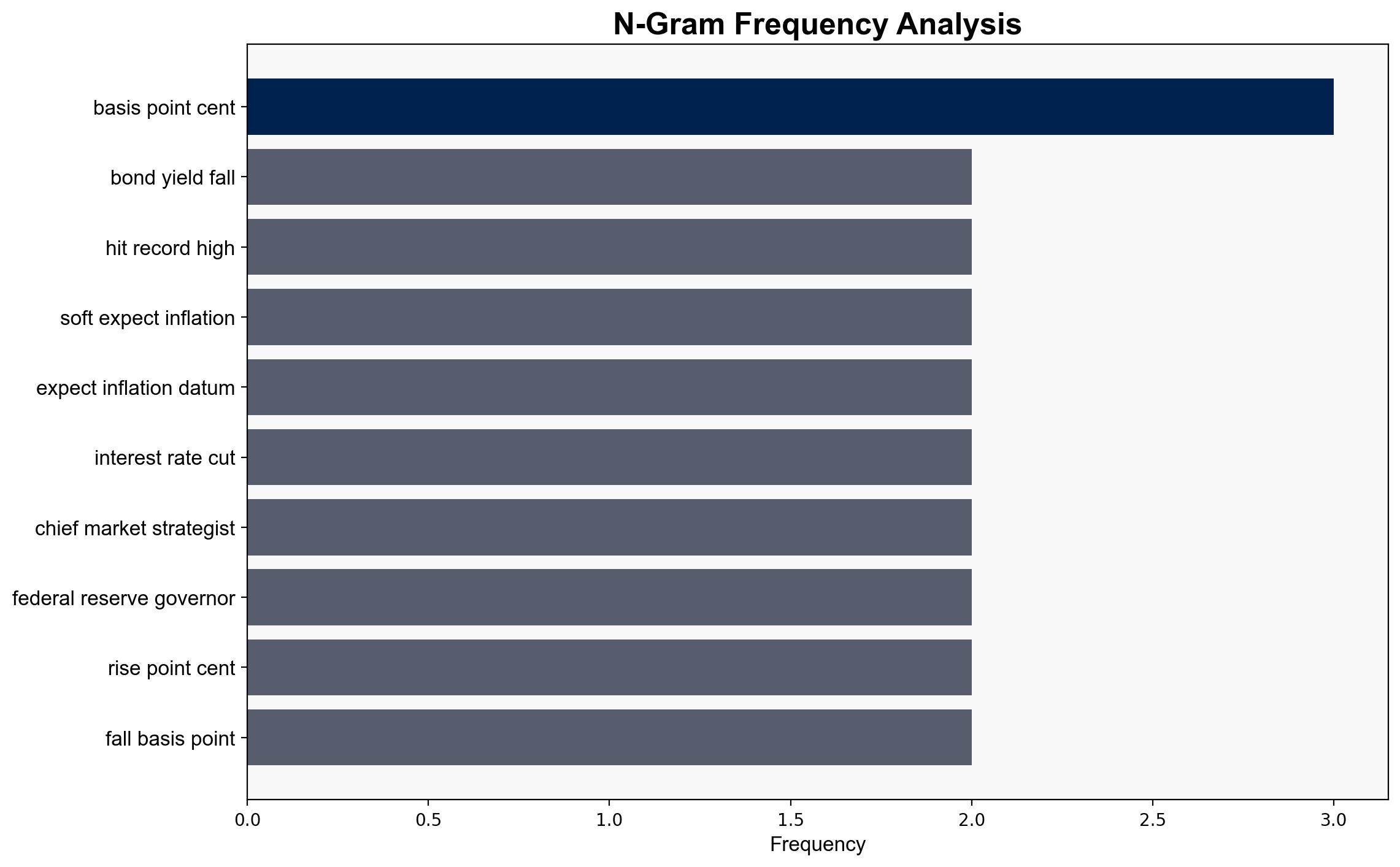

The most supported hypothesis is that market movements are primarily driven by expectations of a Federal Reserve rate cut due to tame inflation data, with a moderate confidence level. It is recommended to closely monitor upcoming inflation reports and Federal Reserve communications for shifts in monetary policy expectations.

2. Competing Hypotheses

Hypothesis 1: The rise in Asian stocks and fall in bond yields are primarily driven by expectations of a Federal Reserve rate cut, fueled by recent tame inflation data and geopolitical tensions.

Hypothesis 2: The market movements are a short-term reaction to geopolitical tensions, particularly in the Middle East and Eastern Europe, with investors seeking safe-haven assets like gold, rather than a fundamental shift in monetary policy expectations.

Using ACH 2.0, Hypothesis 1 is better supported due to the alignment of market behavior with historical patterns following inflation data releases and Fed rate cut expectations. Hypothesis 2 lacks consistent evidence as geopolitical tensions typically lead to increased bond yields and stock market volatility, which is not observed here.

3. Key Assumptions and Red Flags

– Assumption: The Federal Reserve’s actions are primarily influenced by inflation data.

– Red Flag: Over-reliance on a single economic indicator (PPI) without considering broader economic conditions.

– Blind Spot: Potential underestimation of geopolitical impacts on market sentiment.

4. Implications and Strategic Risks

– Economic: A misjudgment in Fed policy expectations could lead to market volatility.

– Geopolitical: Escalating tensions in the Middle East and Eastern Europe could disrupt global markets.

– Psychological: Investor sentiment may shift rapidly with new data, leading to unpredictable market swings.

5. Recommendations and Outlook

- Monitor upcoming inflation data releases and Fed communications for changes in rate cut expectations.

- Prepare for potential market volatility due to geopolitical developments.

- Scenario Projections:

- Best Case: Inflation remains tame, leading to a gradual Fed rate cut and stable market growth.

- Worst Case: Geopolitical tensions escalate, causing market instability and a delay in Fed rate cuts.

- Most Likely: Moderate Fed rate cut with continued market sensitivity to geopolitical news.

6. Key Individuals and Entities

– Carol Schleif

– Stephen Miran

– Lisa Cook

7. Thematic Tags

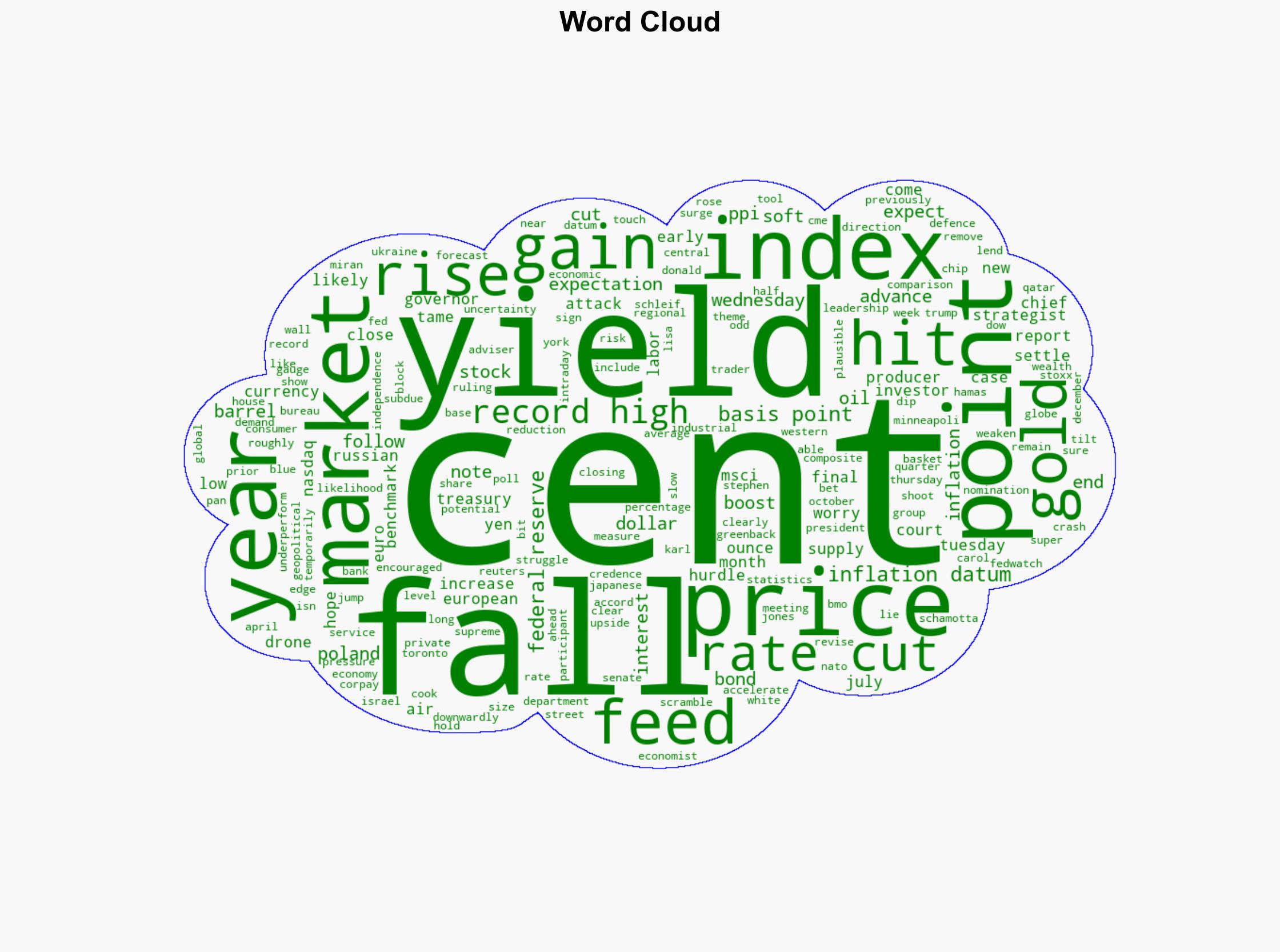

national security threats, economic stability, geopolitical tensions, monetary policy