US firms in China most pessimistic since 1999 survey says – Al Jazeera English

Published on: 2025-09-10

Intelligence Report: US firms in China most pessimistic since 1999 survey says – Al Jazeera English

1. BLUF (Bottom Line Up Front)

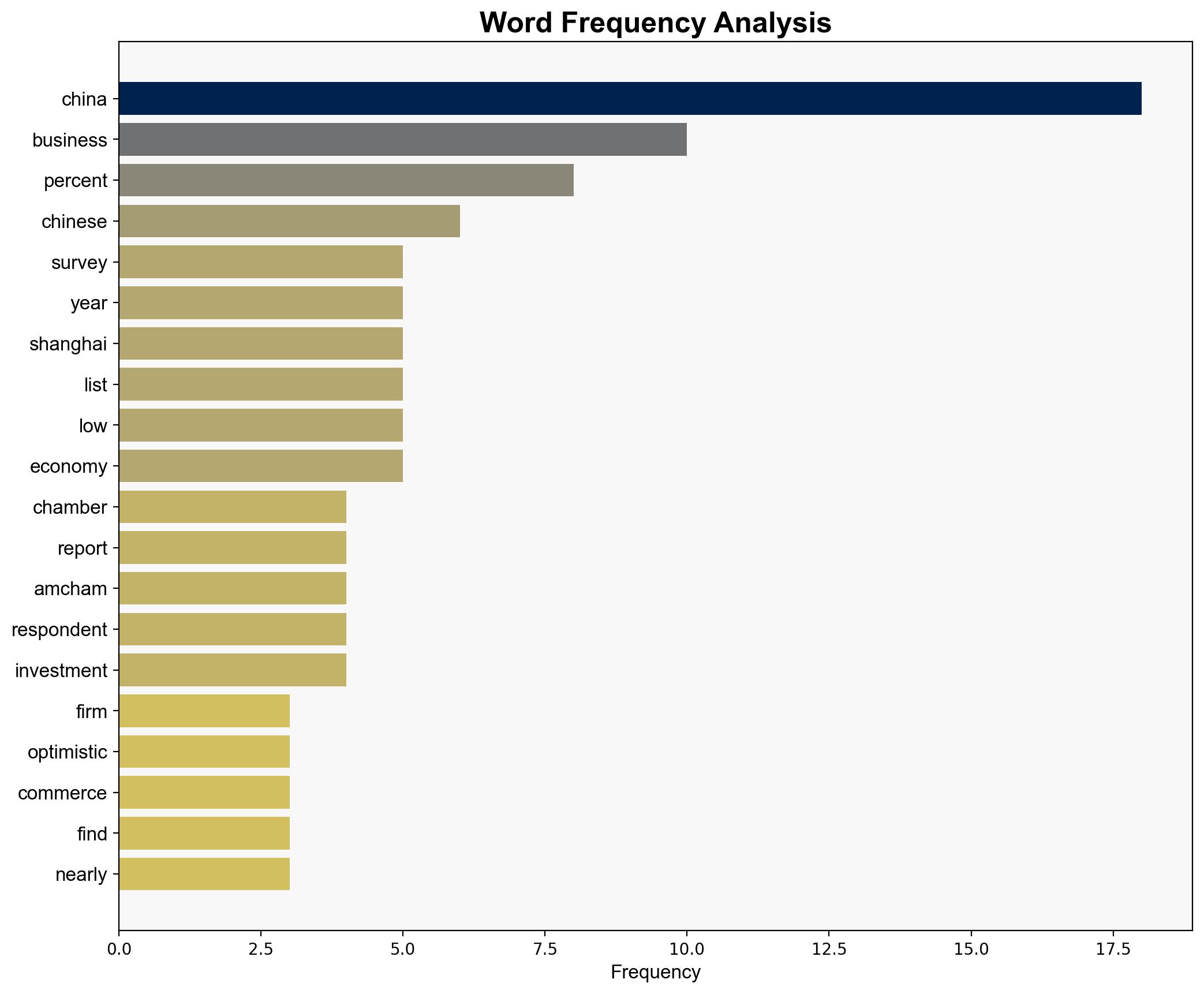

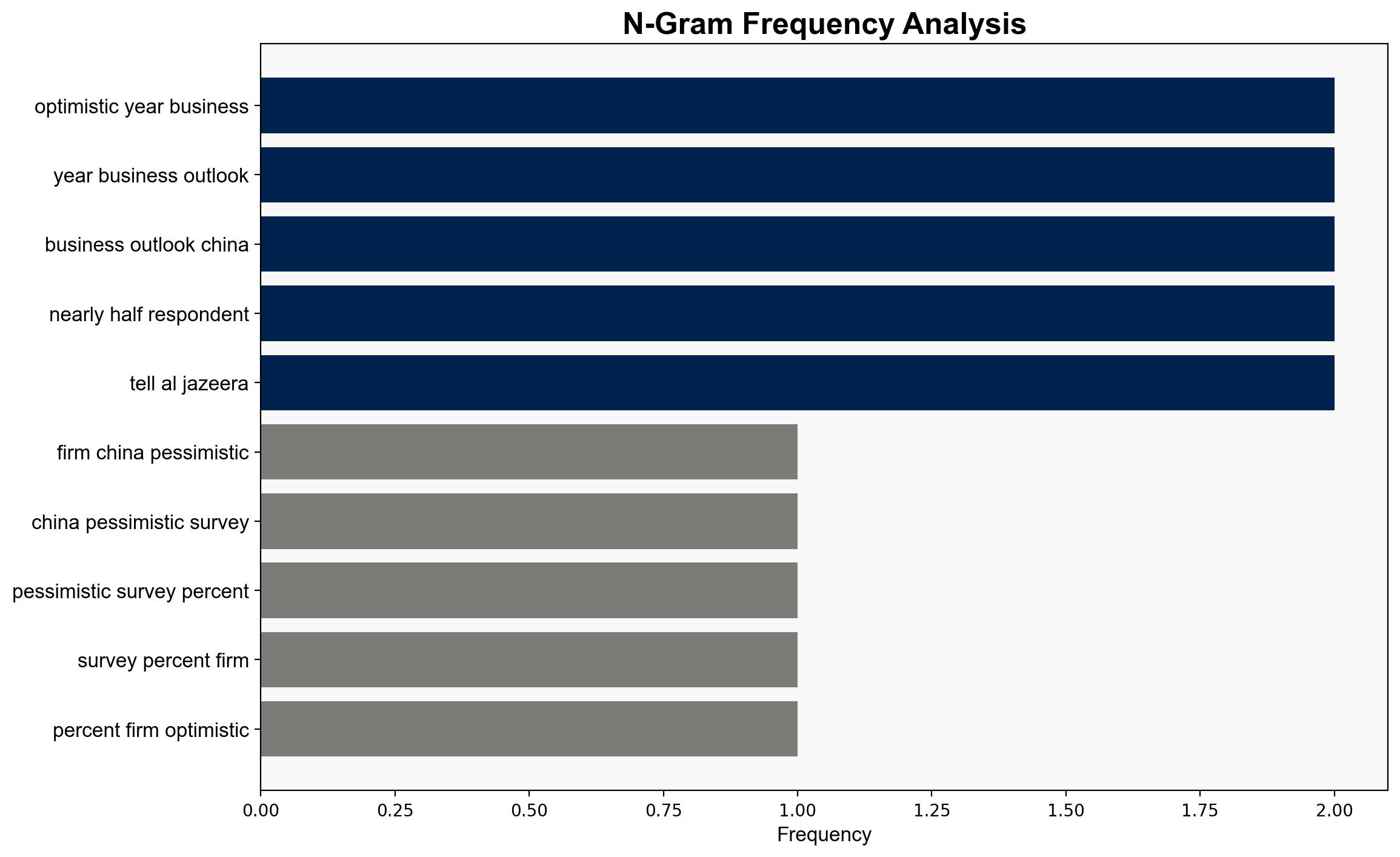

The strategic judgment indicates a significant decline in business optimism among US firms operating in China, attributed to geopolitical tensions and economic challenges. The hypothesis that US-China trade tensions and regulatory challenges are the primary drivers of pessimism is better supported. Confidence level: Moderate. Recommended action: Strengthen diplomatic and economic engagement to address trade barriers and enhance transparency in regulatory practices.

2. Competing Hypotheses

1. **Hypothesis A**: The pessimism among US firms is primarily driven by ongoing US-China trade tensions and regulatory challenges in China.

2. **Hypothesis B**: The pessimism is mainly due to broader economic issues in China, such as a slowing economy and weak consumer demand, independent of geopolitical tensions.

Using ACH 2.0, Hypothesis A is better supported due to the emphasis on geopolitical pressures and regulatory transparency issues highlighted in the survey. The call for tariff removal and improved regulatory frameworks aligns with this hypothesis.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the survey responses accurately reflect the broader sentiment among US firms in China. Another assumption is that geopolitical tensions are the primary factor influencing business sentiment.

– **Red Flags**: Potential bias in survey responses due to political or economic motivations. The data may not account for firms that have already exited the market due to these issues.

– **Missing Data**: Lack of detailed breakdown on how different sectors are affected differently by these challenges.

4. Implications and Strategic Risks

The current sentiment could lead to reduced US investment in China, impacting bilateral trade and economic cooperation. There is a risk of escalating trade tensions if tariff issues are not addressed. Additionally, a prolonged economic slowdown in China could have global repercussions, affecting supply chains and market stability.

5. Recommendations and Outlook

- Engage in diplomatic efforts to negotiate tariff reductions and improve regulatory transparency in China.

- Encourage diversification of supply chains to mitigate risks associated with geopolitical tensions.

- Scenario Projections:

- Best Case: Successful negotiations lead to improved business conditions and renewed optimism.

- Worst Case: Escalation of trade tensions results in further economic decoupling.

- Most Likely: Gradual improvement in conditions with ongoing challenges in regulatory transparency.

6. Key Individuals and Entities

– Jeffrey Lehman

– Liu Pengyu

– American Chamber of Commerce in Shanghai

– Chinese Embassy in Washington, DC

7. Thematic Tags

national security threats, economic diplomacy, US-China relations, trade policy