Oil Prices Hold Three-Day Gain With Trump’s Next Russia Move In Focus – Ndtvprofit.com

Published on: 2025-09-11

Intelligence Report: Oil Prices Hold Three-Day Gain With Trump’s Next Russia Move In Focus – Ndtvprofit.com

1. BLUF (Bottom Line Up Front)

The strategic judgment is that geopolitical tensions, particularly involving Russia and the Middle East, are exerting a significant influence on oil prices, with a medium confidence level. The most supported hypothesis is that geopolitical risks are temporarily overshadowing bearish market fundamentals. It is recommended to closely monitor geopolitical developments and prepare for potential price volatility.

2. Competing Hypotheses

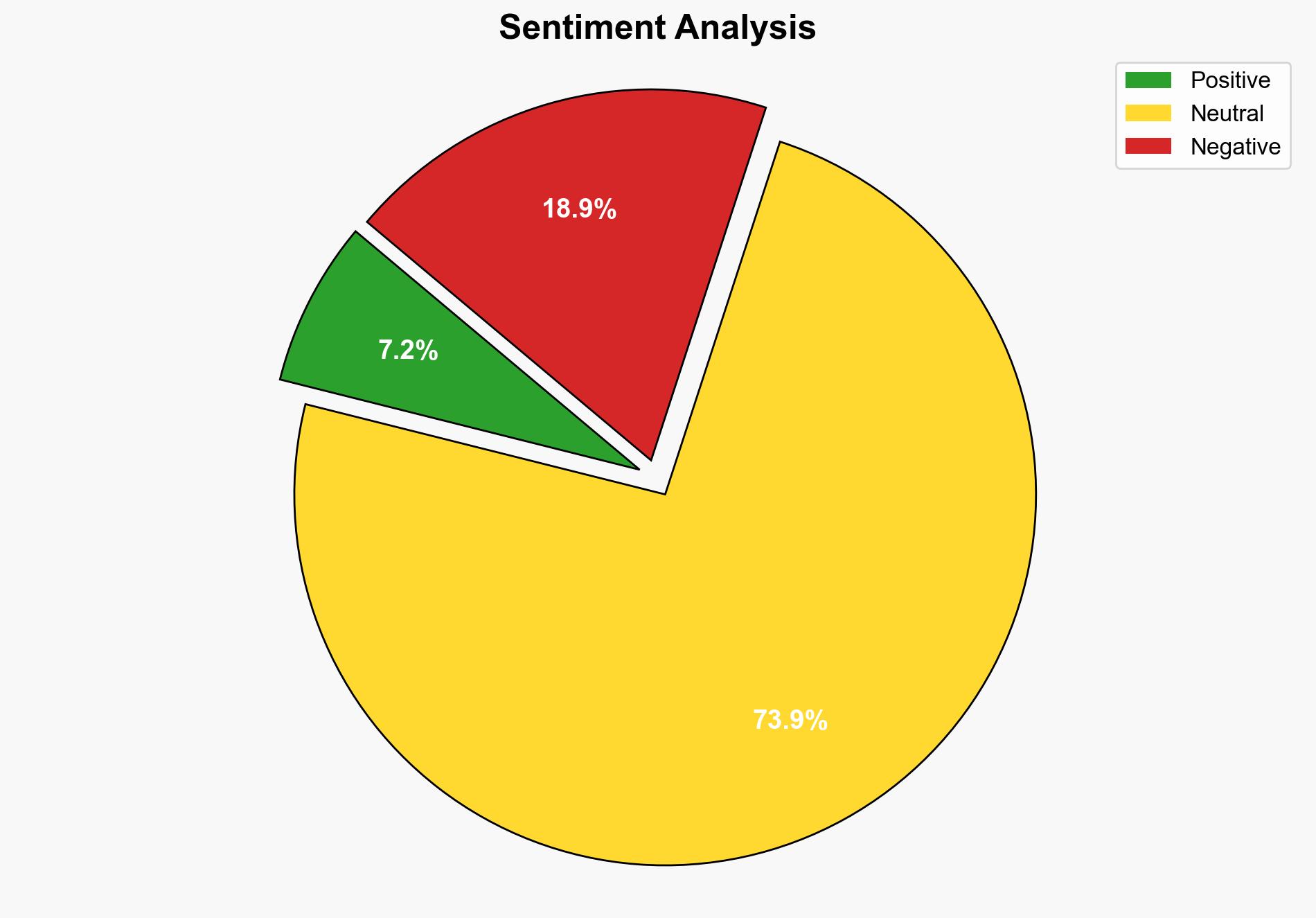

1. **Hypothesis A**: Geopolitical tensions, particularly involving Russia and the Middle East, are driving short-term increases in oil prices, despite a fundamentally bearish market outlook due to oversupply and high inventories.

2. **Hypothesis B**: The recent gains in oil prices are primarily driven by speculative trading and short-covering by investors, with geopolitical tensions having a secondary effect.

Using ACH 2.0, Hypothesis A is better supported as it aligns with the current geopolitical climate and the noted reactions of investors to political developments. Hypothesis B, while plausible, lacks sufficient evidence of sustained speculative activity driving the market independently of geopolitical factors.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Geopolitical tensions will continue to influence market perceptions and investor behavior.

– The current oil surplus will persist unless significant geopolitical disruptions occur.

– **Red Flags**:

– Potential underestimation of the impact of speculative trading.

– Lack of detailed data on the scale and duration of geopolitical tensions.

– Inconsistent reports on the intentions and future actions of key geopolitical players.

4. Implications and Strategic Risks

– **Economic Risks**: Prolonged geopolitical tensions could lead to sustained volatility in oil prices, impacting global economic stability.

– **Geopolitical Risks**: Escalation in tensions involving Russia, the Middle East, or other regions could lead to supply disruptions.

– **Psychological Risks**: Market sentiment may be increasingly driven by fear and uncertainty, leading to erratic trading behaviors.

5. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly actions involving Russia and the Middle East.

- Prepare for potential price volatility by diversifying energy sources and investing in strategic reserves.

- Scenario Projections:

- Best Case: Geopolitical tensions ease, leading to stabilized oil prices.

- Worst Case: Escalation leads to significant supply disruptions and price spikes.

- Most Likely: Continued volatility with periodic price fluctuations driven by geopolitical developments.

6. Key Individuals and Entities

– Donald Trump

– Toril Bosoni

– European Union officials

– CitiGroup analysts

7. Thematic Tags

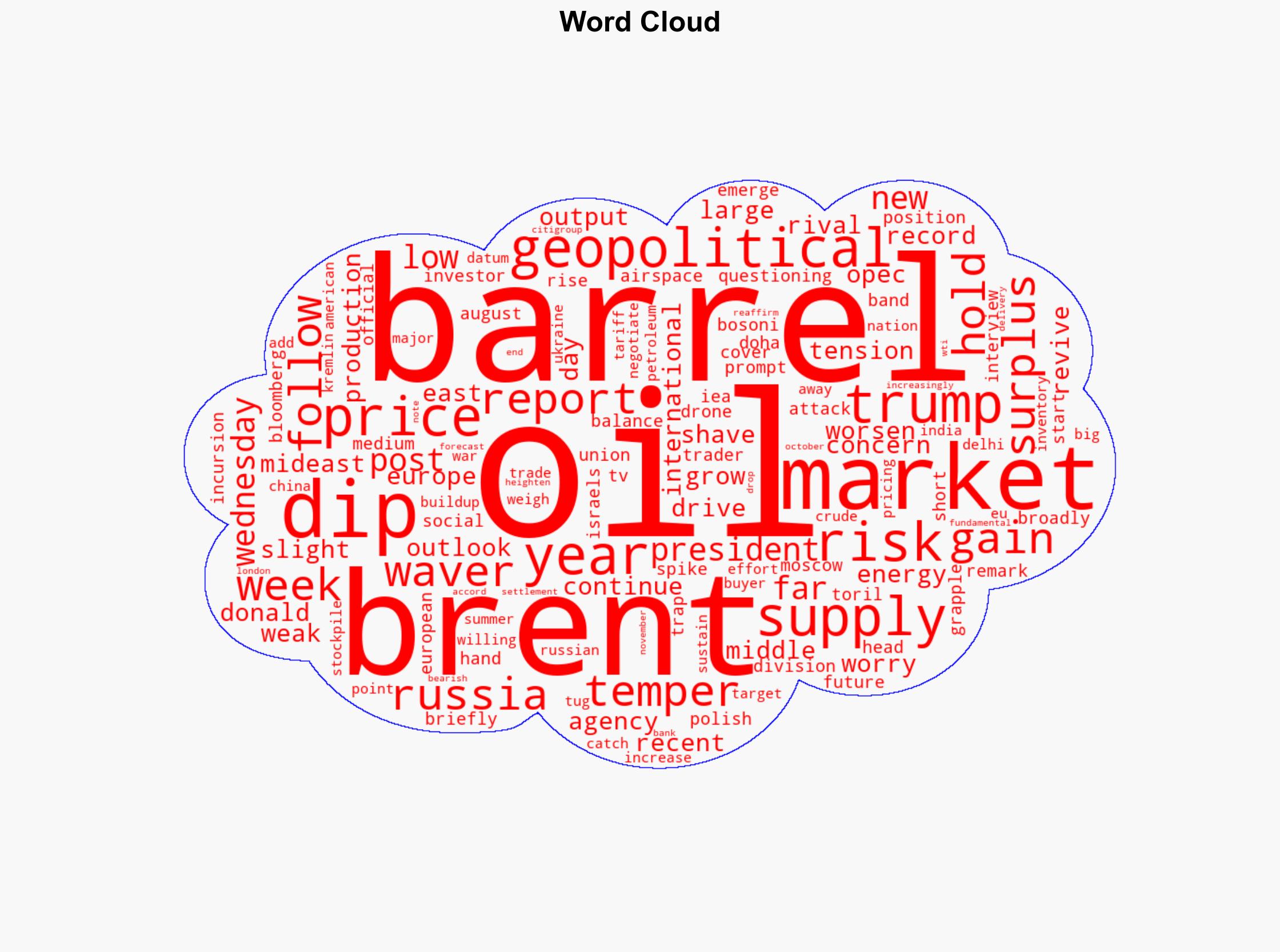

national security threats, geopolitical tensions, energy markets, economic stability