Oil prices extend losses on oversupply US demand concerns – The Times of India

Published on: 2025-09-12

Intelligence Report: Oil prices extend losses on oversupply US demand concerns – The Times of India

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that global oil prices are declining primarily due to increased supply from OPEC+ and concerns over US demand. Confidence in this assessment is moderate, given the complexity of global oil markets and potential geopolitical influences. Recommended action includes monitoring OPEC+ production strategies and US economic indicators to anticipate further price movements.

2. Competing Hypotheses

1. **Hypothesis A**: The decline in oil prices is primarily driven by an oversupply due to increased production from OPEC+ and Russia, alongside a strategic push by Saudi Arabia to regain market share.

2. **Hypothesis B**: The decline is primarily due to weakening US demand, exacerbated by economic uncertainties and potential interest rate hikes by the Federal Reserve.

Using ACH 2.0, Hypothesis A is better supported by the intelligence, which highlights increased production and export activities, particularly by Saudi Arabia and Russia. Hypothesis B, while plausible, lacks direct evidence of significant demand contraction in the US.

3. Key Assumptions and Red Flags

– **Assumptions**:

– OPEC+ production increases will continue as planned.

– US economic indicators accurately reflect demand trends.

– **Red Flags**:

– Potential underreporting of Chinese demand fluctuations.

– Uncertainty in the impact of sanctions on Russian oil exports.

– Lack of detailed data on US consumption patterns.

4. Implications and Strategic Risks

– **Economic**: Prolonged low oil prices could impact global economic stability, particularly in oil-dependent economies.

– **Geopolitical**: Increased production by OPEC+ may strain relations with non-OPEC oil producers.

– **Psychological**: Market volatility could affect investor confidence and lead to broader economic repercussions.

5. Recommendations and Outlook

- Monitor OPEC+ production announcements and align strategic reserves accordingly.

- Engage in diplomatic dialogues with key oil-producing nations to assess future production intentions.

- Scenario Projections:

– **Best Case**: Stabilization of oil prices as demand aligns with supply.

– **Worst Case**: Prolonged oversupply leading to economic downturns in oil-dependent regions.

– **Most Likely**: Continued price volatility with gradual stabilization as markets adjust.

6. Key Individuals and Entities

– Saudi Arabia (key driver in OPEC+ production strategy)

– Russia (significant influence on global oil supply)

– Aramco (major exporter to China)

7. Thematic Tags

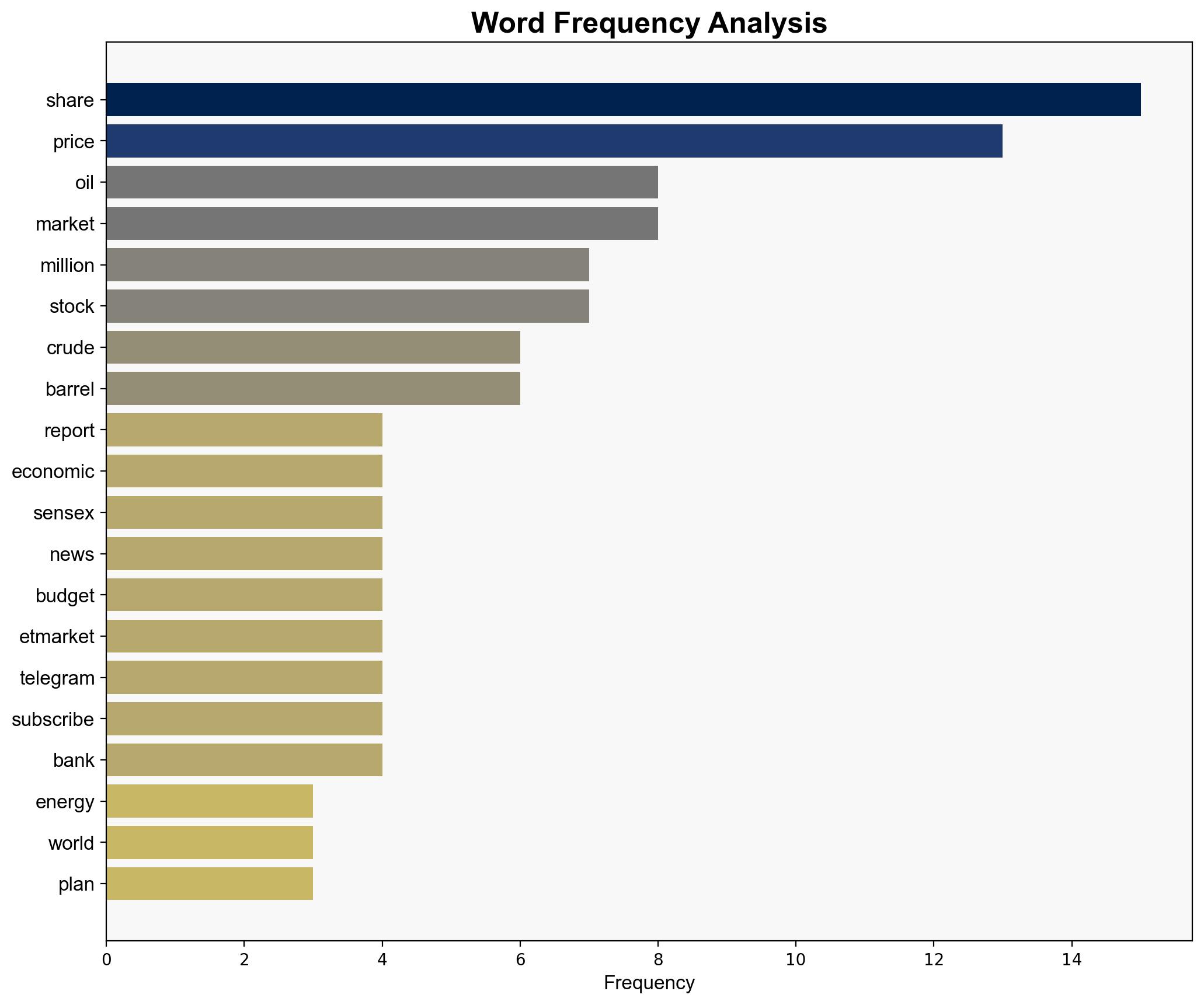

national security threats, economic stability, geopolitical dynamics, energy markets