Oil Extends Drop as IEA Puts Glut Back in Focus After OPEC Hike – Financial Post

Published on: 2025-09-12

Intelligence Report: Oil Extends Drop as IEA Puts Glut Back in Focus After OPEC Hike – Financial Post

1. BLUF (Bottom Line Up Front)

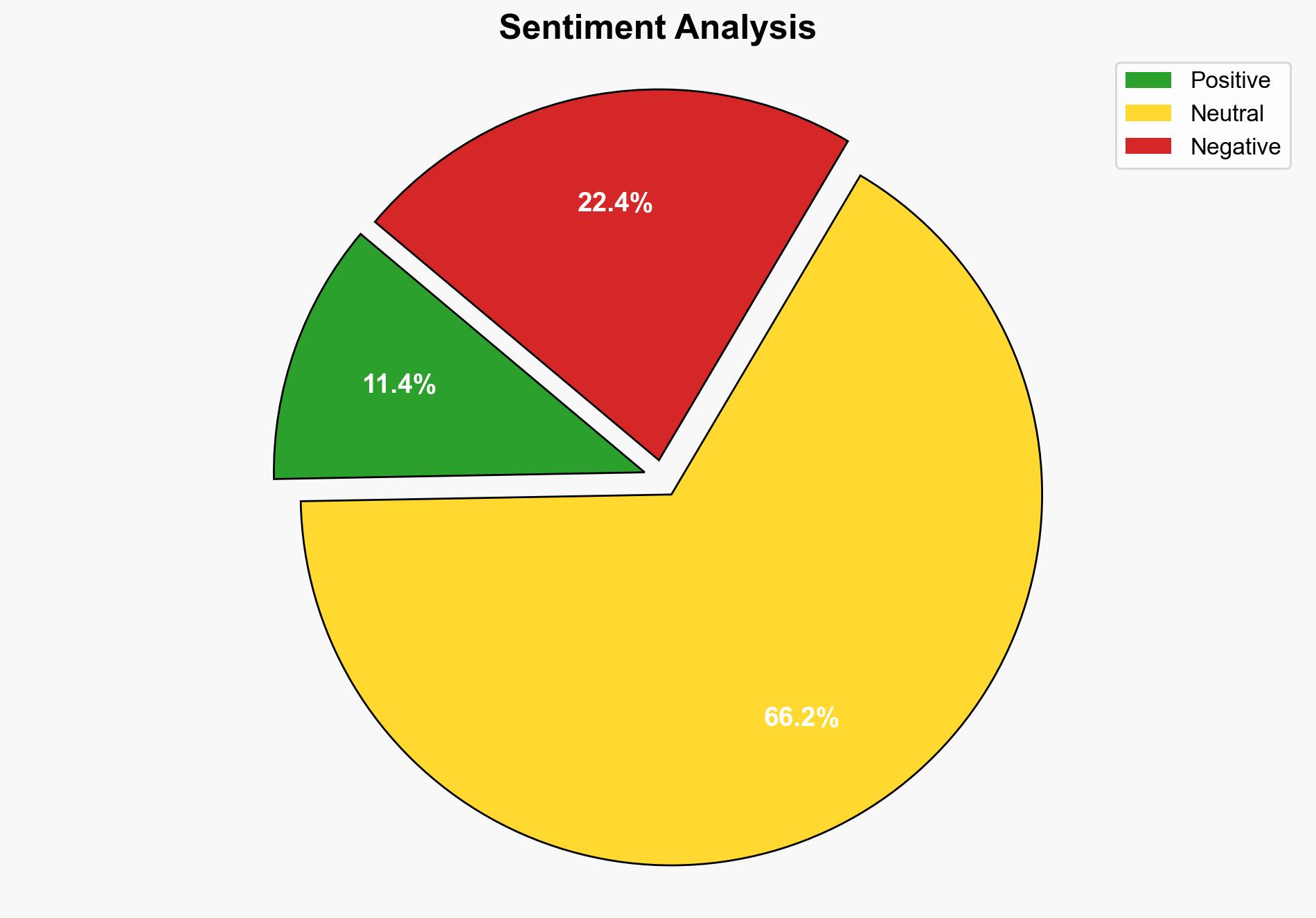

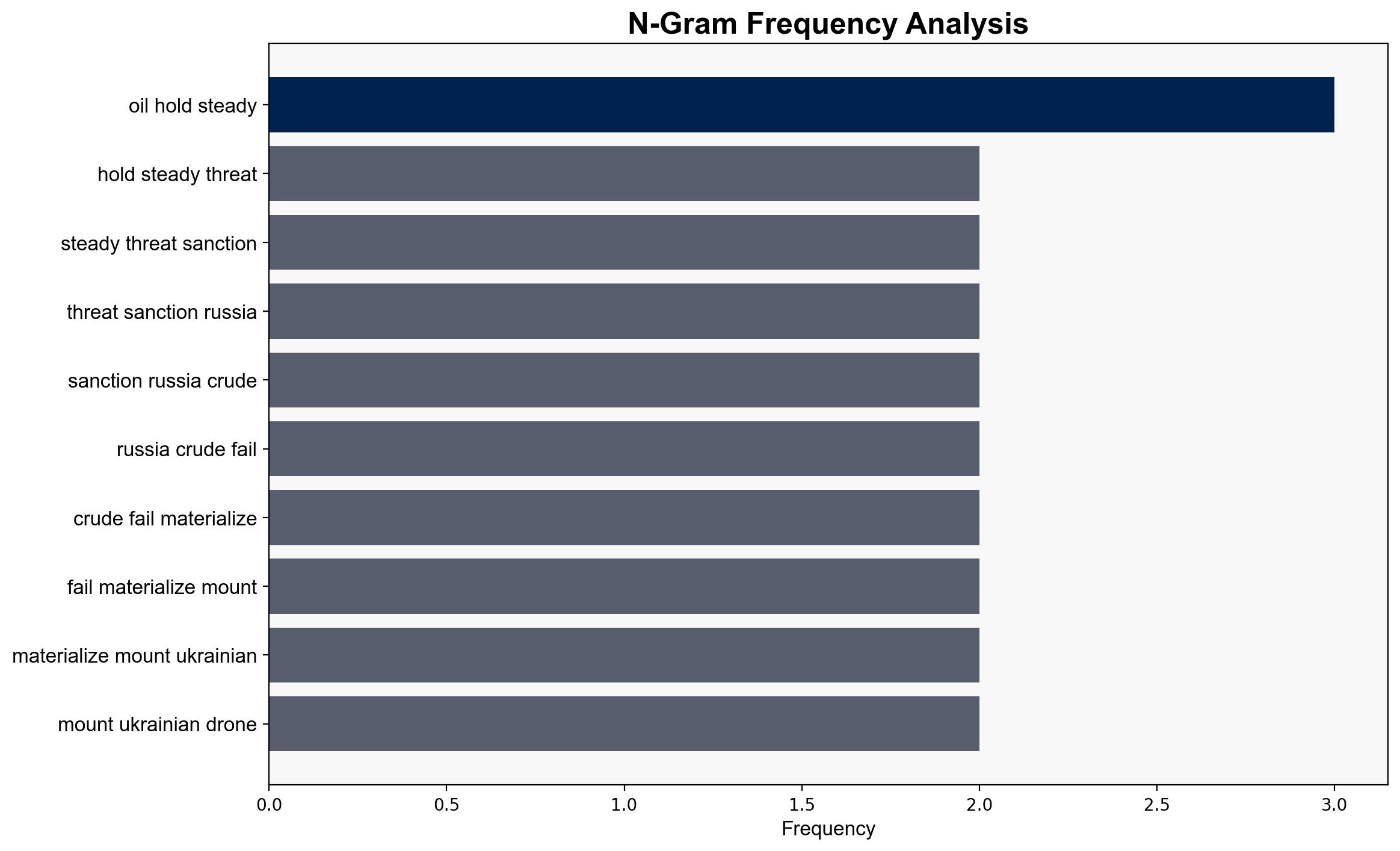

The most supported hypothesis is that geopolitical tensions and supply chain disruptions will lead to short-term volatility in oil prices, despite a projected surplus. Confidence Level: Moderate. Recommended action is to monitor geopolitical developments closely and prepare for potential supply chain disruptions.

2. Competing Hypotheses

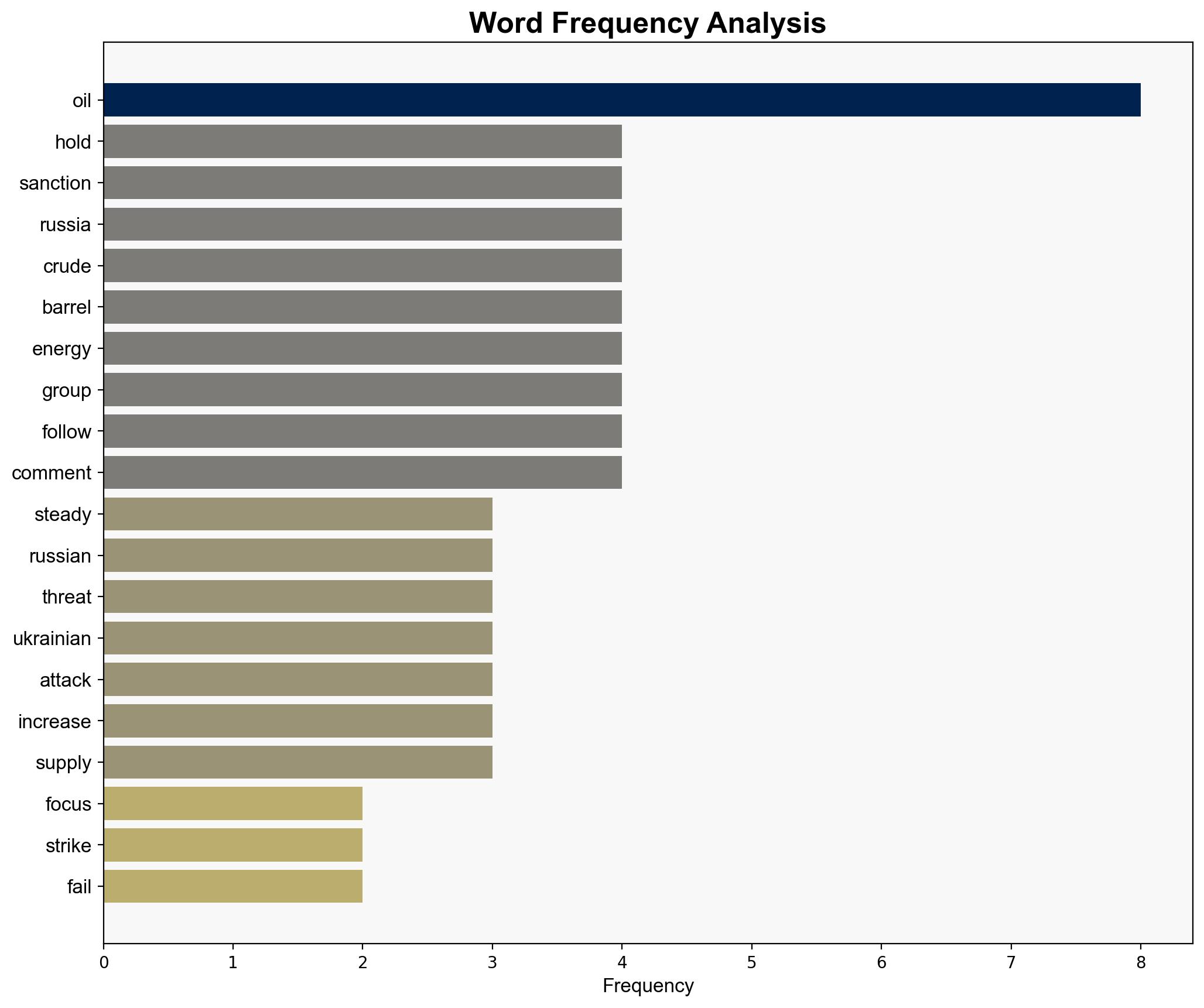

1. **Hypothesis A**: The projected oil surplus by the International Energy Agency (IEA) will lead to a sustained drop in oil prices, as the market adjusts to increased supply from OPEC and other producers.

2. **Hypothesis B**: Geopolitical tensions, particularly involving Russia and Ukraine, will cause intermittent disruptions in oil supply, leading to short-term volatility in prices despite the projected surplus.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis B is better supported due to ongoing geopolitical tensions and recent disruptions in Russian oil exports, which have historically influenced market volatility.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that the IEA’s projections are accurate and that geopolitical factors will not significantly impact supply. Hypothesis B assumes that geopolitical tensions will continue to affect supply chains.

– **Red Flags**: The assumption that geopolitical tensions will not escalate further is a potential blind spot. Additionally, the reliance on IEA projections without considering potential inaccuracies or changes in market dynamics is a risk.

– **Inconsistent Data**: The report lacks detailed information on the potential impact of sanctions and tariffs on Russian oil exports.

4. Implications and Strategic Risks

– **Economic Risks**: A sustained drop in oil prices could impact oil-dependent economies, while volatility could affect global markets.

– **Geopolitical Risks**: Escalation in Ukraine could lead to broader regional instability and further disruptions in energy supplies.

– **Supply Chain Risks**: Disruptions at key Russian export hubs could lead to temporary shortages and price spikes.

5. Recommendations and Outlook

- Monitor geopolitical developments in Eastern Europe closely, particularly any changes in the Russia-Ukraine conflict.

- Prepare contingency plans for potential supply chain disruptions, including alternative sourcing strategies.

- Scenario Projections:

- Best Case: Geopolitical tensions ease, and the market adjusts to the surplus, stabilizing prices.

- Worst Case: Escalation in Ukraine leads to significant supply disruptions and price spikes.

- Most Likely: Continued volatility with intermittent disruptions due to geopolitical tensions.

6. Key Individuals and Entities

– Joe Delaura

– Florence Schmit

– Rebecca Babin

7. Thematic Tags

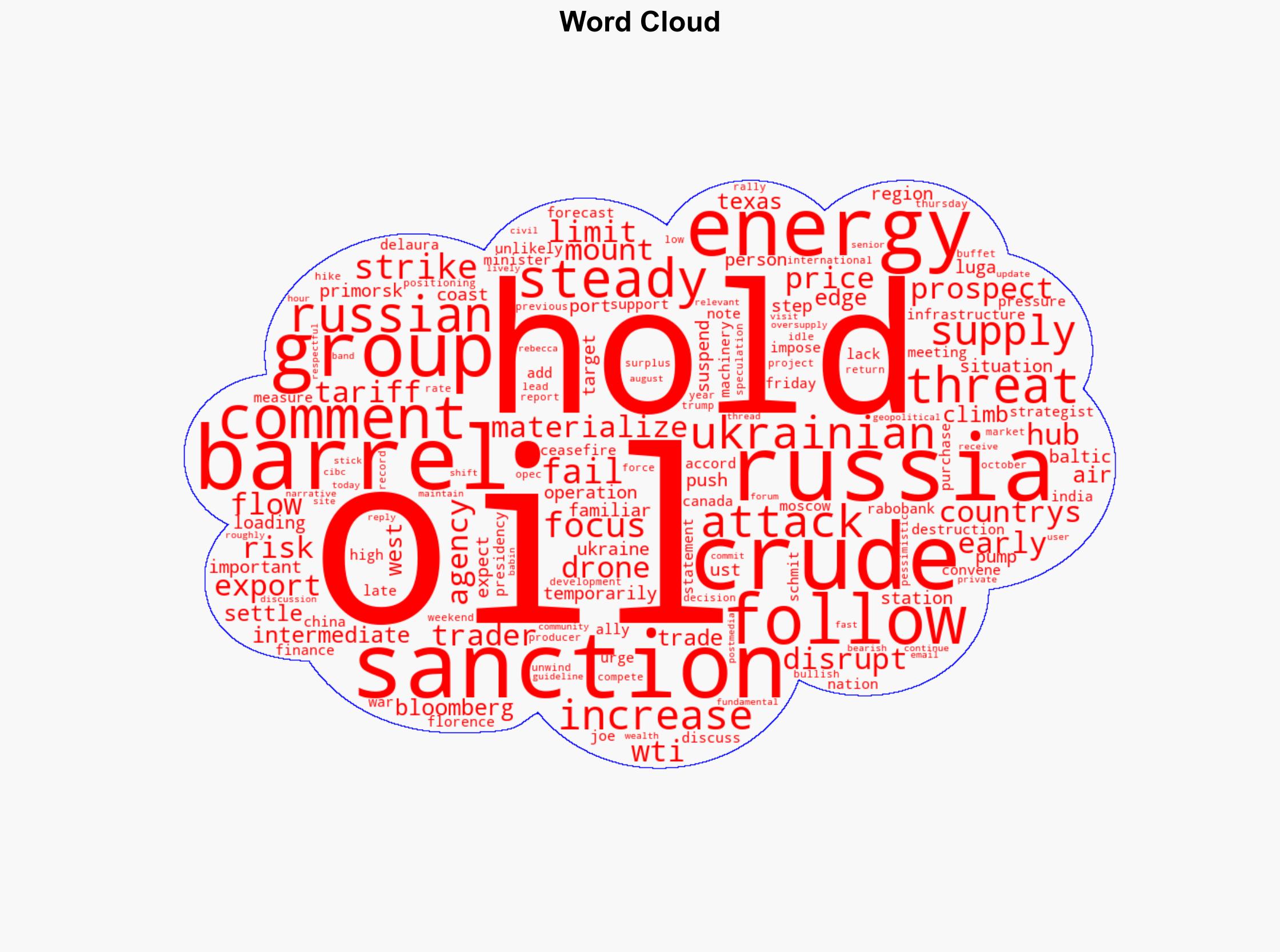

national security threats, supply chain disruptions, geopolitical tensions, energy market volatility