Pakistan seen extending pause on rate cuts after floods ravage farmland Reuters poll – CNA

Published on: 2025-09-12

Intelligence Report: Pakistan seen extending pause on rate cuts after floods ravage farmland Reuters poll – CNA

1. BLUF (Bottom Line Up Front)

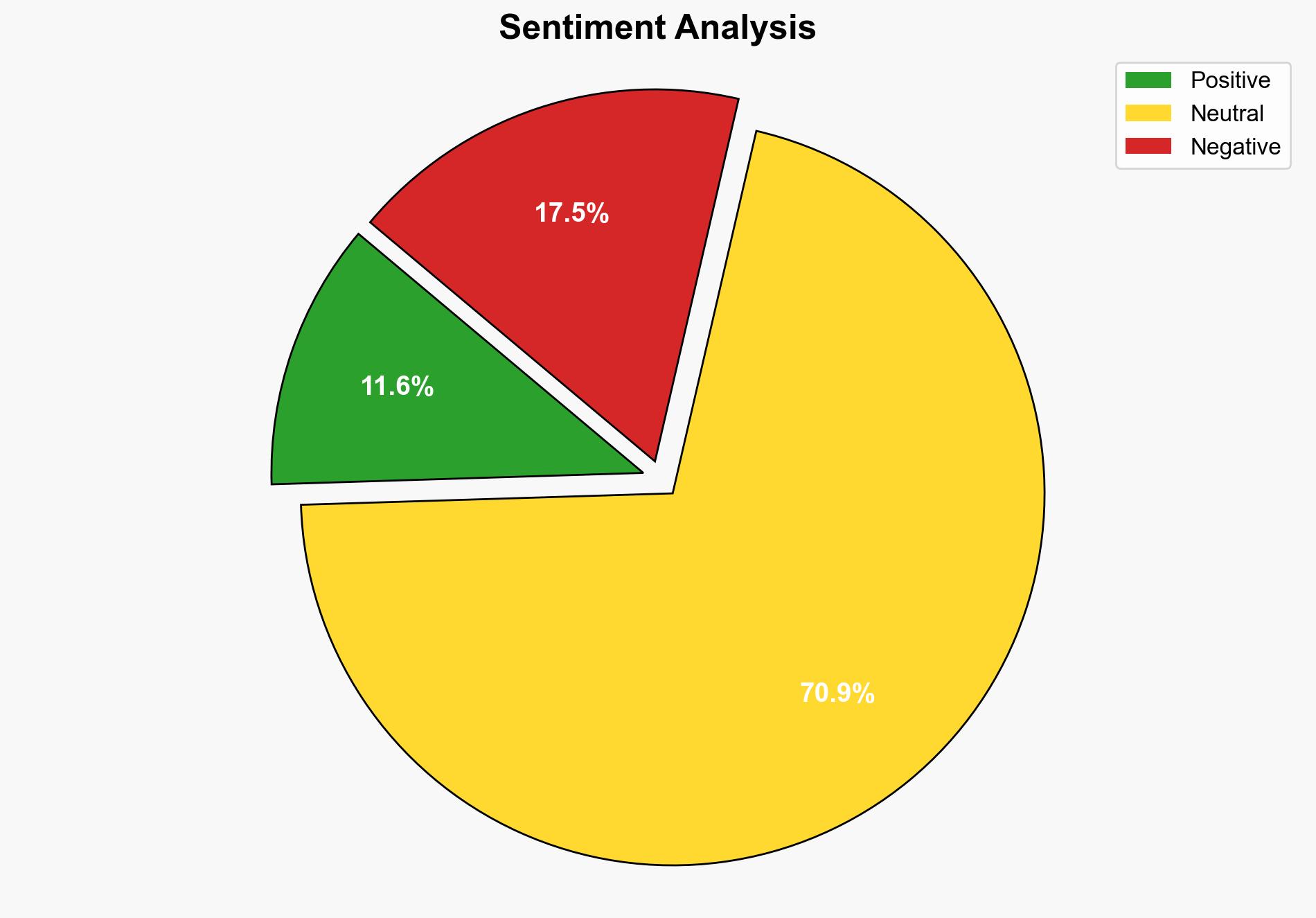

The most supported hypothesis is that Pakistan’s central bank will maintain its current interest rate due to the inflationary pressures caused by recent flooding. Confidence level: Moderate. Recommended action: Monitor inflation trends and agricultural recovery efforts closely to anticipate further economic impacts.

2. Competing Hypotheses

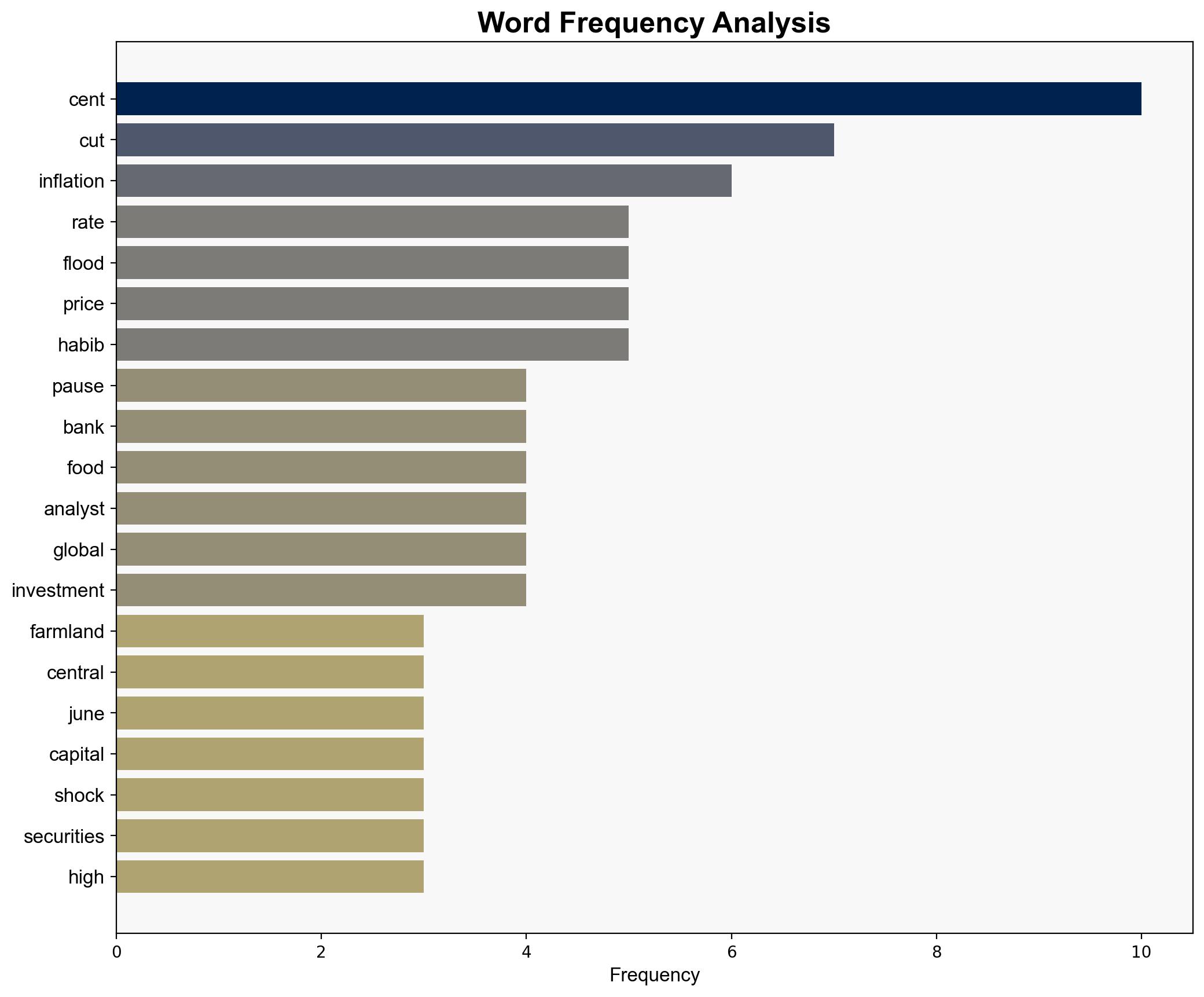

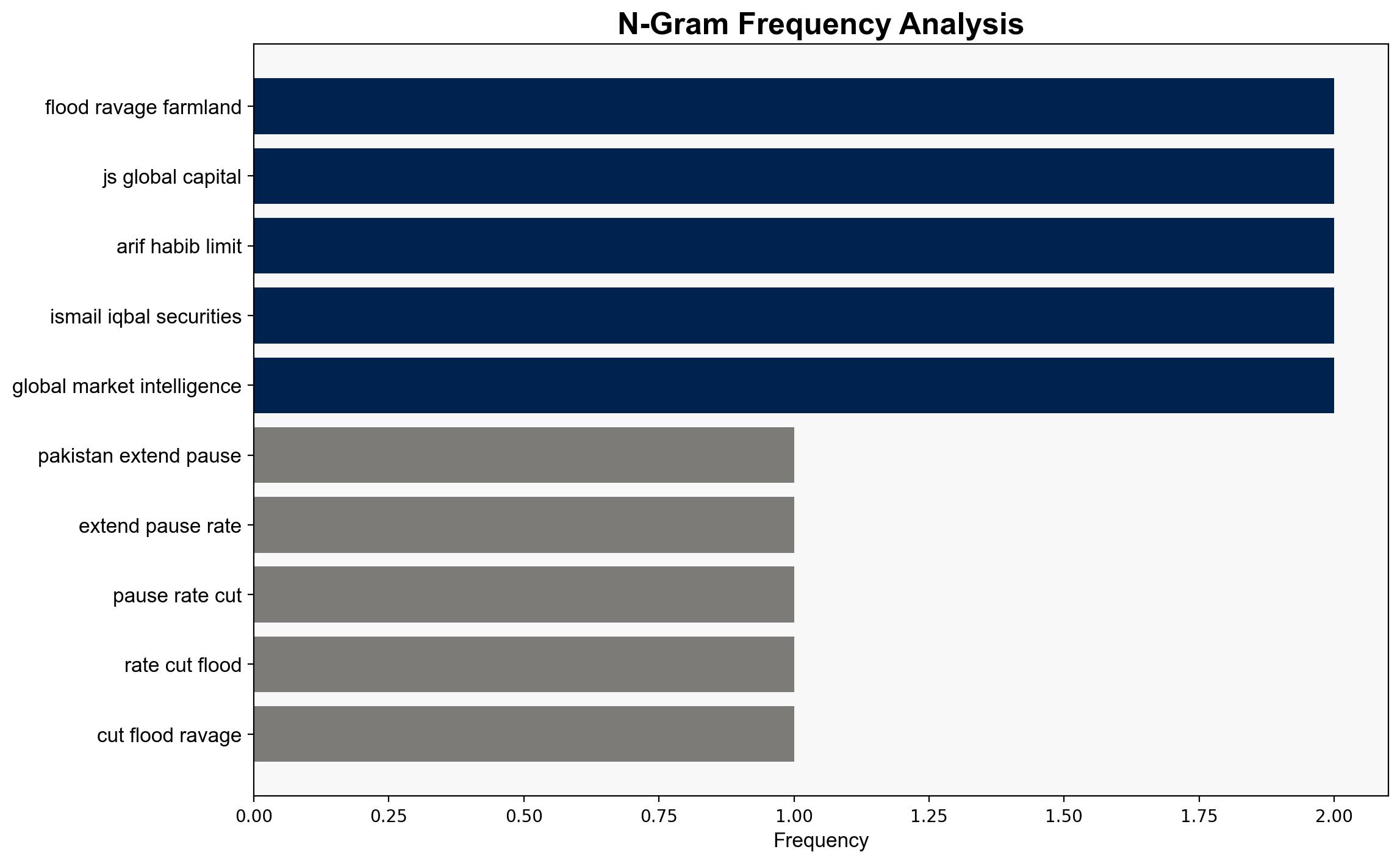

Hypothesis 1: The State Bank of Pakistan (SBP) will maintain the current interest rate due to inflationary pressures from flood-induced agricultural disruptions. This hypothesis is supported by the consensus among analysts that the floods have created a supply shock, particularly in food prices, which necessitates a pause in rate cuts to control inflation.

Hypothesis 2: The SBP will resume rate cuts by the end of the year, assuming that the inflationary impact of the floods is temporary and reconstruction efforts will stabilize the economy. This hypothesis is based on the expectation that the central bank will prioritize economic growth once immediate inflationary pressures subside.

3. Key Assumptions and Red Flags

– **Assumptions for Hypothesis 1:** The inflationary impact of the floods is significant and persistent enough to warrant maintaining the current interest rate. The central bank prioritizes inflation control over economic growth.

– **Assumptions for Hypothesis 2:** The inflationary impact is temporary, and reconstruction efforts will quickly stabilize the economy. Economic growth is prioritized over immediate inflation control.

– **Red Flags:** Over-reliance on short-term data without considering long-term economic impacts. Potential underestimation of the time required for agricultural recovery.

4. Implications and Strategic Risks

– **Economic Risks:** Prolonged inflation could erode purchasing power and increase poverty levels. Delayed economic recovery may lead to increased borrowing and fiscal deficits.

– **Geopolitical Risks:** Economic instability could exacerbate regional tensions, particularly if food shortages lead to internal unrest.

– **Cascading Threats:** Continued inflation could lead to increased cost of living, triggering social unrest and political instability.

5. Recommendations and Outlook

- Monitor inflation indicators and agricultural recovery efforts to adjust monetary policy proactively.

- Engage in international cooperation for disaster relief and agricultural support to mitigate long-term economic impacts.

- Scenario Projections:

- Best Case: Rapid recovery in agriculture stabilizes prices, allowing for rate cuts by year-end.

- Worst Case: Persistent inflation leads to economic stagnation and increased social unrest.

- Most Likely: Inflation remains elevated in the short term, with gradual stabilization by mid-next year.

6. Key Individuals and Entities

– Waqas Ghani

– Sana Tawfik

– Saad Hanif

– Ahmad Mobeen

– Ammar Habib

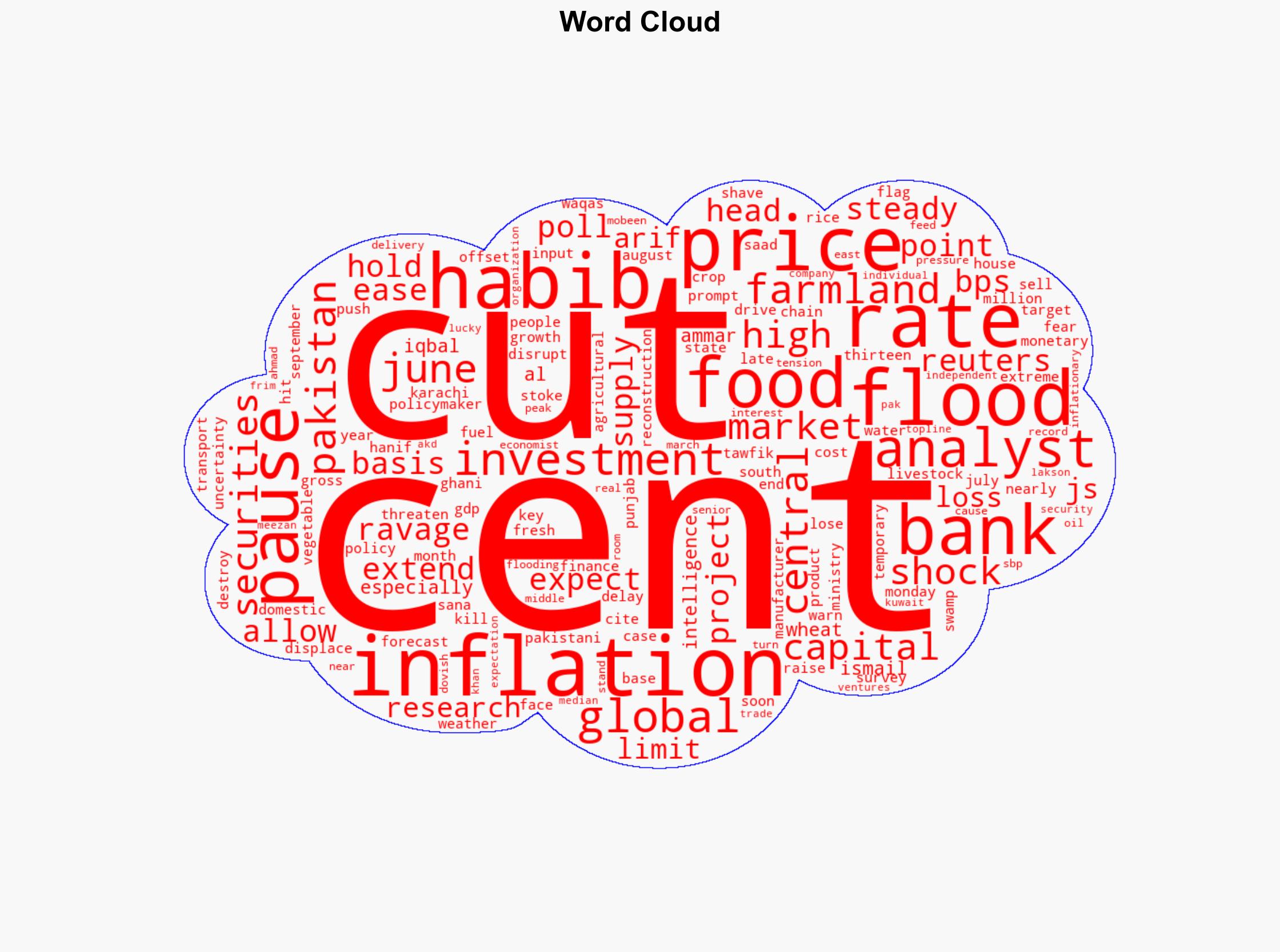

7. Thematic Tags

national security threats, economic stability, regional focus, inflation management