Wall Street coasts to the finish of its best week in the last five – CNA

Published on: 2025-09-13

Intelligence Report: Wall Street coasts to the finish of its best week in the last five – CNA

1. BLUF (Bottom Line Up Front)

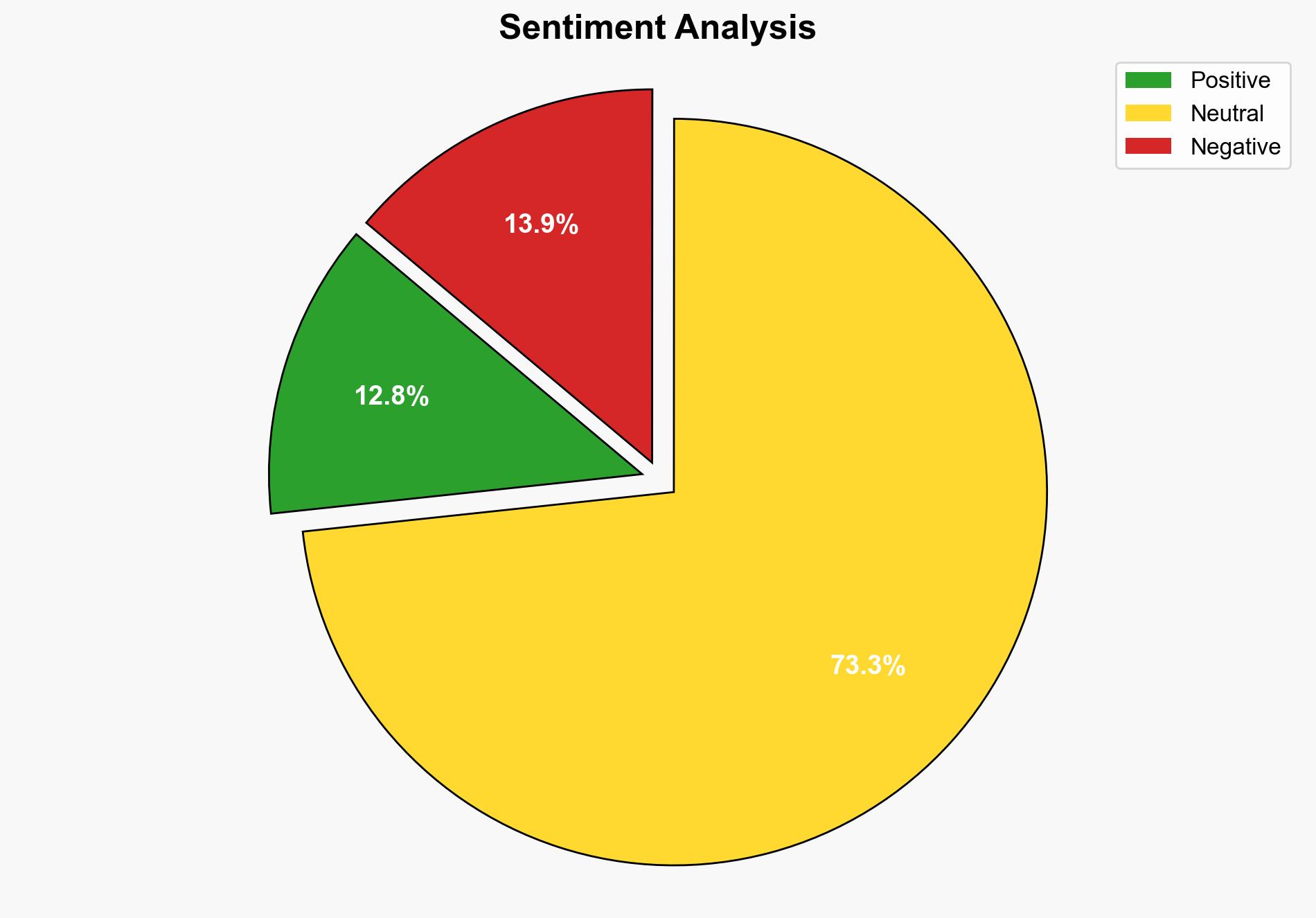

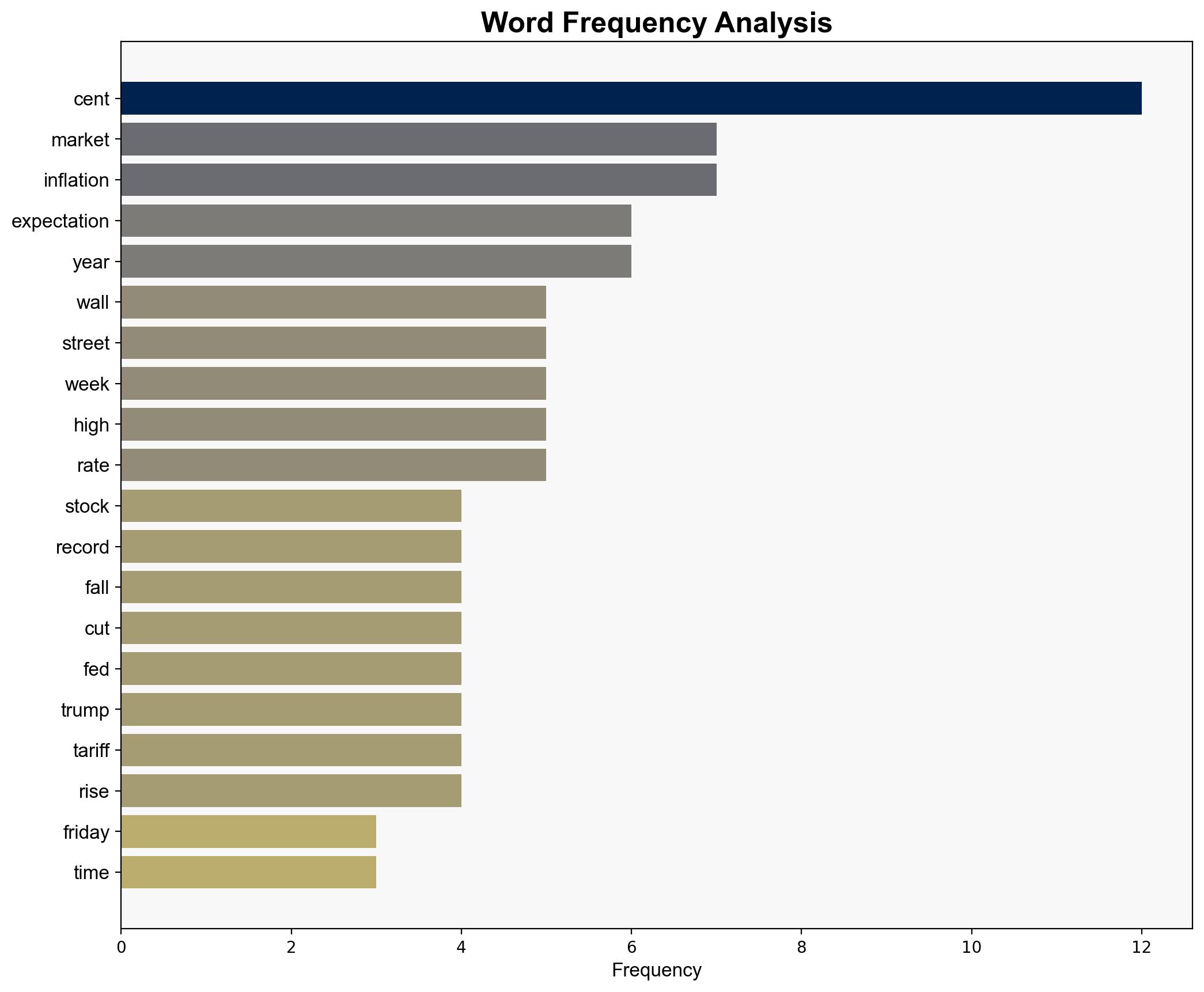

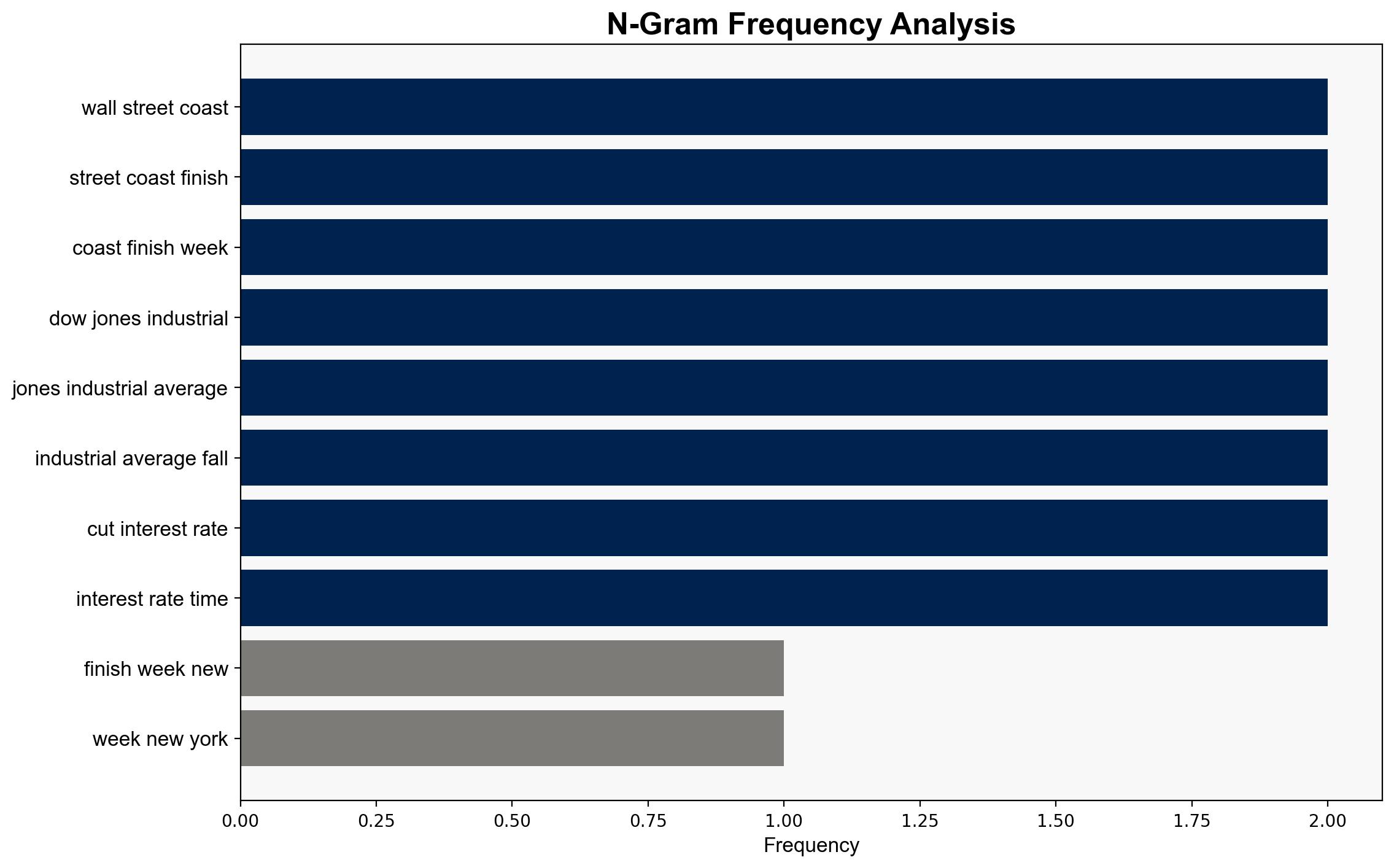

The most supported hypothesis is that Wall Street’s recent performance is primarily driven by expectations of Federal Reserve interest rate cuts, which are anticipated to stimulate economic activity. Confidence level: Moderate. It is recommended to monitor Federal Reserve announcements closely and prepare for potential market volatility if expectations are not met.

2. Competing Hypotheses

Hypothesis 1: Wall Street’s strong performance is due to expectations of Federal Reserve interest rate cuts, which are believed to stimulate the economy and prevent recession.

Hypothesis 2: The performance is a temporary reaction to specific corporate earnings reports and geopolitical developments, such as tariff announcements, rather than a sustainable trend.

3. Key Assumptions and Red Flags

Assumptions:

- Interest rate cuts will have a positive impact on the economy.

- Market participants accurately predict Federal Reserve actions.

Red Flags:

- Potential overreliance on Federal Reserve actions to sustain market growth.

- Uncertainty regarding the impact of tariffs and geopolitical tensions.

4. Implications and Strategic Risks

The expectation of interest rate cuts may lead to increased market volatility if the Federal Reserve’s actions do not align with market expectations. Additionally, geopolitical factors such as tariffs could exacerbate economic uncertainty, potentially leading to a downturn if not managed effectively.

5. Recommendations and Outlook

- Monitor Federal Reserve communications and prepare for potential market adjustments.

- Consider hedging strategies to mitigate risks associated with interest rate fluctuations and geopolitical developments.

- Scenario Projections:

- Best Case: The Federal Reserve cuts rates, stimulating economic growth and sustaining market gains.

- Worst Case: Rate cuts fail to stimulate the economy, leading to a market correction amid escalating geopolitical tensions.

- Most Likely: Moderate market growth with periodic volatility as the Federal Reserve and geopolitical factors play out.

6. Key Individuals and Entities

Jerome Powell, Donald Trump, Scott Wren, Gary Friedman

7. Thematic Tags

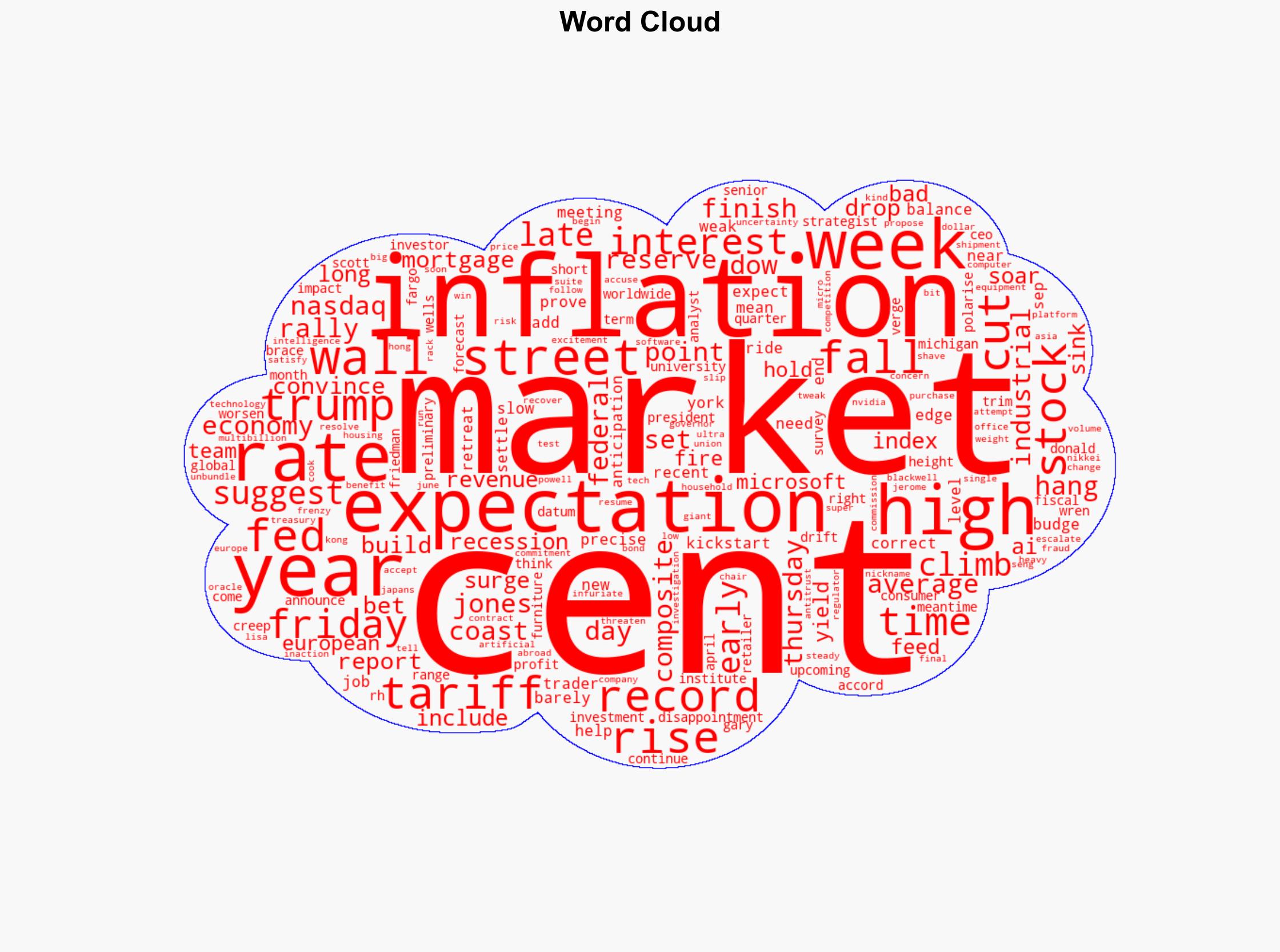

economic stability, market volatility, interest rates, geopolitical tensions