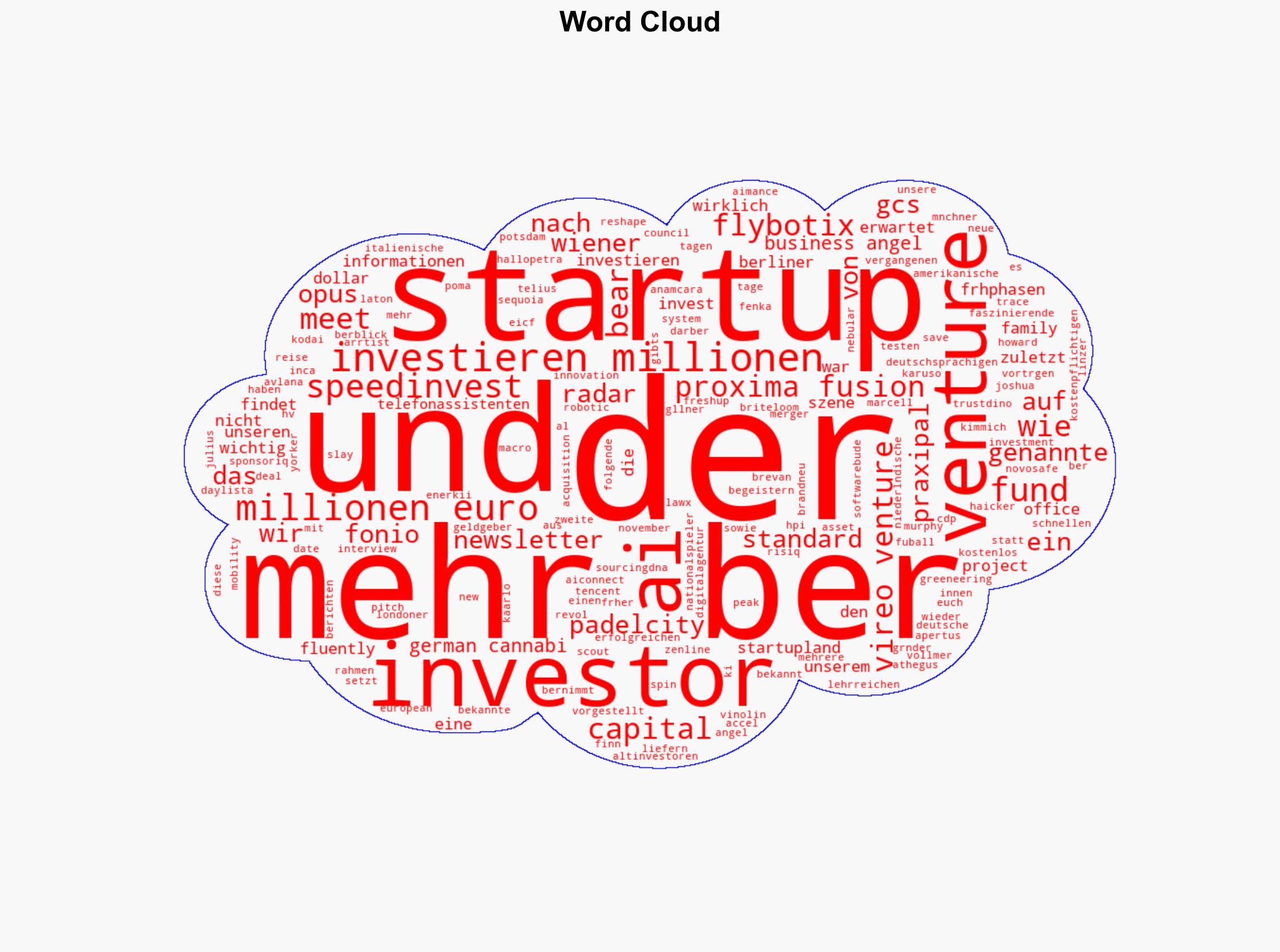

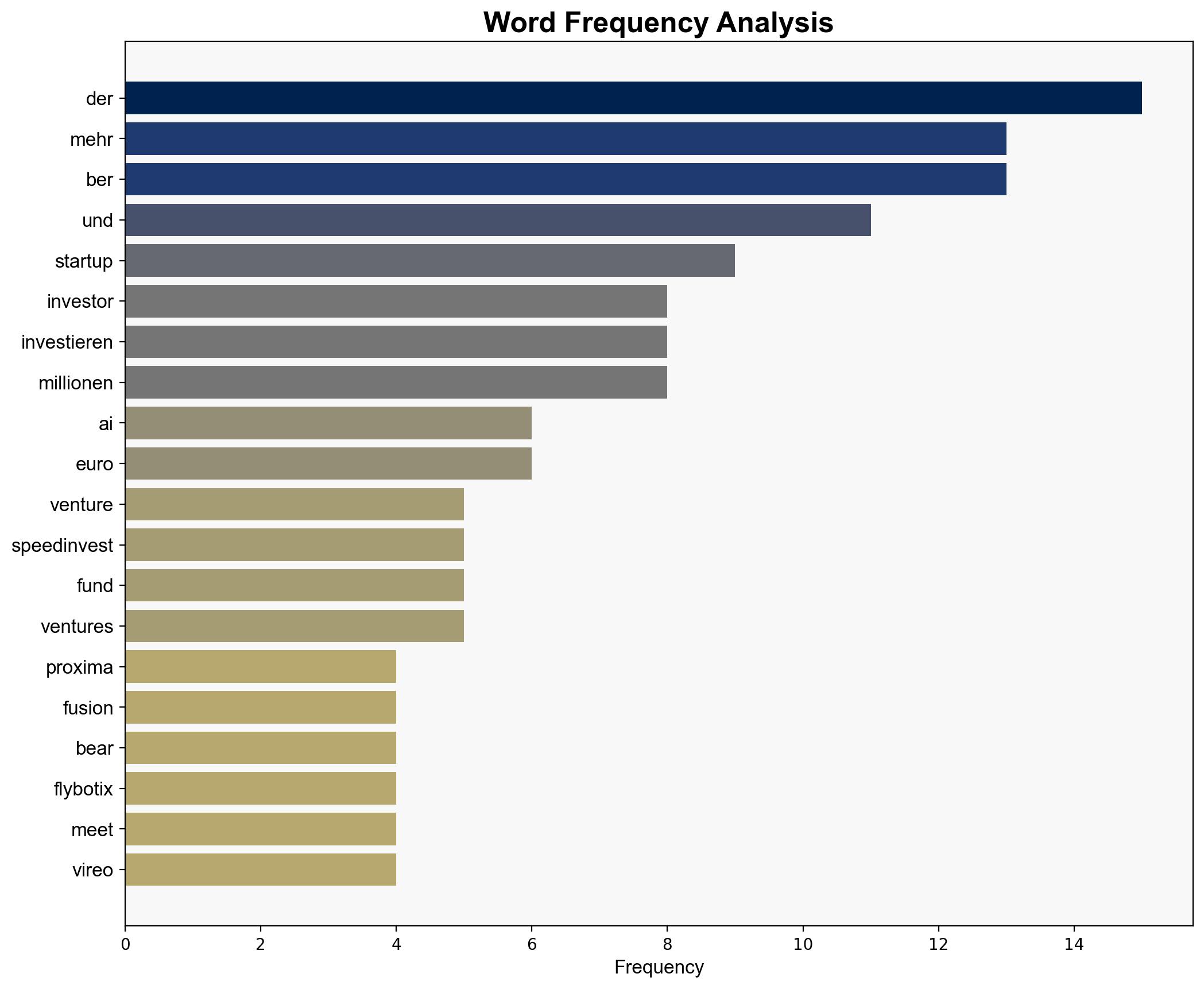

StartupTicker – Proxima Fusion Born GCS Flybotix Meet5 Vireo Ventures Speedinvest – Deutsche-startups.de

Published on: 2025-09-13

Intelligence Report: StartupTicker – Proxima Fusion Born GCS Flybotix Meet5 Vireo Ventures Speedinvest – Deutsche-startups.de

1. BLUF (Bottom Line Up Front)

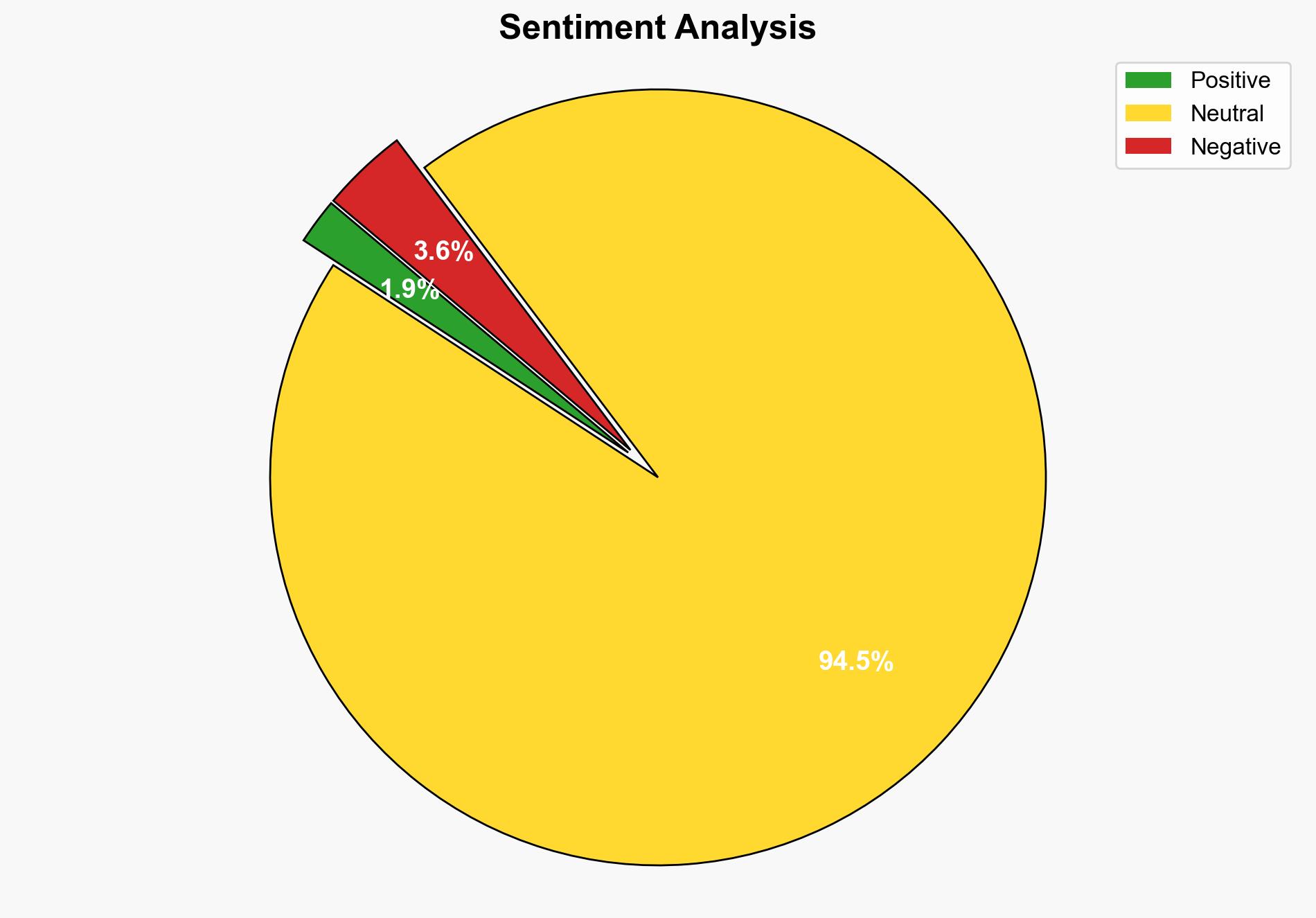

The analysis suggests that the European startup ecosystem is experiencing significant investment activity, particularly in technology and innovation sectors. The most supported hypothesis is that this trend is driven by a strategic push from investors to capitalize on emerging technologies and market opportunities. Confidence level: Moderate. Recommended action: Monitor investment patterns for shifts in focus areas and potential geopolitical influences.

2. Competing Hypotheses

Hypothesis 1: The surge in investments is primarily driven by a strategic focus on technological innovation and the potential for high returns in emerging markets.

Hypothesis 2: The investment activity is a response to geopolitical shifts and economic uncertainties, prompting investors to diversify portfolios and hedge against potential risks.

Using Bayesian Scenario Modeling, Hypothesis 1 is better supported due to the consistent focus on technology-driven startups and the involvement of well-known venture capital firms with a history of tech investments.

3. Key Assumptions and Red Flags

Assumptions include the stability of the European economic environment and continued investor interest in technology sectors. A potential red flag is the lack of detailed information on the specific technologies or sectors being prioritized, which could indicate selective reporting or a focus on high-profile investments only.

4. Implications and Strategic Risks

The current investment patterns could lead to increased innovation and competitiveness within the European startup ecosystem. However, there is a risk of overvaluation and market saturation in certain sectors. Additionally, geopolitical tensions or economic downturns could disrupt these investment flows, affecting startup growth and sustainability.

5. Recommendations and Outlook

- Monitor investment trends for shifts towards specific technologies or sectors, which could indicate emerging opportunities or risks.

- Engage with key investors to understand their strategic priorities and potential geopolitical considerations.

- Scenario-based projections:

- Best Case: Continued growth in investments leads to a robust and innovative startup ecosystem.

- Worst Case: Economic or geopolitical disruptions lead to a significant reduction in investment activity.

- Most Likely: Steady investment growth with periodic fluctuations based on market and geopolitical conditions.

6. Key Individuals and Entities

– Accel

– Tencent

– Joshua Kimmich

– Julius Göllner

– Marcell Vollmer

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus