BONE Price Surges 40 After Shibarium Flash Loan Exploit – CoinDesk

Published on: 2025-09-13

Intelligence Report: BONE Price Surges 40 After Shibarium Flash Loan Exploit – CoinDesk

1. BLUF (Bottom Line Up Front)

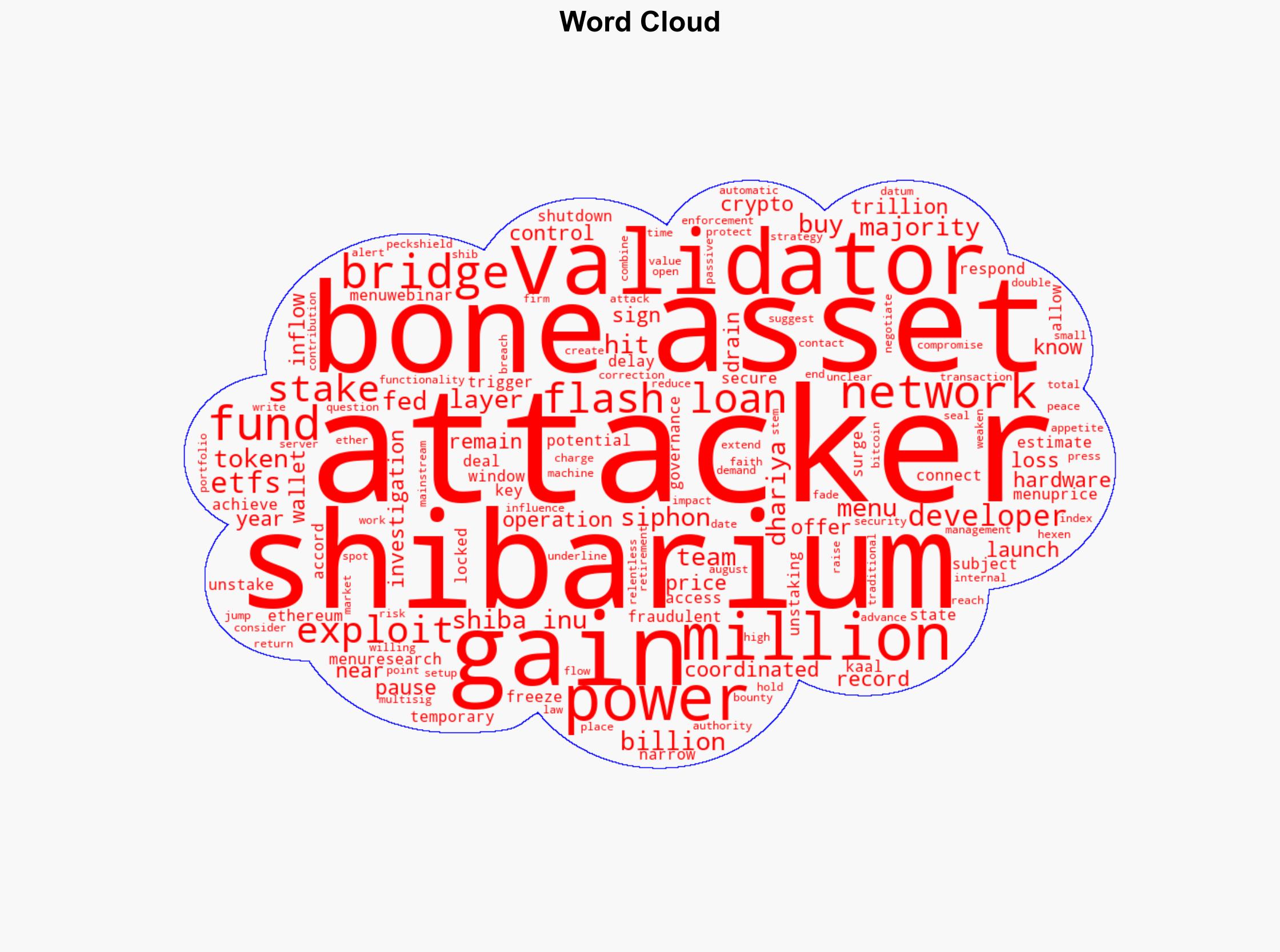

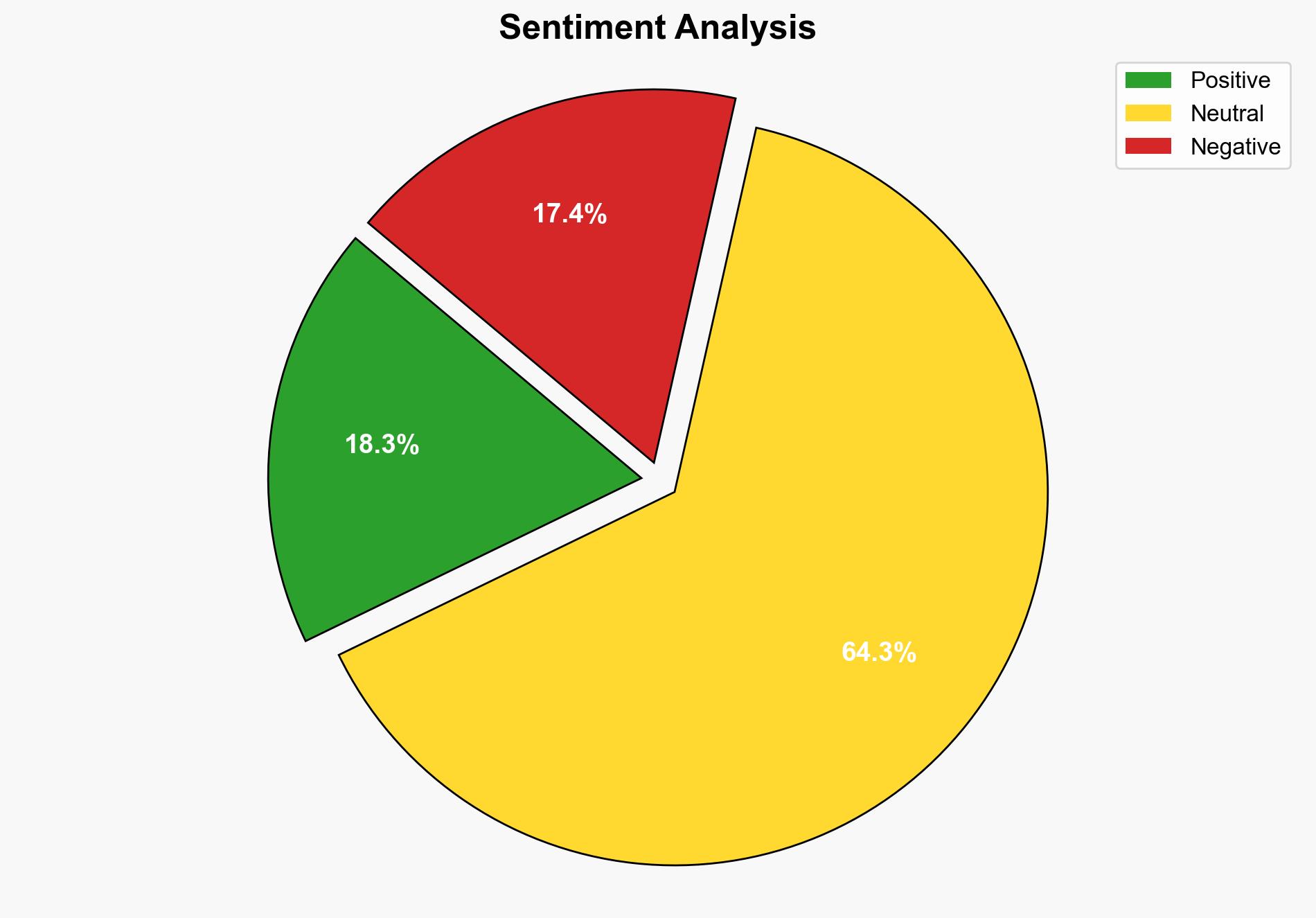

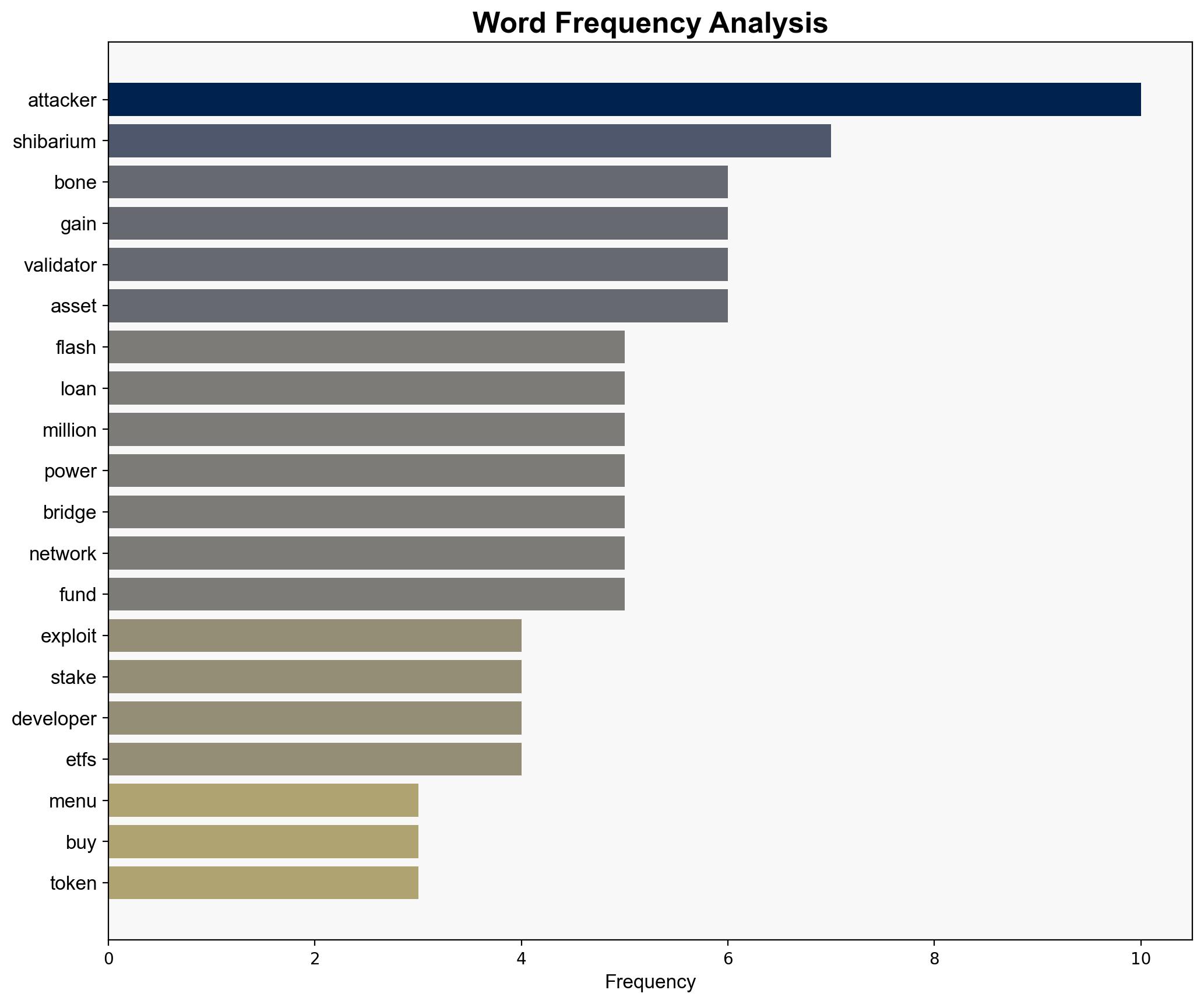

The surge in BONE’s price following the Shibarium flash loan exploit suggests market manipulation or speculative trading. The most supported hypothesis is that the exploit was orchestrated to manipulate BONE’s market value. Confidence Level: Moderate. Recommended action includes enhancing cybersecurity measures and conducting a thorough investigation to identify and mitigate vulnerabilities.

2. Competing Hypotheses

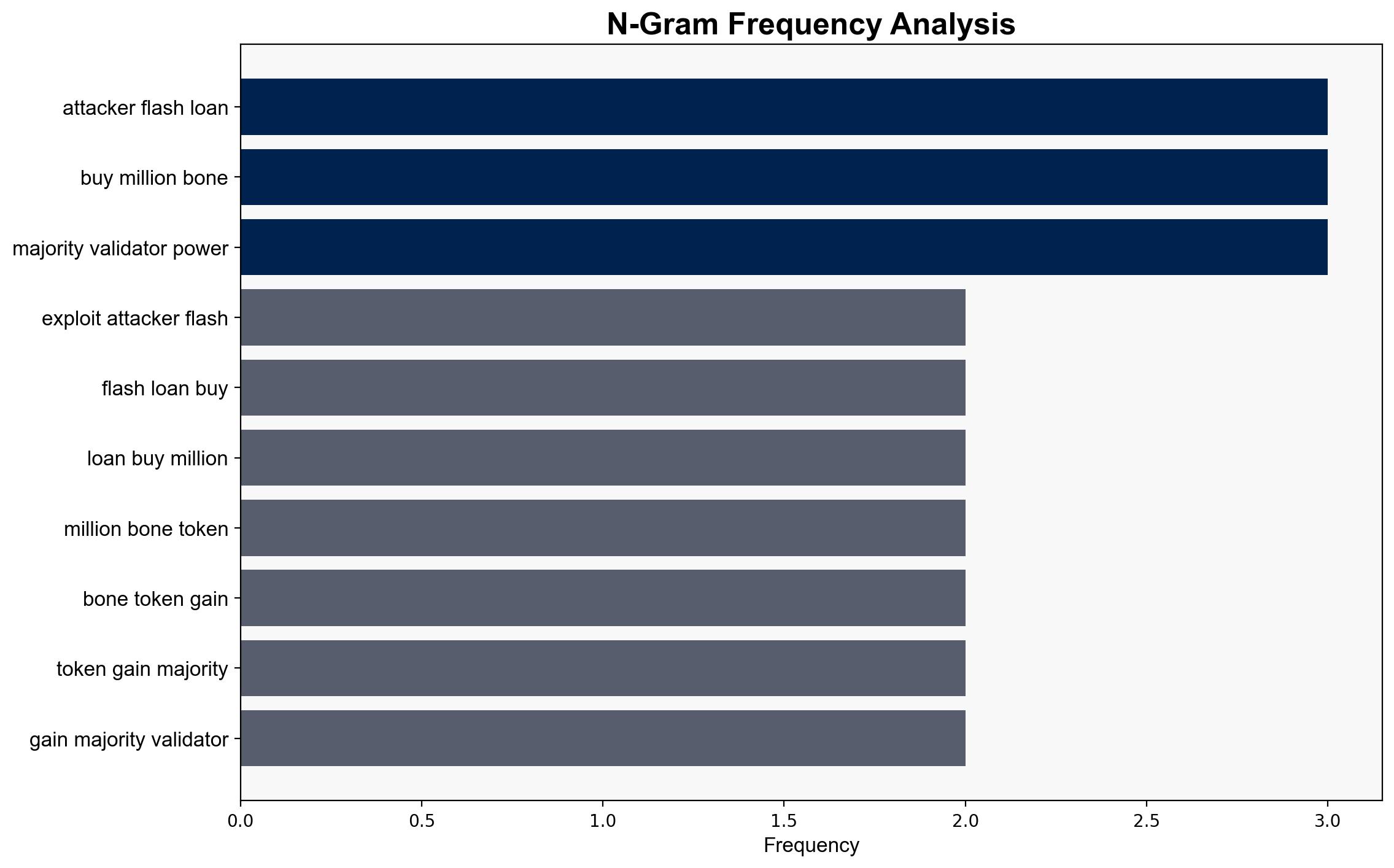

1. **Hypothesis A**: The exploit was a coordinated effort to manipulate the market, leading to the BONE price surge. This hypothesis suggests that the attacker intended to profit from the price increase following the exploit.

2. **Hypothesis B**: The price surge was a natural market reaction to the exploit, driven by speculative trading and investor panic, rather than a deliberate manipulation.

Using ACH 2.0, Hypothesis A is better supported due to the timing and nature of the exploit, which aligns with market manipulation tactics.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes the attacker had prior knowledge of market dynamics and intended to exploit them. Hypothesis B assumes market participants reacted irrationally to the news.

– **Red Flags**: The lack of clarity on how the attacker gained access to validator keys raises questions about internal security protocols. The offer of a “peace deal” to the attacker suggests potential insider involvement or negotiation tactics.

– **Missing Data**: Detailed information on the attacker’s identity and methods is not available, hindering a comprehensive analysis.

4. Implications and Strategic Risks

The exploit highlights vulnerabilities in blockchain networks, potentially undermining investor confidence and leading to increased regulatory scrutiny. Economically, such incidents can destabilize crypto markets. Cybersecurity risks are elevated, with potential for copycat attacks. Geopolitically, the incident could influence regulatory approaches to crypto assets.

5. Recommendations and Outlook

- Enhance cybersecurity protocols and conduct regular audits to identify vulnerabilities.

- Engage with law enforcement and cybersecurity firms to track and apprehend the attacker.

- Scenario Projections:

- Best: Strengthened security measures prevent future exploits, restoring market confidence.

- Worst: Continued vulnerabilities lead to further exploits, causing market instability.

- Most Likely: Increased regulatory scrutiny and gradual market recovery as security measures improve.

6. Key Individuals and Entities

– Kaal Dhariya (Shibarium Developer)

– Shibarium Team

– Security firms: Hexen, PeckShield

7. Thematic Tags

cybersecurity, market manipulation, blockchain vulnerabilities, regulatory impact