Universal Cables Holdings among top 5 unique stocks held by mutual funds in August – Economictimes.com

Published on: 2025-09-14

Intelligence Report: Universal Cables Holdings among top 5 unique stocks held by mutual funds in August – Economictimes.com

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that Universal Cables Holdings’ inclusion among the top unique stocks held by mutual funds in August reflects strategic positioning by fund managers anticipating growth in infrastructure and manufacturing sectors. Confidence in this hypothesis is moderate, given the lack of detailed market analysis. Recommended action includes monitoring sector trends and fund performance for validation.

2. Competing Hypotheses

1. **Hypothesis A**: Mutual funds are strategically increasing holdings in Universal Cables due to anticipated growth in infrastructure and manufacturing sectors, driven by economic recovery and government policies.

2. **Hypothesis B**: The increased holdings in Universal Cables are a result of speculative trading or short-term market trends, rather than long-term strategic positioning.

Using ACH 2.0, Hypothesis A is better supported by the presence of multiple funds across different categories holding significant shares, indicating a broader strategic consensus. Hypothesis B lacks supporting evidence as the data does not indicate short-term trading patterns.

3. Key Assumptions and Red Flags

– **Assumptions**: Assumes that mutual funds have access to reliable market forecasts and are acting on them. Assumes that the data provided is complete and accurate.

– **Red Flags**: Lack of information on the specific reasons behind each fund’s decision to hold Universal Cables. Potential bias in assuming all funds have the same strategic outlook.

4. Implications and Strategic Risks

– **Economic Implications**: If Hypothesis A holds, there could be a positive impact on the infrastructure and manufacturing sectors, potentially boosting related industries.

– **Strategic Risks**: If the market conditions change unexpectedly, funds heavily invested in Universal Cables could face significant financial risks.

– **Geopolitical and Psychological Dimensions**: Changes in government policy or global economic conditions could affect the anticipated growth, impacting investor confidence.

5. Recommendations and Outlook

- Monitor policy changes and economic indicators that could affect the infrastructure and manufacturing sectors.

- Engage with financial analysts to gain deeper insights into fund strategies and market forecasts.

- Scenario Projections:

- Best Case: Economic growth aligns with fund strategies, leading to high returns.

- Worst Case: Market downturns or policy shifts lead to significant losses.

- Most Likely: Moderate growth with some volatility, requiring agile fund management.

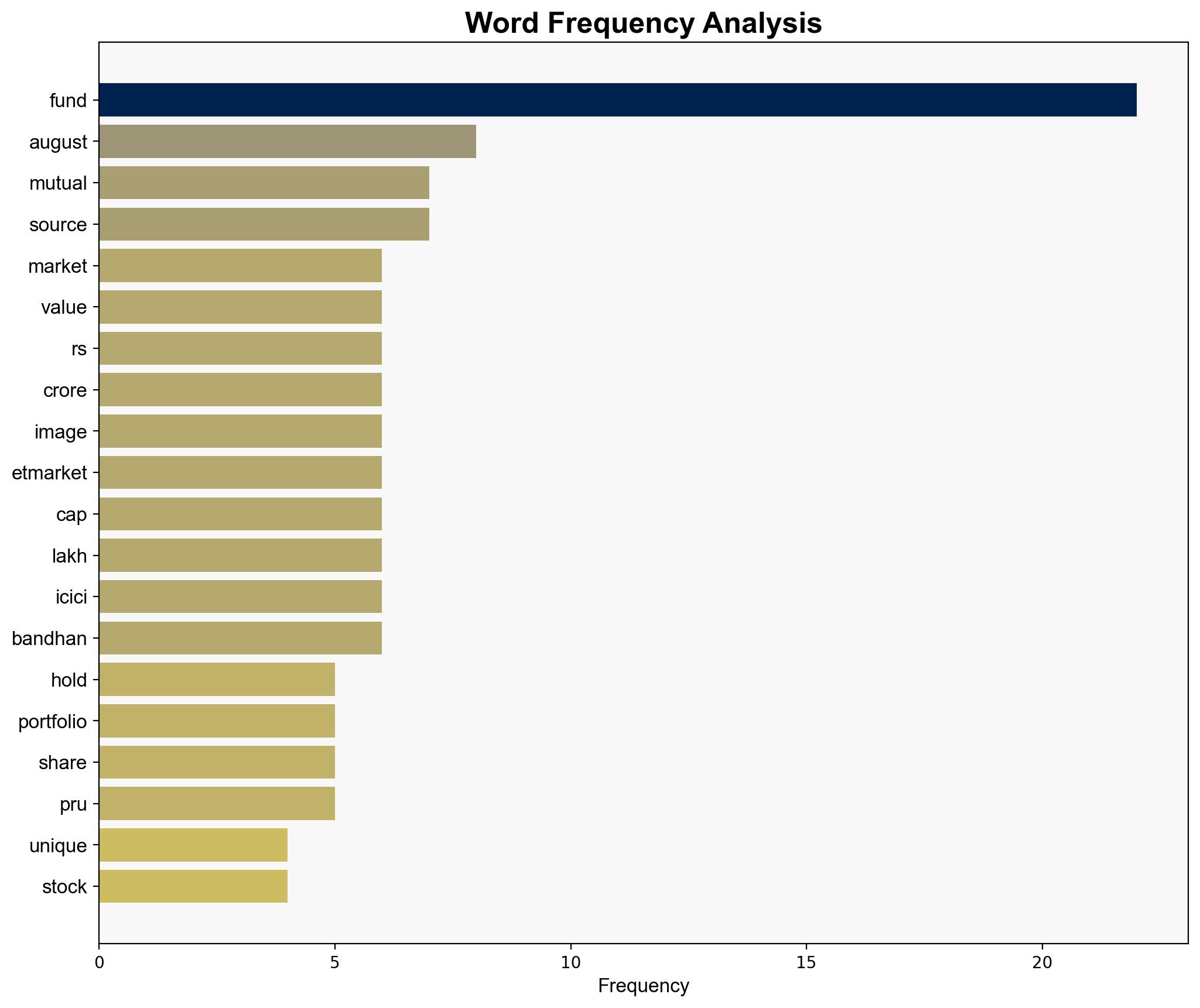

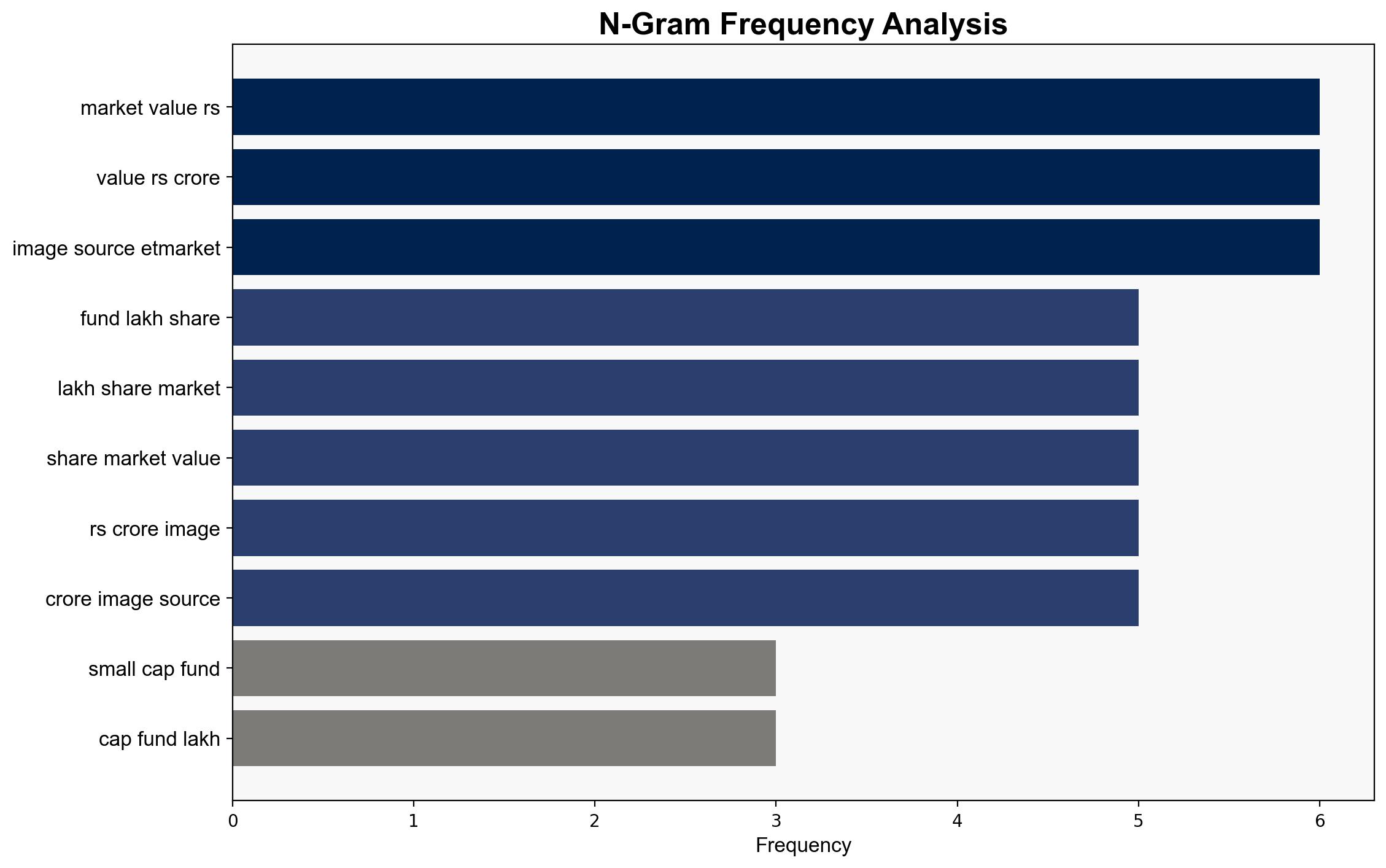

6. Key Individuals and Entities

– Universal Cables Holdings

– Sundaram Finance

– Nippon India Mutual Fund

– ICICI Prudential Mutual Fund

– Tata Mutual Fund

– Bandhan Mutual Fund

7. Thematic Tags

economic strategy, investment analysis, market trends, infrastructure growth